I just love this guy. May I nominate Hussman for Fed Chair?

John P. Hussman, Ph.D.

“Patience is the most valuable trait of the

endgame player. In the endgame, the most common errors, besides those

resulting from ignorance of theory, are caused by either impatience,

complacency, exhaustion, or all of the above.”

– Pal Benko

I’ve long been fascinated by the parallels between

Chess and finance. Years ago, I asked Tsagaan Battsetseg, a highly

ranked world chess champion, what runs through her mind most frequently

during matches. She answered with two questions – “What is the

opportunity?” and “What is threatened?” At present, I remain convinced

that the key opportunity lies in closing down exposure to risk, because

prices in both bonds and stocks have been driven to the point where

the prospective additional compensation for risk is extraordinarily

thin on a historical basis, and much of these gains are the result of

monetary interventions in perpetual search of a greater fool.

The final minutes of a Chess game often go

something like this – each side has exhausted most of its pieces, and

many pieces that have great latitude for movement have been captured,

leaving grand moves off the table. At that point, the game is often

decided as a result of some seemingly small threat that was overlooked.

Maybe a pawn, incorrectly dismissed as insignificant, has passed to

the other side of the board, where it stands to become a Queen. Maybe

one player has brought the King forward a bit earlier than seemed

necessary, chipping away at the opponent’s strength and quietly shifting

the balance of power. Within a few moves, one of the players discovers

that one of those overlooked, easily dismissed threats creates a

situation from which it is impossible to escape or recover.

My impression is that investors have been so

entranced by the moves of their two Knights – Ben Bernanke and Mario

Draghi – that they have allowed an entire army of pawns to pass across

the board without opposition. In Chess, those overlooked, seemingly

insignificant passed pawns can draw away the opponent's resources, or

even be poetically transformed into the most powerful pieces in the

game.

What are those passed pawns? On the basis of

normalized earnings (which correct for the cyclicality of profit

margins over the business cycle, as stocks are very, very long-lived

assets) our projection for 10-year S&P 500 total returns is lower

than it has been at any point prior to the late-1990’s bubble, with the

exception of 1929. While it is very true that valuations have been

even richer at various points in recent years, it should also

be noted the S&P 500 (including dividends) has now underperformed

Treasury bills for well over 13 years as a direct result. Similarly,

the Shiller P/E remains higher than about 95% of instances prior to the

late-1990’s bubble. Numerous recent weekly comments have detailed the

variety of hostile indicator syndromes we presently observe,

particularly the variants of “overvalued, overbought, overbullish”

conditions that have regularly been followed by profound market losses

over the intermediate-term (though not necessarily the short-term).

Meanwhile, my view continues to be that a

recession in the U.S. is already an overlooked passed-pawn, as is the

sharper-than-expected economic weakness in China, as is the

overleveraged, undercapitalized state of the European banking system –

particularly in Spain – where policy makers are misguided enough to

believe that Draghi’s words alone are sufficient to substitute for bank

capital and fiscal stability. The growing U.S. debt/GDP ratio is

another passed-pawn, because while I expect the “fiscal cliff” will be

resolved by a half-hearted combination of tax cuts and modest spending

reductions, the final result is likely to leave a large structural

deficit which we are only capable of financing due to the good fortune

of unrealistically depressed interest costs and a combination of

monetization and Chinese capital inflows (all which make endless

deficits seem misleadingly sustainable).

Hugh Hendry of Eclectica recently got the tone right in his concerns about the endgame we are facing:

"Today, the world is grotesquely distorted by the

presence of fixed exchange rate regimes. There are two. There is the

Euro, and there is the dollar-remnimbi. All of Europe has defaulted.

There are many stakeholders in the European project. There are

financial creditors and then there are the citizens of Europe.

Remarkably, the political economy of Europe is that the politicians

chose to default on their spending obligations to their citizens in

order to honor the pact with their financial creditors. And so of course

what we're seeing is that as time moves on, the politicians are being

rejected. So when I look at Europe, the greatest source of inspiration I

have is fiction... We have the longest-serving Prime Minister, the

Prime Minister of Luxembourg Mr. Juncker, who is on record as having

said that 'when times get tough, you have to lie.' … the truth is

unpalatable to the political class, and that truth is that the scale

and the magnitude of the problem is larger than their ability to

respond, and it terrifies them. The reality is that you just can't make

up how bad it is. But it has precedent, and precedent perhaps offers us

some navigation tools.

"The number one rule in terms of looking after

wealth is preserving that wealth... I think we are single digit years

away from the most profound market clearing moment - a 1932 or a 1982,

where you don't need smart guys or girls, you just need to be bold. The

crisis started here, it went to Europe… we could see a hard landing in

Asia, coinciding and indeed being encouraged by the problems in

Europe, and if you get those two events colliding, and given the lack

of protection on such a scenario in Asia, then you would have another

profound dislocation. And that's the point where you reach the bottom,

and you don't need wise guys, you just need courage."

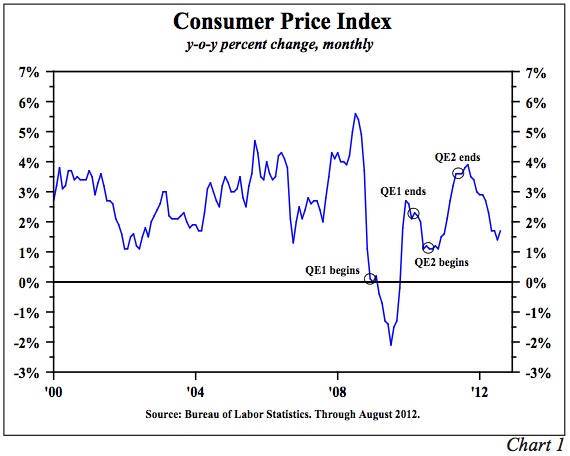

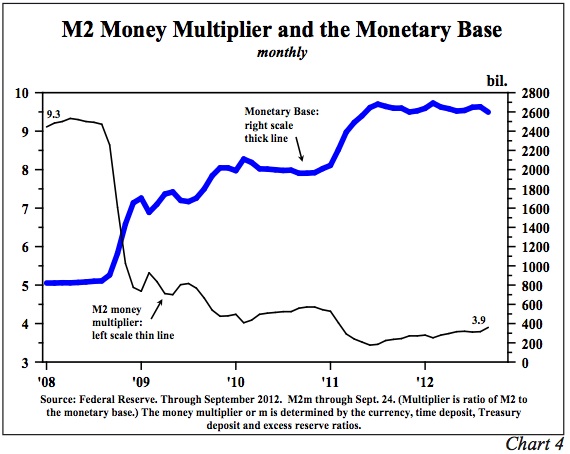

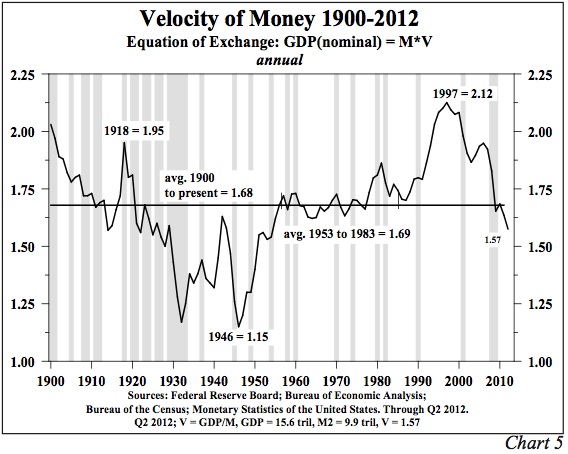

As an economist, I think it is important to

recognize the underlying factors that support the present situation, as

well as those that threaten it. The U.S. has benefited from low

monetary velocity - the willingness of U.S. savers, financial

institutions, China’s central bank, and others, to hold idle currency

balances without meaningful compensation. Indeed, the reason that

tripling the monetary base has not resulted in inflation is that

monetary velocity has declined in direct proportion to that increase. In

effect, people have passively held zero-interest money in whatever

amount it is created. Contrast this with the German hyperinflation,

when velocity rose as money became a “hot potato” – causing prices to

rise even faster than the rate at which money was printed. Contrast the

present situation also with the period from 1973 to 1982, when

monetary velocity was rising, which also resulted in prices rising

faster than the money supply. What creates inflation is the

unwillingness of people to passively hold money balances, which then

turns money into a hot potato. Higher interest rates on safe assets

would have this effect, as that would create an alternative to

zero-interest currency (which is why continued low inflation now relies

on either holding interest rates at zero indefinitely, or massively

contracting the Fed’s balance sheet should non-zero interest rates ever

be contemplated).

Somehow, I suspect that all of us recognize that

the present state of the world economy is being held up by

extraordinary distortions both in the monetary realm and in fiscal

policy, but for whatever reason, it is more pleasant to simply assume

that everything is just fine, instead of thinking about the adjustments

that would be required in order to move back to a sustainable global

economic and financial situation. To some extent, we’ve become

desensitized to extraordinarily large numbers – if hundreds of billions

don’t solve the problem, then a few trillion will – ignoring the

magnitude of those figures relative to our actual capacity to produce

economic output.

Our problems are not insurmountable, but they are

very difficult problems that do not have an easy solution or quick fix

in some bold policy action (even in unrestrained ECB monetization).

Deleveraging is hard. You simply cannot bring down the

debt/GDP ratio unless a) economic growth exceeds interest rates by

enough to offset the primary deficit*, or b) the government chooses to

default on and restructure its debt obligations.

[*Geek's note : technically, the requirement is

that (g - i) * Debt/GDP + PD/GDP > 0, where g and i are GDP growth

and the interest rate on the debt, respectively (either both real or

both nominal), and PD is the primary non-interest deficit (or surplus if

positive)].

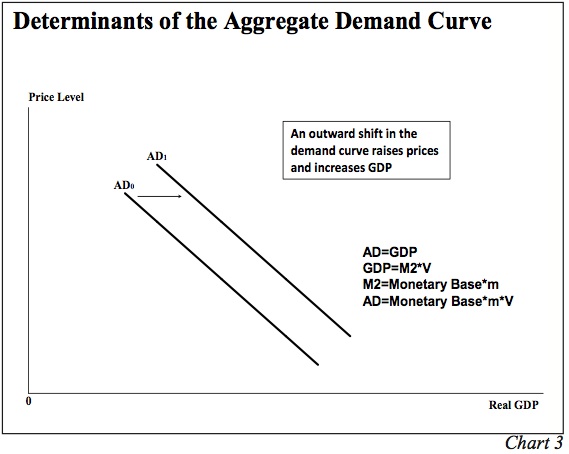

Importantly, printing money can bring down debt/GDP only if the government first locks in a low interest rate on its publicly-held debt by issuing very long term bonds, and then pursues enough inflation to raise nominal

economic growth above that interest rate. Inflation will not devalue

debt if the interest rate on the debt can be continuously reset in

response. Presently, nearly all of the publicly-held U.S. debt is of

short maturity. At an overall deficit of nearly 10% of GDP and a

primary deficit of about 6%, there is very little chance that the ratio

of publicly-held debt/GDP, which has nearly doubled since 2008, will

easily stabilize in the coming years – particularly if we experience

another recession. Moreover, we are unlikely to get consumer demand

sustainably growing without dealing head-on with the problem of

mortgage restructuring and underwater home equity – something that has

been utterly ignored by policymakers. Done correctly, all of that is

uncomfortable enough. Done poorly, it is profoundly destructive. Europe

has already done it poorly, and it is not finished.

That said, I should emphasize that our present

defensiveness does not rely on the assumption that we’ll see some

profound economic dislocation. Rather, our defensiveness is driven by

syndromes of evidence that have repeatedly been associated

with negative return/risk outcomes in dozens of subsets of historical

data. I’ll say this again: we are not defensive because of recession

concerns or views about global financial strains. We are defensive

because the market conditions that most closely resemble those at

present have regularly, and throughout history, been associated with

negative return/risk outcomes, on average.

The endgame of the market cycle

Just as the endgame is the part of the Chess match

that counts the most, the final part of a market cycle is often where

the most critical choices are made. The fact is that a bear market

wipes out more than half of the gains achieved during the average bull

market. For cyclical bear markets that occur during extended “secular”

bear periods as we’ve observed since 2000 (featuring multiple bull-bear

cycles, each which achieves successively lower valuations at the bear

troughs), the bear markets typically wipe out closer to 80% of the

gains achieved during the preceding bull period.

“Once you are in the endgame, the moment of truth

has arrived... The amount of points that can be gained (and saved) by

correct endgame play is enormous, yet often underestimated.”

– Edmar Mednis

In early March, our estimates of prospective stock

market return/risk dropped into the most negative 2.5% of historical

data (see

Warning, A New Who’s Who of Awful Times to Invest),

yet the S&P 500 is presently about 4% higher than it was then, and

our estimates have dropped further, to the most negative 0.5% of

historical observations. As I observed at the time, “While a few of the

highlighted instances were followed by immediate weakness, it is more

typical for these conditions to persist for several weeks and even

longer in some cases ... When we look at longer-term charts like the

one above, it's easy to see how fleeting the intervening gains turned

out to be in hindsight. However, it's easy to underestimate how utterly

excruciating it is to remain hedged during these periods when you

actually have to

live through day-after-day of advances and

small incremental new highs that are repeatedly greeted with

enthusiastic headlines and arguments that ‘this time it's different.’”

And so, we find ourselves facing the likelihood of

another cyclical endgame, where in Benko’s words “impatience,

complacency, exhaustion, or all of the above” can encourage investors

to ignore rich valuations, weak economic fundamentals, heavy insider

selling, overbullish sentiment, overbought market action, increasingly

negative earnings preannouncements, and other syndromes that have

historically been hostile for stocks.

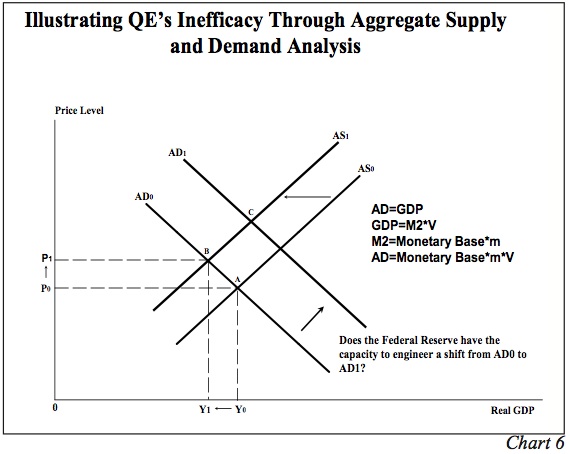

These risks are easy to dismiss. Yields and

prospective returns have been driven lower as investors seek an

alternative to an ocean of zero-interest money, and prices have been

driven higher – a fact that makes rising prices seem somehow automatic.

The question is this - what else is left for investors to anticipate,

with prices not depressed at all (as they were at the start of prior

rounds of QE), and with QEternity now having removed any further

“announcement effects.” Though market risk has been advantageous, it is

doubtful that the market returns we’ve observed are durable.

“It often happens that a player is so fond of his

advantageous position that he is reluctant to transpose to a winning

endgame.”

– Samuel Reshevsky

So while it is true that stocks have advanced a

few percent since March, my strong view is that this is good fortune

born entirely of investor anticipation of ECB and Fed announcements

that are now behind us. Indeed, the S&P 500 is lower now than when

QEternity was announced, and on a volume-weighted basis, is also lower

than when Draghi threw his hail-Mary pass over the Bundesbank. By our

estimate, the present ensemble of market conditions is associated with a

historical rate of loss in the S&P 500 approaching -50%

annualized. Now, I don’t expect conditions to be similarly negative for

a full year - the typical course is for the market to transition to

less negative conditions after an initial hard decline. But I continue

to believe that the gain in the S&P 500 since March, when our

return/risk estimates became overwhelmingly negative, should not be the

basis for complacency here.

“In the endgame, an error can be decisive, and we are rarely presented with a second chance.”

– Paul Keres

From a strategic standpoint, I believe that the

best approach to the complete market cycle is to accept risk roughly in

proportion to the return that can be expected as compensation. Indeed,

this is one of the key results of finance theory. Our estimates of

return/risk vary over the market cycle based on prevailing market

conditions – being very hostile in periods when the market is in a

mature, overvalued, overbought, overbullish market environment, and

generally being aggressive when the market is in an undervalued,

oversold, overbearish environment. To believe that we simply will never

see the latter environment again, or that the next point we observe it

will be at even higher prices than today, is an assumption that strains

credibility from a historical standpoint. In any event, my perspective

is that investment positions should not be based on a one-off forecast

of what will occur in this specific instance, but on the average return/risk profile that has historically accompanied each prevailing set of market conditions.

“It is not a move, even the best move, that you seek, but a realizable plan.”

– Eugene Znosko-Borovsky

As Tsagaan suggested, the two ways to progress,

and the two ways to err, are embodied in the questions “What is the

opportunity?” and “What is threatened?” For our part, this particular

cycle – this particular chess game – has been unusual in that we were

forced to ask in 2009 whether far more was threatened than what had

typically been at risk during other post-war market cycles. The

“two-data sets problem” to address that question took enough time to

solve that we missed an opportunity that we could have taken if our

methods were already robust to out-of-sample Depression-era data at the

time. That said, I believe that investors are committing a mistake in

casually dismissing the question of “What is threatened?” in a mature,

overvalued, overbought, overbullish market here. From my perspective,

it appears to be the same error they made in 2000 and 2007.

“The winner of the game is the player who makes the next-to-last mistake”

– Savielly Tartakover

From an investment perspective, the menu of

opportunities appears very limited in an elevated stock market, with

10-year Treasury yields now down to 1.6%, and even corporate bond

yields down to 2.7%. The opportunity here seems much more likely to be

in limiting risk and taking gains than in extending risk and seeking

further advances. Meanwhile, the historical chronicle of bull market

gains that have been lost during the endgame, and the extent to which

bear markets cause the surrender of those gains, should be a compelling

answer to the question of what is threatened.

... and a final quote with absolutely no context

“A computer once beat me at chess. But it was no match for me at kick-boxing.”

- Emo Philips

The foregoing comments represent the

general investment analysis and economic views of the Advisor, and are

provided solely for the purpose of information, instruction and

discourse. Only comments in the Fund Notes section relate specifically

to the Hussman Funds and the investment positions of the Funds.

Now, reality returns to Wall St! Today, we learn that existing home SALES have declined. There is NO housing recovery!