Friday, March 18, 2011

Oil Price Threatens Economy

by Robert Zubrin from Washington Times:

In recent days, oil prices have climbed above $100 per barrel. As chaos spreads through the Arab world, we could soon see much worse.

The likely impact of a new oil-price rise is shown in the graph below, which compares oil prices (adjusted for inflation to 2010 dollars) to the U.S. unemployment rate from 1970 to the present. It can be seen that every oil-price increase for the past four decades, including those in 1973, 1979, 1991, 2001 and 2008, was followed shortly afterward by a sharp rise in American unemployment.

The distress to American workers caused by such events is manifest, but the economic damage goes far beyond the impact on the unemployed. A sustained oil price of $100 per barrel will add $520 billion to the U.S. balance-of-trade deficit. Furthermore, there is a direct and well-established relationship between unemployment rates and the rates of mortgage defaults. Thus, the $130-per-barrel oil shock of 2008 didn't just throw 5 million Americans out of work, it made many of them default on their home payments and thus destroyed the value of the mortgage-backed securities held by America's banks. This, in turn, threatened a general collapse of the financial system, with a bailout bill for $800 billion sent to the taxpayers as a result. But that is not all. The destruction of spending power of the unemployed and the draining of funds from everyone else to meet the direct and indirect costs of high oil prices reduce consumer demand for products of every type, thereby wrecking retail sales and the industries that depend upon them.

Indeed, the world today is already in deep recession. Yet as a result of the systematic constriction of oil production by the Organization of Petroleum Exporting Countries (OPEC), which is limiting its production rate to 1973 levels of 30 million barrels per day, petroleum prices stand at more than four times what they were in 2003. This has imposed a tax increase on our economy of $500 billion per year, equal in economic burden to a 20 percent increase in income taxes, except that instead of the cash going to Uncle Sam, it will go to Uncle Saud and his lesser brethren.

These governments, however, are said to be our "friends." As current events in the Middle East should make clear, there is every chance that someday - perhaps soon - we could wake up and find that the world's oil is under new management, even less concerned with our well-being than the gang in charge today.

This is a fundamental threat to the American economy. We need to take action to protect ourselves from it now, before it is too late. How can we do this?

From looking at the data in the graph, it is clear that "cap-and-trade" plans or alternative methods of carbon or fuel taxation are not the answer. Indeed, by increasing the cost of energy even beyond those imposed by OPEC, they will only make the economic situation worse.

The only way out of this mess is forcefully to expand production of liquid fuels from sources outside OPEC control, particularly our own. That means unleashing our own domestic oil supplies through expanded drilling and also opening our vehicle-fuel market in a serious way to alternative fuels, such as methanol, which can be made cheaply from coal, natural gas or biomass and used in flex-fuel cars.

It may be too late already to stop the crash that will follow the current oil price run-up, but we still have to get started without further delay. Otherwise, while the crash itself will bring down world fuel demand and thus oil prices for a while, they will just rise once more when the economy begins to recover and slam us right back down again. And again. And again.

The time for action is now.

Robert Zubrin is president of Pioneer Astronautics and author of "Energy Victory: Winning the War on Terror by Breaking Free of Oil" (Prometheus Books, 2007).

Fed Admits It Has Intervened In Currency Markets

Back to Bullish

Thursday, March 17, 2011

What Does $1 Trillion Look Like?

All this talk about "stimulus packages" and "bailouts"...

A billion dollars...

A packet of one hundred $100 bills is less than 1/2" thick and contains $10,000. Fits in your pocket easily and is more than enough for week or two of shamefully decadent fun.

Believe it or not, this next little pile is $1 million dollars (100 packets of $10,000). You could stuff that into a grocery bag and walk around with it.

...and remember those are $100 bills.

That covers an area about the size of a football field.

Cost of Living in U.S. Reaches New All-Time Record

from CNBC:

One would think that after the worst financial crisis since the Great Depression, Americans could at least catch a break for a while with deflationary forces keeping the cost of living relatively low. That’s not the case.

|

|

Wednesday, March 16, 2011

Housing Starts Drop

They rose last month, but that was mostly a seasonal improvement.

WASHINGTON (Reuters) - Housing starts posted their biggest decline in 27 years in February while building permits dropped to their lowest level on record, suggesting the beleaguered real estate sector has yet to rebound from its deepest slump in modern history.

Groundbreaking on new construction dropped 22.5 percent last month to an annual rate of 479,000 units, according to Commerce Department data released on Wednesday. This was just above a record low set in April 2009 and way below the estimates of economists, who had been looking for a smaller drop to 570,000.

Food Inflation Leaps Most In 36 Years!

The Labor Department said Wednesday that the Producer Price Index rose a seasonally adjusted 1.6 percent in February -- double the 0.8 percent rise in the previous month. Outside of food and energy costs, the core index ticked up 0.2 percent, less than January's 0.5 percent rise.

Food prices soared 3.9 percent last month, the biggest gain since November 1974. Most of that increase was due to a sharp rise in vegetable costs, which increased nearly 50 percent. That was the most in almost a year. Meat and dairy products also rose.

Energy prices rose 3.3 percent last month, led by a 3.7 percent increase in gasoline costs.

Separately, the Commerce Department said home construction plunged to a seasonally adjusted 479,000 homes last month, down 22.5 percent from the previous month. It was lowest level since April 2009, and the second-lowest on records dating back more than a half-century.

The building pace is far below the 1.2 million units a year that economists consider healthy.

There was little sign of inflationary pressures outside of food and energy. Core prices have increased 1.8 percent in the past 12 months.

Still consumers are paying more for the basic necessities.

Gas prices spiked in February and are even higher now. The national average price was $3.56 a gallon Tuesday, up 43 cents, or 13.7 percent, from a month earlier, according to the AAA's Daily Fuel Gauge. Rising demand for oil in fast-growing emerging economies such as China and India has pushed up prices in recent months. Turmoil in Libya, Egypt and other Middle Eastern countries has also sent prices higher.

But economists expect the earthquake in Japan to lower oil prices for the next month or two, which should temper increases in wholesale prices in coming months. Japan is a big oil consumer, and its economy will suffer in the aftermath of the quake. But as the country begins to rebuild later this year, the cost of oil and other raw materials, such as steel and cement, could rise.

Oil prices fell sharply Tuesday as fears about Japan's nuclear crisis intensified. Oil dropped $4.01, or 4 percent, to settle at $97.18 per barrel on the New York Mercantile Exchange.

Food costs, meanwhile, are rising. Bad weather in the past year has damaged crops in Australia, Russia, and South America. Demand for corn for ethanol use has also contributed to the increase.

Prices rose 1 percent for apparel, the most in 21 years. Costs also increased for cars, jewelry, and consumer plastics.

Tuesday, March 15, 2011

Speaking of Valuations: Pricey Markets Mean Poor Returns

UPDATE: I was wisely encouraged to consider TOTAL returns, with dividends re-invested

But just how disappointing are returns likely to be? I spent a few hours on Friday afternoon geeking out in excel. I found that when the cyclically adjusted P/E ratio is between 22 and 24 (as it is now) the average annual real returns (after inflation) for the subsequent 10 years is -2.2%! And as usual, the average doesn't quite tell the whole story. In the 66 month ends since 1881 when the P/E was between 22 and 24 the distribution of subsequent returns looks like this:

The median total return is -3.1% real. It seems exceedingly likely to me that long-term returns for the stock market from here will be negative. I don't think most investors are prepared for these sort of outcomes over the next decade.

For those who care to see their returns nominally, the average is +1.2% annual returns and the distributions are as follows:

Several successful investors use the same concepts to drive actual estimates of future market returns.

John Hussman, PhD uses this methodology to help drive decision making with his mutual funds. His recent work produces estimated NOMINAL returns over the next 10 years of 3.1% annualized which may be close to zero real returns depending on inflation.

Using a 5 year time frame, the "probable outcomes" are even worse, with 0% projected nominal returns.

GMO does similar work with additional emphasis on where profit margins are relative to normal (and likely to revert towards) and does so across various asset classes and publishes their results monthly. These are also nominal returns and are certainly not high enough to warrant a buy and hold or long-only approach especially when one considers that this is just a range of estimates and the downside to low estimates is equally as likely as the upside.

The fact is that what you pay matters and expensive markets today mean low or even negative prospective returns going forward. The value restoration project, which began with the peak of the stock market in 2000, is ongoing despite a 2 year cyclical rebound on the heels of unprecedented stimulus.

Read the Sitka Pacific Annual Review for more on the multitude of challenges facing investors.

UPDATE: Hussman cites Mish's work in his latest Weekly Commentary.

Disclaimer:The content on this site is provided as general information only and should not be taken as investment advice. All site content, including advertisements, shall not be construed as a recommendation to buy or sell any security or financial instrument, or to participate in any particular trading or investment strategy. The ideas expressed on this site are solely the opinions of the author(s) and do not necessarily represent the opinions of sponsors or firms affiliated with the author(s). The author may or may not have a position in any company or advertiser referenced above. Any action that you take as a result of information, analysis, or advertisement on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

John Hussman: Anatomy of a Bubble

Great analysis by John Hussman. No one is better!

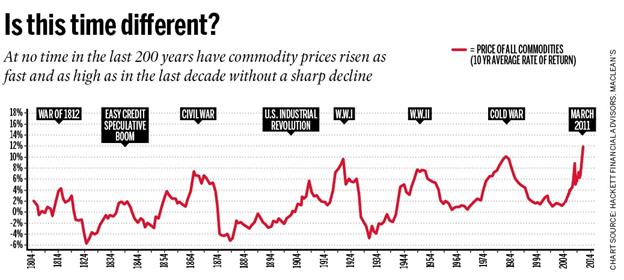

Over the past decade, investors have seen near-parabolic advances in a variety of assets, followed by crashes. These have included dot-com stocks (which peaked and crashed well before the general market peak in 2000), technology stocks, housing, commodities, and stocks in a variety of emerging markets. These experiences have made investors somewhat more attuned to the destructive potential for speculative bubbles in various assets, but has also created something of a "casino economy" where a great deal of resources are directed in hopes of participating in these bubbles.

Fed and China Can't Have it Both Ways

by Charles Hugh Smith of oftwominds.com blog

| Sorry, Fed and People's Bank of China: You Can't Have It Both Ways (March 15, 2011) My thoughts are with those trying to contain the nuclear reactor crisis in Japan, and with their families, who are justifiably worried about the health consequences their loved ones risk as they work long hours in hazardous and difficult conditions. You can't have it both ways, but that isn't stopping the Fed and the PBOC from continuing their doomed policies. The Federal Reserve and the People's Bank of China are each trying to have it both ways: they want rapid growth in money supply, lending and the economy but no troublesome jumps in the price of essentials. Yet the rapid expansion of money supply and credit feeds volatile price increases and politically disruptive income inequality. While the world watches and hopes the reactor containment structures in Japan hold, whatever the aftermath of this deepening nuclear crisis, we will be living in a world defined by the financial policies of the Federal Reserve and the People's Bank of China. Frequent contributor Harun I. neatly summarized the problem with Fed Chairman Ben Bernanke's explanation for why the Fed's policies had nothing to do with skyrocketing global commodity prices: What I find troubling about Bernanke these days is his overt dissembling. Before congress he says that the recovery, not money printing is causing a rather destabilizing spike in commodity prices. Looking for evidence in nominal price charts, there is none to be found. What he is trying to make us believe that from 1982 to 1998 (the great equity bull market) there was not enough demand to drive crude oil prices where they are today. Hmm. At any rate he can not have it both ways. He cannot claim that he needs to print money to spur "acceptable inflation" (which effectively raises prices) while claiming that money printing has nothing to do with rises prices.Thank you, Harun. The Fed is being disingenuous in claiming it is blameless for global inflation: the Fed's zero-interest rate policy and quantitative easing are both unleashing "hot money" that is seeking higher returns anywhere they can be found in the global economy. In a larger sense, the Fed is attempting to repeal the business cycle. In the normal course of capitalism, low rates and easy credit lead to increased borrowing, which leads to rising consumption and investment in production to feed that increased consumption. This leads to higher profits, which feed more investment and debt. At some point, the cycle hits a brick wall: borrowers can't afford to pay more interest, so debt stops rising, and consumption and demand slump as borrowing levels off. In the rush to mint profits, production capacity exceeds demand, and as a result prices and profits both fall. As the boom progressed, investors sought out riskier, more marginal investments. As new debt and demand fall, then these riskier investments lose money and are either shuttered or sold for a loss. As profits decline, workers are laid off and commercial borrowers find their income streams aren't sufficient to meet their obligations. The credit cycle turns from expansion to contraction, as marginal borrowers go bankrupt and insolvent businesses and loans are liquidated or written down. This purging of bad debt, speculative excess and misallocated resources sets the foundation for another cycle of renewed growth. But the Fed has attempted to repeal the credit cycle. Rather than allow credit to fall sharply and interest rates to rise as bad debt is purged from the financial system, the Fed has pursued a policy of making credit even cheaper in the hopes that financial-sector borrowers will be able to borrow more since rates are near-zero. But since consumers and enterprises are still burdened with mountains of existing debt, few are willing or qualified to borrow more. As I recently wrote here, consumer debt in the U.S. has declined a paltry 2.7% in the Great Recession. The Fed's quantitative easing ends up flowing not to households or productive enterprises but to the “too big to fail” banks and Wall Street firms, which then seek higher returns in assets such as stocks and commodities. The Fed's intention was to push money into productive enterprises, but instead it has fed pools of speculative money chasing high returns in global commodities. This is helping to fuel inflation in food and other commodities, not just in the U.S. but globally. Now the Fed has backed itself into a corner: if it keeps interest rates low and continues pouring hundreds of billions of dollars into “hot money” hands, then it will adding to the destabilizing consequences of rising commodity inflation. If it stops its quantitative easing stimulus to help cool global inflation, it threatens to derail the stock market run-up. Without QE2 to hold down rates, interest rates will rise, pushing marginal borrowers out of the market and increasing borrowing costs for everyone from new home buyers to those buying new vehicles. By attempting to repeal the business cycle and refusing to allow a necessary credit cleansing (writing off of bad debt) and repricing of risk, the Fed has created an inescapable double-bind for itself: either continue to pursue easy-money policies and help destabilize the global economy with rising commodity inflation, or allow interest rates to rise and destabilize speculative markets and marginal borrowers. China is also trying to have it both ways. China's leadership is on the horns of a dilemma: if it continues pumping up rapid growth, it will inevitably feed inflation, while if it raises interest rates and curbs lending to limit inflation, that policy will restrain overall growth. Though profits and gross domestic product (GDP) have been surging over the past decade as China's productivity improved, these gains have not trickled down to the workers' paychecks. According to the National Development and Reform Commission, incomes only kept pace with profits and GDP in three of China's 27 provinces. In other words, the "rapid growth" is flowing only to the top tranch of China's households, while food and energy inflation's impact is felt mostly by lower-income wage earners. In effect, China's economy and political structure is creating a nation of Haves and Have-Nots. (Sound familiar? Just substitute "America" for "China" and the statement is equally true.) Victor Shih, an Associate Professor of Political Science at Northwestern University, sees the government's tight control over yields on savings accounts and lending rates as a primary cause of rising inequality: as inflation accelerates, China's savers are losing money, as the return on savings is lower than the rate of inflation. Negative returns on savings act as a stealth tax on China's households and a subsidy to the government-owned banks. The banks then turn around and loan money to politically connected real estate developers and government-owned enterprises at interest rates that are near zero in inflation-adjusted terms. "The Chinese financial system channels wealth from ordinary households to a small handful of connected insiders and state-owned firms," writes Shih. Insiders and top managers take home substantial income in cash that goes unreported in regular channels—so-called "grey income." This is another source of wealth inequality: average workers don't receive these large cash payments, which are considered commissions and bonuses in China. A Credit Suisse survey of urban households in China found $1.5 trillion in grey income unreported in the official household income numbers. About 60 percent of this grey income flowed to the top 10 % of households. According to Shih, while income of normal households rose 8%, the top 10% of households saw their income leap by 25% The net result of these structural imbalances, in Shih's view, is a China that is "increasingly splitting into a small upper class that spends freely on luxury goods, and a remaining population whose earnings and savings are eroded by inflation and state confiscation." So both the Fed and the PBOC are creating two equally destructive and pernicious financial forces: runaway commodity prices fueled by asset bubbles and heavily goosed speculation, and rapidly increasing wealth/income inequality as the gains from speculative excess flow to the top while the price increases and low yield on savings stripmines purchasing power from those least able to afford it. You can't have it both ways, and that's something neither the Fed nor the PBOC is willing to admit--yet. |