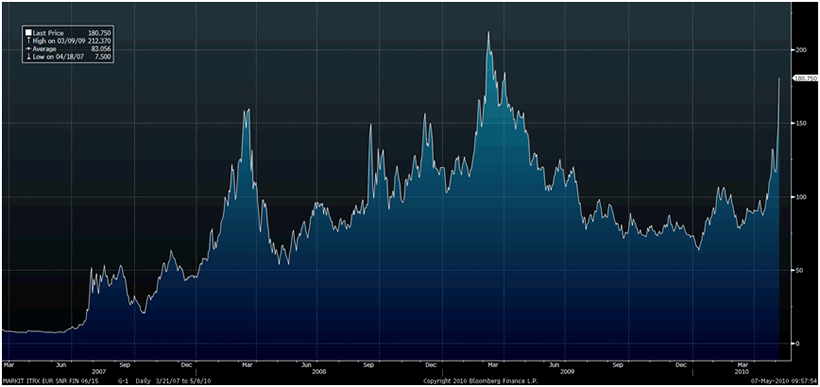

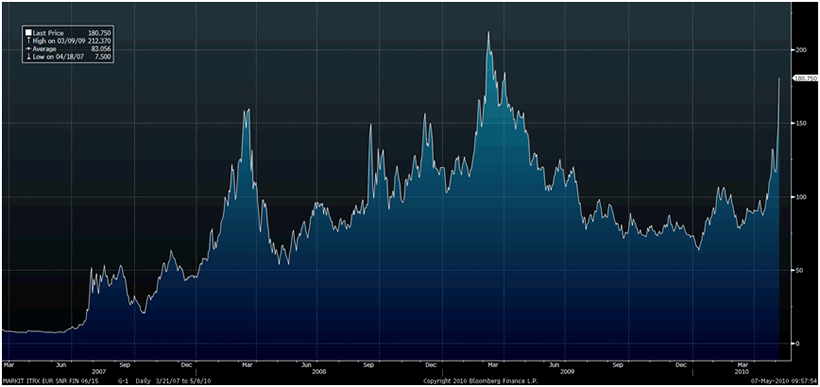

May 7 (Bloomberg) -- The cost of insuring against losses on European bank bonds soared to a record, surpassing levels triggered by the collapse of Lehman Brothers Holdings Inc., as the sovereign debt crisis deepened.

The Markit iTraxx Financial Index of credit-default swaps on 25 banks and insurers soared as much as 40 basis points to 223, according to JPMorgan Chase & Co. The index closed at 212 basis points March 9, 2009. Swaps on Greece, Portugal, Spain and Italy rose to or near all-time high levels.

Credit risk rose for a sixth day on concern the Greek debt crisis is spiraling out of control and triggering concern banks may face losses on their sovereign bond holdings. The Group of Seven plans to hold a conference call today to discuss the turmoil, after a global stock rout that briefly erased more than $1 trillion in U.S. market value.

“Financials are caught in a really bad place right now,” said Aziz Sunderji, a London-based credit strategist at Barclays Capital. “Investors are selling bonds, not just hedging with CDS. It shows investors are repositioning portfolios and there’s a more long-term repricing of peripheral risk.”

Pacific Investment Management Co.’s Mohamed El-Erian and Loomis Sayles & Co.’s Dan Fuss said Europe’s crisis may spread across the globe because of investor concern that governments have borrowed too much to revive their economies.

Portugal, Spain

Markit’s financial gauge was trading at 198 basis points at 2:30 p.m. in London, according to JPMorgan. Contracts on Spanish and Portuguese banks rose to records, according to CMA DataVision prices. Portugal’s Banco Comercial Portugues SA increased 53 basis points to 579 and Spain’s Banco Santander SA rose 12 basis points to 253.

In the U.K., swaps on Royal Bank of Scotland Group Plc jumped 41 to 229 after Britain’s biggest government-owned bank posted the only first-quarter loss among British rivals.

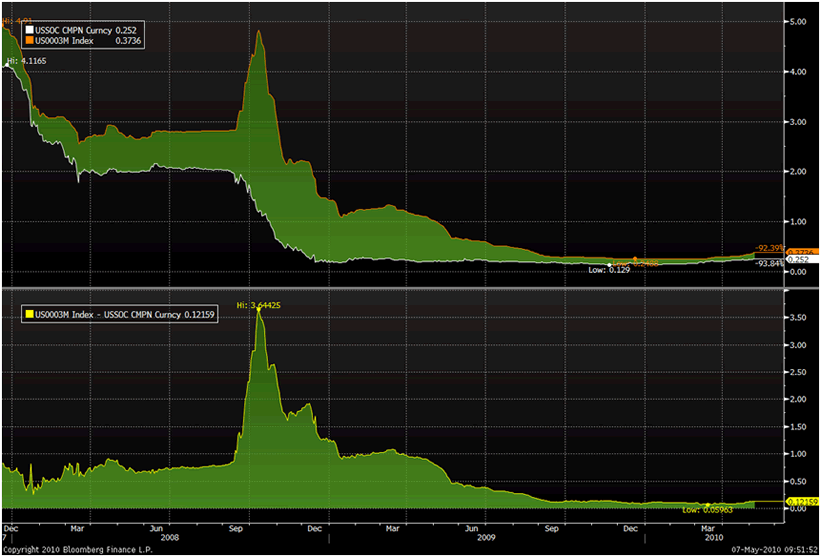

The spread between the three-month dollar London interbank offered rate and the overnight indexed swap rate, a barometer of the reluctance of banks to lend that’s known as the Libor-OIS spread, is at 18 basis points, up from 6 basis points on March 15 and near the highest level in more than five months. It’s still far from the record 364 basis points in October 2008, almost a month after Lehman’s bankruptcy.

Swaps on Greece surged 75 basis points to 1,008 before the advance was pared to 950. Portugal climbed 42 to 502 before falling to 430 and Italy rose 24 to 255.5 before dropping to 227 and Spain increased 14 to 288 before trading at 246, CMA prices show.

British Swaps

Contracts on the U.K. rose 8 basis points to 99, according to CMA. Britain’s election produced a parliament without a majority for the first time since 1974, stoking concern the new government will be too weak to rein in its record budget deficit.

European policy makers are under mounting pressure from investors and foreign officials to broaden their response to the Greek fiscal crisis after a 110 billion euro ($140 billion) bailout package failed to ease concerns.

“We do not see a clear sign that markets will calm down in the absence of decisive action by authorities, which so far have ignored the opportunity to convince investors that they are capable of battling the European sovereign debt crisis,” Markus Ernst, a credit strategist at UniCredit SpA in Munich, wrote in a note to investors.

Merkel Meeting

German lawmakers approved their nation’s share of loans to Greece worth as much as 22.4 billion euros before Chancellor Angela Merkel and other euro region governments meet in Brussels to review the bailout and look for ways to stop the burgeoning crisis. The leaders arrive in Brussels about 6:15 p.m. local time and the final press conference is slated for 10 p.m.

The cost of insuring against losses on corporate bonds also rose. Contracts on the Markit iTraxx Crossover Index linked to 50 companies with mostly high-yield credit ratings increased as much as 74 basis points to 625, JPMorgan prices show, the highest since September. The index pared its advance to 611.

The Markit iTraxx Europe Index of 125 companies with investment-grade ratings climbed as much as 29.5 basis points to 152.5, JPMorgan prices show, the highest since April 2009. It was trading at 139.

A basis point on a credit-default swap contract protecting 10 million euros of debt from default for five years is equivalent to 1,000 euros a year.

Credit-default swaps pay the buyer face value in exchange for the underlying securities or the cash equivalent should a company fail to adhere to its debt agreements. An increase signals deterioration in perceptions of credit quality.

The extra yield investors demand to own investment grade corporate bonds rather than government debt jumped 21 basis points from last week to 174, the largest weekly rise in a year, according to Bank of America Merrill Lynch index data. The gauge has also increased 10 basis points from yesterday, the biggest one-day increase since October 2008.

Saturday, May 8, 2010

Default Swaps Soar to Lehman Levels

Stock Plunge Remains a Mystery!

What amazes me is that everyone seems to know the cause despite that there's no evidence of such. It strikes me as too convenient that they had a cause identified within minutes of the event, but days later, there still isn't the slightest hint of why, how, or evidence that such a glitch or error occurred. I don't buy any of it! It is more likely that it was some sort of intentional selling, or perhaps the collective selling of millions of worried people! Spin, spin, spin!

from FT.com:

The day after $1,000bn was briefly wiped off the market value of US equities, traders were still trying to work out what caused share prices to plunge and then rebound so dramatically in a matter of minutes.

The conventional wisdom held that an incorrectly typed sell order – one that confused “billions” for “millions”, for example – was the likely culprit.

“The trigger for the sell-off was most likely some kind of errant order, a fat-finger typo, which set off a chain reaction of selling,” said Sang Lee, managing principal at Aite Group. “I would be shocked if that was not the case as the fall in stocks was so sudden and extreme.”

However, despite the persistence of this story, officials were struggling to idenfity a specific cause. “We still don’t know what was the initiating signal for the trading activity we saw on Thursday,” said Jeff Wecker, chief executive officer at Lime Brokerage. “The verdict is still out.”

What was clear was the ferocity of the fall. Just before 2.40pm on Thursday, the S&P 500 index, the US equity market’s benchmark, fell from 1,120. Inside six minutes, it bottomed at 1,065.79, a slide of nearly 5 per cent. By 3.00pm, the index was moving above 1,120, although still down 4 per cent on the day before, settling 3.2 per cent lower by the close.

Traders said the day had got off to a gloomy start, with fears that Greece could become the first eurozone country to default on its debt weighing down stock prices. Television images of fighting in Athens reinforced anxieties and encouraged investors to cut risk exposure.

“We already had a significant fear premium in the market and clearly there was some kind of incident which we need to understand,” said William O’Brien, chief executive officer at Direct Edge, one of the four main trading venues for equities.

When the plunge came, traders said it was exacerbated by the rapid-fire computer systems that post prices and execute trades in microseconds. Such trading accounts for the bulk of volume in US equity markets and it served to reinforce a downward move that saw some stocks trade for a penny or less.

Because computers also serve to link markets, the panic spread to currencies and bonds. The yen soared in value against the dollar and the euro. The demand for government debt, a traditional haven during a crisis, soared, pushing the yield on 10-year US Treasury bonds sharply lower.

The situation was made worse, many traders said, by NYSE Euronext’s decision to slow down trading on its trading floor, which sent orders to other venues and intensified the selling.

“This is not a day for the industry to be proud of and when only one exchange slows down or stops trading it does not improve the situation, it exacerbates it,” said Mr OBrien.

One government official said the activity reinforced worries that “the market has outpaced the ability of the infrastructure to handle it. We have detached finance from the real economy and created a monster.”

The selling overwhelmed the market for some stocks, as legitimate bids disappeared, leaving what is called a “stub bid”, or a buy order posted at a penny. In a machine-dominated market such token prices for stocks were duly executed.

Subsequently, the four main trading venues for US stocks – NYSE Euronext, Nasdaq, BATS Trading and Direct Edge – announced the cancellation of trades, executed between 2.40pm and 3.00pm, in which prices deviated sharply.

The Securities and Exchange Commission and the Commodities Futures Trading Commission said they would “review the unusual trading”. Hearings have been scheduled for Tuesday before the House financial services subcommittee on capital markets.

Hedge funds held conference calls to explain the situation to their investors. Algebris Investments in London, which is down 4.5 per cent this month, told clients it was scaling back its positions and adding to hedges by buying credit insurance on companies and taking short positions on European stock indices.

Not Pretty! World Economic Headlines

WASHINGTON (AP) - The U.S. economic recovery is on shakier ground.

The growing European debt crisis has sent stock markets on a wild ride. A weaker European economy could sap demand for U.S. exports and hurt sales by U.S. companies in Europe. U.S. banks that hold European government debt also could cut back on lending to conserve cash.

"The perception of risk has just changed in a major way," said Mark Vitner, senior economist at Wells Fargo Securities. "Business leaders now think there is more risk in the world economy than they did 30 days ago."

Wall Street endured a dizzying plunge Thursday, sending the Dow Jones industrials to a loss of nearly 1,000 points in less than half an hour. A computerized selloff possibly caused by a trader's mistake may have been responsible for the late-session plunge, and the Dow recovered two-thirds of the loss before the closing bell.

But the jitters over Europe remained and the selling spread to Asia on Friday. Markets in Japan, South Korea and China all posted steep losses, with Tokyo's benchmark Nikkei 225 stock average closing down 3.1 percent.

Vitner and other economists worry that Europe's debt crisis could tip the 16 countries that use the euro currency back into a recession. The euro area comprises the second-largest economy in the world, after the United States. And as in the United States, its economy has been slowly recovering from recession.

The likelihood that the U.S. would fall back into recession remains low, economists say. Still, a falling U.S. stock market could unnerve consumers and investors and cause cutbacks in spending. Consumer spending accounts for about 70 percent of U.S. economic activity.

"The stock market has been very important to our recovery because the market's gains over the past year had prompted high-income households to increase their spending," said Mark Zandi, chief economist at Moody's Analytics. "If stocks go south, then those consumers will not spend as much."

And a slowdown in consumer spending could make U.S. corporate executives less willing to hire and expand, Vitner said.

Economists say the situation is reminiscent of the collapse of Lehman Brothers in the fall of 2008. The resulting chaos caused banks to clamp down on lending. Nervous consumers stopped spending. Companies facing plummeting sales cut back on production and laid off millions of workers.

Some economists raise the prospect of a similar cycle in Europe.

"Europe feels like we did after Lehman Brothers," said Barry Eichengreen, an economics professor at the University of California, Berkeley. "No one has seen this kind of thing before ... and they are questioning the competence of their leaders to deal with it, and rightly so."

European consumers may soon cut back on purchases of new cars or appliances, Eichengreen said, "because they don't know what's next."

President Barack Obama's goal of doubling U.S. exports over the next five years is unlikely to be reached under these conditions, economists say.

Obama's plan "is completely off the table if the dollar remains strong and one of the leading economic areas enters a deep recession," said Eswar Prasad, an economics professor at Cornell University.

A $140 billion rescue package agreed to by the International Monetary Fund and European leaders has failed to resolve concerns in the financial markets that Greece might default on its debts.

The concerns are likely amplified, economists said, because memories of the 2008 crisis are still fresh. Before the recession, many experts, including Federal Reserve Chairman Ben Bernanke, said the fallout from the subprime housing bust wouldn't spill over to the broader economy.

"Remember, people thought the subprime mortgage crisis would go away, and it didn't," said Sung Won Sohn, an economics professor at the Smith School of Business at California State University.

Friday, May 7, 2010

Gold De-Couples From Dollar As Fear of Contagion Spreads

from Market Oracle:

The sharp sell off on Wall Street and with equities internationally saw gold decouple and surge in all currencies yesterday. Oil, commodities and bonds also fell sharply in incredibly volatile trading.

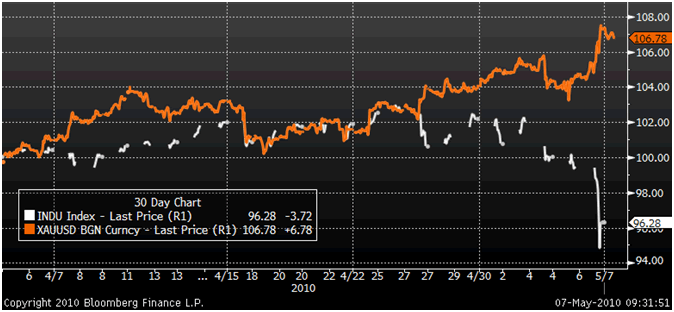

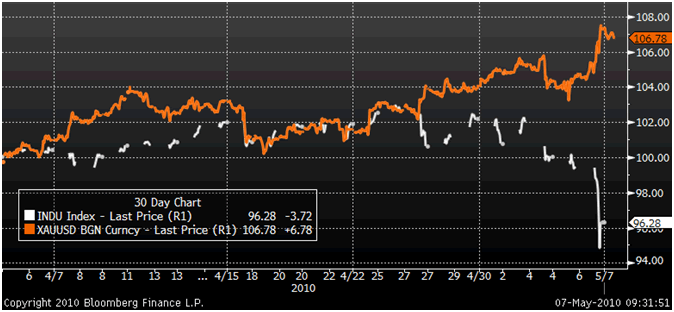

Gold Decouples - Gold and the Dow Jones - 30 Days

The massive intraday drop of nearly 1000 points in the Dow Jones also saw significant volatility in currency markets which may presage a euro currency crisis. There is the risk that the sovereign debt crisis could lead to an international monetary crisis as investors lose faith in fiat currencies most of which are saddled with very significant debt levels. Gold's debt free status and lack of counter party risk is making it an increasingly attractive diversification option - and this looks set to continue for the foreseeable future.

Gold in US Dollars Looks Set to Challenge the Record Nominal Daily High of $1,215 per ounce

The UK hung parliament or minority government will not help sentiment towards sterling. The incoming government will be faced with some of the most challenging economic challenges to be faced in modern history. The UK's public finances are in very poor shape and the UK's AAA credit rating is at risk. While the UK is no Greece, its fiscal challenges are extremely challenging and will involve considerable economic pain - possibly even austerity measures. Sterling may remain under pressure until the markets perceive that the incoming government means business about tacking the deficits.

Gold in GBP Surges 4% Yesterday on Political and Economic Concerns

With all the focus on the Greek and European sovereign debt crisis, many have yet to notice the growing risks of another Lehman Brothers style interbank cash market seize up. Sovereign debt contagion fears are feeding into interbank contagion fears as concerns about the solvency of some banks saw Libor rates rising sharply. Moody's warned of risk of contagion in the banking sector yesterday.

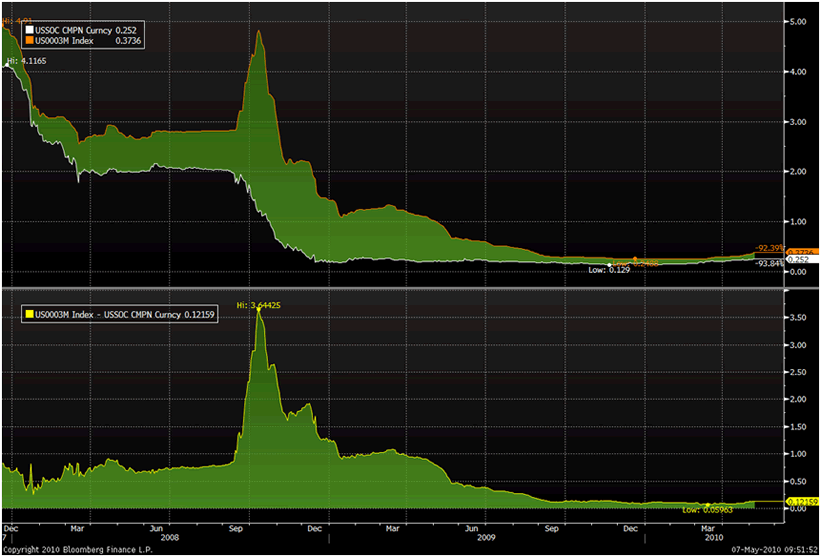

Important benchmarks of the health of the global banking system are again flashing red signals. The spread between three-month Libor and the overnight indexed swap rate, a key gauge of banks' reluctance to lend, rose to the most in more than five months yesterday, as concern deepened that the financial crisis in Greece is spreading to other nations (see chart below).

3 Month Libor and the Overnight Indexed Swap Rate

Another sign of 'Lehmanesque' problems recurring is that the Markit iTraxx Financial Index of credit-default swaps linked to the senior debt of 25 European banks and insurers soared as much as 40 basis points to an all-time high of 223. The cost of default protection on corporate debt in Europe rose to the highest since April 2009.

Markit iTraxx Financial Index of Credit-Default Swaps

Silver

Silver fell slightly in dollars yesterday to $17.47/oz but rose to new record highs in euros, British pounds and Swiss francs.

Silver remains less than half its nominal high of $50 per ounce 30 years ago and less than 20% of its inflation adjusted high of over $130 per ounce.

Platinum Group Metals

Platinum is trading at $1,660/oz marginally up and palladium is currently trading at $505/oz down another 1%. Rhodium is trading at $2,760/oz.

News

Respected analyst, David Rosenberg of Guskin-Sheff has forecast that gold will rise to $3,000 per ounce. Unlike Nouriel Roubini who has recently warned that the risk of deflation is abating and the growing risk was of inflation, Rosenberg remains a deflationist, but still thinks gold will continue to perform very well.

He argues that the breakdown of the euro is very bullish for gold. With the ECB being no Bundesbank and the Euro no D-Mark, gold is set to soar in euros and dollars.

Rosenberg warns that the Euro is less of a "hard currency" than its architects could have ever envisaged a decade ago. Now there is talk that the ECB is contemplating a quantitative easing plan. The case for gold heading to $3,000 an ounce is getting stronger by the day. The euro has already broken below 1.30 to the U.S. dollar and there is plenty of room for additional decline going forward. It's only at a one-year low - wait until it moves to a decade low.

Make no mistake - the problems in Greece are mirrored in places like Portugal and Spain - this is not about liquidity, like Bear Stearns and Lehman, it is a crisis in confidence (Banco Santander, widely seen as a barometer of financial health in Spain, cratered 7% yesterday). The FT reports today that there has been some market chatter that Spain has been "negotiating" with the IMF for assistance (€280bln) too. History shows that crises over confidence are tougher to repair over the near-term than liquidity crunches. The fact that Greek short- term bonds have collapsed in price even more - even though the country does not have to come to the market for the next few years so long as Germany comes through after the vote - is a case in point.

So contagion risks loom and there are simply not enough trees on the planet that can provide enough paper currency to backstop countries like Portugal and Spain. Moreover, what investors see is that if there is so much political foot- dragging in Germany and other EU countries to approve a bailout of tiny Greece, achieving a rescue plan for other large basket-cases will be even more arduous a task. Have a look at Martin Wolf's column on page 9 of the FT - A Bailout For Greece is Just the Beginning. What a tale of woe. And let's not forget about Italy - its public finances are less dire but still fragile (Business Insider).

CME Denies Rumors About 1000-Point Stock Drop

CME Group has issued a statement following rumors that erroneous or irregular trades by Citigroup Global Markets Inc may have been the cause for a more than 900 point drop in the Dow Jones Industrial Average during mid-day trading on Thursday:

“While our policy is not to comment on individual participation in our markets, in light of volatile market conditions, CME Group confirmed that activity by Citigroup Global Markets Inc. in CME Group stock index futures markets does not appear to be irregular or unusual in light of market activity today.”

Stock Market Stumble: Not Just a Computer Glitch

Good Evening: The major U.S. stock market averages were all down more than 3% today, but after our markets suffered a harrowing afternoon plunge and rebound, most investors will take it. Market participants were already on edge before trading even began, with the recent riots in Greece providing the backdrop to a rapidly deteriorating financial situation in Europe. When the European Central Bank (ECB) gave no indication this morning that it would soon inflate the equivalent of monetary life rafts for the peripheral EU nations that threaten to sink into the Mediterranean Sea, the stage was set for a substantial decline in risk appetites. Our capital markets duly responded, as equities and commodities fell while Treasurys and the dollar rose. What happened during a sudden and heart-thumping swoon cum comeback in the afternoon is anything but clear. It could even have been some mistakenly entered trades, but what is clear is that the underlying problems have not gone away.

Markets in Asia and Europe were under pressure overnight as investors awaited news from both Greece and the ECB. The Greek Parliament actually voted in favor of the austerity measures that gave rise to the deadly unrest in Athens this week, but it was the press conference after the ECB meeting that saw some jaws drop (see below). ECB president, Jean-Claude Trichet, all but dashed the hopes of those who wanted to see the ECB hose down the solvency fires burning in southern Europe with the liquidity of Quantitative Easing. Not only did Trichet just say no to QE, he announced the ECB wasn’t even lowering its policy rate, at least for now. Perhaps he was just trying to be stoic, and maybe he was just trying to act as a responsible steward of the euro currency, but it is an understatement to say his (in)actions didn’t help.

The euro slumped to new lows and European stock markets followed suit. After two straight down days, U.S. investors apparently were hoping what was happening in Europe would stay in Europe. Our index futures were only down mildly prior to the open in New York. Prices leaked steadily once trading began in earnest, however, and the major averages were off some 3% by mid afternoon. It all made sense until stocks suffered what can only be described as a “mini-crash” and equally frantic rebound during the 45 minute period between 2:30 and 3:15 edt. Different media sources are blaming the hair-raising action on erroneous trades in certain equities and equity index futures (see below). I have friends who work at Citigroup, and I was told that the rumors were false — that Citi was not asleep at the switch that represents their electronic trading efforts.

Something, somewhere went wrong, though, and the NYSE and NASDAQ are investigating a series of what they thought looked like “erroneous trades” during the time period cited above. To pick just one example, P&G was trading roughly unchanged ($62) at 2:38 edt. Ten minutes later, it traded below $40, and just a few minutes after that it was back above $62. The media can call action like this “panic selling” all they want, but it looks to me like some mistakes were definitely made. Stocks like PG haven’t traded like they did today since the days surrounding October 19, 1987. THAT was a crash; today was not. Today’s trading did expose just how fragile our markets can be, however, especially when bids disappear and momentum-driven trading programs take over.

By day’s end, and after indexes like the Dow saw trading ranges approaching 10%, the averages finished with losses ranging from -3.2% (Dow) to -3.7% (Russell 2000). Treasurys were a highly sought alternative as risk aversion peaked this afternoon, and yields fell between 12 and 21 basis points. As 2010 dawned, I said periods of falling risk appetites should be used to reduce Treasury exposure. This is one of those times. The dollar rose a stout 0.75%, and commodities understandably tumbled in sympathy with stocks. Without nice rallies in gold and silver due to the flight from managed currencies the CRB index would have fallen more than the 2% it did today.

Nothing so spoils the digestion of a long and late lunch quite like returning to one’s desk to find the markets sporting gaping holes in their price charts. Before I could even ascertain what was happening, the market closed and I decided to go back about my business. After work, I did some digging, made some calls, and came to the conclusion that most of the worst of today’s move was a mistake. Does that mean investors should buy with both fists tomorrow? No, though I think stocks could enjoy a nice snapback rally in the coming days. Nimble traders might chase the to and fro volatility, but long term investors should ask themselves whether the underlying causes have been resolved.

At the moment, the issue is a funding crisis for certain countries in Europe, but the real issue is debt itself. Far too much of it was taken on during the late, great credit bubble, and it was a global phenomenon. What started in subprime, then spread to other mortgage products, crushed the GSEs and sent LEH to the NYSE symbol graveyard, was a process arrested in this country only when the Fed opened up its balance sheet and financed almost everything. By effectively shifting what had been private sector obligations onto the public balance sheets of the Fed and Treasury Department, what we really accomplished was changing who was responsible for paying back much of this stranded debt. The U.K. did the same thing, and both nations monetized a hefty portion of these debt purchases. Nations in Europe can’t pull off the same trick because countries like Greece, Portugal, and Spain can’t print euros — only the ECB can do that.

The options open to these European nations are not good ones, and the investment implications vary with each path taken. Default, a reconstitution of the euro, and/or some QE/debt monetization by the ECB — none of them are optimal and all require various measures of pain. I think the best decision is to wait for some policy clarity out of Europe. Until that day comes, I’m quite content to keep some cash, own some stocks, have some hedges in place, and let the precious metals portion of the portfolio grow as other currencies tumble. The rally in gold, despite a rising dollar and despite falling commodity prices, may be telling us that the yellow metal is finally asserting itself as the world’s most desirable currency.

– Jack McHug

Jobs AND Unemployment Rise, U-6 Rises to 17.1%

Mixed bag! From Bloomberg:

May 7 (Bloomberg) -- Employment in the U.S. increased in April by the most in four years and the unemployment rate unexpectedly rose as thousands of people entered the labor force, indicating the recovery is becoming self-sustaining.

Payrolls jumped 290,000 last month, more than the median estimate of economists surveyed by Bloomberg News, after a revised 230,000 increase in March that was larger than initially estimated, figures from the Labor Department in Washington showed today. The jobless rate rose to 9.9 percent last month from 9.7 percent.

from Financial Sense:

Thursday, May 6, 2010

Productivity Slows

In the first quarter, output increased 4.4% on an annualized basis, while hours worked rose 0.8%, the government estimated.

Wild Day on Wall Street

Daily View

INflation, DEflation, HYPERinflation

from my friend Koot on Marketwatch. I will have to investigate and read more later, but wanted to record this.

sbenard, thanks for the kind words. I believe one of the articles that I posted was from Ron Hera of Hera Research LLC. Bernankes Delemma.

--------------------------------------------------------------

http://www.heraresearch.com/images/Bernankes_Dilemma_Hyperinflation_and_the_US_Dollar_20100309e.pdf

http://www.heraresearch.com/

"Rather than a crisis of confidence, hyperinflation results from a crisis of credibility.

Hyperinflation results when the social, legal and political structures that create the value of paper

money break down. When a government borrows excessively and its promises to repay are

contradicted by mathematical realities, the value of its currency cannot be maintained. If a

government so lacks credibility that it cannot issue bonds because there are no buyers other than

its own central bank, the value of its currency declines faster than money is printed to cover its

obligations. Perhaps the most important indicator of impending hyperinflation is whether the

statements of a government or of its central bank, e.g., with respect to the government’s budget or

the central bank’s balance sheet, are evidence based or ideological. If they are not evidence

based, the credibility of the government or central bank, and its currency, will weaken and

eventually fail."

----------------------------------------------------

There were other articles related to the difference between supply demand type inflation-deflation and loss of trust or credibility of government caused hyperinflation. Many people believe a country goes from inflation to hyperinflation but that is not what happens. What happens is a country goes from a credit crisis and loss in credibility of government type deflation directly into hyperinflation, Zimbabwe, Wiemar, et. al. Like Ron explained when people and other nations no longer trust the words or credibility of government or central banks currency, everyone seeks other places of holding their money even if the nation is in a depression.

Gold De-Couples From Dollar As Fear of Contagion Spreads

The sharp sell off on Wall Street and with equities internationally saw gold decouple and surge in all currencies yesterday. Oil, commodities and bonds also fell sharply in incredibly volatile trading.

Gold was up by more than 2% in dollar terms and by more than 3.5% in euros and pounds as the euro and pound fell sharply on contagion fears, hung parliament and economic concerns respectively. Gold reached new record nominal highs in sterling, euros and Swiss francs and 27 year highs in Japanese yen, also reaching a five-month high in dollars. Given the scale of the international debt crisis, the December record (nominal) high of $1,226 per ounce (interday) could be reached in the coming days and respected analysts are now forecasting gold to rise to $3,000 per ounce (see News).

Gold Decouples - Gold and the Dow Jones - 30 Days

The massive intraday drop of nearly 1000 points in the Dow Jones also saw significant volatility in currency markets which may presage a euro currency crisis. There is the risk that the sovereign debt crisis could lead to an international monetary crisis as investors lose faith in fiat currencies most of which are saddled with very significant debt levels. Gold's debt free status and lack of counter party risk is making it an increasingly attractive diversification option - and this looks set to continue for the foreseeable future.

Gold in US Dollars Looks Set to Challenge the Record Nominal Daily High of $1,215 per ounce

The UK hung parliament or minority government will not help sentiment towards sterling. The incoming government will be faced with some of the most challenging economic challenges to be faced in modern history. The UK's public finances are in very poor shape and the UK's AAA credit rating is at risk. While the UK is no Greece, its fiscal challenges are extremely challenging and will involve considerable economic pain - possibly even austerity measures. Sterling may remain under pressure until the markets perceive that the incoming government means business about tacking the deficits.

Gold in GBP Surges 4% Yesterday on Political and Economic Concerns

With all the focus on the Greek and European sovereign debt crisis, many have yet to notice the growing risks of another Lehman Brothers style interbank cash market seize up. Sovereign debt contagion fears are feeding into interbank contagion fears as concerns about the solvency of some banks saw Libor rates rising sharply. Moody's warned of risk of contagion in the banking sector yesterday.

Important benchmarks of the health of the global banking system are again flashing red signals. The spread between three-month Libor and the overnight indexed swap rate, a key gauge of banks' reluctance to lend, rose to the most in more than five months yesterday, as concern deepened that the financial crisis in Greece is spreading to other nations (see chart below).

3 Month Libor and the Overnight Indexed Swap Rate

Another sign of 'Lehmanesque' problems recurring is that the Markit iTraxx Financial Index of credit-default swaps linked to the senior debt of 25 European banks and insurers soared as much as 40 basis points to an all-time high of 223. The cost of default protection on corporate debt in Europe rose to the highest since April 2009.

Markit iTraxx Financial Index of Credit-Default Swaps

Silver

Silver fell slightly in dollars yesterday to $17.47/oz but rose to new record highs in euros, British pounds and Swiss francs.

Silver remains less than half its nominal high of $50 per ounce 30 years ago and less than 20% of its inflation adjusted high of over $130 per ounce.

Platinum Group Metals

Platinum is trading at $1,660/oz marginally up and palladium is currently trading at $505/oz down another 1%. Rhodium is trading at $2,760/oz.

News

Respected analyst, David Rosenberg of Guskin-Sheff has forecast that gold will rise to $3,000 per ounce. Unlike Nouriel Roubini who has recently warned that the risk of deflation is abating and the growing risk was of inflation, Rosenberg remains a deflationist, but still thinks gold will continue to perform very well.

He argues that the breakdown of the euro is very bullish for gold. With the ECB being no Bundesbank and the Euro no D-Mark, gold is set to soar in euros and dollars.

Rosenberg warns that the Euro is less of a "hard currency" than its architects could have ever envisaged a decade ago. Now there is talk that the ECB is contemplating a quantitative easing plan. The case for gold heading to $3,000 an ounce is getting stronger by the day. The euro has already broken below 1.30 to the U.S. dollar and there is plenty of room for additional decline going forward. It's only at a one-year low - wait until it moves to a decade low.

Make no mistake - the problems in Greece are mirrored in places like Portugal and Spain - this is not about liquidity, like Bear Stearns and Lehman, it is a crisis in confidence (Banco Santander, widely seen as a barometer of financial health in Spain, cratered 7% yesterday). The FT reports today that there has been some market chatter that Spain has been "negotiating" with the IMF for assistance (€280bln) too. History shows that crises over confidence are tougher to repair over the near-term than liquidity crunches. The fact that Greek short- term bonds have collapsed in price even more - even though the country does not have to come to the market for the next few years so long as Germany comes through after the vote - is a case in point.

So contagion risks loom and there are simply not enough trees on the planet that can provide enough paper currency to backstop countries like Portugal and Spain. Moreover, what investors see is that if there is so much political foot- dragging in Germany and other EU countries to approve a bailout of tiny Greece, achieving a rescue plan for other large basket-cases will be even more arduous a task. Have a look at Martin Wolf's column on page 9 of the FT - A Bailout For Greece is Just the Beginning. What a tale of woe. And let's not forget about Italy - its public finances are less dire but still fragile (Business Insider).

Tuesday, May 4, 2010

Global Warming - Not Just Faulty Data, But FRAUDULENT Data

from Gary Baise, a farmer and lawyer, at Farm Futures:

Agriculture has a lot at stake in the climate change or global warming debate. Troubling questions have been raised recently over the science supporting global warming.

As a corn and soybean producer and lawyer, I am always skeptical when someone like former Vice President Al Gore alleges he knows the complete story on global warming. In my opinion every story, like a pancake, has two sides.

The first story that got my attention refers to "Climategate," which began in November 2009 with an internet leak of thousands of emails and other documents from the University of East Anglia's Climate Research Unit. According to the university, the emails and documents were obtained through the hacking of a server. The emails were used to support widely-publicized allegations by climate change skeptics that the emails showed scientific misconduct and mishandling of Freedom of Information requests.

Now a story written in Environment & Climate News, May 2010, by James M. Taylor, describes a recent letter sent by the Institute of Physics, a London-based scientific charity with a membership of over 36,000 devoted to the understanding and application of physics. Taylor’s article declares that “The letter criticizes global warming alarmists at the heart of the Climategate scandal for manipulating data, abusing the scientific method and strong-arming the peer-review publication process.”

The Institute further advises the British Parliament that it is concerned that some of the research and emails may prove to be “…forgeries or adaptations [with] worrying implications aris[ing] for the integrity of scientific research in this field…”

Forgeries of data? This is a strong accusation!

It is clear that the Institute of Physics wants to learn the truth about activities of scientists involved with the United Nations Intergovernmental Panel on Climate Change (IPCC). The Institute’s Memorandum sets forth 13 assertions and requests to Parliament. The most important paragraph declares “The emails reveal doubts as to the reliability of some of the reconstructions and raise questions as to the way in which they have been represented; for example, the apparent suppression in graphics widely used by the IPCC of proxy results for recent decades that do not agree with contemporary instrumental temperature measurements.”

Fraud? In plain English, the scientists are suggesting, as many articles have suggested, that the truth is not being told about global warming issues. (In other words, it is fraud!!!)

The second story that caught my attention arose here in Virginia from the Attorney General, Ken Cuccinelli, who filed a Civil Investigative Demand against the Commonwealth’s flagship University of Virginia (UVa). The Attorney General is demanding UVa produce all its documents in connection with one of its scientists, Dr. Michael Mann, who was implicated in several stories regarding the Climategate scandal. Dr. Mann is one of the major advocates of the “hockey stick graph” which demonstrates that global temperatures have risen suddenly and with an unprecedented upward spike and looks like a hockey stick.

Both the Institute of Physics and the Attorney General of Virginia are seeking facts and truth regarding the alleged Climategate scandal. Of course, the reaction against these efforts has been widespread and full of condemnation.

I find this curious, as you should, that people are afraid to have documents paid for by taxpayer money made available for others to read.

The Attorney General of Virginia, not being an academic, is concerned about Virginia taxpayer money being used by UVa and Mann to develop data and conclusions which also may be questionable (or fraudulent) as they relate to climate change. Mann has been accused of manipulating climate data to support the idea of manmade global warming.

As a result, the Attorney General has commanded UVa to produce all information and documentary materials that might show possible violations by Mann of the Virginia Fraud Against Taxpayers Act.

Among the 10 requests for information from Mann include a request for all of the computer programs that were created or edited by Mann from January 1, 1999 to the present. The Attorney General wants all of Mann’s hard drives, floppy drives, tape drives, optical drives, desktop and laptop - well, you get the idea. The Attorney General wants the truth. (Dr. Mann is no longer at the University of Virginia and now works at Penn State.)

Serious questions As I said earlier, I do not know the truth, but I do know the Institute of Physics is raising a number of serious questions regarding the integrity of the scientific research related to global warming. I also know the Attorney General of Virginia is a sincere and tough lawyer, and he will not stop until he is convinced we have the truth about Mann’s work while at UVa working on convincing the world that global warming is real.

Producing these documents from all the scientists will help all of us understand whether global warming is real or manmade.

Agriculture has a major stake in finding out the truth about Climategate. Many organizations believe agriculture is a major problem and contributes to global warming. Data should not be used that might unfairly target agricultural operations.

As has been said: “Sunshine is the best disinfectant” - Justice Lewis Brandeis.

The Debt Contagion Begins to Spread

May 4 (Bloomberg) -- The euro slid to a one-year low against the dollar and stocks tumbled amid concern the European government debt crisis is spreading to Spain and Portugal. Commodities and shares of their producers slid on a slowdown in Chinese manufacturing and fallout from the BP Plc rig disaster.

The euro weakened below $1.31 for the first time since April 2009. The MSCI World Index of 23 developed nations’ stocks declined 1.8 percent at 9:37 a.m. in New York and the Standard & Poor’s 500 Index dropped 1.5 percent, erasing yesterday’s rally. BP Plc slumped to a seven-month low as the costs of containing an oil spill in the Gulf of Mexico mounted. Copper fell to its lowest level in nine weeks, while oil sank 2.8 percent to $83.75 a barrel as the dollar rose against 14 of 16 major counterparts.

Greece’s 110 billion-euro ($146 billion) bailout, approved by finance ministers over the weekend, is failing to ease speculation the debt crisis will spread to nations such as Portugal and Spain. A Chinese purchasing managers’ index declined to 55.4 from 57 in March, signaling government attempts to cool the world’s fastest-growing economy are working.

“There’s spillover effect from China,” said Stanley Nabi, New York-based vice chairman of Silvercrest Asset Management Group, which manages $9 billion. “Spain and Portugal are both endangered species. The attention could shift to one of those countries. In the U.S., it’s no longer news that earnings are better than expected. The stock market has had a great run. I’ve got a feeling that May is going to be a month of consolidation or even of backing down a little bit.”

The S&P 500 erased most of yesterday’s 1.3 percent rally triggered after Warren Buffett defended Goldman Sachs Group Inc. in the wake of fraud accusations against the firm, while reports on manufacturing and consumer spending signaled the economy is strengthening.

“The biggest concern today remains the European peripheral countries and Spain is the big one because there’s fear of another downgrade,” said Sal Catrini, a managing director for equities at Cantor Fitzgerald & Co. in New York. “That’s shaking things up today.”

Monday, May 3, 2010

CPI Explodes!

Americans saw prices rise two percent in the year to March according to the Commerce Department's personal consumption expenditures index published on Monday. The figure, which is closely watched by the Federal Reserve as a sign of broader inflation levels, is approaching the maximum the central bank normally considers sustainable.

Energy and food costs rose 18.7 percent against March 2009, up almost four percentage points compared with February.

Without food and energy spending the inflation level remained stable at 1.3 percent.

The Federal Reserve last Wednesday vowed to keep historically low interest rates for an "extended period," amid "subdued" inflation trends.

Pointing to a slightly quickening economic recovery, the Fed said labor and housing markets showed glimmers of improvement and spending had ticked up.

That impression was reinforced Monday by the Commerce Department, which said spending rose for the sixth consecutive month in March, up by 0.6 percent.

Seasonally adjusted figures showed spending, a key driver of the US economy, rose as Americans saved less.

Federal Pension Insurance Fund Is Insolvent

Last November, the federal corporation charged with protecting Americans’ retirement funds issued an ominous public warning: the amount of pensions at risk inside failing companies had more than tripled during the recession.

The Pension Benefit Guaranty Corporation’s announcement signaled it might need tens of billions of new dollars to rescue traditional pensions paid by U.S. firms whose economic collapse left them unable to meet their retirement obligations to workers.

At the same time, however, the federally chartered corporation was receiving some bad news of its own: for the first time it was going to flunk an independent audit of the way it manages its finances.

On Nov. 12, 2009, PBGC’s outside audit firm and the corporation’s own internal watchdog jointly informed the federal body it was being cited for a “material weakness” in its internal financial controls, the accounting equivalent of an F grade.

“PBGC did not have effective internal control over financial reporting (including safeguarding assets) and compliance with laws and regulations and its operations,” Inspector General Rebecca Anne Batts wrote in a letter that has escaped public attention despite their potential importance to taxpayers.

Americans may expect such adverse audit findings for corporate bad actors, but the finding is more unusual for a government agency, especially one charged with cleaning up failed companies’ messes and rescuing workers’ pensions.

A Center for Public Integrity review of hundreds of pages of memos, audits and internal reports shows the pension guaranty corporation has been unable to make several guarantees about its own work — in some cases directly misleading Congress and its inspector general into believing long-simmering problems were resolved.

“Providing false information to OIG or Congress can be a criminal violation,” an angry Sen. Charles Grassley of Iowa, the senior Republican on the Senate Finance Committee, warned in a letter March 31 that was provided to the Center. The letter chided the corporation for its “apparent dishonesty” in erroneously reporting it had implemented solutions to past problems.

Created in 1974, PBGC is essentially the government’s insurance program for retirees, protecting the pensions of approximately 44 million workers and retirees in more than 29,000 private defined benefit pension plans that promise a fixed monthly payment to retirees for life. When a covered company’s pension plan defaults, PBGC swoops in and protects workers’ retirements.

The corporation receives no tax dollars, and is funded instead by insurance premiums paid by pension plan operators, investments and assets it recovers from companies whose pension plans needed to be rescued.

A Litany of Problems

Getting its story straight with Congress is just one of PBGC’s problems.Despite being the custodian of some of Americans’ most private data, PBGC suffers from such lax security that a contractor was able in 2008 to download the pension and Social Security numbers of 1,300 Americans to an unsecured electronic thumb drive that was then lost at an Ohio train station, according to documents and interviews.

The corporation also has been criticized for letting its contractors hire employees with inadequate experience or education, and has been cited repeatedly since 1997 for failing to create a unified financial management system to better safeguard its funds. It lacks the ability, for instance, to independently confirm the investment revenue figures reported by a contractor hired to engage in securities lending on its behalf, according to audit reports and interviews.

And its former chief executive was the subject of a year-long criminal investigation that ended in March with no criminal charges but a conclusion that his conduct raised “serious ethical concerns,” documents show.

“I am acutely aware that every dollar spent on a contractor who doesn’t provide the promised level of service or who doesn’t provide contract workers with the minimum qualifications needed to do the job is a dollar that is not available to pay the pension benefits of the workers that PBGC was created to protect,” Batts said in an interview.

Such systemic problems are equally concerning to lawmakers like Grassley and Democratic Sen. Herb Kohl of Wisconsin, the chairman of the Senate Aging Committee, particularly because the corporation’s own long-term financial outlook has worsened over the last few years.

Kohl, who is pressing for legislation to strengthen the PBGC’s oversight and governance, said the corporation’s “long-running problems …. should serve as a wake-up call to Congress.”

“Nearly one in six Americans relies on the PBGC to guarantee the pensions they’ve worked a lifetime for. The agency is far too important to let it operate without adequate oversight,” he said.

Working on Fixes

In an interview with the Center, PBGC Acting Director Vincent Snowbarger said the corporation is taking steps to fix the problems that led to the adverse audit finding as well as the communication gaps that led his agency to provide erroneous information to Congress and its inspector general.“Some of it is human error. Some of it is sheer sloppiness. And some of it is when an executive takes information from down below and doesn’t check its accuracy. All of it needs to, and will be, fixed,” Snowbarger said.

While fixing communication gaps should theoretically occur quickly, officials cautioned that addressing some of the systemic problems — like finishing a long-overdue unified financial management system or fortifying the agency’s information technology security — will take time, making it likely that PBGC will carry the stain of a material weakness finding on its audits for as many as three to five more years.

“What the IG has called to our attention are some things we can do better at,” Snowbarger said. “There also has to be the capacity within the organization to put all that in place. So we’re slowing down our implementation process on this. We’re trying to get more realistic about what we can get accomplished and when.”

PBGC officials said in the meantime the corporation is still able to perform its primary mission of making good on a growing number of pension obligations from companies that have collapsed.

“We’re not this rogue agency out there, about to fall off a cliff…. We have had no adverse results from this,” General Counsel Judith Starr said in an interview. “It’s all potential problems. We have to plug leaks so bad things don’t happen.”

Added Snowbarger, a former Kansas congressman who joined the corporation during the Bush administration: “We have been inundated by new participants and our primary responsibility is to make sure those people get paid… We’ve been sort of swamped from the intake process and that’s where resources naturally would go.”

Starr said senior executives agree that problems have “been going on long enough. We’ve been trying to fix this and we need to be much more comprehensive in our approach.”

Economic Repercussions

The corporation is also facing a variety of more basic financial challenges. At the end of the Bush administration, PBGC sought to change its investment strategy, switching away from secure bonds and toward more risky Wall Street investments that offered the potential for higher returns in good economic times.The Obama administration, however, put the plan on hold before it could be fully implemented, asking the corporation’s next chief executive, Joshua Gotbaum, to “prudently rebalance” its investment portfolio. Gotbaum’s nomination, though, has been pending for months.

When the recession struck, the corporation’s long-term financial position worsened in large part because the number of faltering U.S. companies with pensions that might need to be rescued ballooned.

PBGC reported in November that its deficit — the gap between its current assets and its future obligations — grew from $11.2 billion in fiscal 2008 to $21.9 billion in fiscal 2009, reversing several years of progress.

Meanwhile, the corporation reported its potential obligations to cover future pension losses from financially troubled companies more than tripled from $47 billion at the end of fiscal 2008 to about $168 billion at the end of last year.

Among the companies whose pensions PBGC have recently been forced to assume are the electronics retailer Circuit City, the IndyMac Bank, and the Lehman Brothers investment firm.

And General Motors’ and Chrysler’s continued losses leave their massive pension plans hanging in the balance, potentially adding $42 billion in auto industry retirement obligations to PBGC’s burden if they went under, the Government Accountability Office reported April 6. The automakers reported last month their condition is improving, but losses continue to accumulate.

Audit Policies

To ensure its own health, PBGC undergoes two audits each year. One determines if its books accurately reflect its financial state and the second reviews whether it has adequate internal controls over its finances to ensure it complies with laws and regulations and spends its money wisely.PBGC passed the first audit at the end 2009 with an unqualified or clean finding, the 17th straight year it has done so. But Batts and the outside auditor flunked the corporation on its internal controls, citing three serious deficiencies that they said amounted to a corporation-wide material weakness.

Batts’ auditors specifically cited the corporation’s failure to safeguard its sensitive data, and alleged it falsely claimed it had fixed problems. The auditors concluded that the problems not only left Americans’ personal data vulnerable to loss but also “impacted strategic decisions” the corporation made on how to spend its resources.

The Sarbanes-Oxley law passed after the Enron scandal required all public companies to conduct regular audits on their internal controls, seeing it as an essential safeguard for investors.

But the government does not require such an audit of all of its own agencies, leaving it instead for each agency to decide. Some address internal controls with a separate audit, and others evaluate internal controls as part of their financial statements. A handful, like the Department of Veterans Affairs, Treasury Department, and Agriculture Department, currently have at least one material weakness finding concerning internal controls.

PBGC, with its billions in assets and investments, conducts a formal internal controls audit each year. And after years of warning of problems that went unresolved, the auditing firm hired by inspector general Batts decided to cite the agency with its first material weakness.

“Internal controls over these operations are essential to ensure the confidentiality, integrity, and availability of critical data while reducing the risk of errors, fraud, and other illegal acts,” the auditors said in explaining the significance of their negative finding.

George Mason University professor Anthony B. Sanders, a financial accountability expert who has testified before Congress, said the PBGC’s inability to pass its own internal controls audit raises the question, “How can we rely on this corporation to successfully audit these failing pensions? It tells us they may not be up to the task.”

A bigger concern, Sanders said, is that politicians are not trying to address the inevitability of PBGC eventually being unable to meet its obligations. “We have to first be rethinking our whole approach to pension benefits because clearly that model is broken and cannot be sustained,” he said.

Snowbarger said PBGC faces no short-term cash flow problems, in part because the corporation has assumed cash and other assets from a large number of failed companies whose pension plans have been taken over. But those assets will run out over time, and lawmakers will be forced to decide whether the government assumes those liabilities.

The options for closing the gap are limited. Congress could raise the premium costs for companies who buy the pension insurance to close the gap, but it would likely cause an outcry from companies. It could increase the investment returns on the corporation’s current assets, but that would open it up to additional risks. It could change the entire approach and cover only a pro-rata share of defaulted pensions, or lawmakers could simply use tax dollars to close the gap when the corporation’s current assets run out.

“Right now, the way we are structured, we don’t have the full faith and credit of the U.S. government behind us,” Snowbarger said. “That is something Congress will one day have to wrestle with.”

Batts, who was hired two years ago as an independent watchdog by the PBGC’s board of directors, has been an unrelenting siren about the state of the corporation’s affairs. PBGC, her office’s memos show, was warned for years before November’s audit about weaknesses in its procurement processes, its internal controls over its accounting practices, and information technology security.

In fact, the IG disclosed in a letter April 26 to Congress that 201 proposed solutions to problems identified as far back as the late 1990s still have not been implemented. The culture in certain key departments, Batts said, simply allowed bad practices to be swept under the rug or to fester until they manifested themselves into more dramatic failures.

For instance, IG reports dating several years back warned PBGC that it lacked a comprehensive and secure information technology platform, a red flag for a corporation trusted with protecting Social Security numbers, personal account balances, and proprietary actuarial data from pension funds.

A Security Breach

So it came as no surprise to insiders when the infamous flash drive with sensitive pension data was lost.A Transportation Security Administration employee was heading home from work in 2008 when he spotted a computer thumb drive lying in the parking lot of a Cleveland, Ohio, commuter train station. The worker popped the thumb drive into a computer, and discovered it had Social Security numbers, account details from PBGC-protected pensions, and actuarial data from other private pension plans.

“Not exactly the sort of stuff you want lying on the ground of a public train station,” Batts said.

The worker managed to get the thumb drive back to the PBGC. Batts said she ultimately concluded that a supervisor and employee for a PBGC contractor downloaded unauthorized pension account data and Social Security numbers for 1,300 Americans. The information was stored on a flash drive with no encryption or password protection, leaving it totally exposed when it fell out in the train station lot. “These actions violated PBGC’s policy to protect sensitive information,” Batts concluded.

After the episode, Batts pressed PBGC anew to finally address its information security weaknesses.

The corporation reported back a few months later that it had implemented 45 of the 65 recommended security enhancements. And to address the case of the flash drive, PBGC reported both to Congress and the IG that it went to the offending contractor’s facility, provided additional security training, emphasized the need for greater care in handling sensitive data, and took other steps to ensure there would be no repeat.

The action plan sounded great — until Batts’ team went to check the fixes. She found they did not exist, according to documents and interviews.

“PBGC fabricated this follow-up action,” Grassley concluded in a March 31 letter to the corporation. “Other than providing routine annual security training, PBGC took no trips to the contractor’s facility, provided no additional IT security training, and to date has not ensured the contractor is adequately securing” sensitive data. Batts ultimately concluded that PGBC failed to implement any of the 65 “common security controls” it had promised.

Recent changes in the corporation’s information technology leadership have resulted in some progress in creating a more efficient, more secure technology system, according to both Snowbarger and Batts. PBGC’s former chief information officer left the corporation in November.

But the pattern of claiming fixes that didn’t occur has persisted. After Batts’ office raised concerns about two actuarial contracts with a Canadian firm that ballooned to $15 million in costs, corporation officials promised they had made changes to ensure the corporation could verify it got the services it paid for. The corporation even stated in writing that the corrective actions were “approved,” “in place,” and “effective,” according to Grassley’s letter.

Not true, Batts found, when she went back to check. In fact, there were a total of 17 fixes for procurement problems stemming from four separate audits that were inaccurately reported to be implemented. None of the corrective actions to make contracting safer had actually been taken, according to Batts and Grassley.

In an April 14 letter to Grassley, Snowbarger acknowledged a “number of shortcomings” and communication breakdowns but insisted that “any implication that PBGC employees have been fraudulent or dishonest in their dealings with Congress or the OIG is unwarranted.” Instead, Snowbarger said, the misinformation sent to Congress “involved failures of communication and/or good faith errors.”

A Controversial Former CEO

Sensitivities about PBGC’s procurement practices are also high in the aftermath of former chief executive Charles Millard’s tenure in 2007-09. Batts said Millard was the subject of a criminal investigation conducted by her office and the U.S. Attorney in Manhattan. Her office last month advised Congress that Millard would not face criminal charges.But the IG concluded that the former PBGC boss had ignored staff warnings and intervened in 2008 in the evaluation of major Wall Street firms, including Goldman Sachs Group Inc., JP Morgan Chase & Co., and BlackRock Inc., as they were bidding for contracts to invest or manage $2.5 billion of the corporation’s money. The probe found the CEO later sought personal job search help from an executive at one firm that had just won a PBGC contract to manage hundreds of millions of dollars in investments. Millard “had inappropriate contacts with bidders … and took actions incompatible with his role,” investigators concluded. The investigation ultimately located 29 e-mails between a senior Goldman Sachs executive and Millard involving the director’s request to assist him in his search for employment.

Millard did not reply to multiple e-mail messages seeking comment on the investigation. His attorney, Stan Brand, did not immediately respond to a phone message seeking comment.

Meanwhile, the audit documents discuss numerous other problems. For instance the IG concluded the corporation lacked written rules “from the highest level down” to govern the risks associated with securities lending it performs as part of its investment strategy. PBGC “is unable to independently calculate” the revenues its main contractor claims it is generating from the strategy, the internal watchdog warned.

PBGC said a new investment policy it is drafting will provide written guidance on ensuring the accuracy of securities lending figures.

Greece Bailout Is Insufficient, Will Fall Short

from WSJ:

BRUSSELS—The €110 billion ($147 billion), three-year bailout offered to Greece by euro-zone countries and the International Monetary Fund won't be enough to cover Greece's costs, an examination of Greek financial figures shows, setting Europe up for more tough choices if private markets don't start lending again.

The bailout announced here over the weekend will solve one pressing problem: Greece will have enough cash to repay an €8.5 billion bond that comes due in two weeks. But the bailout package is based on assumptions that by the end of 2011 Greece will be able to borrow again from capital markets.

Sunday, May 2, 2010

BIS Says Drastic Measures Required to Reduce Sovereign Debt

What are the chances that the US Government will deal with this before a crisis? Near zero!

This is from John Mauldin:

The paper looks at fiscal policy in a number of countries and, when combined with the implications of age-related spending (public pensions and health care), determines where levels of debt in terms of GDP are going. The authors don't mince words. They write at the beginning:

"Our projections of public debt ratios lead us to conclude that the path pursued by fiscal authorities in a number of industrial countries is unsustainable. Drastic measures are necessary to check the rapid growth of current and future liabilities of governments and reduce their adverse consequences for long-term growth and monetary stability."

Drastic measures is not language you typically see in an economic paper from the BIS. But the picture they paint for the 12 countries they cover is one for which drastic measures is well-warranted. I am going to quote extensively from the paper, as I want their words to speak for themselves, and I'll add some color and explanation as needed. Also, all emphasis is mine.

"The politics of public debt vary by country. In some, seared by unpleasant experience, there is a culture of frugality. In others, however, profligate official spending is commonplace. In recent years, consolidation has been successful on a number of occasions. But fiscal restraint tends to deliver stable debt; rarely does it produce substantial reductions. And, most critically, swings from deficits to surpluses have tended to come along with either falling nominal interest rates, rising real growth, or both. Today, interest rates are exceptionally low and the growth outlook for advanced economies is modest at best. This leads us to conclude that the question is when markets will start putting pressure on governments, not if.

"When, in the absence of fiscal actions, will investors start demanding a much higher compensation for the risk of holding the increasingly large amounts of public debt that authorities are going to issue to finance their extravagant ways? In some countries, unstable debt dynamics, in which higher debt levels lead to higher interest rates, which then lead to even higher debt levels, are already clearly on the horizon.

"It follows that the fiscal problems currently faced by industrial countries need to be tackled relatively soon and resolutely. Failure to do so will raise the chance of an unexpected and abrupt rise in government bond yields at medium and long maturities, which would put the nascent economic recovery at risk. It will also complicate the task of central banks in controlling inflation in the immediate future and might ultimately threaten the credibility of present monetary policy arrangements.

"While fiscal problems need to be tackled soon, how to do that without seriously jeopardising the incipient economic recovery is the current key challenge for fiscal authorities."

They start by dealing with the growth in fiscal (government) deficits and the growth in debt. The US has exploded from a fiscal deficit of 2.8% to 10.4% today, with only a small 1.3% reduction for 2011 projected. Debt will explode (the correct word!) from 62% of GDP to an estimated 100% of GDP by the end of 2011. Remember that Rogoff and Reinhart show that when the ratio of debt to GDP rises above 90%, there seems to be a reduction of about 1% in GDP. The authors of this paper, and others, suggest that this might come from the cost of the public debt crowding out productive private investment.

Think about that for a moment. We are on an almost certain path to a debt level of 100% of GDP in less than two years. If trend growth has been a yearly rise of 3.5% in GDP, then we are reducing that growth to 2.5% at best. And 2.5% trend GDP growth will NOT get us back to full employment. We are locking in high unemployment for a very long time, and just when some one million people will soon be falling off the extended unemployment compensation rolls.

Government transfer payments of some type now make up more than 20% of all household income. That is set up to fall rather significantly over the year ahead unless unemployment payments are extended beyond the current 99 weeks. There seems to be little desire in Congress for such a measure. That will be a significant headwind to consumer spending.

Government debt-to-GDP for Britain will double from 47% in 2007 to 94% in 2011 and rise 10% a year unless serious fiscal measures are taken. Greece's level will swell from 104% to 130%, so the US and Britain are working hard to catch up to Greece, a dubious race indeed. Spain is set to rise from 42% to 74% and "only" 5% a year thereafter; but their economy is in recession, so GDP is shrinking and unemployment is 20%. Portugal? 71% to 97% in the next two years, and there is almost no way Portugal can grow its way out of its problems.

Japan will end 2011 with a debt ratio of 204% and growing by 9% a year. They are taking almost all the savings of the country into government bonds, crowding out productive private capital. Reinhart and Rogoff, with whom you should by now be familiar, note that three years after a typical banking crisis the absolute level of public debt is 86% higher, but in many cases of severe crisis the debt could grow by as much as 300%. Ireland has more than tripled its debt in just five years.

The BIS continues:

"We doubt that the current crisis will be typical in its impact on deficits and debt. The reason is that, in many countries, employment and growth are unlikely to return to their pre-crisis levels in the foreseeable future. As a result, unemployment and other benefits will need to be paid for several years, and high levels of public investment might also have to be maintained.

"The permanent loss of potential output caused by the crisis also means that government revenues may have to be permanently lower in many countries. Between 2007 and 2009, the ratio of government revenue to GDP fell by 2-4 percentage points in Ireland, Spain, the United States and the United Kingdom. It is difficult to know how much of this will be reversed as the recovery progresses. Experience tells us that the longer households and firms are unemployed and underemployed, as well as the longer they are cut off from credit markets, the bigger the shadow economy becomes."

We are going to skip a few sections and jump to the heart of their debt projections. Again, I am going to quote extensively, and my comments will be in brackets [].Note that these graphs are in color and are easier to read in color (but not too difficult if you are printing it out). Also, I usually summarize, but this is important. I want you to get the full impact. Then I will make some closing observations.

[That makes these estimates quite conservative, as growth-rate estimates by the OECD are well on the optimistic side.]

"But the main point of this exercise is the impact that this will have on debt. The results plotted as the red line in Graph 4 [below] show that, in the baseline scenario, debt/GDP ratios rise rapidly in the next decade, exceeding 300% of GDP in Japan; 200% in the United Kingdom; and 150% in Belgium, France, Ireland, Greece, Italy and the United States. And, as is clear from the slope of the line, without a change in policy, the path is unstable. This is confirmed by the projected interest rate paths, again in our baseline scenario. Graph 5 [below] shows the fraction absorbed by interest payments in each of these countries. From around 5% today, these numbers rise to over 10% in all cases, and as high as 27% in the United Kingdom.

"Seeing that the status quo is untenable, countries are embarking on fiscal consolidation plans. In the United States, the aim is to bring the total federal budget deficit down from 11% to 4% of GDP by 2015. In the United Kingdom, the consolidation plan envisages reducing budget deficits by 1.3 percentage points of GDP each year from 2010 to 2013 (see eg OECD (2009a)).

"To examine the long-run implications of a gradual fiscal adjustment similar to the ones being proposed, we project the debt ratio assuming that the primary balance improves by 1 percentage point of GDP in each year for five years starting in 2012. The results are presented as the green line in Graph 4. Although such an adjustment path would slow the rate of debt accumulation compared with our baseline scenario, it would leave several major industrial economies with substantial debt ratios in the next decade.

"This suggests that consolidations along the lines currently being discussed will not be sufficient to ensure that debt levels remain within reasonable bounds over the next several decades.

"An alternative to traditional spending cuts and revenue increases is to change the promises that are as yet unmet. Here, that means embarking on the politically treacherous task of cutting future age-related liabilities. With this possibility in mind, we construct a third scenario that combines gradual fiscal improvement with a freezing of age-related spending-to-GDP at the projected level for 2011. The blue line in Graph 4 shows the consequences of this draconian policy. Given its severity, the result is no surprise: what was a rising debt/GDP ratio reverses course and starts heading down in Austria, Germany and the Netherlands. In several others, the policy yields a significant slowdown in debt accumulation. Interestingly, in France, Ireland, the United Kingdom and the United States, even this policy is not sufficient to bring rising debt under control.

[And yet, many countries, including the US, will have to contemplate something along these lines. We simply cannot fund entitlement growth at expected levels. Note that in the US, even by "draconian" estimates, debt-to-GDP still grows to 200% in 30 years. That shows you just how out of whack our entitlement programs are.

Sidebar: This also means that if we - the US - decide as a matter of national policy that we do indeed want these entitlements, it will most likely mean a substantial VAT tax, as we will need vast sums to cover the costs, but with that will come slower growth.]

[Long before interest rates rise even to 10% of GDP in the early 2020s, the bond market will have rebeled. This is a chart of things that cannot be. Therefore we should be asking ourselves what is the End Game if the fiscal deficits are not brought under control.]

"All of this leads us to ask: what level of primary balance would be required to bring the debt/GDP ratio in each country back to its pre-crisis, 2007 level? Granted that countries which started with low levels of debt may never need to come back to this point, the question is an interesting one nevertheless. Table 3 presents the average primary surplus target required to bring debt ratios down to their 2007 levels over horizons of 5, 10 and 20 years. An aggressive adjustment path to achieve this objective within five years would mean generating an average annual primary surplus of 8-12% of GDP in the United States, Japan, the United Kingdom and Ireland, and 5-7% in a number of other countries. A preference for smoothing the adjustment over a longer horizon (say, 20 years) reduces the annual surplus target at the cost of leaving governments exposed to high debt ratios in the short to medium term.

[Can you imagine the US being able to run a budget surplus of even 2.4% of GDP? $350 billion-plus a year? That would be a swing in the budget of almost 10% of GDP.]

That is enough for today. We will delve further next week.