Monday, November 18, 2019

Dollar Devastation

"Following the report that Trump and Powell discussed negative rates, among other things, the dollar has slumped to session lows, with the Bloomberg dollar index dipping below 1,200." Zero Hedge

Friday, October 11, 2019

Wednesday, October 2, 2019

Stocks Stumble on Bad Economic News

Wednesday, August 28, 2019

Stocks RISE On Perfect Track Record of Recession

If this doesn't spell B-U-B-B-L-E, what does? The last time it happened, the bubble popped then, too!

David Robsenberg at Bloomberg said this today:

"We now have had three months of a 3-mo/10-yr yield curve inversion. The track record this has had in predicting recessions: 100%."

Tuesday, August 20, 2019

Is An Economic Crisis Imminent?

The answer I would reply for the above question is that I don't know. I hope not! The stock market of the past few days suggests not! But based upon this article by Michael Snyder, perhaps so. He makes a good case on his website .here

Of the items Mr. Synder elucidated, here are a few that startled me:

According to the Federal Reserve Bank of New York, the probability that a recession will happen within the next 12 months is now the highest that it has been since the last financial crisis.

Major U.S. retailers continue to shut down more stores, and we have continued to stay on a pace that would break the all-time record for sThe total number of bankruptcy filings in the United States has been steadily shooting uptore closings in a single year.

For the complete list, I recommend Mr. Synder's entire article.

Wednesday, August 14, 2019

Treasury Yield Inversion Signals Recession

This treasury yield curve inversion is one of the most accurate recession signals in history! It hasn't been wrong once in the past half century! This is a huge red flag!

Monday, August 12, 2019

Update: Corn Goes Limit Down on Crop Report Results

I have learned that the price of corn plunged this morning when the US Department of Agriculture released the latest crop planting report, indicating that the corn crop is significantly higher this year than originally forecast. The price of corn futures today is limit down, dropping 25 cents today!

Corn Price Decimated

This quote from CNBC today:

"U.S. farmers lost their fourth largest export market this week after China officially cancelled all purchases of U.S. agricultural products, a retaliatory move following President Donald Trump’s pledge to slap 10% tariffs on $300 billion of Chinese imports."

Wednesday, August 7, 2019

Crude Gets Clobbered

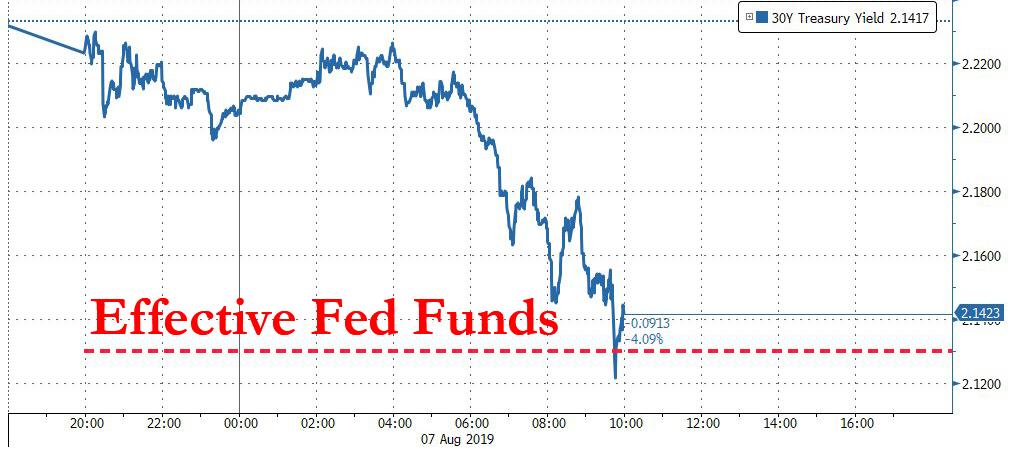

30-Year Yield Drops Below Fed Funds Rate

Friday, July 26, 2019

A Bubble Defined!

If this headline doesn't describe a bubble, I don't know what does! This is the very definition and description of a bubble. It's just a question of time when it pops!

Wednesday, July 17, 2019

Food Shortages Are Here!

This sign was recently posted at WalMart. Food shortages have become a reality. Higher food prices aren't far away!

Friday, July 12, 2019

Market Canary In the Coal Mine Throws Up Red Flag

Another market canary in the coal mine has throw up a red flag today. That said, the Dow is once again trading at fresh record highs, just as is the S&P 500. This market looks more like a bubble with every day that passes. I suggest keeping tight stops!

Here is the headline today on Marketwatch:

Food Commodity Prices Continue Sharply Higher

This is the price of corn futures today. The price of corn and other food futures continue to rise sharply. Expect food inflation soon!

Wednesday, July 10, 2019

Something Doesn't Jive In This!

This doesn't make sense! If the economy is doing so well, why would central bankers need to artificially boost the markets and asset prices to bubble levels by more quantitative easing?

Thursday, July 4, 2019

Wednesday, July 3, 2019

Food Commodity Prices Leap Again!

As if we hadn't seen charts like this one enough already this year, corn futures are leaping higher again today! After a few days last week when investors took their profits and liquidated their contracts, today, prices are leaping higher once again, as even planted crops are being devastated! This is today's chart of higher prices!

This Sounds More and More Bubbly! Meet the Everything Bubble!

...And it sounds more and more like the "everything bubble"! Look at these headlines today:

Friday, June 28, 2019

Farm Devastation Contitnues, But Commodity Prices Collapse

Despite that weather continues to devastate American farms, the price of corn futures today dropped by the most in several months. This headline was on Zero Hedge:

I'm still investigating the reasons why!

Thursday, June 27, 2019

Farm Economy Getting Bludgeoned This Year

Zero Hedge this morning has this photo and article:

Todd Burrus, owner, said:

“If we experienced a year like this, I don’t remember it. When the farm economy is tough, it’s going to be tough for all the suppliers.”

Wednesday, June 26, 2019

The Economic News Continues to Degrade

Stocks are up today! But the economic news isn't! I just read this quote by Michael Snyder:

"It is going to take a miracle for the U.S. economy to pull out of this tailspin, because the economic numbers are really starting to deteriorate very rapidly now.

On Tuesday we got some more new numbers, and they were just as bad as

we thought they might be. But even before today’s numbers all of the

data were telling us the exact same thing. The New York Fed’s Empire

State manufacturing index just suffered the worst one month decline in U.S. history, Morgan Stanley’s Business Conditions Index just suffered the largest one month decline that we have ever seen, global trade numbers are the worst they have been since the last recession, and just last week I detailed the complete and utter “bloodbath” that we are witnessing in the U.S. trucking industry right now."

You can read his full article here.

And this is even more bad news:

Tuesday, June 25, 2019

Recession Predicted By Gary Shilling

This headline today by Marketwatch suggests that recession may be imminent. I don't generally take such predictions seriously, but Gary Shilling has a pretty accurate record of forecasting such events.

Latest Real Estate Data Hints At Popping Bubble

This headline this morning suggests that the latest real estate bubble is on the verge of popping:

Monday, June 24, 2019

Are We Near Boom -- Or Bust?

This quote seems to make the point well by Deutsche Bank's Aleksandar

Kocic:

"...the economy at the moment is in a superposition of two states - it is both booming and it is headed for a recession."

One Year's Difference in Crop Growth Hints Higher Food Prices

This photo shows a one-year difference taken of the same person in the same spot on the same date one year apart. The one on the right is this year. What will happen if fall or winter weather begins before the crop on the right can be harvested? Food prices would be sharply higher!

Where's the Logic In This Headline?

I saw this headline today on Marketwatch. Where's the logic in this?

Wednesday, June 19, 2019

Fed Leaves Interest Rates Unchanged, Market Sighs

Tuesday, June 18, 2019

Many Farmers Have Given Up On Planting Crops This Year

"The storms that have caused major flooding in Illinois have forced farmers to give up on their crops. Forecasts for even more rain also sent corn futures to a 5-year-high, bringing the food crisis ever closer to reality. Few farmers will even see a benefit from the higher prices because they can’t even get their corn planted in the ground."

Sunday, June 16, 2019

Food Prices Leap Again!

Compare this chart with the one I posted on June 13th. That green candle at the top right is the rise in price within the last 20 minutes when the market reopened this evening! Note also the steady rise over the intervening days. Get used to higher food costs. They're coming!

Friday, June 14, 2019

Is Recession Headed Our Way? Morgan Stanley Seems to Think So!

One wonders, when we see a headline like this one on MarketWatch today.

Here is a similar headline on Zero Hedge:

Thursday, June 13, 2019

Friday, June 7, 2019

The Bubble Grows! Stocks Leap on Bad Economic News

Wednesday, June 5, 2019

Fed Is Pandering to Stock Market. That Spells B-U-B-B-L-E!

I thought this was an interesting insight this morning from Bill Blain at Morning Porridge.

"US employment is at a high, the labour market is tightening, there is

minimal real inflation and the stock market is off to the races because the Fed says its ready to ease if trade tensions impact the stock market economy.

"In 35 years of markets, this is perhaps the stupidest moment I’ve ever seen.

"There is a danger Powell et al seem are confusing the Dow and S&P for the health of the economy, thereby making the Fed complicit in the ultimate market distortion that’s being going on since someone dreamt up QE. The

World’s most important central bank is missing the point completely,

and more or less promising to bail out stock markets if Trade Tension

causes them to weaken."

One of the chief characteristics of a bubble is that everyone dismisses risk. Heeeeere we go again!

Tuesday, June 4, 2019

Farm Production Weak

"The 12 month period that concluded at the end of April was the wettest 12 month period in U.S. history, and more storms just kept on coming throughout the month of May," said Michael Snyder today.

Bloomberg said yesterday, "There has never been a spring planting season like this one.

Rivers topped their banks. Levees were breached. Fields filled with

water and mud. And it kept raining."

Manipulated Markets, Not Free Markets

Guess which one of these headlines has affected stock prices today. The Dow is currently up over 400 points. How can stocks be so bullish when today's economic data is so bearish? Central bankers, that's how! Today's markets are manipulated. They are no longer free markets!

Tuesday, May 28, 2019

Food Crop Prices Accelerate Higher

Each day, I hope that farm crops will get planted and prices will reverse. However, instead of reversing, close attention to the last few candles on this chart show an acceleration higher instead!

Bond Market Flashes SIgns of Trouble Ahead

Interest rates are collapsing in the bond market, which is a sign that investors are very worried.

“Recent data points suggest US earnings and economic risk is greater than most investors may think,” says Chief Equity Strategist Michael Wilson of Morgan Stanley.

Food Commodity Prices Continue to Climb

I wonder when we'll begin to see food prices rise this sharply in t\he grocery stores. Corn is up another 8+ cents (32+ ticks) today. Other food commodities are up also.

Monday, May 27, 2019

Crop Catastrophe Coming?

Another scary headline. Wake up, America!

Sunday, May 26, 2019

Are We Facing a Food Crop Crisis Soon?

This is the latest headline that I saw today that portends a possible food crisis by late this summer.

The main reason for this is that North America has been very wet this spring. Much of America's midwest farm land is flooded.

Why isn't this in the news headlines?