Chicago PMI disappoints

Consumer confidence leaps most in six months

Case Shiller Index suggests another housing bubble

Tuesday, December 31, 2013

News Headlines for 12/31/2013

Risk Is Rising, Even As Stock Hit New Records

"Risk is an ever-present characteristic of life; it cannot be eliminated, it can only be masked or hedged. We know this intuitively, yet we blithely accept official assurances that risk can be eliminated by the monetary machinations of the Federal Reserve, the Central Bank of China, the Bank of Japan and the European Central Bank. To confuse masking risk with the elimination of risk is the acme of hubris and the perfect setup for disaster." Tyler Durden at Zero Hedge

It appears that the original quote is from Charles Hugh Smith here:

When Risk Is Separated From Gain, The System Is Doomed

How Cliche! Stocks Hit New All-TIme Record High!

... for the kazillionth time this year!

The QE Taper... That Isn't!

Grant Williams wrote a brilliant piece, with a few excerpts here and a link to John Mauldin's website:

That Was the Weak That Worked

On

the one hand, Bernanke would want to leave the Fed with the wind-down

of his expansionist policy underway so that he would have the kind of

plausible deniability that history has gradually been stripping away

from Alan Greenspan. ("Hey, don't blame ME. We were exiting QE when I

left office!") On the other hand, though, he wouldn't want to hand Janet

Yellen an impossible situation.

The solution? Taper Lite

"All the goodness of the Taper with no bitter aftertaste!"

... and the markets, after the scares in May and June, LOVED it!!"

Or what I call it: The Taper ... that isn't!

Bernanke

is trying to evade accountability for what's coming, while giving

Yellen the green light to keep the monetary heroin going.

Later, after the market collapse again, he'll then deny all responsibility!

Just like Greenspan has done, including just within the last few weeks.

Then,

after having KILLED free markets and capitalism, they'll declare that

free markets and capitalism don't work. As if their endless state

interventions were somehow some form of capitalism.

We will need

to hold them accountable when that happens. What they have been doing

is NOT capitalism nor free markets. It's progressivism. It's statism.

It's fascism. They have the same roots.

"Errrr ... sorry to spoil the party, but a couple of things here:

Firstly,

the reason the market spiked is that the Fed's Taper turned out to be a

paltry $10 bn a month and not the "whopping" $20 bn a month that had

been floated by various Fed mouthpieces back in May

cough-cough-cough-hilsenrath-c ough." /Jon Hilsenrath, the Fed's "voice"

at the Wall St Journal, who I refer to as Bernanke's whore./

from

the article, quoting "Bernanke's whore", who released the Fed's

"translation" (this is only a tiny quote, while Hilsenrath's entire

explanation was much longer) just seconds after the Fed's statement. My,

how fast he types!

"(WSJ): The Fed went to great lengths to send

the message that interest rates are staying low even longer than the

Fed indicated earlier. It said today that it will keep interest rates

low "well past" the time when the unemployment rate reaches 6.5%."

As I said, the Taper... that isn't!

"Thirdly,

they managed to communicate that this policy will be reversible at the

drop of a hat should things start to look as though the vaunted

"recovery" is nothing more than a mirage conjured by their actions."

"...the

markets reacted just as you would expect, once they realized that they

had faced down the Fed in the summer and forced them into a taper that

is essentially a non-event."

Again, the taper... that isn't! This so-called QE taper is worse than mere mistake. It's deception! It's PROPAGANDA!

I will next post a graph that shows what a farce -- a HOAX -- the Fed's

QE taper really is! It's just more debt monetization, while calling it a

return to normalcy. It's really a SCAM!

The QE Taper... that isn't!

Does that really look like much of a wind-down to you? The Fed will still monetize $900 billion of new debt over the next year! Does that sound like the end of QE to you?

Me neither!

It's looks like more of the SAME to me! It's a hoax -- a scam -- perpetrated by the Fed on a grand scale!

another excerpt from the article:

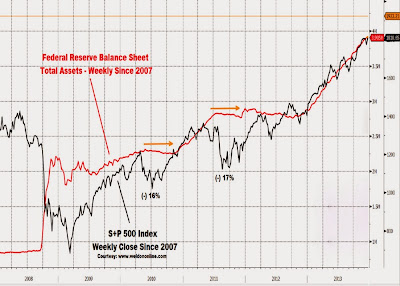

"A look at the correlation of the S&P 500 to the Fed's balance sheet tells you just about all you need to know. Since 2009, the correlation has been an astonishing 89.7%. Why would anybody not just buy markets, given that they are going to go up based purely on the Fed's aggressive stimulus?"

more:

"Bizarrely, by creating an environment that forces those with capital to seek out additional risk due to the paltry returns afforded by zero percent rates, the Federal Reserve has steered investors to seek out the least-risky place to invest their money, and that has been equities."

Just posted another chart that shows that 89.7% correlation between the Fed's balance sheet and stocks.

Note that without endless QE, stocks would be only about 1/3 of their current price.

more from the article:

"Equity prices USED TO BE a reflection of the strength of the underlying economy — after all, the component pieces of benchmark indices were functioning companies that existed in the real world where they need to manufacture something and sell it to a buyer in order to stay in business and make a profit...

"But under the surface and in the wider economy, the story is very different, indeed, as the mountain of cash on corporate balance sheets has led to an avalanche of buybacks, which has in turn boosted earnings and given the impression that things are roaring, when in fact the true story is a familiar one of an increase in debt." (emphasis mine)

more from the article:

"Assets less liabilities for corporations economy-wide are approximately where they were in the last quarter of 2004 or the first quarter of 2005. But stock prices are much higher in aggregate."

Do you understand that? Corporations aren't any stronger today. But stock prices are MUCH higher. Does that sound sustainable to you? Doesn't that sound like a description of a BUBBLE, rather than sound economic growth?

more:

"This chart was bad at the end of 2012 — in bubble territory, for sure — which was a big part of why I didn't think we'd get through 2013. Well, we did — and now it's worse, because this is only updated through the end of September and of course the market has gone screaming higher in the last three months."

Did he use the word "bubble"? And that was a YEAR AGO! And he's says it's much worse NOW!

"(USA Today): Boosting optimism for the new year ahead, the government announced Friday that the economy in the third quarter grew at its fastest rate in nearly two years and much better than previously estimated...

""The consumer is back in the game," exulted Chris Rupkey, chief financial economist of Bank of Tokyo-Mitsubishi UFJ, in a client note Friday. "Is this economic growth fast enough to put America back to work? The answer is, yes. The wheels of the economy are turning fast enough to bring down the unemployment rate further."

But the reality from the GDP report cited in the media is this:

"...Meanwhile, over a third of the strength in the economy was down to private inventory buildup — the biggest such buildup since records began almost 70 years ago /He then shows another chart, which I won't post here/.

"So, despite equity markets making all-time highs in 2013 more often than Miley Cyrus gave offence, beneath the surface, the economy — which equities are supposed to reflect — didn't perform as well as the headlines would have you believe; and by far the biggest driving force behind the strength of the equity market was free money courtesy of QE."

Monday, December 30, 2013

Volume Paper Thin At Year's End

This is not unusual for the end of the year. I'm not trading with volume so paltry. Trading signals are unreliable and risky!

Saturday, December 28, 2013

Probability of a Crash Increasing Exponentially

from Dr. John Hussman's market commentary earlier this week:

This first link is to a paper on the website of the National Bureau of Economic Research. The NBER is the group that OFFICIALLY declares when a recession begins and ends. In their paper, they explain the phenomenon that as a bubble matures, it ACCELERATES higher, and why that contributes to the ensuing crash. Here is a quote that summarizes the paper:

“The probability that the bubble ends may well be a function of how long the bubble has lasted, or of how far the price is from market fundamentals. If the probability of a crash increases for example, the price, in the event the crash does not take place, will have to increase faster, not only to compensate for the increased probability of a fall, but also to compensate for the large risk involved in holding the asset.”

And here is the paper (pdf format). The paper is very academic and arcane, with lots of complex math, so unless you are a math whiz, don't expect to be able to understand all of it:

http://www.nber.org/papers/w09 45.pdf

This second link is to Dr. John Hussman's market commentary from earlier this week:

http://www.hussmanfunds.com/wm c/wmc131230.htm

Here is a quick summary of this rising risk of a crash, which I've taken from Hussman's most recent market commentary:

“As the price variation speeds up, the no-arbitrage condition, together with rational expectations, then implies that there must be an underlying risk, not yet revealed in the price dynamics, which justifies this apparent free ride and free lunch. The fundamental logic here is that the no-arbitrage condition, together with rational expectations, automatically implies a dramatic increase of a risk looming ahead each time the price appreciates significantly, such as in a speculative frenzy or in a bubble. This is the conclusion that rational traders will reach. This phenomenon can be summarized by the following proverb applied to an accelerating bullish market: ‘It’s too good to be true.’” Didier Sornette, Why Stock Markets Crash, 2003

“Our positions are always built on observable evidence rather than scenarios. We already have sufficient evidence to be fully defensive. Only later will we read in the headlines exactly why this defensive position was warranted.” John Hussman, PhD 12/23/2013

"My guess is that the present speculative advance may have a few percent to run – I’ll be particularly concerned if the market does so in a rapid, uncorrected manner in the next couple of weeks, which could suggest crash probabilities approaching 100% based on the sort of analysis above." John Hussman, PhD, 12/23/2013

Friday, December 27, 2013

The Statistical Probability of a Stock Market Crash

This from Dr. John Hussman:

Thursday, December 26, 2013

Note to a Friend About Current State of Financial Markets

Following is the text of an email I sent earlier today:

I hope you and your family had a great Christmas!

I read

several articles on the Kiyosaki website. I am a fan of Robert Kiyosaki,

and I've read 2-3 of his books (just not recently)! I like this quote

in particular from his website, written by Richard Duncan:

"The press has attributed the Fed’s decision to taper to an improvement

in the outlook for the economy. I don’t believe that is the correct

explanation. The recovery is still too weak and uncertain to justify

tapering on those grounds. In my opinion, the real reason is to prevent

excess liquidity from creating a new, destabilizing asset price bubble

in stocks and property."

But stocks continue the ramp-up into

record territory. The futures are higher today (Dec 26), and are set to

hit the 50th all-time record high this year -- again, if stocks remain

at these levels by the end of the day today. But the volume is razor

thin, even for holiday trading (thin trading is typical for holidays,

but this is exceptional even for a holiday)!

I also perused

Richard Duncan's economics website, and saved it. He's very sharp, in my

opinion. I then did some research on Mr. Duncan. He has been

interviewed numerous times in the media. He has also written some

best-selling books. I then remembered having seen him in a very lengthy

interview several months ago, which I found on Youtube and watched

again. He had just released his new book titled The New Depression in

early 2012. He said that due to excessive debt over the past several

decades to fuel domestic consumption, we have created bubble upon

bubble, and that bubble will eventually collapse in a depression that he

says will last for "generations" (HIS word, not mine).

I also

read some of the reviews of Mr. Duncan's book on Amazon.com. There were

two reviews that were extensive and were several pages long. You can

read them there if you want, but be forewarned that they were quite

lengthy! They were some of the most expansive reviews I've ever read on

Amazon. They must have taken hours to write. After reading them, I

decided that I didn't need to buy Duncan's book because I knew all the

salient points in them.

Two of the lengthier reviews critiqued

Duncan's proposed "solution" to our debt crisis. In the book, he

proposes that the US government borrow even MORE, go into even deeper

debt, and "invest" in advanced technologies in alternative energies,

nanotechnology, etc. He said that he believes that if the government

does this, it can ensure that the US "empire" will endure another

century. So his solution is even MORE government debt and government

programs in a bet that we can perpetuate our technology edge for the

next century. The lengthy reviews were skeptical, but fair.

Over

the past year, I've read at least five books that are dedicated, either

in whole or in part, to describing asset bubbles and their

characteristics. One of them was so arcane that I had to borrow it from

the BYU library, where it had only been checked out 3 previous times in

10 years. I've taken notes of some of the characteristics of what

constitutes bubbles. What we are seeing now in stocks manifests every

single characteristic of a bubble that I've read. Attached is a chart

that Dr. John Hussman published this week (the one with the white

background) . It shows the current stock market, and is literally a

textbook example of what an asset bubble looks like. In fact, in the

advanced stages of what he called a log-periodic Sornette-style bubble

(Swiss academic Didier Sornette was the author of the book I borrowed

from the BYU library, which I heard about from Hussman), the asset

bubble goes parabolic as investors not only increase their bets without

abandon, but they even go into DEBT to do it. Margin debt is now at

record levels, which Hussman also mentioned this week in his online

commentary on his website. Margin debt not only amplifies the gains on

the way up, but the losses to investors also amplify the speed of

decline on the way down. Crashes occur much faster than rallies for this

reason. Hussman reminds us that we have already seen TWO stock market

crashes in the past ten years (2003 and 2007-2008). But he also says

that stocks may increase an additional 5% before they crash again. That

would put the S&P 500 at about 1920. It's trading on my futures

charts at 1832 as I type this. We could reach 1920 over the next 90

days.

In Hussman's chart, note that as the asset bubble matures,

the asset goes increasingly parabolic -- straight up! There are no more

pull-backs or retracements whatsoever. Stocks, for example, have barely

looked back since mid-2012, since the fed began QE-Infinity! On his

chart, the red line is what a bubble historically looks like, and the

blue line is the current S&P 500. They are virtually identical!

On

my other chart that I've attached (black background), which is a screen

capture from my own (monthly) charts on my PC from one week ago (and

stocks have gone even higher since), you'll also see that stocks are no

longer even pulling back to the exponential moving average (light blue

line). They are even trading much of the time above the purple line,

which is the upper Bollinger Band, which represents two standard

deviations (a chance to use your statistics from biz school) outside the

norm. We're now close to THREE standard deviations!

I don't try

to forecast the future. I have a saying I made up: "Predicting the

future is for prophets, not profits". I don't know what the future

holds. I trade based upon what the charts and the market tell me, NOT

what prognosticators say. Prognosticators have a historically poor track

record! BUT -- I know a bubble when I see one. All it will take is

another "Lehman Bros moment" that triggers a sudden collapse in

confidence, and the next crash will ensue (John Mauldin wrote about this

extensively in his book Endgame). I have no idea what that trigger event

will be. But I am certain it will come. And the more euphoric Wall St

becomes, and the more they ignore the red flags, the more likely that

event will occur with immensely cataclysmic consequences.

One

small note: public sentiment (measured by "consumer confidence"

indicators), tends to mirror the stock market -- NOT vice versa! (see 2

Ne 28:21)

Interestingly, over the past few months, I've read

information from some of Pres. Obama's advisers that indicates that they

INTEND to bring "fiscal collapse" (their term, not mine) to the US

government. Remember "never let a crisis go to waste"? If you don't have

a crisis, you CREATE one! That reminds me of what the secret

combinations did in 3 Ne 7! I'll share with you those details next time

we have a chance to get together to chat.

The market just

opened, and I need to go. There is a new book out by John Mauldin,

called Code Red. I asked for the local library to get it so I can read

it. They said it will arrive after Jan 1st (new budget). Mauldin, after

being quite optimistic over the past few years, has suddenly turned

somewhat pessimistic over the course of 2013. I want to read his book to

learn why. His last book was about what he and others have termed "the

debt supercycle" which is coming to an end soon. Duncan also expressed

his worries about the same phenom. I use the term The Mother of All

Bubbles to refer to US government debt. When that bubble pops, we will

have a depression that Duncan says will likely last for DECADES, even

generations. That's his opinion! Wow!

One last thing and then I MUST go:

re: deflation

There

hasn't been broad-based deflation since the Fed was created. The dollar

has depreciated 98% since then. (By the way, the Fed's 100th

anniversary was Dec 23d -- the same day as Joseph Smith's birthday. One

was a great day in history, and the other was a day of infamy!) I'm

convinced that inflation is a better bet than deflation. We HAVE seen

some deflation, most notably in housing, but the deflation was from

BUBBLE levels. We all know that food and energy inflation are MORE

likely, not less. Notwithstanding the gas price deflation you mentioned,

the price of gas is still almost DOUBLE the price of gasoline when

Obama took office. For this time of year (there are seasonal aspects to

crude/gas prices), gas prices are unusually high.

Well, time to

go to work. Let's keep up the dialogue. I appreciate having someone with

your knowledge and background to palaver with.

Keep up the great work! I appreciate your example and ethic!

God bless!

Steve

Tuesday, December 24, 2013

Mixed Messages In Today's Headlines

Meanwhile, stocks are hitting fresh all-time record highs.

Holiday shopping is weak this year, but that doesn't appear to have dampened Wall St.'s euphoric love of stocks.

But on the other hand, durable goods orders showed a healthy increase:

But there is a dark side to this news! The government used that old tool that we have all come to love -- those "seasonal adjustments" -- to inflate the durable goods figures! Furthermore, Durables Goods ex-transports was DOWN by -0.5% instead of rising by 1.2%.

Monday, December 23, 2013

Bubble Acceleration Noted

This

is the monthly chart of the current S&P 500 stock index. This is

literally a textbook case of what a bubble looks like. There are many

characteristics of a bubble, and I literally can't think of a single one

that this current market circumstance does NOT manifest.

Note in this chart the light blue line, which represents the 8-period EXPONENTIAL moving average. Take note also that as stocks accelerate higher and higher, faster and faster, they are leaving even this "exponential" acceleration far behind. Despite that stocks are already valued at excessive levels from a historical perspective, investors are willing to pay even MORE for them. Is that rational behavior?

Last week, Dr. John Hussman did analysis on his website that indicated that corporate earnings are now beginning to stagnate and are likely over coming quarters to collapse back to more historically normal levels that would be about 40% below today's levels. But even still, speculators are paying even higher prices for stocks, driving valuations beyond even these historical levels. Stocks are, after all, the price an investor pays for a stream of earnings extending into the future. If an investor pays too much for them, then their YIELD on those earnings will be poor. Dr. Hussman has calculated that at earnings levels of the past few months, an investor's yield for the next ten years, based upon historical patterns, will likely be near ZERO. Here is what Dr. Hussman said today about the current bubble market:

"Regardless of last week’s slight tapering of the Federal Reserve’s policy of quantitative easing, speculators appear intent on completing the same bubble pattern that has attended a score of previous financial bubbles in equity markets, commodities, and other assets throughout history and across the globe." (emphasis mine)

Something else that is noteworthy in the above chart:

In the past, even in this overbullish market, stocks have traded between the light blue line (the exponential moving average), and the upper Bollinger Band, which represents, from a statistical perspective, TWO standard deviations outside the norm. In the past few months, stocks haven't even dropped back to the light blue line. Stocks barely made it half way back to that level. This bubble is accelerating even faster to stratospheric levels, only guaranteeing that when reality finally can no longer be denied, this house of cards will also follow historical patterns of what a popping bubble looks like.

As further evidence of how overbought this market is, note also that the last time stocks even closed below the blue line was in mid-2012 -- a year and a half ago! Stocks have barely even looked back since then! And this, despite already stratospheric price levels!

OVERNIGHT

This chart following shows the acceleration of stocks during the overnight sessions in Asia and Europe.

This shows the Dow futures over the past few hours. Stocks are already 57 points higher than last Friday's close. This stock market bubble is advancing at an accelerating pace.

Sunday, December 22, 2013

Stocks Continue Record-Setting Climb

Friday's relatively strong GDP reading sent stocks to new record highs, and Sunday evening, stocks set still another record.

Friday, December 20, 2013

Screw Lew: Treasury Secretary Jack Lew's Signature

Screw Lew! (To the censors, NO, that is NOT mature content!)

What an amazing resemblance. Can you distinguish between them?

Or is it screw LOOSE? Why would he do that? Is he trying to make a mockery of our fiat currency, which will be worthless any day now?

Thursday, December 19, 2013

Stocks Close Higher By a Hair

...and all this, despite weaker data today! Just bubbly!

Quadruple Whammy of Bad Economic News...

...even as stocks closed at new all-time record highs yesterday. Something is wrong with this picture! A great reset is coming! Stocks are barely in the red.

Here are the headlines this morning.

Wednesday, December 18, 2013

It's The Taper... That Isn't!

It's a "non-taper" taper!

Fed reveals that it will ease off it's debt monetization by $10 billion/month, but will continue low interest rates indefinitely. In some ways, this is even more dovish that previous statements were. Wall St is thrilled! The bubble builds!

- *FED TAPERS QE TO $75 BLN MONTHLY PACE, STARTING IN JANUARY

- *FED SAYS `FURTHER MEASURED STEPS' POSSIBLE ON TAPERING

- *FED: EXCEPTIONALLY LOW RATES UNTIL JOBLESS FALLS WELL PAST 6.5%

Tuesday, December 17, 2013

Market Snapshot -- In Holding Pattern for Fed Decision

This image from Yahoo Finance provides a good summary of today's market action on the eve of another Fed monetary policy statement tomorrow.

Monday, December 16, 2013

Nat Gas Futures Plunge On Better Weather

Nat gas is today's big mover.

from Business Recorder:

"NEW YORK: U.S. natural gas futures slid more than 2 percent in early trading on Monday on forecasts for reduced heating demand this week and on profit-taking after prices reached seven-month highs last week.

"'Natural gas futures are receding this morning on a combination of a round of profit-taking selling motivated by what looks like a moderating weather pattern working its way across the country over the next week or so,' Energy Management Institute partner Dominick Chirichella said in a report."

Technical Bounce, China Worrisome, Europe Hopeful!

China is causing worry!

Seeking Alpha explains today's strange market behavior:

"...the sell-off in S&P futures came on the heels of disappointing

China Manufacturing data. Almost in lock step, whether it was a nervous

trader or a more concerted effort, and in conjunction with the tensions

on the Street about the FOMC meeting, they reacted harshly to that China

data.

"Conversely, Europe had positive news on the same front, and

that is what allowed futures to recover, but the same major concern

still exists. The FOMC is clearly front and center, concerns about

tapering are on everyone's mind, and analysis al have an opinion. Some

think turmoil could lie ahead before the year's end, but I prefer to pay

attention to one simple thing, the technicals.

"The near and

midterm technicals told me to expect the bounce we are getting today,

but the longer term technicals tell me that the major markets, the

S&P 500 (SPY), Dow Jones Industrial Average (DIA), NASDAQ (QQQ), and Russell 2000 (IWM), have not yet tested longer term support."

And their assessment going forward:

"Therefore,

even with this nice bounce, our combined analysis warns us that it can

be short lived, and the market can turn lower and officially test longer

term support levels. Our rules tell us to short near resistance levels

and buy near support levels. That is therefore what we intend to do as

this year comes to an end."

Where Are Stocks "Beaten Down"?

BEATEN DOWN?

This shows the stock market today, with a tiny little red "candlestick"

showing the month of December at the top right. I have highlighted it

with a yellow arrow. It would be hard to see it at all if I didn't. Does

that look "beaten down" to you? That tiny little red mark, if I had

left all the technical indicators on the chart (I removed them so that

this "beaten down" red mark could be seen more easily), would be close

to the upper Bollinger Band, which indicates two statistical standard

deviations outside of normal market activity.

|

| I'm still struggling to find that "beaten down" part on this chart. |

It IS true that until today, stocks had closed lower 9 of the past 12 days. But the losses were relatively small, as evidenced by this chart, while the few days in the green showed much higher gains. One of those 3 "up" days had a gain of 200 points. That is another sign of the bubbly overbullishness of this market.

Interestingly, in his very arcane book (I had to borrow it from a university library, where only 3 other people had checked it out in 10 years), "Why Stock Markets Crash" by Swiss academic Didier Sornette, he mentions that one characteristic of a bubble is that the news media become cheerleaders for the bubble, buying into and promoting all the hype! They become tools in ramping the bubble even higher.

But ask yourself this: If the economy is doing so well, why has the Fed been using "unprecedented measures" (Bernanke's own term for all this QE) for FIVE YEARS? Why are we still on life support if the market is so strong? Does that make sense to you?

If these "unprecedented measures" are so effective, why are they still using them five years later? Does that really suggest that they have been INeffective instead? (In which case, if they DON'T work, it would be logical to eliminate them instead.)How much further will this bubble rise? I DON'T KNOW!

But we would be wise to be wary, because the classic pin prick of a bubble usually comes in the form of some news event that typically wouldn't be all that significant, but that causes an abrupt and precipitous loss of confidence that sends markets literally crashing.

If you look at market crashes, they tend to collapse much more rapidly than they rose. If they were rising at a 30 or 45 degree angle, then they tend to crash at a much sharper 75 degree angle.

All it takes is one small event that causes an abrupt awakening, and everyone runs for the exit doors at once. That is, in the words of Sornette, "why stock markets crash".

And by the way, the attitude held by investors that they will be the first ones to find an "exit" chair when the music stops playing, is another classic characteristic of a bubble. All the players on Wall St believe that THEY will be one of the fortunate few that gets out the emergency exit door when the trigger event occurs. That is what causes the mad and hysterical rush for the doors -- that one seat in the game of musical chairs -- when the music stops and the insane clamor for safety begins. And that is also why it is Main St investors (on Wall St they call them "retail investors) that get slaughtered and suffer the greatest losses when bubbles pop. Main St investors tend to hang on in the hopes that the market will turn around and redeem them, so they don't throw in the towel until well after their losses have produced staggering losses. And Wall St counts on continued buying by Main St to allow them (Wall St insiders) to get OUT the exit doors first. They depend on Main St continuing to hang on while they literally "take their money and run" for the exit doors.

Note also that in this poor little "beaten down" stock market chart, stocks have barely looked backward since mid-2012. There hasn't been a single month of downward market correction since May 2012. Even the few months that closed in the red were still part of a trend higher. So in the face of economic weakness, stocks have continued an unabated rally without looking back since then. Isn't that a classic description of a bubble?

Empire Fed Misses Expectations, But Stocks Leap Still Higher

This is a classic characteristic of a Fed-induced bubble. The Fed's own Empire State Index fell short of expectations, but stocks leaped higher on the news. Stocks left bad news in Asian markets in their tracks, and used some good news in Europe to leap higher still. Now, this news is sending stocks into the rafters in expectation that the Fed is less likely to reduce its debt monetization scheme on Wednesday. When all news is perceived as good news, and no news introduces thoughts of risk, then all news leads to higher prices. When all thought of proper pricing is discarded, and even the slightest dip sends investors scrambling to buy more, this is textbook bubble mentality! The Dow is up more than 130 points in just the first hour of trading!

And here is the market reaction in the charts. Last night's sharp losses are already forgotten:

Sunday, December 15, 2013

Friday, December 13, 2013

Wednesday, December 11, 2013

Unconvinced by Budget Deal

| |

| Running for the exits before end of 2013 |

| |

| More taper rumors. Is this the beginning of another taper tantrum? |

| |

| The beginning of a taper tantrum? |