Washington lawmakers have failed to reach a compromise over how to

reduce the national debt, and the automatic budget cuts of the 2011

Budget Control Act are set to take force on January 2, 2013. These

automatic cuts, known as sequestration, are inflexible, across-the-board

cuts that were designed to be so harmful that no politician would ever

let them occur. Unfortunately, the White House and Congress have yet to

reach a deal that would prevent their implementation.

Sequestration is particularly harmful for national defense, as it

would cut another half trillion from the military's budget on top of

nearly $900 billion in cuts already under the Obama administration.

Contrary to public perception, most defense dollars today go to small

and medium-sized businesses rather than large firms. In a recent letter

to Ohio's congressional delegation, concerned small businesses wrote,

"[b]etween two-thirds and three-quarters of defense industrial purchases

go to smaller suppliers, and three-quarters of all defense related

manufacturing jobs are at supply chain firms." This means the real harm

of sequestration will fall disproportionately on small business owners

and entrepreneurs.

Defense Shouldn't Be the Target

"Sequestration will bring steep reductions to the defense budget at a time when the American military urgently needs to modernize the force and address longstanding maintenance and readiness shortfalls."Sequestration will bring steep reductions to the defense budget at a time when the American military urgently needs to modernize the force and address longstanding maintenance and readiness shortfalls.

Americans are rightfully concerned about the national debt, and many see the defense budget as a deserving target to cut. After all, popular perceptions of the Pentagon are still largely colored by Dwight Eisenhower's speech about the "military-industrial complex." Yet despite this common characterization, what America spends on its military is a relatively small (and shrinking) part of total government spending. When President Eisenhower warned of the military-industrial complex in 1961, the military accounted for 44 percent of the federal budget, well over 8 percent of GDP. Today, America devotes 15 percent of the federal budget to defense, just over 3.5 percent of its economy. Under current budget plans, defense spending will become the lowest national priority sometime in this decade after the Big Three entitlements, non-defense discretionary spending, and interest on the debt.

While about half of the defense budget is spent on people, the rest funds readiness, operations, training, research and development, and the purchase of goods and services for the three million people working for the Department of Defense. America's arsenal of democracy helps equip and serve those in uniform and plays a critical role in the American economy as both an employer and exporter. The aerospace and defense industry is the nation's largest net exporter, adding $89.6 billion in exports in 2010 and contributes 2.3 percent to the nation's economy.

A Reliance on Small Business

Small businesses are the lifeblood of the American economy. According to the Small Business Administration, 99.7 percent of all employer firms are small businesses. Small businesses have created 60 to 80 percent of net new jobs since 1990, and account for half of the nation's private sector workforce and economy. Moreover, small businesses produce 13 times more patents per employee than large firms. Since 1995, these smaller companies have hired 43 percent of all high-tech workers and are responsible for roughly one-third of all exports.Small businesses are just as vital to equipping and servicing the U.S. military as they are to the national economy. America's shipbuilding, aerospace, and defense manufacturing workforce employs more than one million people directly, many of whom are employed by small firms. Two-thirds to three-quarters of all defense industrial purchases are directed to small and medium-sized suppliers and vendors. As Aerospace Industries Association President Marion Blakey has put it, 70 cents of every defense dollar goes to small firms. In 2011, 20 percent of Department of Defense contracts and 35 percent of subcontracts were awarded to small businesses specifically.

"As Aerospace Industries Association President Marion Blakey has put it, 70 cents of every defense dollar goes to small firms." Small business' value to the defense industry goes beyond the raw percentages. Smaller, specialized firms are often the only producers of niche equipment, software or technology, and as such, play an indispensable role in the military's supply chain. Michael Petters, CEO of Huntington Ingalls, shipbuilder for the U.S. Navy and Coast Guard, notes that 60 percent of the firms that supply his shipyards are "sole source"—companies that may be the only possible provider for critical components. If sequestration breaks these lines, his whole supply chain could crumble. This could leave the U.S. Navy unable to find another business that can make the same parts for the ships built by Ingalls.

One firm of six employees produces a unique "Hot Press" furnace used in the manufacture of ceramic body armor plates that protect American soldiers, for example. If the demand for such furnaces goes down further, that firm could go out of business. If the Department of Defense wanted to resume furnace manufacture down the line, it would take approximately 18 to 24 months to restart production. In the meantime, there would be a gap in protection for U.S. fighting forces overseas.

Sequestration Will Hurt Small Firms Most

Several studies have already examined how sequestration will wreak havoc upon America's small businesses. Dr. George Fuller of George Mason University recently testified to the House Small Business Committee that in 2013 alone, sequestration will put at risk 2.14 million jobs, including over 950,000 small business jobs. In fact, 45 percent of job losses from the first year of sequestration will come from businesses with 500 or fewer employees.As one representative example, security and aerospace company Lockheed Martin has around 40,000 supplier contracts—12,000 of which come from small and minority-owned businesses. While Lockheed is arguably large enough to absorb substantial cuts, its second and third-tier suppliers and long-lead vendors are not as fortunate. If sequestration causes the Pentagon to break contracts with Lockheed, Lockheed will turn around and break contracts with its suppliers—in many cases, small and medium-sized firms. For these firms, sequestration may wipe out much of their expected operating profits and force them into contract termination suits whose costs are shifted up to the government from Lockheed instead of building products for the military. These lawsuits may end up costing the government almost as much as the sequestration cuts were designed to save in the first place.

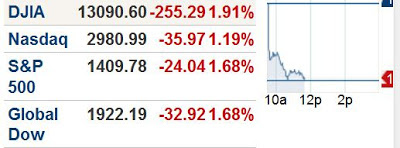

The "fiscal cliff" and the uncertainties surrounding sequestration's resolution are coming at a time when America's small businesses are already feeling squeezed and worried about the future. Many of these smaller firms rely heavily on obtaining loans for future capital investment. Yet, according to a recent survey, 43 percent of small companies claimed that they needed extra funding but were unable to obtain loans over the past four years.

These trends are magnified by the cloud of uncertainty created by Washington. According to the National Small Business Association, 68 percent of small businesses said that economic uncertainty was the most significant challenge to their future growth and survival. Moreover, 34 percent of small business owners anticipate a recession in the coming year—the highest level since December 2009. The climate for small businesses is so acidic that only 25 percent of small business owners anticipate increasing their number of employees in the coming year, which is 15 percent fewer than in December 2011.

These impacts are not just limited to the future. The shadow of uncertainty has led to a soft sequestration already underway. At the Procurement Technical Assistance Center (PTAC) in Genesee County, Michigan, orders have already declined by 30 percent since their peak levels in 2010 due to ongoing defense cutbacks. These cuts are not simply "trimming the fat." Real businesses and smart owners that have succeeded in the past are falling victim to politics, which has allowed this threat to fester. Miller-Holzwarth, a 2007 recipient of the Small Businesses Association subcontractor of the year award, is going out of business due to the pervasive uncertainty surrounding defense budgets. This firm provided steady jobs in Salem, Ohio, for over 35 years yet it was powerless against the last three years of defense budget cuts and a future of much the same.

Lame Ducks Must Think Big

Unless Congress acts swiftly and decisively upon its return after the November elections, countless companies will follow in the footsteps of Miller-Holzwarth. The pillaging of America's small and medium aerospace and defense firms is not an exercise in responsible fiscal restraint but an arbitrary and inefficient process that will have lasting consequences for America's national security and the economy.In many ways, small businesses represent the very best of America. They represent the promise of a better life—the dream that can pay off with hard work, perseverance, and a touch of faith. Yet small businesses can only thrive in an environment that encourages, or at least does not inhibit, innovation and risk taking. Sequestration will hinder innovation by striking small and entrepreneurial businesses hardest.

Sean O'Keefe, chairman of the North American division of EADS, an aerospace and defense corporation, recently told Congress that "American workers are unemployed today because of the uncertainty that has been allowed to surround sequestration." The president can convene Congressional leaders at any time, however, and remove the threat of the fiscal cliff. But the clock is ticking and businesses are not waiting on Washington. They are already starting to act on their own.

The components of a deal are already in place. Both sides of the political aisle know they will need to give a little in order to avert sequestration. The issue is whether one side is willing to careen off the fiscal cliff rather than blink first. If Congress and the president address these major challenges confronting the American economy, then, as Australian Foreign Minister Bob Carr said recently in Washington, America is just "one budget deal away from banishing the notion of American declinism."

As politicians prepare to come up with a plan to strengthen the American economy, they would be wise to think first of those running and employed at America's small businesses. As EADS' O'Keefe also said, "the most vulnerable of these aerospace and defense suppliers are the vast number of small to mid-cap businesses that sustain millions of jobs, drive technology, and create the innovation that is the hallmark of American aerospace. While larger companies have the capacity to more successfully weather the impending fiscal storm, small businesses do not."

Mackenzie Eaglen is a resident fellow in the Marilyn Ware Center for Security Studies.