Friday, December 30, 2011

Gaping Hole In Europe's Deficit Expectations

The Eurozone's Constitution requires countries to keep their deficits below 3% of GDP. Nearly all of them have deficits higher than this amount. Spain's is more than 2 1/2 times that amount!

The Pandemic of Corruption in the Financial Markets

Jim Puplava: Joining me as my special guest on the program today is Ann Barnhardt, formerly of Barnhardt Capital Management. And Ann, you were a commodity broker for eight years and then you formed your own independent brokerage for six years. A couple of weeks ago you made the painful decision to shut your doors because you felt your clients’ money and positions were no longer safe. What led you to draw those conclusions?

Ann Barnhardt: Well, obviously, it was the MF global collapse and more specifically the fall out after the MF Global collapse and the reaction by the CFTC, the SEC and most especially by the Chicago Mercantile Exchange [the “Merc”]. The actions, specifically by the Merc after the MF Global collapse were unprecedented, unfathomable and completely and totally intolerable. The Merc itself basically did the equivalent of sticking a nine millimeter in their mouth and pulling the trigger by not stepping forward, backstopping the MF Global client accounts and at the very least, the Merc should have allowed the MF Global customers to liquidate their accounts and then transfer to other firms. What the Merc did was the worst possible thing—they froze those people out of their accounts and didn’t allow them to liquidate while the markets continued to trade. And I cannot over-emphasize the importance of that, the risk that those people were exposed to in the cattle business (and my forte is cattle. I am actually a cash cattle person. My brokerage business was geared almost exclusively towards livestock and grade. I have a lot of contacts in the cattle industry who didn’t necessarily do their futures business with me but were contacts of mine who did do business through brokers that cleared through MF) who lost tens of thousands of dollars on hedge positions that they wanted to get out of but could not get out of in the week and a half after the MF Global collapse.

This has never happened before. This was a complete breach of fiduciary duty by the Chicago Mercantile Exchange itself to the point that it literally has destroyed the entire paradigm. I got to the point where I could no longer tell my clients that their free cash customer funds, not even exposed to the market place—just their cash sitting in their account, non-margined—was not safe. I couldn’t tell them that their money was safe. At that point it was morally incumbent upon me to get my client out of this completely dysfunctional, basically destroyed marketplace. Get them off of those railroad tracks and get them away from the risk. Now, I didn’t clear through MF, but with the European collapse and knowing what we know about how these financial entities are leveraged in European paper and the cascading nature of all of this I had to act before the proverbial poop hit the fan because if you sit around and you wait until after the poop hits the fan it is too late. You wouldn’t get anybody out. To me, it wasn’t really a painful decision. It was a complete no brainer.

Jim Puplava: In the past, when firms went under customer funds were intact and the exchanges would step in, as you mentioned earlier, to backstop everything to keep customers 100% liquid. And normally, a quick transfer from the bankrupt firm, the bankrupt firm would be immediately replaced. Why do you think they did not allow that to happen this time?

Ann Barnhardt: You tell me. I will use the word again, it is suicidal. What they did was suicidal. So you are absolutely right. Up until last month on Friday, October 31st, the customer segregation of funds rule was utterly sacrosanct. Even when Refco imploded and imploded quite dramatically in 2005, no customer funds were gone. It was on the prop trading side of the company but the customer funds were there, were accounted for, and it is the onus of the Mercantile Exchange to audit these FCMs [Futures Commission Merchant]. MF Global was under the auspices and under the supervision, of the auditing supervision, of the CME. And I believe that MF was audited not just annually, but quarterly. Also, there is the question of how in the world can the Merc miss the margin being posted. The Merc is supposed to be moving equity and doing margin wire transfers twice a day every day. How could those customer funds be “missing”. They aren’t missing. They were stolen. They were stolen by Jon Corzine and his cadre of associates at MF Global. So yes, again, to your listeners who may not fully appreciate the gravity of this, this has never, ever happened before. Nothing even close to this has ever even happened before and it is the function of the Mercantile Exchange itself—the reason why the exchanges exist is that they stand in the middle of every transaction and they act as the de facto counterparty to every single transaction so that, for example, my clients never had to worry about the credit worthiness of the other individual, whoever it might be, who is on the other side of any trade that they did.

Now, for every buyer there is a seller and it is a one-for-one, zero-sum game; but to ensure the credit worthiness and the integrity of the market, the function of the Mercantile Exchange itself is to stand in the middle of every transaction and be the guarantor. So a year ago when Terry Duffy held a press conference [watch it here] and said never in the history of the Mercantile Exchange has a customer ever, ever lost funds resulting from the collapse of a firm, he was telling the truth a year ago. Everything changed on Halloween of this year though. And that's why I had to shut the doors of my brokerage because I could not in good conscience continue forward knowing that the Mercantile Exchange was no longer going to fulfill their fiduciary duty.

Jim Puplava: In the futures market, which is highly leveraged, if you open up a futures contract you are usually leveraged 10-to-1, so they require an exceptional firm base on which to function. And the major integrity of the whole system is the segregation of customer funds. That was breached by MF Global. And let’s not sugar coat this, Ann, basically management stole all of the non-margin cash, invested it in highly speculative securities and what has astonished me has been the reaction of the exchange and regulators—where is the investigation into Jon Corzine?

Ann Barnhardt: Well that is the point of this. We are now living in a lawless, Marxist, Communist, usurped, what used to be a representative republic but is no more. This is no longer a nation of laws. This has now transformed into a nation of men. It doesn’t matter what crime you commit. In the case of Jon Corzine, this man has stolen in excess of a billion dollars. I think by the time it is all panned out it is going to be closer to $3 billion of customer funds that he stole. Why did he do it? Is he stupid? Well, of course he’s not stupid. This is a former head of Goldman Sachs. This man doesn’t have a low IQ per se. Why in the world would a man wake up in the morning one day and say you know what, I think I am going to steal all the customer seg funds in this FCM that I’m running, which is the biggest FCM in the country. Yeah, that sounds like a good plan. No. Why would a man like that even engage in a nefarious plot like this? Because he knew going into it he could get away with it. And the reason he could get away with it is he is in tight with the Obama regime. He is one of Obama’s highest fundraisers. Earlier this year Jon Corzine had a fundraiser dinner at his New York City apartment for Barack Obama where it was charged at $35,000 a plate. Okay? He bundled high six figures for Obama in one evening! He is a crony of the regime. This is Marxist Communism. There is no rule of law. And these people, these poor MF customers are just sitting out here helpless to do anything because there is no law enforcement because this is no longer a nation of laws. The rule of law no longer exists. There is no longer justice in this nation. And no nation, no culture, no society can survive if there isn’t a foundation of justice. That is why we are teetering on the precipice of collapse and I foresee civil war coming within the next several years.

Jim Puplava: You know, we had Gerald Celente on this program and he had an account with Lynn-Waldok, which was eventually taken over by MF Global, and he's been trading futures in gold. He had a plan when he built up enough he would eventually take delivery. Well, they stopped him out of his trade, sequestered his margin (or his cash) and forced him out of a trade and closed his account.

Ann Barnhardt: Absolutely. If we are talking several billion in customer seg funds then the losses that were incurred could easily by the customers in that week, week and a half that they were frozen out could easily, easily get into the hundreds of millions it might even breach into the low billions. No question about that. And yeah, and even with options. You know, I talked to cattleman who have put options on as hedges to put a floor underneath the price of the cattle in case—so imagine this, you buy a put option four months ago, you pay the premium. You post that money. Then this happens, you are frozen out of your account. Your account gets transferred to another firm, without your consent. By the way, none of the customers were allowed any input into this. Their accounts were just sent to RJ O’Brien and other firms like that without their consent. And then once the positions were transferred, even if it was a risk limited position like a long put option, then the new clearing firm called them the next morning after the trade settled and said there was no equity in your account because all that money got stolen. So you are going to have to pay the premium for this put option again. So it's doubling the cost essentially for a lot of these people out here who are dealing in what is supposed to be the very risk limited paradigm of long options. The entire situation could not have been handled any worse. In fact, I would take it a step further. It was handled so poorly I can’t imagine that these people are that stupid at the Merc and at the CFTC and so forth. I can’t believe that the bankruptcy trustee is that stupid. This almost seems like it was so bad that it had to have been nefarious.

Jim Puplava: You know, Ann. You believe that MF Global is just the tip of the iceberg. That there is massive industry exposure to European sovereign debt. In fact, the day you and I are doing this interview the Fed just engineered a major swap with central banks. It was a central bank love fest on Wednesday of group money printing. That tells me that central banks acting in unison the way they did shows they are afraid that there's something big out there that is about to happen and that they are trying to maybe plug a hole in the dyke.

Ann Barnhardt: Well, if anybody out there understands fourth grade arithmetic you know from metaphysical certitude that Europe is done. Europe is mathematically impossible. It cannot be saved. You want to make a start. You even want to make a start at trying to bail out Europe we are talking $25 trillion just to start. And it would then—if you were going to bail out the entirety of Europe—you would now be talking about hundreds of trillions of dollars. Okay, people, there isn’t that much wealth or money on the surface of the earth. The total gross domestic product of the entire planet earth is I think just under $70 trillion. And we are talking about in excess of $100 trillion to bail out Europe? This is now mathematically impossible. These people have so leveraged themselves and so leveraged these governments in these countries giving their brain dead citizenry free hand outs and entitlements that it is now mathematically impossible to save the paradigm. It's not a matter of if the global financial system is going to collapse. Oh, it's going to collapse. You better trust and understand that. It's just a matter of when. And these piddling little maneuvers that these people are making that the Fed is doing. Oh, we are going to give Europe some money. Okay. What I saw this morning, what the Fed is getting ready to do in terms of Europe, is keep Europe going for another seven days. Well, fantastic. Thanks for that. That is literally the brain dead mindset of these politicians. All they are doing is looking to kick the can down the road. At first it was kick the can down another 10, 12 years. Then it is kick the can down the road for another year. And then it was well, let’s kick the can down the road for another few months. Now we're literally to the point where all we can do is kick the can down the road for a matter of a few days. It's not going to make it. I will be very surprised if we make it until Christmas.

Jim Puplava: You know, one would have thought Ann, after the 30 to 40:1 leverage leading up to the financial crisis of 2008, pre-Lehman, that financial firms would have learned. And especially a guy like Jon Corzine that saw Goldman have exposure to AIG with $13 billion in credit default swaps which we bailed him out 100 cents on the dollar. Apparently, this lesson was not learned at MF Global because the leverage, what was the figure? I think it was 100:1—it was just astounding.

Ann Barnhardt: The only lesson that these criminal degenerates learned from the 2008 situation was that they could do anything they want and that pimp daddy government would bail them out. You have to understand, people like Jon Corzine, these are evil, evil people. He went into MF Global looking to rape that company personally for his own good. And that's what the motivation of a lot of these people are. You have to get your heads around this. You have to get your heads around the fact that there are truly evil people in the world who do not give a crap about anyone or anything except themselves, their own personal wealth and their own personal power. And they would sell their grandmother to the Nazis for a nickel without hesitation if they thought they could get away with it. It's the same with people like Jon Corzine, and then we have talked about the fact that Jon Corzine is tied into the Obama regime. And we now know that the government is absolutely stuffed to the gills almost exclusively with this same type of moral degenerate culture. These people that are in the government—not just the Congress and Executive Branch but also in the bureaucracy—they are in it for themselves. They are in it for the money. And two weeks ago when we had the 60 minutes exposé on the insider trading, those of us who have been in the business have known intuitively that that was going on for a very, very long time. We knew that there was front running going on by politicians. A great example of this is someone like Harry Reid. When he entered Congress, Harry Reid had a low six-figure net worth. He now has an eight-figure net worth. And he's never done anything except be a United States Senator. The salary I think of which is something like $170,000 a year. How does that happen? How does a man with $170,000 a year salaried position go from having a six-figure net worth to an eight-figure net worth? That doesn’t make any sense unless he is doing nefarious, illegal, insider trading type deals.

It is obvious what's been going on. You have to start acknowledging these people for what they are, and that is moral degenerates who are basically sociopaths and psychopaths. Meaning they don’t feel any sympathy or empathy for other human beings. The only thing they care about is themselves. They will do anything. They will steal. They will lie. They will cheat. They will lie to your face. They will look in the camera with this tremendous earnestness and lie with fork tongues through their teeth in order to advance their wealth and power. And if we, as a people, don’t get real about this, if we keep having these Pollyanna visions that these people are all on our side and they are really looking out for us. And they are doing the best they can. We will be cork screwed into the ground and this nation will be reduced to a smoldering rubble. You've got to wake up.

Jim Puplava: I would like to go back to MF Global for a second. There is something even worse as you look into the details—it's been hinted and that there could be possible clawbacks. I’m wondering if you might explain that possibility and what a clawback means for, let’s say you had an account at MF Global and, I don’t know, you didn’t feel comfortable with the commodities market—the volatility. So you pulled the money out. There is a possibility they can go after you.

Ann Barnhardt: Oh, absolutely. Clawback is a fairly common tactic in bankruptcies. And what it is is looking at the bankrupt entity and looking at the money that went out of that entity in the time period immediately preceding the collapse. And I don’t know what time frame they would look at MF. I don’t know if it would be 30 days or 60 days or 90 days—I have no idea. But the trustee has in the last two weeks said that yes, clawback is on the table. So what that means is, let’s say for example, you are a savvy individual and you are a good steward of your money. And you are doing business with a firm that clears through MF Global. You are looking at MF Global’s publicly available bond yields. And you see in the six weeks before the collapse that their bond yields spiked parabolically [see chart here]. They went from 6% to 18%. That is a sure, sure sign of massive trouble. And so being an intelligent, informed, aware person who is a good steward of their wealth, what do you do? You say I’m getting out of this company. I am getting my money out of MF Global because something bad is about to happen looking at these bond yields. You can also do the same thing looking at the stock price. You could do the same thing looking at downgrades by the ratings agencies. There's all kinds of ways that you can come to these conclusions.

The other thing is if you're a hedger. If you are a bonafide hedger—if you had positions on and the market moves in favor of your hedge position on the futures side, you don’t leave that equity sitting in your account. What your broker like me does is they wire that money home because you are using that money probably to either offset a cash transaction or to pay down a revolving line of credit. You're not getting any interest on your money sitting at MF Global so you might as well get that equity out of there, send it home and pay down your line of credit so you are not paying interest on that money. So there would organically have been lots and lots of money flowing out of that company in the period immediately before the collapse. Either due to natural hedges, organic in and out functions or due to intelligent people looking at the bond yields and saying uh oh we better get out of here. The bankruptcy trustee can legally claw that money back. Say okay, I am going to go and I am going to dive into your pocket now. And I am going to claw back your money which you, in your responsibility and in your good stewardship pulled out of a company that you knew to be in trouble. Oh yeah, so these MF customers will essentially be raped three times—they will have their cash stolen out of their accounts, they were then locked out of their position so they couldn’t trade and were fully exposed to market risk, paralyzed, unable to do anything for excess of a week. And then, number three rape, is having the bankruptcy trustee come back and literally seize money out of your own personal checking accounts and business accounts and so forth. And clawing it back to feed this bankrupt entity. And you know what the cherry on top of the sundae of all this is? And this is what blows my mind—the bankruptcy trustee, right now, as this is being recorded on the 30th of November. The bankruptcy trustee is still allowing MF Global to trade proprietarily for itself, for the company proper.

It is unbelievable. The rule of law is dead in this country.

Jim Puplava: You know, adding to this just prior to that was the restructuring of Greek debt, where the derivatives association announced that it was a voluntary restructuring so therefore the bankers didn’t have to pay out on credit default swaps. So what you have here, Ann, I believe is a system where the government is protecting the too-big-to-fail at the expense of the customers. And with it, the rule of law is thrown out to protect Wall Street, what does that say about the integrity of the system? It is no wonder people are losing faith.

Ann Barnhardt: There is no integrity in the system. And let’s make it simple—it is not just about the government protecting the “too big to fail banks". It is about criminal oligarchs as individuals protecting each other. They don’t give a crap about the customers of JP Morgan or you know, Citi or Goldman or anything. What they care about is each other. The Obama regime is protecting Jon Corzine proper, the individual. Because he is one of them. He is one of these criminal oligarchs. And for your listeners who may not remember, Jon Corzine is a former congressman. But immediately preceding MF Global he was the Governor of New Jersey and he just cork screwed Jersey into the ground. It is Chris Christy who beat Jon Corzine to become the governor of New Jersey. So yes, this Republican, Chris Christy, was elected in New Jersey—uber liberal, blue state New Jersey—because Corzine financially destroyed this state. And again, this guy Corzine is former head of Goldman. He is not stupid. You have to stop thinking that these people are just misguided or that there is some sort of a difference of opinion on economic theory. These people are nefariously trying to destroy everything in this country. It's called the Cloward-Piven strategy. Go in and destroy and collapse the entire economy, everything and then rebuild a new Marxist, Socialist, fascist state out of the burning rubble of this destruction. This is intentional. This is nefarious. This is not a function of incompetence. It's a function of malice of forethought and conscientious theft and destruction.

Jim Puplava: What would you advice? I am a long term believer in the bull market in commodities, but how do you play commodities when the futures market is no longer secure? And what does this do to the proper functioning of the markets? In other words, now that you've closed your firm because you don’t believe in the integrity of the system and we just listed a series of reasons why—not honoring contracts, appropriating funds, not allowing trades to go off. Not one investigation, in fact, this goes even further than that. We had Bill Black on the program recently, who helped make prosecutions in the S&L scandal. And at that time, 2,000 individuals went to jail. There has not been one criminal charge brought by the justice department since the 2008 crisis. So given that this is where we are, what do you advise and what will you do personally?

Ann Barnhardt: Well get the hell out. Get out of all paper and it's not just the commodities markets. This is going to cascade through everything. It is going to get into the equities. It is going to get into 401ks and IRAs, it is going to get into pension plans and so on and so forth. Total systemic collapse. Get out! I don’t know how I can be anymore plain about this. I say this over and over and over again and then I get scads of emails saying, well I can’t get out of my 401k. Yes, you can. Yes, you can. Take the penalty and get the hell out of there. What would you rather do? Would you rather pay the 10% penalty or would you rather have it all go up in smoke? Because that's what we're staring down the barrel of. Number two, we seem to have this backwards. In terms of what I do, cattle and grain specifically, the futures markets are the derivatives. The futures markets are derived from the actual cash commodity market. Now, I am blessed because my area of expertise is actually in the physical cash market, actual cattle on the hoof. So I have a consulting firm and I'll continue to teach cattlemen how to trade actual physical cattle. But, yeah, to all the people out there listening—you are going to have to get away from paper and get back into physical commodities, the real deal. Anything that is on paper anything that involves a promise or a commitment is no longer valid because as we said there isn’t a rule of law anymore. People can steal from you. Your money can be confiscated. And think how easy now it is to confiscate people’s wealth. Most of our wealth in this society exists as zeroes and ones on a computer server. It takes no effort whatsoever to steal zeros and ones on a computer server. So what I have been telling people is you need to get into physical commodities. And the rule of thumb is if you can stand in front of it with an assault rifle and physically protect it, then it's real—it's a real commodity. That includes food, that includes water, that includes long guns and ammunition. That includes fuel. That includes precious metals—gold and silver coinage. Most especially silver coinage because silver is the metal of barter and transaction and currency. Gold is the storage metal because it's so valuable per ounce. And also, silver is extremely undervalued relative to gold because that market has been synthetically suppressed for the last several years by again, these nefarious actors. So yeah, reallocate into physical commodities.

Jim Puplava: How do you know that somebody like just as we saw in 2008 or recently with MF Global—that is somebody like a Goldman, a JP Morgan that is writing credit default swaps on European debt—how do you know if you have an account with this group that they pledge your assets for collateral or they comingle them with the firm’s assets and then what do you do?

Ann Barnhardt: Oh, exactly. Corzine isn’t alone in this. The reason the MF Global situation happened the way it did is as we eluded to earlier because Corzine had that company just suicidally leveraged. He took those customer funds and then leveraged it into European, sovereign, junk paper at about 100:1 ratio. Massive. Massive leverage. That is why his collateral call was the first one to come and why it took him out because he was so heavily leveraged. Don’t kid yourself. These other entities are doing the same thing. It is just that they are not as heavily leveraged as Corzine was. So yes, the entire paradigm is no longer trust worthy. There is no meaningful government or industry wide regulation and I have been saying this for years. That regulation in the financial industry in the United States both government based and private regulation—private industry regulation—is a monstrous, monstrous joke. The top tier of those organizations are evil, nefarious people. The mid level are halfway stupid, halfway evil who again, are just there to collect their salary paycheck and will say and do anything that they are told and who really don’t understand the business that they are trying to regulate. And then the lower level, the grunts, the actual auditors who go out on site, a lot of those people are super incompetent, affirmative action hires. And yes, I said it and I am not ashamed of it. They are affirmative action hires. They have no business being there doing what they are doing. They are also hiring a lot of kids 15 minutes out of college who are literally reading off the script and couldn’t audit a company if their life depended on it.

So what they do is they send these incompetent people out into the field and into lower management. And then when the poop hits the fan, they blame them. It is absolutely evil and it is a complete joke. And Madoff was the first proof of that. There have been other ponzi schemes since Madoff happened that haven’t gotten as much notoriety, but there was a big one in the futures industry that all of the FCMs were invested in. And the regulatory body of the futures industry the NFA, they audited that Ponzi scheme, they totally missed it. They even admitted that they signed off on it because they really didn’t understand what they were doing. I mean, that is the level of incompetence and evil that we are talking about in terms of these regulatory bodies. The only way to fix this is to shut the whole damn thing down and start from scratch. I am personally looking in the next decade for the emergence of a new exchange within the United States [that is, a replacement of the Chicago Mercantile Exhange]. Word on the street is it might happen in Dallas and I would be fully in favor of that. Start over from scratch.

Jim Puplava: Alright. Well the message: get physical and protect yourself. We have been speaking with Ann Barnhardt, formerly of Barnhardt Capital Management. Ann, I want to thank you for coming on the program and sharing your thoughts.

Ann Barnhardt: Thank you for having me, it's been a pleasure.

Thursday, December 29, 2011

Central Banking and the Destruction of Free Markets

Submitted by Jeffrey Snider of Atlantic Capital Management

Volatility Is The Price Of Real Progress

As we all ponder what may come at us in 2012, the ongoing volatility in almost every corner of every marketplace is certainly concerning, as it should be. This record volatility has enormous implications for any investor, but especially those in leveraged ETF’s. Volatility is the anathema to these vehicles, as has been well discussed, but that does not diminish their targeted usefulness.

As a portfolio manager I use leveraged inverse ETF’s as hedges against the dramatic downside. They have a very narrow window and only perform when the market more or less moves in a straight-line down – just as it did in early October 2008, May 2010 or July/August 2011. Other than those sustained sell-offs, they are a drag on portfolio performance, a cost of doing business in this risk-on, risk-off “marketplace”.

I willingly pay that cost because I have no concrete idea when another fit of sustained selling will actually take place, but I have more than an inkling that it will. Instead, this massive and growing volatility, even though it is costing me some short-term performance, is a good sign that there is actually progress being made. What we are witnessing is a titanic battle between the world as it really is and the one central banks need you to believe it might be (if only you would set aside your own perceptions and self-interest). The fact that volatility has risen is a clear indication that the central bank-inspired anesthesia is no longer as effective as it was in 2009, or even in the QE 2.0 inspired insanity of 2010. Reality, and the free market, is being imposed – and that means there is a place for even narrowly-useful hedging vehicles.

The current market battle is nothing more than the extreme measures of the rational expectations theory and a form of the fallacy of composition, combined with the political aspirations of a century-old theoretical notion of how the economic system should be ordered. Mainstream economic “science” has developed in a relatively straight line since the Great Depression, starting with the idea that the economy must be governed in emergencies. Executive Order 6102 and the subsequent devaluation of the dollar solidified the place for the entire field of economic management, marking perhaps the last time it would be challenged by mainstream thought.

Without the guiding hand of the educated economist, capitalist, free market economies are believed to be wrought with the danger of total collapse, unable to escape from their own emotional whimsies. At the most primal level of modern economics is a deathly fear of deflation, a fear that is best summed up by Fisher’s paradox.

In 1933, Irving Fisher published a paper in the Federal Reserve’s Econometrica circular that amounted to a point-by-point logical deduction of the string of events that led to the unusual collapse of the economic and banking systems. The scale and pace of the disaster confounded “experts” of the era (it seems experts have trouble with inflections in every era), so his deduction offered a highly plausible, well-reasoned and “logical” explanation.

For Fisher, the combination of over-indebtedness and deflation was the toxic mix from which the calamity grew. But within that mix lay a paradox that formed a trap by which no self-made recovery was possible:

The lessons of this paradox are interwoven into the fabric of modern/conventional economics, that whenever deflation might be present a recovery has to be forced since it cannot start on its own. But it is extremely curious that only one half of the equation was chosen as an outcast: deflation. Over-indebtedness has, obviously, been warmly embraced in the decades since Fisher’s proposition. The development of the mainstream of economics has led to the belief that intentional inflation can always defeat deflation, and therefore debt can assume a role, even a primary role, within the schematic of economic stewardship.“…if the over-indebtedness with which we started was great enough, the liquidations of debts cannot keep up with the fall of prices which it causes. In that case, the liquidation defeats itself. While it diminishes the number of dollars owed, it may not do so as fast as it increases the value of each dollar owed. Then, the very effort of individuals to less their burden increases it, because the mass effect of the stampede to liquidate in swelling each dollar owed. Then we have the great paradox which, I submit, is the chief secret of most, if not all, great depressions: the more the debtors pay, the more they owe. The more the economic boat tips, the more it tends to tip. It is not tending to right itself, but is capsizing.”

Fisher’s paradox survives in many forms, but among the most important was a logical derivation, namely the idea that economic participants can do what they believe is best for themselves, but in doing so harm themselves through systemic processes. This is known as a fallacy of composition; that what is good for individuals is not necessarily best for the whole. It overturned the traditional economic notion of an economy at its most basic level, from the time of Adam Smith describing individual self-fulfillment. Sure, this idea had been around for awhile before Fisher’s paper, but the Great Depression “proved” that the fallacy was real and potentially cataclysmic. Originally it was confined to the narrow interpretation of depression economics, and so the evolution of unquestioned economic management started from there.

The economics profession truly believes that there exists economic states where individual self-maximization no longer benefits the larger societal association of economic actions, so it “logically” follows that some process (or entity) has to step in and enforce conditions contrary to individual notions of self-maximization. In other words, there are times when people must be forced to do what they perceive is against their own best interest.

In the context of depression avoidance this seems to be rather innocuous, but in the displacement of political thinking since the 1930’s, it was a slippery slope. What Fisher’s paradox essentially required was a benevolent authority to administer and visit a kind of beneficial tyranny upon the economic population. In the constant forward roll of history, though, the slippery slope of needed benevolence has been applied to a larger and larger cohort of economic circumstances – emergencies breed human desire for such authoritarianism.

It is important to remember that the Federal Reserve was a secondary institution for much of the post-Depression period. After the monetary debacles of the Great Depression, especially the unnecessary reserve requirement hike in 1936 that initiated the depression-within-a-depression in 1937, the Fed was relegated to being simply a monetary check-writer. The Treasury Dept. was the economic powerhouse, especially during a time in which the dollar was the primary tool of economic management. The Fed was consigned to managing the money supply around treasury debt auctions to ensure the federal government’s uninterrupted ability to borrow (in some ways things never change). When that borrowing exploded in 1965, the money supply went with it and the seeds of the Great Inflation were embedded.

Paul Volcker changed this with his “heroism” in defense of the dollar, a dramatic departure from the previous era of Treasury Dept. domination. Conventional wisdom posits that it was Volcker’s Fed that vanquished the inflation dragon, in doing so he “created” another pillar of the fallacy of composition (high interest rates were not good for individuals, but seemed to be good for the larger system). The chastened Fed of 1965 that allowed inflation to begin building was dropped for the activist Fed of 1980 that could apparently do no wrong (the monetary history of the 1970’s was completely and conveniently ignored). The Fed’s reputation soared with the perceived economic success of the 1980’s, handing Alan Greenspan an amount of power unparalleled in human history.

But how much economic success in the 1980’s was earned? Again, conventional wisdom sees the Great Inflation ending in 1982, giving way to the Golden Age of Economic kingship – the Great Moderation. What I see is simply a transformation of inflation from consumer prices to asset prices. Instead of overwrought money creation circulating within the real economy in the form of wages and higher consumer prices, new credit production capabilities allowed a secondary circulation of credit money into assets, indirectly feeding into the real economy – first as interest income, second as debt – as the notorious “wealth effect”. The economy in this age would transform from one based on earned income to one based on paper movements of created money, with the irony of the “wealth effect” being its tendency to incrementally create economic activity without actually creating productive wealth. The global economy was increasingly reliant solely on money creation, a transformation that cannot be understated and a prime cause for re-evaluating the whole of the Great Moderation.

We see this quite clearly in the consumerism of the period. In 1975, household spending was still largely a function of wage income. If we adjust Disposable Personal Income by subtracting asset income (interest and dividends), we see a modest deficit in spending sources of about 3.5%. Households spent more than they brought in from wages, benefits, government transfers (net of taxes) and rental income. Consumer/household spending needed asset income to make up that small funding shortfall (and to go beyond to generate a positive savings rate). By the midpoint of the Great “Moderation” in 1990, the spending deficit was a chasm, 19.3%. Without the $898 billion (nominal dollars) in asset income there was no way that consumer spending would have grown so far so fast.

That interest/asset income was a leftover effect of the Great Inflation when monetary creation found its way into growing stockpiles of “safe” financial assets for the household sector. By 1990, US households had accumulated $5.1 trillion in deposits and credit market assets (largely US treasury bonds) against only $3.6 trillion in debt (including mortgages). But that was a huge “problem” for the growing acumen of an activist Federal Reserve. As the 1980’s progressed, interest rates were declining with consumer inflation (and providing a helping hand to asset prices running wild with credit now focused in that direction). The mainstream of economics took this as a sign of success, but it was really just a marked decrease in monetary efficiency since new money was now circulating heavily in asset prices (the junk bond bubble and the new, great bull market in equities).

Concurrently, economic management had evolved in the 1980’s with the innovation of the “rational expectations” theory. It was hailed as a huge advancement in monetary thinking coming out of the Great Inflation. In many ways it was an adjunct to the fallacy of composition. The rational expectations theory holds that the economic children of modern society can be fooled into undertaking activity that might be against their own best interest if some benevolent authority simply makes it look like everything will be better in the not-too-distant future. If the Fed screws with the price and cost of money (for debt accumulation), manipulates the price of gold (for inflation expectations), or “nudges” stock or real estate prices in the “right” direction (the notorious wealth effect), the population will act today on those conjured expectations of good times tomorrow.

By the end of the 1980’s, the S&L crisis (a stark warning that economic management might not have been all that it was advertised to be, a warning that has largely been ignored) threatened to plunge the world back into depression. The Fed and Alan Greenspan feared the consequences of a banking crisis and any attendant deflation. The Fed funds rate was pushed from around 8.25% in April 1990 to a ridiculous 3.25% by July 1992 – staying at that low level well into 1994. Alan Greenspan was trying to save the entire banking system from the S&L crisis by reducing the cost of funds so dramatically (hoping to see an increase in bank profits, leading to higher retained earnings and therefore equity capital upon which to pyramid more debt). The pressure on household spending because of the collapse in interest rates necessitated a marginal change in spending, but not back toward earned income. Instead we got the wealth effect and the myth of Greenspan’s genius.

Despite a persistently weak recovery (just ask George HW Bush) from a relatively mild recession, the Fed’s management of the economy into a “soft landing” was hailed as a new form of a New World Order. The business cycle could be smoothed (or even eliminated) by the marginal attraction to debt and the wealth effect. If expectations were properly managed, the public would suppress their base emotional instincts and dance to the tune set by the monetary kingship.

It was hubris of the highest order, of course. By the time the tech bubble finally burst (another warning of the dangers of an artificial economy) the Fed doubled down to save itself and its primacy. The results have been disastrous as the marginal economy progressed further and further away from the fundamental foundation of wages and earned income. The savings rate fell to zero by 2005. Worse than that, US households added $10 TRILLION (+269%) in debt between 1990 and 2007, with $7 TRILLION coming after 2002 alone. The household funding deficit reached a high of 24%! Even worse than that, households had shifted preferences out of “safe” credit market assets or bank deposits and into much riskier price assets simply because the systemic cost of risk was intentionally held artificially low.

The economic foundation of the Great Moderation was an illusion, nothing more than asset prices and debt; wealth effect and rational expectations. None of this describes a free market, capitalist economy.

Central banks and economists love to talk about economic potential, spending so much time trying to calculate it with their complex modeling capabilities and elegant mathematical equations. But the hard truth of economic overlordship is rather simple. The Federal Reserve, in cooperation with global central banks, Wall Street and the interbank wholesale money marketplace, simply substituted credit for earned income. And the reason is also very simple, because debt accumulation is far more easily manipulated. As long as households remained attached to earned income and “safe” savings assets, economic management was nearly impossible. The rational expectations theory needs a system more attuned by asset prices and malleable debt levels. And so marginal consumer spending shifted away from the solid foundation of jobs and wages right into the hands of the fallacy of composition and the rational expectations theory.

It is more than a little ironic that the Fed so willingly embraced indebtedness in light of their history with Fisher’s paradox. But mathematical advances in modeling along with a growing commitment to steady inflation allowed the Fed to really believe it could stave off deflation. So they made a deal with the debt devil to obtain the keys to the marginal economic castle and its grand artificial economy, and in the process dangerously surrendered to the over-indebted part of the Fisher’s paradox equation. Thus the housing bubble to mediate the tech bubble since the tech bubble had some potentially deflationary consequences. Even today, everything the Fed has done since 2007 can be seen in these terms: the fallacy of composition, rational expectations and the preservation of the benevolent stewardship of the economic, academic masters.

Somewhere in all this transition from Fisher’s paradox to Greenspan’s genius to debt-slavery, the system ceased to function as a free-market, capitalist system. The free market values the bottom-up dispersal and divergence of billions and billions of free opinions, freely associating together as unfettered price discovery. A central bank devoted to the fallacy of composition and rational expectations is a top-down system committed to manipulating price discovery to achieve ends that seem to be, and very often are, contrary to the perceptions of the vast majority of doltish economic participants. The monetarist system is forced upon the population, no matter how much they resist.

Indeed, the idea of an economic fallacy of composition is itself a logical fallacy. I have no quarrel with the idea of a fallacy of composition or any logical fallacy for that matter, but logic holds no special place in social interactions. There are no logical deductions from economics no matter how much math is applied. It is, and will remain, a subjective interpretation of events. Even the vaunted Fed and its accumulation of Ivy League PhD’s performs no leaps of logic. Like anyone else with an opinion, whatever fallacy of composition it thinks it sees is still just subjective interpretation.

And that is the real danger. Cloaked in the apparent objectivity of math, the economic elite have gained unlimited economic power. When you stop and think about it, you can create a fallacy of composition pretty much anywhere (and write and enforce rules based on it) – from the steep tax on savers with five-plus years of zero interest rates to mandating everyone has to purchase health insurance even if they don’t have the need for it.

The volatility of today is nothing more than a fight between the active perceptions of participants trying to maximize self-interest within the classical, traditional concept of a free economy, and the opposing forces of overlordship of the landed economic elite, trying to get the uninitiated to simply follow orders. The elite really believes that if everyone would gladly pile on even more debt and spend with reckless abandon, the Great Moderation would once again be within reach. Consumers should only stop thinking for and of themselves since common sense is dangerous to the controlled economic system. To get more debt “flowing” requires active price manipulation to make the world seem like it will be better in the near future so that people will start acting like it.

Economic potential to the Fed is the level of economic activity of 2006. To them, this is a cyclical recovery from a cyclical interruption in their normal smoothing of the business cycle. Sure it veered way off into panic, but that was just more confirmation that human emotion needs to be managed. But if we view the economy from the historical perspective, the lack of a cyclical recovery is not at all surprising. The Fed spent decades building up so much monetary inefficiency, so many artificial monetary channels for indirectly “stimulating” economic activity, that it will simply take an enormous amount of new money to get it all moving in the “right” direction again (Ben Bernanke and Paul Krugman at least have that part right).

The fact that resistance is growing, that investors are not drinking the economic Kool-Aid as much as 2009 or late 2010 is a sign of growing discord. The efforts in the realm of rational expectations are simply not working. That is the ultimate danger because the entire central bank gameplan is based on only that. Without willing adherents (useful idiots?) to the central authority of economic management, everything falls back to the true potential – earned income and boring cash flow of un-manipulated dollars or euros. With such a massive chasm between marginal economic activity and earned income sources of spending, it is not likely to be a shallow or short transition (this explains most of the inability of the economy to create jobs – so many jobs in the central planning era were based on money creation and financial “innovation”).

That is both the opportunity and danger of a system reaching its logical end. Put another way, there is a growing realization that while free markets are messy and somewhat unstable, central planning is not really a cure for those symptoms. In fact, it has created more harm ($13 trillion in debt is only US households) than good, more illusion than solid results. Volatility means that the free market is at least attempting to impose itself at the expense of central planning’s soft financial repression and control. By no means is such a beneficial outcome assured; rather the other half of all this volatility (the risk-on days) is the status quo desperately trying to hang on through any and all means (even those less than legal, like bailing out Europe through cheapened dollar swaps).

So the cost of using leveraged ETF’s as insurance against the failure of soft central planning necessarily rises, but that just may mean their ultimate usefulness is closer to being realized. Unless you know exactly when this transition might reach its conclusion, it is, in my opinion, a cost worth bearing.

Unemployment Shows Signs of Rising Again

from Zero Hedge:

Following 4 weeks of supposed improvements in the labor picture courtesy of declining initial jobless claims, even as we all know too well that Wall Street has been firing thousands and thousands of highly paid bankers and CNBC talking heads left and right (are bankers too good for that $400/week paycheck from Uncle Sam?) today initial claims for the week ended December 24 once again resumed their drift higher, printing at 381k, up 15k from the perpetually upward revised prior week total of 366K (previously 364K). And as usual, the Seasonal Adjustment process smoothed out a whooping jump in actual terminations of 69k, which rose from 421K to 490K. Continuing claims also rose by 34K, from 3567K (upwardly revised, duh) to 3601K. Finally, those on EUCs and Extended Benefits once again saw a net drop off from the 99 week cliff as more and more people fall out out of the workforce in perpetuity following 2 years of being unable to find a job. The total amount of jobless on extended claims is now down by 1 million from a year ago, down from 4.5 million to 3.5 million, and dropping. We for one, can't wait to hear what the media spin will be next month when employers put the pinkslipmobile on turbo boost next month and fire all those temp workers they has been stockpiling to help with the EOY inventory liquidations, and we get another 400K claims print.

Why "Tax the Rich" Won't Work!

by Charles Hugh Smith at the Of Two Minds blog:

Will "Tax the Rich" Solve Our Deficit/Spending Crisis? (December 28, 2011)

If we look at tax revenues and income in a practical way, we find "tax the rich" will not close the widening $1.5 trillion gap between Federal revenues and spending.

Clearly, $1.5 trillion annual Federal deficits to fund the Status Quo--fully 10% of the nation's GDP--is unsustainable. Eventually, the ad hoc "solutions" currently being pushed by the Federal Reserve--zero interest rates to keep borrowing costs artificially low and money-printing operations that buy Treasury debt--will encounter political and/or market pressures which will limit the marginal effectiveness of these interventions, and the real cost of these historically unprecedented deficits will trigger a host of unintended consequences--all negative.

Everyone knows there are only two ways to bring deficits back to sustainable levels: skim more tax revenues from the national income or cut spending on the massive Status Quo programs of Defense/National Security, Medicare/Medicaid and Social Security. The rest of the Federal programs so reviled by various constituencies are a relative drop in the bucket.

Everyone with a stake in the Status Quo Federal spending--and that is certainly in excess of 100 million residents of the U.S.--is vocally in favor of "taxing the rich" as the "obvious and just solution" to the widening gap between revenues and spending.

If there is one stance that can gather non-partisan support, it's "tax the rich." More knowledgeable observers refine this to "tax the super-rich," as the majority of the wealth and income of the top 1% is actually held by the top 1/10th of 1%.

We can break this idea down into two basic parts: the ethical case and the revenue case. Ethically, at least in a democracy, the idea that everyone with substantial wealth and income should pay at least as much (as a percentage of income) as wage-earning citizens is compelling.

Various studies have found that the extremely wealthy pay about 17% of their income in Federal taxes, which is less than half of what we self-employed people pay (15.6% self-employment + 25% Federal tax on all income above about $34,000 = 40.6%).

The merely well-off--typically professionals, managers and small business owners--pay the majority of Federal taxes, with the very wealthy paying a substantial share as well. Roughly half of all those filing tax returns pay no Federal tax other than the employees' 7.65% FICA (Social Security) tax.

In the larger scheme of things, the bottom 60% of the workforce pays relatively little of the total Federal tax revenues. (Check U.S. Census records or search my site for sources that break down the sources of Federal tax revenues.)

In other words, the "rich"--or those who the average person considers "rich"--already pay most of the Federal taxes.

How much additional tax could be raised were the super-wealthy to pay the same 40% rate that we self-employed people pay? It is tempting to estimate that another $1 trillion or so could be raised from the super-wealthy, largely from non-wage (unearned) income.

I have addressed this yawning gap between spending and revenues in the past, for example:

The Promises That Cannot Be Kept (July 6, 2011)

As noted in the above entry (the TrimTabs chart), Americans' after-tax income is around $5.3 trillion and $900 billion in income from "other sources." Additional taxes would of course come from current after tax-income. It's difficult to sort out all the various measures of income; the BEA, for example, includes "government transfers" as personal income--though those transfers come from tax revenues.

Including government transfers and arcane categories such as "inventory valuation adjustment (IVA) and capital consumption adjustment (CCAdj)", the BEA counts $12 trillion in earned income. But if strip out transfers and inventory adjustments etc., that number drops to around $8.4 trillion. (Two Americas: The Gap Between the Top 5% and the Bottom 95% Widens August 18, 2010)

Total Federal tax revenues are about $630 billion from Social Security taxes and $1.5 trillion from Federal income taxes, or a total of $2.1 trillion. To Fix Social Security, First Ask Why It Is Deep in the Red (January 18, 2011).

There are local and state taxes, too, of course, which leaves the $6.2 trillion in after-tax income noted earlier. Since the top 10% collect roughly half the income, we can guesstimate that the top 10% receives about $3 trillion. To balance the current budget, they would need to pay 50% of their after-tax income ($1.5 trillion)--on top of the substantial taxes they already pay. (maybe the top 1/10th of 1% pay 17%, but the merely wealthy pay much higher rates on earned income.)

Add this up and you get tax rates of around 65% on the top 10% (25% total income rate plus 50% of the remaining income).

We then have to ask whether these rates would ever be collected.

There are a number of factors that affect actual tax collections from theoretical calculations. One is that Congress is a collection of wealthy people who are seeking to increase their power while minimizing their taxes and those paid by their cronies and contributors. As long as this is the case, then the tax code will continue to be thousands of pages long with exclusions, taxbreaks and exemptions for the politically connected wealthy.

Another is that studies have found Federal tax collections have historically topped out around 21% of total income. Above that level, people make choices that reduce their tax burdens.

Just as a thought experiment, put yourself in the shoes of someone with $20 million in assets and an income of $1 million. First off, you have a tax attorney who works the complex tax code to put as much of your income as possible in lower-rate income--for example, long-term capital gains.

Wealthy individuals shelter their income and assets with corporations, which have many more options in terms of shifting income.

Secondly, you have overseas accounts, assets and options. Let's say you are ethical, and pay your legal taxes without resorting to questionable tax havens. Let's stipulate that you are just like any other taxpayer--you feel no obligation to pay more than your legal share.

International agreements mean that income need only be declared and taxes paid on it in one jurisdiction. So income declared in Switzerland is exempt from taxes in the U.S., as taxes have already been paid in Switzerland.

Though I am not that knowledgeable about tax law, anecdotally it seems total tax rates in Switzerland are around 25%. If rates in the U.S. were jacked to 50% or higher, then very wealthy individuals will shift income to places like Switzerland and pay the lower tax rates there--perfectly legally. They would also liquidate assets in states which attempted to raise taxes on real property or enterprises, and shift those assets to lower-tax states or nations.

This would not be perceived as "tax avoidance," but as rational money management. In this sense, the super-wealthy are simply doing what every household does--attempt to lower taxes by whatever legal means are available. The means available to those with income and assets that can be shifted around are simply more capacious.

In practical terms, collecting another $1.5 trillion annually is problematic on multiple levels. Practically speaking, it might be wise to align total U.S. tax burdens with those of Switzerland and similar developed-world tax havens, for those essentially set the top rate that very wealthy individuals will pay.

Such a system would flatten taxation rates and very likely increase total tax collections. But it is simply not practical to think that the Federal government can skim 45% of the nation's $8.4 trillion in income to fund the bloated, corrupt and inefficient $3.7 trillion Federal budget.

How about those soaring corporate profits? If we taxed 100% of the $1.5 trillion corporate profits, then we could close the $1.5 trillion budget deficit. But then Wall Street would have nothing to support those sky-high stock valuations.

Wednesday, December 28, 2011

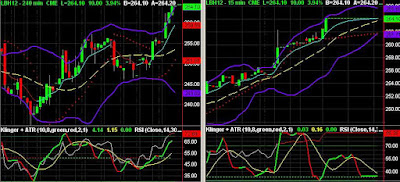

Stocks Tank, Euro Too!

No certain news as to why. I think it may be a reversal at resistance. Euro is tanking too!

Stocks

Euro

Monday, December 26, 2011

The Nightmare After Christmas

By Detlev Schlichter of The Cobden Center

The pathetic state of the global financial system was again on display this week. Stocks around the world go up when a major central bank pumps money into the financial system. They go down when the flow of money slows and when the intoxicating influence of the latest money injection wears off. Can anybody really take this seriously?

On Tuesday, the prospect of another gigantic cash infusion from the ECB’s printing press into Europe’s banking sector, which is in large part terminally ill but institutionally protected from dying, was enough to trigger the established Pavlovian reflexes among portfolio managers and traders.

None of this has anything to do with capitalism properly understood. None of this has anything to do with efficient capital allocation, with channelling savings into productive capital, or with evaluating entrepreneurship and rewarding innovation. This is the make-believe, get-rich-quick (or, increasingly, pretend-you-are-still-rich) world of state-managed fiat-money-socialism. The free market is dead. We just pretend it is still alive.

There are, of course those who are still under the illusion that this can go on forever. Or even that what we need is some shock-and-awe Über-money injection that will finally put an end to all that unhelpful worrying about excessive debt levels and overstretched balance sheets. Let’s print ourselves a merry little recovery.

How did Mr. Bernanke, the United States’ money-printer-in-chief put it in 2002? “Under a paper-money system, a determined government can always generate higher spending…” (Italics mine.)

Well, I think governments and central banks will get even more determined in 2012. And it is going to end in a proper disaster.

Lender of all resorts

Last week in one of their articles on the euro-mess, the Wall Street Journal Europe repeated a widely shared myth about the ECB: “With Germany’s backing, the ECB has so far refused to become a lender of last resort, …” This is, of course, nonsense. Even the laziest of 2011 year-end reviews will show that the ECB is precisely that: A committed funder of states and banks. Like all other central banks, the ECB has one overriding objective: to create a constant flow of new fiat money and thus cheap credit to an overstretched banking sector and an out-of-control welfare state that can no longer be funded by the private sector. That is what the ECB’s role is. The ECB is lender of last resort, first resort, and soon every resort.

Let’s look at the facts. The ECB started 2011 with record low policy rates. In the spring it thought it appropriate to consider an exit strategy. The ECB conducted a number of moderate rate hikes that have by now all been reversed. By the beginning of 2012 the ECB’s policy rates are again where they were at the beginning of 2011, at record low levels.

So why was the springtime attempt at “rate normalization” aborted? Because of deflationary risks? Hardly. Inflation is at 3 percent and thus not only higher than at the start of the year but also above the ECB’s official target.

The reason was simply this: states and banks needed a lender of last resort. The private market had lost confidence in the ability (willingness?) of certain euro-zone governments to ever repay their massive and constantly growing debt load. Certain states were thus cut off from cheap funding. The resulting re-pricing of sovereign bonds hit the banks and made it more challenging for them to finance their excessive balance sheets with money from their usual sources, not least U.S. money market funds.

So, in true lender-of-last resort fashion, the ECB had to conduct a U-turn and put those printing presses into high gear to fund states and banks at more convenient rates. While in a free market, lending rates are the result of the bargaining between lenders and borrowers, in the state-managed fiat money system, politicians and bureaucrats define what constitutes “sustainable” and “appropriate” interest rates for states and banks. The central bank has to deliver.

The ECB has not only helped with lower rates. Its balance sheet has expanded over the year by at least €490 billion, and is thus 24% larger than at the start of the year. This does not even include this week’s cash binge. The ECB is funding ever more European banks and is accepting weaker collateral against its loans. Many of these banks would be bust by now were it not for the constant subsidy of cheap and unlimited ECB credit. If that does not define a lender of last resort, what does?

And as I pointed out recently, the ECB’s self-imposed limit of €20 billion in weekly government bond purchases (an exercise in market manipulation and subsidization of spendthrift governments but shamelessly masked as an operation to allow for smooth transmission of monetary policy) is hardly a severe restriction. It would allow the ECB to expand its balance sheet by another €1 trillion a year. (The ECB is presently keeping its bond purchases well below €20 billion per week.)

Deflation? What deflation?

It is noteworthy that there still seems to be a widespread belief that all this money-printing will not lead to higher inflation because of the offsetting deflationary forces emanating from private bank deleveraging and fiscal austerity.

This is an argument I came across a lot when I had the chance in recent weeks to present the ideas behind my book to investors and hedge fund managers in London, Edinburgh and Milan. Indeed, even some of the people who share my outlook about the endgame of the fiat money system do believe that we could go through a period of falling prices first, at least for certain financial assets and real estate, before central bankers open the flood-gates completely and implement the type of no holds barred policy I mentioned above. Then, and only then will we see a dramatic rise in inflation expectations, a rise in money velocity and a sharp rise in official inflation readings.

Maybe. But I don’t think so. I consider it more likely that we go straight to higher inflation.

The deleveraging in the banking sector is the equivalent of austerity in the public sector: it is an idea. A promise. The reflationary policy of the central bank is a fact. And that policy actively works against private bank deleveraging and public sector debt reduction.

Consider this: The present credit crisis started in 2007. Yet, none of the major economies registered deflation. All are experiencing inflation, often above target levels and often rising. In the euro-area, over the past twelve months, the official inflation rate increased from 2 percent to 3 percent.

From the start of 2011 to the beginning of this month, the U.S. Federal Reserve boosted the monetary base by USD 560 billion, or 27 percent. So far this year, M1 increased by 17.5 percent and M2 by 9.5 percent.

Below is the so-called “true money supply” for the U.S. calculated by the Mises Institute.

In the UK the official inflation reading is at around 5 percent, but nevertheless in October the Bank of England embarked on another round of “quantitative easing”. It has so far expanded its balance sheet by another £50 billion in not even three months, which constitutes balance sheet growth of about 20 percent.

What we have experienced in the UK in 2011 provides a good forecast in my view for the entire Western world for 2012: rising unemployment, weak or no growth, failure of the government to rein in spending, growing public debt, further expansion of the central bank’s balance sheet, rising inflation.

Death of a safe haven

And what about Switzerland? Here the central bank expanded its balance sheet by 40 percent over just the first three quarters of the year, and almost tripled the monetary base over the same period of time. Most of this even occurred before the 6th of September, the day on which Mr. Hildebrand, the President of the Swiss National Bank, told the world and his fellow Swiss countrymen and women that the whole safe-haven idea was rubbish and that Switzerland was now joining the global fiat money race to the bottom.

Deflation has become the bogeyman of the policy establishment. It must be avoided at all cost! Of course for most of us regular folks deflation would simply mean a tendency toward lower prices. It would mean that the capacity of the capitalist economy to increase the productivity of labour through the accumulation of capital and to thus make things more affordable over time (a true measure of rising general wealth) would accurately be reflected in falling nominal prices. The purchasing power of money would increase over time. This, however, would require a form of hard and apolitical money. Instead we are constantly told that our economy needs never-ending monetary debasement in order to function properly. We are constantly told to fear nothing more than deflation, which can only be averted by a determined government and a determined central bank. And the never-ending supply of new fiat money.

Appropriately, there is no talk of exit strategies any longer.

Given the size of the already accumulated imbalances I think a stop to this madness of fiat money creation would be painful at first but hugely beneficial in the long run. I am the last to say that no risk of a very painful deflationary correction exists. But a correction is now unavoidable in any case, and every other policy option will make the endgame only worse. Even if I am wrong on the near-term outlook on inflation and even if all this money-printing does not lead to higher inflation readings imminently, it will still be a hugely disruptive policy. Money injections obstruct the dissolution of imbalances and invariably add new imbalances to the economy, including new debt and capital misallocations, that will make even more aggressive money printing necessary in the future.

The nationalization of money and credit

Herein lies a fundamental contradiction in our present system: The desire for constant inflation and constant credit expansion requires that the banks be shielded from the effects of their own business errors. Allowing capitalism’s most efficient regulators, profit and loss, to do the regulating, would mean that banks could face the risk of bankruptcy – this is, of course, the ultimate disciplinary force in capitalism. This could then lead to balance sheet correction and thus periods of deflation. Ergo, banks cannot be capitalist enterprises at full risk of bankruptcy as long as constant credit growth and inflation are the overriding policy goals. The constant growth of the banking sector must be guaranteed by the state through the unlimited provision of bank reserves from a lender-of-last resort central bank.

That banks get ever bigger, that they routinely hand out multi-million dollar bonuses, and that they frequently get bailed out, is not a result of the greed of the bankers – a stupid explanation anyway, only satisfactory to the intellectually challenged and perennially envious – but is integral to the fiat money system.

Banking under state protection ultimately means banking under state control. In the end it means state banking. And this is where we are going.

Last week the Federal Reserve and the Bank of England announced plans to tighten the control over the balance sheet management and the risk-taking of private banks. This is just the beginning, believe me. The nationalization of money and credit will intensify in 2012 and beyond. More regulation, more restriction, more control. Not only in defence of the bankrupt banks but also the bankrupt state. We will see curbs on trading, short-selling restrictions and various forms of capital controls.

A system of state fiat money is incompatible with capitalism. As the end of the present fiat money system is fast approaching the political class and the policy bureaucracy will try and defend it with everything at their disposal. For the foreseeable future, capitalism will, sadly, be the loser.

The conclusion from everything we have seen in 2011 is unquestionably that the global monetary system is on thin ice. Whether the house of cards will come tumbling down in 2012 nobody can say. When concerns about the fundability of the state and the soundness of fiat money, fully justified albeit still strangely subdued, finally lead to demands for higher risk premiums, upward pressure on interest rates will build. This will threaten the overextended credit edifice and will probably be countered with more aggressive central bank intervention. That is when it will get really interesting.

We live in dangerous times. Stay safe and enjoy the holidays.

In the meantime, the debasement of paper money continues.