Wednesday, July 11, 2012

Fed Meeting Minutes -- Reaction

It appears that the Fed seem little disposed to additional monetary stimulus. But Bernanke has promised!

Economic World Woes

China's trade surplus widened in June as export and import growth both weakened.

But stocks are marginally higher.

Tuesday, July 10, 2012

Hussman: How QE Works

![]()

|

|

July 9, 2012 What if the Fed Throws a QE3 and Nobody Comes?

John P. Hussman, Ph.D.

All rights reserved and actively enforced.

Reprint Policy

The financial markets were largely unresponsive to

news of further easing by the European Central Bank, the Bank of

England, and the People’s Bank of China last week. Notably, Spanish

bonds plunged, while German short-term government bonds now yield

-0.17%, indicating growing concern about sovereign default risk in the

Euro area. Every few days will undoubtedly bring word of new

“agreements” and “mechanisms” – arcane enough to mask their futility –

that promise to solve the European crisis. The headwinds remain very

strong. The key distinction here remains liquidity versus solvency.

There is little doubt that liquidity will be provided at every

opportunity, though the continual degrading of collateral standards by

the ECB suggests that all the good collateral has been pledged already.

More importantly, with a global recession visibly unfolding, solvency

risk will only increase.

The odds remain against European countries

agreeing to the surrender their national sovereignty to the extent

needed to create a “fiscal union” and enable massive and endless

transfers of public resources from stronger to weaker European

countries. Barring a catastrophe severe enough to either prompt

European countries to hand fiscal control to a central administrator,

or to prompt Germany to agree to unconditional bailouts, the least

disruptive move would be for Germany and a handful of stronger countries

to leave the Euro first, and allow the remaining members to inflate as

they wish.

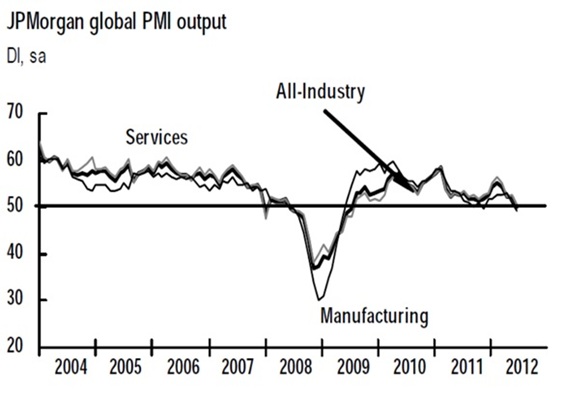

With regard to the economy, I noted two weeks ago

that the leading evidence pointed to a further weakening in employment,

with an abrupt dropoff in industrial production and new orders. Mike Shedlock

reviews the litany of awful figures we’ve seen since then, focusing on

the new orders component of global purchasing managers indices: U.S.

manufacturing new orders and export orders plunging from expansion to

contraction, Eurozone new export orders plunging (only orders from

Greece fell at a faster rate than those of Germany), and an

accelerating decline in new orders in both China and Japan.

Recall that the NBER often looks for “a

well-defined peak or trough in real sales or industrial production” to

help determine the specific peak or trough date of an expansion or

recession. From that standpoint, the sharp and abrupt decline we’re

seeing in new orders is a short-leading precursor of output. As the

chart below of global output suggests, I continue to believe that we

have reached the point that delineates an expansion from a new

recession.

On the employment front, Friday’s disappointing

report of 80,000 jobs created in June may be looked on longingly within

a few months, as we continue to expect the employment figures to turn

negative shortly. That said, it remains important to focus on the joint

action of numerous data points, rather than choosing a single figure

as an acid test. I noted last week in Enter, the Blindside Recession, GDP and employment figures are subject to substantial revision. Lakshman Achuthan at ECRI has observed the first real-time

negative GDP print is often seen two quarters after a recession

starts. Earlier data is often subsequently revised negative. As for the

June employment figures, the internals provided by the household

survey were more dismal than the headline number. The net source of job

growth was the 16-19 year-old cohort (even after seasonal adjustment

that corrects for normal summer hiring). Employment among workers over

20 years of age actually fell, with a 136,000 plunge in the 25-54

year-old cohort offset by gains in the number of workers over the age of

55. Among those counted as employed, 277,000 workers shifted to the

classification “Part-time for economic reasons: slack work or business

conditions.”

What if the Fed throws a QE3 and nobody comes?

To date, the stock market has largely shrugged off

the evidence of oncoming recession, in the confidence that the Federal

Reserve will easily prevent that outcome and defend the market from

any material losses. On that point, it is helpful to remember that the

real economic effects of Fed actions in recent years have been limited

to short-lived bursts of pent-up demand over a quarter or two. Not

surprisingly, as interest rates are already low, and risk-premiums on

more aggressive assets are already remarkably thin, the impact of

quantitative easing around the globe continues to show evidence of

diminishing returns.

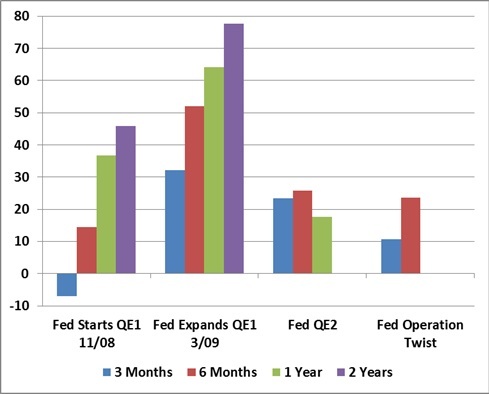

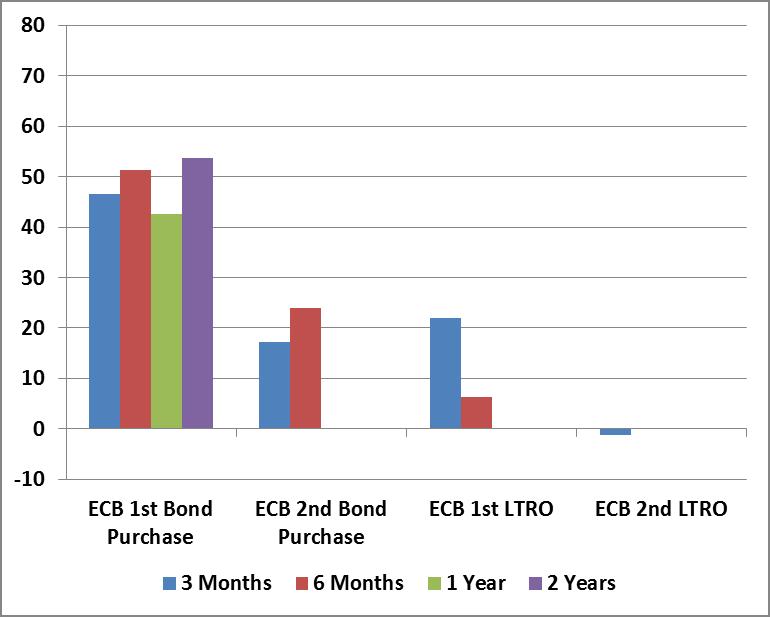

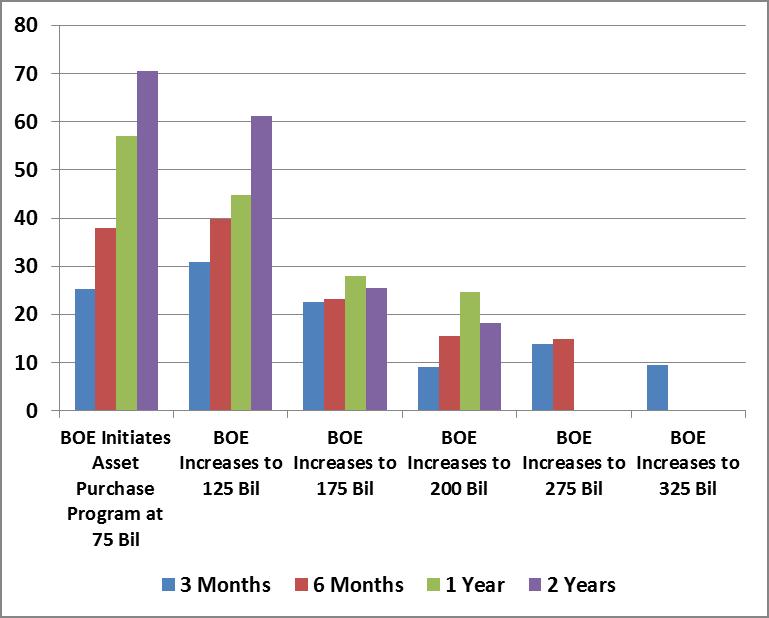

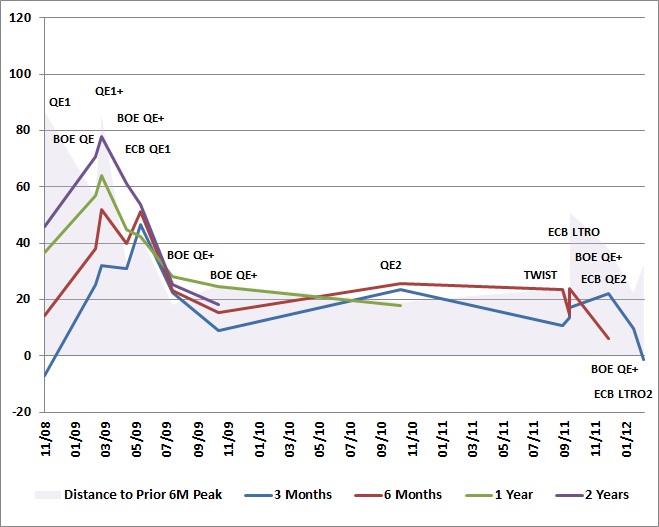

With the help of some preliminary work from Nautilus Capital,

the following charts present the market gains, in percent, that

followed versions of quantitative easing by the Federal Reserve, the

European Central Bank, and the Bank of England on their respective

stock markets (measured by the S&P 500, the Dow Jones EuroStoxx

Index, and the FTSE Composite, respectively). In order to give QE the

greatest benefit of the doubt and account for any “announcement

effects,” the advances in each chart are based on the 3-month, 6-month,

1-year and 2-year gains in each index following the initiation of the

intervention, plus any amount of gain enjoyed by the market from its lowest point in the 2 months preceding the actual intervention. The effects of most interventions would look weaker without that boost.

Remember that quantitative easing “works” through

central bank hoarding of long-duration government bonds, paid for by

flooding the financial markets with currency and reserves that

essentially bear no interest. As a result, investors in aggregate have

more zero-interest cash, and feel forced to reach for yield and

speculative gains in more aggressive assets. Of course, in

equilibrium, somebody has to hold the cash until it is

actually retired (in aggregate, “sideline” cash can’t and doesn’t “go”

anywhere). Increasing the quantity simply forces yield discomfort on

more and more individuals. The process of bidding up speculative assets

ends when holders of zero-interest cash are indifferent between

continuing to hold that cash versus holding some other security. In

short, the objective of QE is to force risky assets to be priced so

richly that they closely compete with zero-interest cash.

Understanding this dynamic, it follows that QE

will have its greatest impact on financial markets when interest rates

and risk-premiums have spiked higher. If interest rates are low

already, and risky assets are already priced to achieve weak long-term

returns (we estimate that the S&P 500 is likely to achieve total

returns of less than 4.8% over the coming decade), there is not nearly

as much room for QE to produce a speculative run. Leave aside the

question of why this is considered an appropriate policy objective in

the first place, given the extraordinarily weak sensitivity of GDP

growth to market fluctuations. The key point is this – QE is effective

in supporting stock prices and driving risk-premiums down, but only

once they are already elevated. As a result, when we look around the

globe, we find that the impact of QE is rarely much greater than the

market decline that preceded it.

To illustrate, each of the Fed, ECB and BOE

quantitative easing interventions since 2008 are presented below as a

timeline. The shaded area shows the amount of market gain that would be

required to recover the peak-to-trough drawdown experienced by the

corresponding stock index (S&P for Fed interventions, EuroStoxx for

ECB interventions, FTSE for BOE interventions) in the 6-month period preceding

the quantitative easing operation. The lines plot the 3-month, 6-month,

1-year and 2-year market gain following each intervention, adding any

gain from the low of the preceding 2 months, to account for any

"announcement effects." Technically, the lines should not be connected,

since they represent the gains following distinct actions of different

central banks, but connecting the points shows the clear trend toward

less and less effective interventions, with the most recent

interventions being flops. Notice also that central banks have typically

initiated QE interventions only when the market had somewhere in the

area of 18% or more of ground to make up.

Of all the experiments with QE, the round of QE2

from late-2010 to mid-2011 was most effective, in that stocks recovered

their prior 6-month peak, and even some additional ground. Yet even

with QE2, the Twist and its recent extension, as well as liquidity

operations such as dollar swaps and so forth, the S&P 500 is again

below its April 2011 peak, and was within 5% of its April 2010 peak

just a month ago (April 2010 is a particularly important reference for

us, since that is that last point that the ensemble methods we

presently use would have had a significantly constructive market

exposure). The largely sideways churn since April 2010 reflects

repeated interventions to pull a fundamentally fragile economy from the

brink of recession, and recessionary pressures are stronger today than

they were in either 2010 or 2011. Investors seem to be putting an

enormous amount of faith in a policy that does little but help stocks

recover the losses of the prior 6 month period, with scant evidence of

any durable effects on the real economy.

In short, the effect of quantitative easing has diminished substantially since 2009, when risk-premiums were elevated

and amenable to being pressed significantly lower. At present,

risk-premiums are thin, and the S&P 500 has retreated very little

from its April 2012 peak. My impression is that QE3 would (will) be

unable to pluck the U.S. out of an unfolding global recession, and that

even the ability to provoke a speculative advance in risky assets will

be dependent on those assets first declining substantially in value.

Labels:

quantitative easing

Monday, July 9, 2012

Sunday, July 8, 2012

Kudlow: Obama's Goose Is Cooked

Obama needed a filet mignon in the June employment report. Instead he got a rubber chicken.

Only 80,000 new jobs were created last month, way below Wall Street

expectations. It’s the fourth consecutive monthly disappointment. For a

few months last winter, jobs were rising at an average of 225,000 a

month. But that has sloped way down to only 75,000. The unemployment

rate continues at 8.2 percent, which is the forty-first straight month

above 8 percent. The U6 unemployment rate, which includes discouraged

workers, is just under 15 percent.As voters finalize their election impressions this summer, all of this is bad news for the Chicago incumbent.

At a campaign stop in Ohio on Friday, Obama actually said we’re still “heading in the right direction.” Is he kidding? As a stagnant GDP drops below 2 percent, employment falters, retail sales decline, and the ISM index for manufacturing drops below 50 (signaling contraction)? No objective observer can deny that the economy is headed in the wrong direction.

I don’t like playing the pessimist, but the numbers are the numbers. This is exactly what former Clinton advisers James Carville, Doug Schoen, and Stanley Greenberg have been warning Obama about. People just don’t believe the economy is getting better. So he’s gotta change his message.

But what change? Taxing rich people won’t create jobs. Neither will bashing Bain Capital. Obama is surrounded by leftist campaign advisers. And it’s hard to see them shifting gears to something constructive like making a summer deal to extend the Bush tax cuts for a year, or heaven forbid backing off the 20-some-odd tax hikes embodied in Obamacare. In other words, Obama’s goose may already be cooked.

The Joint Economic Committee (JEC), spearheaded by Texas congressman Kevin Brady, put out a report saying that the Obama recovery now ranks dead last in modern times. That’s a real milestone in the post-WWII era. It’s ten out of ten for both jobs and economic growth. According to the Bureau of Economic Analysis, real GDP has expanded only 6.7 percent over the eleven-quarter recovery since the recession ended. The Reagan recovery at the same stage had increased by 17.6 percent. The Clinton recovery by 8.7 percent.

As for jobs, the Bureau of Labor Statistics reports that the number of private-sector jobs has grown by only 4.1 percent since the cyclical low point. Reagan’s record was 10.7 percent.

So much for Obamanomics. Didn’t work. Still isn’t working. As the JEC put it, spending stimulus, housing bailouts, auto bailouts, financial bailouts, cash for clunkers, cash for caulkers, and $5 trillion in deficit spending left the Obama recovery dead last in modern times.

Whatever happened to the great boom of the ’80s and ’90s, when the animal spirits were strong and the American economy wasn’t held hostage by Europe or China? In an odd twist, both Obama and his top economist Alan Krueger blame “problems built up over decades.” Does that mean they blame Clinton? Reagan?

For nearly 25 years — during those bad old decades — the economy increased 3.3 percent annually. Unemployment dropped from 11 percent to 6 percent to 5 percent to below 4 percent. Obama would swoon for numbers like that. But those statistics come from the era when big government was over, when pro-market forces stopped the expansion of Leviathan, and when marginal tax rates were slashed to grow the economy.

Now the question is, with Obama’s economic goose cooked, does Mitt Romney have what it takes to win the election and provide a pro-growth economic model that will restore prosperity at home and America’s number-one position around the world?

Some powerful figures — including Rupert Murdoch, Jack Welch, and even my brothers and sisters at the Wall Street Journal editorial page — have taken shots at Romney in recent days. But I am more optimistic. In response to his critics on the day of the bad June jobs report, Romney talked about expanding energy resources, approving the Keystone pipeline, cutting taxes, and increasing trade with Latin America. He reaffirmed his intention to cut federal spending and eliminate programs.

Basically, Romney is promising a return to free-market, supply-side policies on taxes, trade, regulation, and spending. Hopefully he will embrace a sound and stable dollar as well. I still believe Romney is the most underrated politician in America today, and that he’s the most conservative Republican standard-bearer since Ronald Reagan.

In other words, he’s some real filet mignon.

– Larry Kudlow, NRO’s economics editor, is host of CNBC’s The Kudlow Report and author of the daily web log, Kudlow’s Money Politic$.

Subscribe to:

Comments (Atom)