The US created 204,000 jobs in November. This used to be a number that represented malaise. Now, it sends stocks 200 points higher.

Friday, December 6, 2013

Dow Up 200 on Better-Than-Expected Jobs Report

Thursday, December 5, 2013

What George Soros Says About Asset Bubbles

EXCERPT FROM THE GEORGE SOROS ‘ACT II OF THE DRAMA’ SPEECH, JUNE 2010 (emphasis added)

Let me briefly recapitulate my theory for those who are not familiar with it. It can be summed up in two propositions. First, financial markets, far from accurately reflecting all the available knowledge, always provide a distorted view of reality. This is the principle of fallibility. The degree of distortion may vary from time to time. Sometimes it’s quite insignificant, at other times it is quite pronounced. When there is a significant divergence between market prices and the underlying reality I speak of far from equilibrium conditions. That is where we are now.

Second, financial markets do not play a purely passive role; they can also affect the so-called fundamentals they are supposed to reflect. These two functions that financial markets perform work in opposite directions. In the passive or cognitive function, the fundamentals are supposed to determine market prices. In the active or manipulative function market, prices find ways of influencing the fundamentals. When both functions operate at the same time, they interfere with each other. The supposedly independent variable of one function is the dependent variable of the other, so that neither function has a truly independent variable. As a result, neither market prices nor the underlying reality is fully determined. Both suffer from an element of uncertainty that cannot be quantified. I call the interaction between the two functions reflexivity. Frank Knight recognized and explicated this element of unquantifiable uncertainty in a book published in 1921, but the Efficient Market Hypothesis and Rational Expectation Theory have deliberately ignored it. That is what made them so misleading.

Reflexivity sets up a feedback loop between market valuations and the so-called fundamentals which are being valued. The feedback can be either positive or negative. Negative feedback brings market prices and the underlying reality closer together. In other words, negative feedback is self-correcting. It can go on forever, and if the underlying reality remains unchanged, it may eventually lead to an equilibrium in which market prices accurately reflect the fundamentals. By contrast, a positive feedback is self-reinforcing. It cannot go on forever because eventually, market prices would become so far removed from reality that market participants would have to recognize them as unrealistic. When that tipping point is reached, the process becomes self-reinforcing in the opposite direction. That is how financial markets produce boom-bust phenomena or bubbles. Bubbles are not the only manifestations of reflexivity, but they are the most spectacular.

In my interpretation equilibrium, which is the central case in economic theory, turns out to be a limiting case where negative feedback is carried to its ultimate limit. Positive feedback has been largely assumed away by the prevailing dogma, and it deserves a lot more attention.

I have developed a rudimentary theory of bubbles along these lines. Every bubble has two components: an underlying trend that prevails in reality and a misconception relating to that trend. When a positive feedback develops between the trend and the misconception, a boom-bust process is set in motion. The process is liable to be tested by negative feedback along the way, and if it is strong enough to survive these tests, both the trend and the misconception will be reinforced. Eventually, market expectations become so far removed from reality that people are forced to recognize that a misconception is involved. A twilight period ensues during which doubts grow and more and more people lose faith, but the prevailing trend is sustained by inertia. As Chuck Prince, former head of Citigroup, said, “As long as the music is playing, you’ve got to get up and dance. We are still dancing.” Eventually a tipping point is reached when the trend is reversed; it then becomes self-reinforcing in the opposite direction.

Typically bubbles have an asymmetric shape. The boom is long and slow to start. It accelerates gradually until it flattens out again during the twilight period. The bust is short and steep because it involves the forced liquidation of unsound positions.

Mixed Headlines for 12-5-2013

Another dose of cold water for Obamacare.

Durable goods orders drop:

Wednesday, December 4, 2013

Roller Coaster Day!

More Good News Sends Stocks Into Red, Near Opening Prices

The Warped World of Wall St

When stocks go higher without regard for ANY news, it sounds like a classic bubble to me!

For perspective, in order to bring the economy back to the state it was in before Obama was elected president, it would require about 500,000 jobs be created every month until his presidency ends. This morning's "good" jobs report indicated that 215,000 jobs were created last month. And on THAT news, stocks leaped this morning!

Only in the Fed-warped world of Wall St!

Tuesday, December 3, 2013

Monday, December 2, 2013

John Hussman Describes What Causes Bubbles to Crash

Stocks Close Down, But Maintain Key Levels

The Dow closed down 77 points today, but barely held the key 16,000 level. The S&P 500 scarcely managed to hold onto the 1,800 level also -- for now!

Sunday, December 1, 2013

Stock Market Reality Bomb From Bob Shiller

Recent

Nobel Prize winner Bob Shiller just unloaded a reality bomb.

from Zero Hedge:

On the heels of his recent appearance pouring cold water on Jim Cramer's housing recovery exuberance,

recent Nobel Prize winner Bob Shiller unloads another round of

uncomfortable truthiness (presumably on the basis of his future-proofing

tenure guaranteed by the Nobel). "Bubbles look like this," Shiller tells Der Spiegel, adding that he is, "most worried about the boom in US stock prices." As Reuters reports,

Shiller is concerned since "the world is still very vulnerable to a

bubble," and with stock exchanges around the world at record highs

despite an economy that is "still weak," the Nobel winner proclaimed, "this could end badly."

Via Reuters,

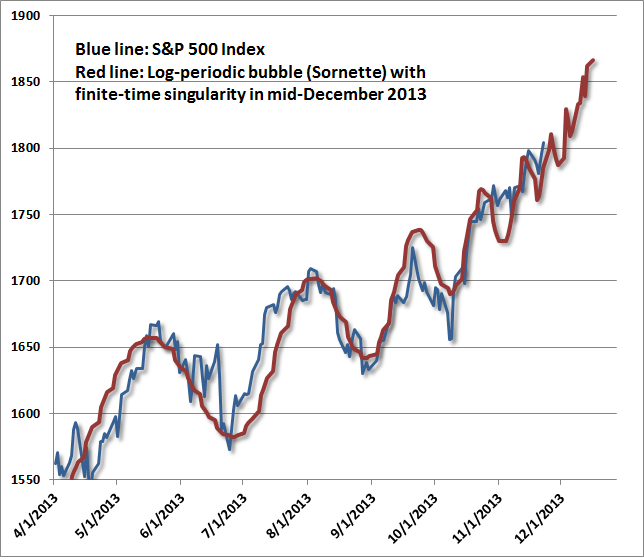

[Bob Shiller] believes sharp rises in equity and property prices could lead to a dangerous financial bubble and may end badly, he told a German magazine.We tend to agree - bubbles do look like this...

...

"I am not yet sounding the alarm. But in many countries stock exchanges are at a high level and prices have risen sharply in some property markets," Shiller told Sunday's Der Spiegel magazine. "That could end badly," he said.

"I am most worried about the boom in the U.S. stock market. Also because our economy is still weak and vulnerable," he said, describing the financial and technology sectors as overvalued.

...

"Bubbles look like this. And the world is still very vulnerable to a bubble," he said.

Bubbles are created when investors do not recognize when rising asset prices get detached from underlying fundamentals.

...we observe a variety of other features typically associated with dangerous extremes:

- unusually rich valuations on a wide variety of metrics that actually have a reliable correlation with subsequent market returns; margin debt at the highest level in history and representing 2.2% of GDP (eclipsed only briefly at the 2000 and 2007 market extremes);

- a blistering pace of initial public offerings - back to volumes last seen at the 2000 peak - featuring “shooters” that double on the first day of issue;

- confidence in the narrative that “this time is different” (in this case, the presumption of a fail-safe speculative backstop or “put option” from the Federal Reserve); lopsided bullish sentiment as the number of bearish advisors has plunged to just 15% and bulls rush to one side of the boat;

- record issuance of covenant-lite debt in the leveraged loan market (which is now spreading to Europe);

- and a well-defined syndrome of “overvalued, overbought, overbullish, rising-yield” conditions that has appeared exclusively at speculative market peaks – including (exhaustively) 1929, 1972, 1987, 2000, 2007, 2011 (before a market loss of nearly 20% that was truncated by investor faith in a new round of monetary easing), and at three points in 2013: February, May, and today (see A Textbook Pre-Crash Bubble).

Black Friday Sales Down 13%, Stocks Higher

According to ShopperTrak, total Black Friday traffic plunged 11% and total sales fell 13.2%, the second consecutive year of declines following last year's 1.8%.