Wednesday, December 10, 2014

Friday, December 5, 2014

So Which Economy Is It?

It's the Obamalaise Economy! Perpetual malaise! Even while the Propaganda Press tells us it's all great!

This morning, the US Bureau of Labor Statistics told us that job growth last month was the most in almost 3 years. Not so fast! Look at the jobs created! Low-wage, temporary, retail! Ie., SUBSISTENCE jobs, not breadwinner jobs!

We should always remember that payrolls are one of the MOST lagging of indicators. Often payrolls rise at the start of a recession. Payrolls typically only crash months after a recession begins.

"But, but, but payrolls data was awesome!! /He was saying that in satire./ US Factory Orders tumbled 0.7% in October (missing 0.0% expectations) for the 3rd month in a row (for the first time since June 2012). Rather notably, the only other time we had 3 straight months of factory orders declines was in the recession..." Tyler Durden @ Zero Hedge.

Monday, December 1, 2014

Gold Soars As US Government Prints Money

“We have seen a lot of the physical gold go from the West to the East and I’m sure that the central banks do not have anywhere near the gold they should have,” Egon von Greyerz said, explaining that China has been one of the largest buyers of gold recently, and asked for a physical delivery.

“It will be significantly high, definitely,” he said commenting on the price of gold in the future. “And the wise countries in the world, which is Russia, China, India – they understand this and they accumulate gold and buy more. Russia is continuously buying more, they understand what is happening.”

Gold has soared $67/oz today off it's lows! Wow!

Wheat Soars

from Reuters:

"...wheat hovered near three-months highs, supported by concerns over potential supply disruptions from Russia."

from Agrimoney:

"Wheat futures soared to $6 a bushel for the first time since June, boosted by concerns of a squeeze on Russian exports, and stealing

thunder from a Rabobank recommendation of the grain as a bullish bet."

Friday, November 21, 2014

Wall St Sees Cheap Labor

...and Obama sees 5 million new marxists -- er, I mean Democrats! The pink line is yesterday's close!

Thursday, November 13, 2014

Is This a Bubble?

Crude Oil Collapses

As the world economy stagnates, demand declines, and production produces a glut, the price of crude oil is collapsing.

Thursday, October 9, 2014

Tuesday, September 30, 2014

Crude Crushed, Corn Clobbered

Corn hit multi-year lows today. I believe this is the lowest price for corn I've seen in two years!

Sunday, September 21, 2014

Record Corn, Soybean Crops Crush Prices

from Yahoo Finance:

Tuesday, September 16, 2014

Crude Spikes on OPEC Threat to Restrict Production

from Business Recorder:

NEW YORK: Brent and US crude futures rose more than a dollar on

Tuesday on the prospect of a possible OPEC production cut and on news

that Libya curbed output after rockets hit an area near a refinery.

Oil

prices received more lift when Russia said deploying troops in Crimea,

which Russia annexed from Ukraine in March, was a top priority with NATO

holding military exercises in the Ukraine near its border with Poland.

Tuesday, September 9, 2014

Weak Economic Data Suppress Crude Prices

And this, despite bellicose talk and acts from Russia.

New York - Brent crude fell below $100 a barrel on Monday, the first time in nearly 15 months, before returning to close in three-digit territory but down on the day as fear of Opec output cuts helped the market recover from weak Chinese and US data.

Slower-than-expected growth in the world's top oil consumers, and ample supply, has pushed prices down from a high for the year above $115 in June, complicating central banks' efforts to ward off deflation.

Global Weakness Collapses Copper Prices

Copper tends to be a bellwether commodity because prices tend to reflect overall supply and demand. Here is the headline from FT yesterday:

Corn Continues Weak

Corn extended a slump to trade near the lowest level in four years on speculation yields in the U.S., the biggest grower, will be bigger than the government estimated last month. Soybeans and wheat also declined.

Sugar Prices to Go Higher

CNBC:

Cutbacks in the world's largest sugar producer could end a multi-year

supply glut, sending prices higher next year, according to traders.

Friday, September 5, 2014

Thursday, September 4, 2014

ECB Initiates QE

If the economy is so great that the stock market merits new all-time record highs today, then why does the ECB need QE?

from CNBC:

"U.S. stocks rose on Thursday, lifting the Dow and S&P 500 to

records, after the European Central Bank unexpectedly reduced its key

rate and announced plans to purchase asset-backed securities to spur

economic growth."

ISM Does "Seasonal Adjustments" Too!

And I thought that only the government manipulated the economic data!

from Zero Hedge:

Moments ago, the Institute for Supply Management, reported some

blistering numbers in the August Non-Manufacturing Report, whose

headline print rose once again, this time to 59.6, or the highest since August 2005. Not only that, but the all-important employment component, ahead of tomorrow's NFP report, which also rose to 57.1, printed at what, at least on the surface, was the highest number since February 2006!

Superficially, this is great news. And yet, remember: this is the seasonal-adjustment challenged ISM,

the same ISM which for some inexplicable reason believes that survey

responses (not hard, or soft data), have to be seasonally adjusted.

So what happens when one looks below the seasonally-adjusted surface. Well, then things get uglier.

In fact, if one looks at the two most important data series that comprise the ISM report, New Orders and Employment, one

sees that the number of respondents who reply with "Higher", i.e., are

optimistic about current conditions, is actually sliding at the fast

pace in a year!

Specifically, the number of respondents who saw "Higher" employment

dropped to just 22, a plunge from the 26 in July and 29 in June. This is

happening as the actual number, net of seasonal adjustments, rose to,

as noted above, the highest since 2006! It was also the lowest number

since February when the unadjusted % of respondents seeing "Higher" jobs

was at 16.

What about New Orders? Pretty much the same thing: at 29 responding

"Higher", this was the drop from the 32% in July, the 31% in June and

36% in May. In fact, a print of 29% was matched for lowest since March of 2014! Quite a bit of difference from a headline, adjusted number which is near the highs of a decade.

So, if for some reason you lose your job because your employer

doesn't share the S&P's enthusiasm about the economy, just tell them

to seasonally adjust the pink slip to a bonus check - the strategy

seems to be working for everyone else, so why not for Joe Sixpack?

Tuesday, August 26, 2014

Friday, August 15, 2014

Ukraine Conflict Crushes Stocks

News that the Ukraine military attacked a Russian convoy of 300 semi-trucks sent stocks from bullish to bearish within minutes.

Thursday, August 14, 2014

Wednesday, August 13, 2014

Copper Futures Offer Dour Warning!

"Copper futures slid more than 1 percent Wednesday, falling to the

lowest level since late June as investors looked at an increasingly dour

picture for global growth.

According to data released Wednesday, China's

industrial production rose 9 percent in July, and its retail sales rose

12.2 percent. Both numbers missed expectations. And in more bad Chinese

news, new loans for July fell nearly 70 percent from June." CNBC

Tuesday, August 5, 2014

Monday, August 4, 2014

Trading ETFs Vs Futures

by Jeff Carter:

In the comments, and in my email I received corrections on my math.

That 500 SPY equal 1 ES. That changes the calculation on my

profit/loss. Also in calculating the emini profit, I made the mistake

of calling a 5 lot emini trade a “one lot” trade. My confusion came

from 5 ES=1 SP.

The advantages of futures are these:

1. lower commissions

2. little or no slippage, no trading against your order, no internalization of your order.

3. more bang for the buck, you are able to control a lot of stock for smaller money.

4. ability to trade 24/7

5. Faster electronic systems. Futures platforms are speedier for the retail trader.

6. Better taxation

ETF advantages

1. Less volatility; the market isn’t as highly leveraged

2. More accessible through more retail platforms. Your broker might not offer futures.

3. If you decide to step up your size, your commission rate can go

down. In futures to get rates down you must lease or purchase a seat at

a futures exchange.

Original Post with corrections below (corrections in italics)

There are a lot of fund manager’s that recommend ETF’s. There are a

lot of traders that like trading them, and the retail public seems to

like them. ETF’s can be pretty innovative. They allow you to take a

flyer on a market segment, while still incorporating Eugene Fama’s

efficient market hypothesis(EMH) because you aren’t picking a single stock, but a basket of them.

If you adhere to the EMH, you will be invested in a mutual fund or ETF

that replicates that broader market. Buying sector ETF’s allow you to

raise the “beta” in your portfolio, assume a little more risk, without

assuming the risk of holding one single stock.

However, if you are looking to increase your beta on the entire market,

you’d be better off trading futures. If you want to cash in on the

commodities craze don’t trade a commodities ETF. You’ll be better off

in the futures market.

Let’s compare and contrast a popular futures contracts with it’s ETF.

Everyone knows about the S+P 500. It is the fund manager’s index.

The ETF that replicates that index is called the $SPY

or “spider”. The futures contract that replicates it is the S+P 500,

but there is a bite sized contract called the emini S+P that is

exclusively traded electronically.

For this example, assume that you thought the market was going up. We

will also assume you are clairvoyant, and bought the low of the day and

sold the high of the day.

If you buy a $SPY,

the commission rate for a normal trader is $9.99. Some discount

houses don’t charge you a commission at all! Of course, that means

they are trading in house against your order and giving you a worse

price than you would have gotten in the market. Or, they are selling

your order to a hedge fund or bank and you still are getting a worse

price. Let’s assume your slippage is only one penny, it’s probably a

bit more. There is no free lunch anywhere in the market. If you are

buying 1000 contracts though, it’s still costing you an extra $10 on

each side of your trade, or $20 all day.

Yesterday’s $SPY

range (2/4/2011) was 130.23-131.20, or .97. If you bought the low and

sold the high you made $970. Nice trade! Of course, your commission

costs were $19.98, slippage costs $20, leaving you with a profit of

$930.02. Uncle Sam wants his piece. That will cost you 35% in the

top tax bracket. $325.51 bucks. Your net/net is $604.51. You can still

buy the first round of beers at the close.

But, what if you did the same thing in the futures market using an eMini S+P? The cost to trade 1 eMini future is $2.01. To compare apples to apples, you would have executed a two lot. 2 ES=500 SPY Commission=$4.02. In futures, there is no internalization or payment for order flow. You play in the same pool with everyone else. Advantage here is the futures market by $35.97 all in on commissions and slippage.

The range yesterday was 1298-1308.50 If you bought the low, and sold the high you made 10.50. On a 2 lot trade, you made $525. Less commissions, you made $520.98.

Uncle Sam still wants his piece, but he wants it in a different

manner. Futures are taxed at 60/40. This means 60% of your gain is

taxed at the capital gains rate, 15%, and 40% at whatever the highest

tax bracket rate is. In this case, the highest rate is 35%. The

blended rate works out to be roughly 23% or $119.83. Your net profit is $401.15.

ETF profit, 604.51. ES profit $401.15. $203.36 in favor of the

ETF. For every future you add, you get $262.50 added to your profit.

It costs you $2.01 to add. If you trade 3 futures, the profit is

equivalent.

Already I can hear the critics and retail brokers screaming.

Here are some other differences in the markets. Futures trade 24

hours, and are more volatile than ETF’s. I’d readily concede that

point. Because futures are traded on margin, they have more volatility.

ETF’s margin can only be 50%. A futures contract will always have

more intraday volatility than a cash equity contract.

They will say the ranges of the two products are different, so of

course the money will be different. However, dollar for dollar the all

in costs of trading+taxes are significantly higher in the ETF world

than the futures world. Let’s assume I made $1000 bucks in each.

After commissions, slippage and taxes, my take in the ETF would be

$624.01. In futures, $754.52. You are giving up 21% of your profits

for the same analysis that goes into the trade!

You might say, I don’t trade 1000 lots in the stock market. That’s

cool. You can assume as much or as little risk as you want in the

futures trading. Just remember 1 eMini~ 250 500 shares. As you trade

less, the advantage swings to futures even more, because commission

rates get even cheaper by comparison.

The bang for the buck you get with futures, lower all in commissions,

and lower taxes gives you incentive to take on that volatility. Plus,

virtually all futures are traded electronically. You are not waiting to

find out if you are filled. You are filled in the blink of an eye.

The nice thing about ETF’s is that there are so many of them. They are

pretty versatile so you can use different ones to try and take on more

risk. The federal government via the SEC prohibits trading of narrow

based indexes. Exchanges like CME Group and ICE can’t offer a futures

contract based on a narrow basket of stocks. There are ETF’s that you

may want to trade that cannot be replicated by futures.

But, if you are going to trade Gold ETF’s you can see from the above

example you’d be far better off trading Gold eMini’s. If you want to

trade an Oil ETF, you are far better off trading an Oil eMini. Take a

flyer on a currency? You are better off trading eMicro’s or eMini

currencies at $CME.

You get the picture. Expand your horizons and you will expand your profitability.

Sunday, August 3, 2014

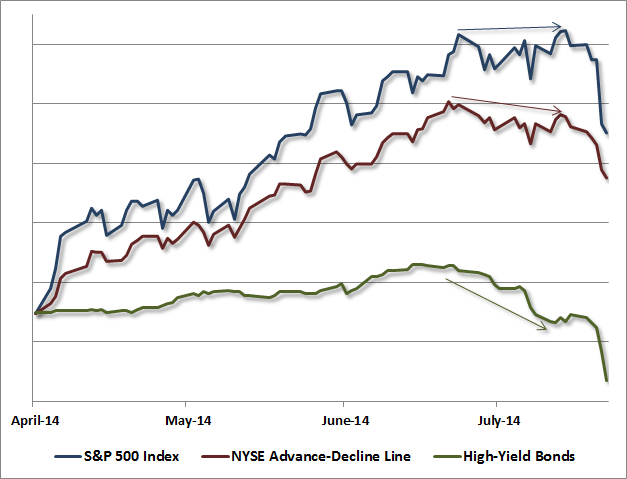

Deteriorating Market Internals

"Historically-informed investors are being given a hint of advance

warning here, in the form of a strenuously overvalued market that now

demonstrates a clear breakdown in internals. We observe these

breakdowns in the form of surging credit spreads (junk bond yields

versus Treasury yields of similar maturity), weakness in small

capitalization stocks, and other measures. These divergences have

actually been building for months, but rather quietly. Note, for

example, that as the S&P 500 pushed to new highs in recent weeks,

cumulative advances less declines among NYSE stocks failed to confirm

those highs, while junk bond prices were already deteriorating. We

don’t take any single divergence as serious in itself, but the

accumulation of divergences in recent weeks should not be ignored." John Hussman, PhD

Friday, August 1, 2014

See-Saw Day On Wall St

Stocks Collapse Following Good News?

This may seem strange, but one day after GDP growth of 4% was announced, the stock market plunged 317 points. Is this the beginning of the consequences for so much market manipulation by the Fed?

Thursday, July 31, 2014

Cost of Beef Goes Parabolic

Jason Lusk:

- "That leaves supply-side issues. Cattle inventories are at their lowest level since the 1950s. Because of technological advancement, we don't need as many cattle today today to produce the same amount of beef as we did in 60 years ago. Still, fewer cattle numbers means less beef, and less beef supplied means higher prices. Contraction in cattle supplies can be explained by a number of factors, such as drought in the plains states that limited the amount of grass and hay available and higher feed (mainly corn) prices due to drought, ethanol policy, etc., which pushed pushed more cattle to slaughter several years ago, leading to smaller inventories today. Feed prices have now come down off their highs but cattle prices are still rising, partially because producers are holding back breeding stock to rebuild inventory. Still, if high feed prices were THE answer, I would have expected chicken prices to rise in tandem with beef and pork (at least over part of the period), but as the above graph reveals, they didn't."

Why Beef Prices Are So High

Friday, July 25, 2014

Tuesday, July 22, 2014

"Crippling Blow" to Obamacare

"In a potentially crippling blow to Obamacare, a federal appeals court panel declared Tuesday that government subsidies worth billions of dollars that helped 4.7 million people buy insurance on HealthCare.gov are illegal."

Tuesday, July 15, 2014

Why Collapse Becomes Inevitable!

"It's easy to see what's happening with debt and the real economy (as measured by GDP, gross domestic product): debt is skyrocketing while real growth is stagnant. Put another way--we have to create a ton of debt to get a pound of growth."

Monday, July 14, 2014

Signs of An Approaching Stock Market Top?

Wall

St insiders know that once John and Mary Mainstreet pile into the

market, the time is now to get OUT. They're jumping ship like rats,

while the small investors on Main St piling into the market. One reason

for this is that there's not big piles of cash left to keep pushing the

market still higher. Once John and Mary pile in, who's left with

mountains of cash to keep buying and pushing the market higher?

Look

at the chart in this article that shows that just as the Wall St

bankers are jumping OUT, small "retail" investors from Main St are

finally (foolishly) piling in. This phenomenon has existed for

generations in history. Many on Wall St know that this is a sign of an

impending top. That's why this article was written to talk about it.

Professional investors, such as Nick Skiming of Ashburton Ltd., say that individuals investors are attracted to stocks after seeing others getting rich from a big rally, a time when equities are usually overpriced. The bursting of the technology bubble in March 2000 was marked by mutual funds absorbing a record $102 billion in the first quarter."

Tuesday, July 8, 2014

What A Bubble Looks Like!

Dose of Reality Hits Wall St?!

This morning, as the National Federation of Independent Business released its survey showing that 6 of the NFIB's 10 indicators decreased, with about half of the decline in the overall index due to less confidence in future business conditions, perhaps a dose of reality is hitting Wall St.

We're now in the 2nd half of 2014, and for the first six months, Wall St has been bidding up the stock market in expectation of a break-out higher for the global economy. This morning may be the first of a forced dose of reality for the Fed-pumped delusions of Wall St. It's not going to happen!

Sunday, July 6, 2014

Thursday, June 26, 2014

Go Vegetarian or Starve

I don't buy beef any more. I'm not vegetarian, but I don't buy beef. It's too expensive. This chart shows why. This is the price of cattle futures over the past year. And the price of beef is only accelerating higher!

Thursday, June 12, 2014

Delusions of Grandeur On Wall St

NEW YORK, June 12 (Reuters) - U.S. stock index futures pointed to a flat open on Thursday as a round of disappointing data gave investors few reasons to buy, even after the S&P 500's biggest one-day drop in three weeks.

* Data on both retail sales and jobless claims were below expectations, though neither read was seen as so weak as to derail the thesis that economic conditions are improving.

* Retail sales rose 0.3 percent in May, half of the growth rate that had been expected, while the number of Americans filing new claims for unemployment benefits unexpectedly rose last week.

And when the collapse comes from this latest bubble, these same people will then be telling us that no one saw it coming!

Thursday, June 5, 2014

Stocks Go Vertical As ECB Announces NIRP

Saturday, May 3, 2014

Evans-Pritchard Shreds Friday's Jobs Data

Ambrose Evans-Pritchard at the Daily Telegraph:

The rest can be found here.

Wednesday, April 30, 2014

GDP Barely Breathing

But stocks are higher, near all-time records. Thank you, central bankers, for delivering yet another bubble that will need to crash before investors wake up!

Goldman Sachs, by the way, internally refers to these people -- their own clients -- as "muppets". A Goldman insider blew the whistle on this a few years ago and revealed the true collusion on Wall St against small investors.