from the NYTimes article on whether China will continue to bankroll the United States.

from the NYTimes article on whether China will continue to bankroll the United States.

Saturday, May 16, 2009

81% Tax Increase to Fund Entitlements

from Forbes:

This week, the federal government published two important reports on long-term budgetary trends. They both show that we are on an unsustainable path that will almost certainly result in massively higher taxes.

The first report is from the trustees of the Social Security system. News reports emphasized that the date when its trust fund will be exhausted is now four years earlier than estimated last year. But in truth, this is an utterly meaningless fact because the trust fund itself is economically meaningless.

The 2010 budget, which was finally released this week, confirms this fact. As it explains in Chapter 21, government trust funds bear no meaningful comparison to those in the private sector. Whereas the beneficiary of a private trust fund legally owns the income from it, the same is not true of a government trust fund, which is really nothing but an accounting device.

Most Americans believe that the Social Security trust fund contains a pot of money that is sitting somewhere earning interest to pay their benefits when they retire. On paper this is true; somewhere in a Treasury Department ledger there are $2.4 trillion worth of assets labeled "Social Security trust fund."

The problem is that by law 100% of these "assets" are invested in Treasury securities. Therefore, the trust fund does not have any actual resources with which to pay Social Security benefits. It's as if you wrote an IOU to yourself; no matter how large the IOU is it doesn't increase your net worth.

This fact is documented in the budget, which says on page 345: "The existence of large trust fund balances … does not, by itself, increase the government's ability to pay benefits. Put differently, these trust fund balances are assets of the program agencies and corresponding liabilities of the Treasury, netting to zero for the government as a whole."

Consequently, whether there is $2.4 trillion in the Social Security trust fund or $240 trillion has no bearing on the federal government's ability to pay benefits that have been promised. In a very technical sense, it would lose the ability to pay benefits in excess of current tax revenues once the trust fund is exhausted. But long before that date Congress would simply change the law to explicitly allow general revenues to be used to pay Social Security benefits, something it could easily do in a day.

The trust fund is better thought of as budget authority giving the federal government legal permission to use general revenues to pay Social Security benefits when current Social Security taxes are insufficient to pay current benefits--something that will happen in 2016. Effectively, general revenues will finance Social Security when the trust fund redeems its Treasury bonds for cash to pay benefits.

What really matters is not how much money is in the Social Security trust fund or when it is exhausted, but how much Social Security benefits have been promised and how much total revenue the government will need to pay them.

The answer to this question can be found on page 63 of the trustees report. It says that the payroll tax rate would have to rise 1.9% immediately and permanently to pay all the benefits that have been promised over the next 75 years for Social Security and disability insurance.

But this really understates the problem because there are many people alive today who will be drawing Social Security benefits more than 75 years from now. Economists generally believe that the appropriate way of calculating the program's long-term cost is to do so in perpetuity, adjusted for the rate of interest, something called discounting or present value.

Social Security's actuaries make such a calculation on page 64. It says that Social Security's unfunded liability in perpetuity is $17.5 trillion (treating the trust fund as meaningless). The program would need that much money today in a real trust fund outside the government earning a true return to pay for all the benefits that have been promised over and above future Social Security taxes. In effect, the capital stock of the nation would have to be $17.5 trillion larger than it is right now. Alternatively, the payroll tax rate would have to rise by 4%.

To put it another way, Social Security's unfunded liability equals 1.3% of the gross domestic product. So if we were to fund its deficit with general revenues, income taxes would have to rise by 1.3% of GDP immediately and forever. With the personal income tax raising about 10% of GDP in coming years, according to the Congressional Budget Office, this means that every taxpayer would have to pay 13% more just to make sure that all Social Security benefits currently promised will be paid.

As bad as that is, however, Social Security's problems are trivial compared to Medicare's. Its trustees also issued a report this week. On page 69 we see that just part A of that program, which pays for hospital care, has an unfunded liability of $36.4 trillion in perpetuity. The payroll tax rate would have to rise by 6.5% immediately to cover that shortfall or 2.8% of GDP forever. Thus every taxpayer would face a 28% increase in their income taxes if general revenues were used to pay future Medicare part A benefits that have been promised over and above revenues from the Medicare tax.

But this is just the beginning of Medicare's problems, because it also has two other programs: part B, which covers doctor's visits, and part D, which pays for prescription drugs.

The unfunded portion of Medicare part B is already covered by general revenues under current law. The present value of that is $37 trillion or 2.8% of GDP in perpetuity according to the trustees report (p. 111). The unfunded portion of Medicare part D, which was rammed into law by George W. Bush and a Republican Congress in 2003, is also covered by general revenues under current law and has a present value of $15.5 trillion or 1.2% of GDP forever (p. 127).

To summarize, we see that taxpayers are on the hook for Social Security and Medicare by these amounts: Social Security, 1.3% of GDP; Medicare part A, 2.8% of GDP; Medicare part B, 2.8% of GDP; and Medicare part D, 1.2% of GDP. This adds up to 8.1% of GDP. Thus federal income taxes for every taxpayer would have to rise by roughly 81% to pay all of the benefits promised by these programs under current law over and above the payroll tax.

Since many taxpayers have just paid their income taxes for 2008 they may have their federal returns close at hand. They all should look up the total amount they paid and multiply that figure by 1.81 to find out what they should be paying right now to finance Social Security and Medicare.

To put it another way, the total unfunded indebtedness of Social Security and Medicare comes to $106.4 trillion. That is how much larger the nation's capital stock would have to be today, all of it owned by the Social Security and Medicare trust funds, to generate enough income to pay all the benefits that have been promised over and above future payroll taxes. But the nation's total private net worth is only $51.5 trillion, according to the Federal Reserve. In effect, we have promised the elderly benefits equal to more than twice the nation's total wealth on top of the payroll tax.

Of course, theoretically, benefits could be cut to prevent the necessity of a massive tax increase. But how likely is that? The percentage of the population that benefits from Social Security and Medicare is growing daily as the baby boom generation ages and longevity increases. And the elderly vote in the highest percentage of any age group, so their political influence is even greater than their numbers.

The reality, which absolutely no one in either party wishes to face, is that benefits are never going to be cut enough to prevent the necessity of a massive tax increase in the not-too-distant future. Those who think otherwise are either grossly ignorant of the fiscal facts, in denial, or living in a fantasy world.

Bruce Bartlett is a former Treasury Department economist and the author of Reaganomics: Supply-Side Economics in Action and Impostor: How George W. Bush Bankrupted America and Betrayed the Reagan Legacy. He writes a weekly column for Forbes.

Friday, May 15, 2009

Up, Up, and Away! Credit Card Defaults Continue Rising

from Reuters:

U.S. credit card defaults rose in April to record highs, with Citigroup and Wells Fargo posting double digit loss rates, as the recession slashed more than 2 million jobs since the beginning of the year.

"U.S. card credit quality continues to struggle," John Williams, an analyst at Macquarie Research, said in a note to clients.

* Citigroup credit card charge-off rate at 10.21 percent

* Wells Fargo credit card charge-off rate at 10.03 percent

* Capital One changes customer bankruptcy accounting

* Banks' shares fall as much as 4 percent

Obama's Barbs Worry Corporate World

from AP: Relations between President Barack Obama and U.S. corporate leaders have grown tense in recent weeks, with business groups bristling over his sharp rebukes of lenders and multinational companies in particular. Executives and trade groups that praised Obama's outreach during his post-election transition period say they have felt less welcome since he took office in January. More troubling, they say, are his populist-tinged, sometimes acid critiques of certain sectors, including large companies that keep some profits overseas to reduce their U.S. tax burden.

Another Copy of Patterson's Remarks

from Naked Capitalism blog:

The TARP elicited a firestorm of criticism at its inception, and at various points of its short existence, particularly the repeated injections into "too big to fail" Citigroup and Bank of America, plus the charade of Paulson forcing TARP funds onto banks who were eager to take them once the terms were revealed. Now, however, conventional wisdom on the program might be summarized as, "it's flawed, but still better than doing nothing."

That of course is a false polarity. Having the TARP, particularly given the amount of funds committed, precluded quite a few other courses of action. And the TARP was part of a strategy to avoid resolving sick banks, when the history of banking crises shows that speedy action to clean up dud banks and restructure or write off bad debt (both of the bank and to the bank) is the fastest course to economic recovery.

So far, the beneficiaries of the handouts equity injections have complained only about the Obama Adminstation's occasional efforts to act like a substantial shareholder and exercise some influence over the companies' affaris. We are the first to acknowledge that these too often have involved matters of appearance (executive pay) as opposed to substance (risk taking on the taxpayer dime for the benefit of shareholders and employees).

But now we have a salvo from an unexpected source: an investor who used TARP funds to buy a bank, and thinks taxpayers are getting ripped off. Mark Patterson, of MartnPatterson Advisers, used TARP matching funds to buy a Michigan bank. This by no means was a large transaction, but the point is that someone that one would expect to praise the process (after all, he benefitted from its largesse) is a pointed critic.

From the Telegraph:

“The taxpayers ought to know that we are in effect receiving a subsidy. They put in 40pc of the money but get little of the equity upside,” said Mark Patterson, chairman of MatlinPatterson Advisers...

Mr Patterson said the US Treasury is out of its depth and seems to be trying to put off drastic action by pretending that the banking system is still viable.

“It’s a sham. The banks are insolvent. The US government is trying to sedate the public because they are down to the last $100bn (£66bn) of the $700bn TARP funds. They think they’re doing this for the greater good of society,” he said, speaking at the Qatar Global Investment Forum.

Mr Patterson said it would be better for the US to bite the bullet as Britain has done, accepting that crippled lenders must be nationalised. “At least the British are not hiding the bail-out,” he said.

MatlinPatterson said private equity and hedge funds were deluding themselves in hoping to go back to business as usual after the trauma of the last 18 months.

“This is not a normal recession and there will be no V-shaped recovery. The crisis has destroyed leveraged companies. We’re going to see a catastrophic increase in the number of LBO’s (leveraged buyouts) going into default because they’re knee-deep in debt and no solution exists since they can’t refinance,” he said.

“Alpha hedge funds have been making their money by gambling with excessive leverage, so the knife that cuts off leverage is going to cut off their heads as well,” he said...

“The US government has thrown 29pc of GDP at this crisis compared to 8pc in the early 1930s. The Fed’s balance sheet has risen from $900bn to $2.7 trillion to bail out the system. America has to do it because the only way out is to debase the currency, but that is going to lead to some very high inflation three years down the road,” he said.

Hedge Fund Beneficiary of TARP Calls It a "Sham"

from Zero Hedge blog:

The chairman of $7 billion distressed Private Equity firm and TARP beneficiary MatlinPatterson calls a spade a spade and in the process exposes the entire Geithner plan for the complete sham that it is. His comments before the Qatar Global Investment Forum were captured by the Daily Telegraph's Evans-Pritchard earlier, and Zero Hedge republishes the piece in its entirety as it presents every nuance of our predicament with masterful simplicity.

***

US 'sham' bank bail-outs enrich speculators, says buy-out chief Mark Patterson

The US Treasury’s effort to stabilise the banking system through the TARP programme is a hopelessly ill-conceived policy that enriches speculators at public expense, according to the buy-out firm supposed to be pioneering the joint public-private bank rescues.

“The taxpayers ought to know that we are in effect receiving a subsidy. They put in 40pc of the money but get little of the equity upside,” said Mark Patterson, chairman of MatlinPatterson Advisers.

The comments are likely to infuriate Tim Geithner, the US Treasury Secretary, because MatlinPatterson took advantage of the TARP’s matching funds to buy Flagstar Bancorp in Michigan. His confession appears to validate concerns that the bail-out strategy is geared towards Wall Street.

Under the convoluted deal agreed earlier this year, MatlinPatterson has come to own 80pc of the shares while the US government has ended up with under 10pc.Mr Patterson said the US Treasury is out of its depth and seems to be trying to put off drastic action by pretending that the banking system is still viable.

“It’s a sham. The banks are insolvent. The US government is trying to sedate the public because they are down to the last $100bn (£66bn) of the $700bn TARP funds. They think they’re doing this for the greater good of society,” he said, speaking at the Qatar Global Investment Forum.

Mr Patterson said it would be better for the US to bite the bullet as Britain has done, accepting that crippled lenders must be nationalised. “At least the British are not hiding the bail-out,” he said.

MatlinPatterson said private equity and hedge funds were deluding themselves in hoping to go back to business as usual after the trauma of the last 18 months.

“This is not a normal recession and there will be no V-shaped recovery. The crisis has destroyed leveraged companies. We’re going to see a catastrophic increase in the number of LBO’s (leveraged buyouts) going into default because they’re knee-deep in debt and no solution exists since they can’t refinance,” he said.

“Alfa hedge funds have been making their money by gambling with excessive leverage, so the knife that cuts off leverage is going to cut off their heads as well,” he said.

Like many bears, Mr Patterson expects the great crunch to end in deliberate inflation, deemed a lesser evil than outright depression.

“The US government has thrown 29pc of GDP at this crisis compared to 8pc in the early 1930s. The Fed’s balance sheet has risen from $900bn to $2.7 trillion to bail out the system. America has to do it because the only way out is to debase the currency, but that is going to lead to some very high inflation three years down the road,” he said.

Matlin Patterson, however, has missed the Spring rebound, the most powerful rise in equities in over 70 years. “We shorted the equity rally because we thought it was lunatic. We’ve kept adding positions seven times, and we’re still holding,” he said. Ouch!

States Begin to Lay Off, Citing Insufficient Stimulus

from Washignton Post:

Eleven weeks after Congress settled on a stimulus package that provided $135 billion to limit layoffs in state governments, many states are finding that the funds are not enough and are moving to lay off thousands of public employees...

The layoffs are one early indication of how the stimulus funding could be coming up short against the economic downturn. As the stimulus plan was being drawn up, there was agreement among the White House, congressional Democrats and many economists that a key goal was to keep states from making big layoffs at a time when 700,000 Americans were losing their jobs every month.

The House passed a stimulus bill with $87 billion in extra Medicaid funding for states, as well as $79 billion in "stabilization" money to plug gaps in states' budgets for education and other areas.

But in the Senate, the stabilization funding was cut by $40 billion to secure the support of the three Republicans who were needed for a filibuster-proof 60 votes -- Sens. Susan Collins and Olympia J. Snowe of Maine and Sen. Arlen Specter of Pennsylvania -- as well as to gain the support of conservative Democrats such as Sen. Ben Nelson of Nebraska. The senators wanted to reduce the package to less than $800 billion, and several wanted to make room for a $70 billion patch of the alternative minimum tax.

Supporters of the final $787 billion bill, which included $25 billion less in state aid than the House plan, said it would help states avoid severe cuts. But tax revenue is coming in even lower than feared.

Daily Stock Chart Shows More Selling Volume

The divergence has been confirmed, and selling is picking up steam on the daily chart also. Note the selling volume increasing on the Klinger Volume indicator. We are now struggling to find support at the 20-day Moving Average.

The divergence has been confirmed, and selling is picking up steam on the daily chart also. Note the selling volume increasing on the Klinger Volume indicator. We are now struggling to find support at the 20-day Moving Average.

Stock Market: Freefall!

Was it the announcement that GM will shutter 2,400 dealerships -- that's 40% of its network from about 5,900 today? I don't know! But this is remarkable! Imagine how many jobs that will represent!

Was it the announcement that GM will shutter 2,400 dealerships -- that's 40% of its network from about 5,900 today? I don't know! But this is remarkable! Imagine how many jobs that will represent!

Up and Coming: The Yuan As World Reserve Currency

Professor Roubini, of New York University's Stern business school, believes that while such a major change is some way off, the Chinese government is laying the ground for the yuan's ascendance.

Known as "Dr Doom" for his negative stance, Prof Roubini argues that China is better placed than the US to provide a reserve currency for the 21st century because it has a large current account surplus, focused government and few of the economic worries the US faces.

In a column in the New York Times, Prof Roubini warns that with the proposal for a new international reserve currency via the International Monetary Fund, Beijing has already begun to take steps to usurp the greenback.

China will soon want to see the yuan included in the International Monetary Fund's special drawing rights "basket", he warns, as well as seeing it "used as a means of payment in bilateral trade."

Stock Futures Start Rocky

Stock index futures pointed to a lower open on Friday after weak European economic data fanned concerns about the depth of the global recession and UBS cut its rating on global equities.Investors were also cautious ahead of a slew of economic data, including a report on consumer inflation, a consumer sentiment survey, a report on manufacturing activity in New York state, and industrial output numbers.

Europe sank to what may be the recession's low point in the first quarter as gross domestic product fell 2.5 percent from the last quarter of 2008, both in the euro zone and the broader European Union block.

Investors unloaded riskier assets, like stocks, as the data added to concerns about the global economy and as UBS lowered its rating on global stocks to "neutral" from "overweight," citing the economy.

S&P 500 futures fell 4.9 points and were below fair value, a formula that evaluates pricing by taking into account interest rates, dividends and time to expiration on the contract. Dow Jones Industrial Average futures shed 35 points, while Nasdaq 100 futures were off 9.50 points.

Now Mega-Insurers Get TARP

from FT:

At least four US insurers won approval on Thursday to raise billions of dollars through the government’s bank bail-out plan, the US Treasury Department said.Hartford Financial , the No. 4 US insurer and beset by worries about capital, got preliminary approval to raise $3.4bn via the Troubled Assets Relief Program, known as Tarp.

We've become a "bailout" nation! This is certain to end very ugly! Prudential, Hartford, Lincoln National, Ameriprise Financial, Principal Financial, and Allstate are included. Is the government going to take over them now, too? Why wouldn't they?

Let the Trade Wars Begin!

from the Washington Post:

Is this what the first trade war of the global economic crisis looks like?

Ordered by Congress to "buy American" when spending money from the $787 billion stimulus package, the town of Peru, Ind., stunned its Canadian supplier by rejecting sewage pumps made outside of Toronto. After a Navy official spotted Canadian pipe fittings in a construction project at Camp Pendleton, Calif., they were hauled out of the ground and replaced with American versions. In recent weeks, other Canadian manufacturers doing business with U.S. state and local governments say they have been besieged with requests to sign affidavits pledging that they will only supply materials made in the USA.

Outrage spread in Canada, with the Toronto Star last week bemoaning "a plague of protectionist measures in the U.S." and Canadian companies openly fretting about having to shift jobs to the United States to meet made-in-the-USA requirements. This week, the Canadians fired back. A number of Ontario towns, with a collective population of nearly 500,000, retaliated with measures effectively barring U.S. companies from their municipal contracts -- the first shot in a larger campaign that could shut U.S. companies out of billions of dollars worth of Canadian projects.

This is not your father's trade war, a tit-for-tat over champagne or cheese. With countries worldwide desperately trying to keep and create jobs in the midst of a global recession, the spat between the United States and its normally friendly northern neighbor underscores what is emerging as the biggest threat to open commerce during the economic crisis.

Rather than merely raising taxes on imported goods -- acts that are subject to international treaties -- nations including the United States are finding creative ways to engage in protectionism through domestic policy decisions that are largely not governed by international law. Unlike a classic trade war, there is little chance of containment through, for example, arbitration at the World Trade Organization in Geneva. Additionally, such moves are more likely to have unintended consequences or even backfire on the stated desire to create domestic jobs.

Buy AmericanTake, for instance, Duferco Farrell Corp., a Swiss-Russian partnership that took over a previously bankrupt U.S. steel plant near Pittsburgh in the 1990s and employed 600 people there.

The new buy American provisions, the company said, are being so broadly interpreted that Duferco Farrell is on the verge of shutting down. Part of an increasingly global supply chain that seeks efficiencies by spreading production among multiple nations, it manufactures coils at its Pennsylvania plant using imported steel slabs that are generally not sold commercially in the United States. The partially foreign production process means the company's coils do not fit the current definition of made in the USA -- a designation that the stimulus law requires for thousands of public works projects across the nation.

In recent weeks, its largest client -- a steel pipemaker located one mile down the road -- notified Duferco Farrell that it would be canceling orders. Instead, the client is buying from companies with 100 percent U.S. production to meet the new stimulus regulations. Duferco has had to furlough 80 percent of its workforce.

"You need to tell me how inhibiting business between two companies located one mile apart is going to save American jobs," said Bob Miller, Duferco Farrell's executive vice president. "I've got 600 United Steel Workers out there who are going to lose their jobs because of this. And you tell me this is good for America?"

The United States is not alone in throwing up domestic policies assailed by critics as protectionist. Britain and the Netherlands, for instance, are forcing banks receiving taxpayer bailouts to jump-start lending at home at the expense of overseas clients. French President Nicolas Sarkozy initially insisted that his nation's automakers move manufacturing jobs home in exchange for a government bailout, but backed down after outrage surged among his peers in the European Union, of which France is a central member.

But the number of measures, both proposed and enacted, from the Obama administration and Congress in recent months has raised an alarm among foreign governments, pundits and news media outlets. The buy American provisions in the stimulus package, signed into law in February, were just the beginning. Last week, Obama unveiled a series of proposals aimed at increasing taxes by nearly $200 billion over the next decade on U.S. companies doing business abroad. At a White House event, Obama said the measures were designed to "close corporate loopholes" that permit companies to "pay lower taxes if you create a job in Bangalore, India, than if you create one in Buffalo, N.Y."

Keeping Jobs at HomeA slew of legislative proposals is also aimed at keeping jobs at home. In recent weeks, the House attached additional buy American provisions to a $14 billion clean-water fund that provides loans to local communities and a $6 billion program to finance environmentally friendly school construction projects.

Other pending measures would require the federal government to buy 100,000 U.S.-made plug-in hybrid cars, mandate that the president's airplanes be made in the country by an U.S. company, and force several federal agencies, including the Pentagon and Department of Transportation, to use only domestic iron and steel.

Last month, Senate Majority Whip Richard J. Durbin (D-Ill.) introduced a measure with Sen. Charles E. Grassley (R-Iowa) to tighten rules governing the H-1B visa program for guest workers. Among its provisions: Companies seeking to import specialized workers from abroad first must make a good-faith effort to recruit U.S. citizens.

"The H-1B program was never meant to replace qualified American workers. It was meant to complement them because of a shortage of workers in specialized fields," Grassley said. "In tough economic times like we're seeing, it's even more important that we do everything possible to see that Americans are given every consideration when applying for jobs."

Buy American provisions are not new. Federal transportation projects have been required to use domestic iron and steel since 1982, and some defense contracts are limited to U.S. bidders. But the stimulus package marks the first time a buy American mandate has been broadly applied to projects across an array of federal agencies.

No one appears to be more concerned than America's largest trading partner -- Canada.

Initial concern north of the border over the buy American provisions died down after a clause, supported by the administration, was inserted in the bill clearly stating that the measure would not supersede existing U.S. trade obligations. During his Feb. 19 trip to Ottawa, Obama additionally pledged to avoid protectionism.

Creeping ProtectionismAs passed, the act keeps that pledge, White House spokeswoman Jennifer Psaki said. "The president is committed to creating jobs in America and committed to global engagement with our trading partners and does not see any contradiction between those two goals," she said.

But in recent weeks as federal authorities drafted broad guidelines for implementing the law and hundreds of states and towns have begun preparing for stimulus-related projects, Canadian companies have been surprised to discover that while some federal contracts are still open to Canadian materials and equipment because of trade treaties, most of those issued by state and local governments are not.

The Government Accountability Office estimates that state or local officials will administer about $280 billion in stimulus spending, including about $50 billion for transportation projects. But federal authorities have determined that construction projects even partially funded with stimulus dollars must also buy American, dramatically increasing the universe of affected contracts.

As a result, John Hayward, president of Hayward Gordon, a Canadian manufacturer of pumps used in water works projects, says U.S. towns, including Peru, Ind., have told him that they can no longer buy his Canadian-made products.

"We're not China. We're not even Mexico. We have the same relative cost of labor as you do," he said. "If we have a better price, you should buy from us. That's what competition is supposed to be about."

To stay in business, Hayward is considering moving some manufacturing operations to the United States, potentially creating jobs here. That, Peru Mayor Jim Walker notes, is what the stimulus was supposed to be about.

"You're trying to get America turned around, trying to put Americans back to work," Walker said. "And if American taxpayers are paying for this, well then, Americans deserve the benefits."

Thursday, May 14, 2009

President Obama Warns of "Unsustainable" Debt Load, Higher Interest Rates

from Bloomberg:

President Barack Obama, calling current deficit spending “unsustainable,” warned of skyrocketing interest rates for consumers if the U.S. continues to finance government by borrowing from other countries.

“We can’t keep on just borrowing from China,” Obama said at a town-hall meeting in Rio Rancho, New Mexico, outside Albuquerque. “We have to pay interest on that debt, and that means we are mortgaging our children’s future with more and more debt.”

Holders of U.S. debt will eventually “get tired” of buying it, causing interest rates on everything from auto loans to home mortgages to increase, Obama said. “It will have a dampening effect on our economy.”

Three Questions to Ask At the Start of the Trading Day

from Dr. Brett--

Here are three questions to ask at the start of the trading day:

1) Am I bringing baggage to the day's trade? Am I carrying over frustrations from losing money or missing opportunity? Am I feeling particular pressure to make winning trades? Am I locked into a view of markets because those views haven't been paying me?

2) Am I prepared? Have I identified significant price levels for the day? Have I gained a feel for how various markets have been trading overnight? Do I know if economic reports are scheduled for the day and what the expectations are?

3) What am I working on? Do I have goals for the day? What have been the mistakes I've been making that need to be corrected? What improvements have I made that I want to cement? What kinds of trades have been working best for me, and am I prepared to actively look for those?

The idea is to become a good self-observer: it's harder to get locked into negative patterns if you're standing apart from those patterns. It's also easier to enact your best trading patterns if you're fully aware of them. Just asking where your head is at when you're trading helps you interrupt patterns that hurt your trading.

Internal Russian Report Suggests Upcoming Wars Over Energy

from AP:

A Kremlin policy paper says international relations will be shaped by battles over energy resources, which may trigger military conflicts on Russia's borders.

The National Security Strategy also said that Russia will seek an equal "partnership" with the United States, but named U.S. missile defense plans in Europe among top threats to the national security.

The document, which has been signed by President Dmitry Medvedev, listed top challenges to national security and outlined government priorities through 2020.

"The international policy in the long run will be focused on getting hold of energy sources, including in the Middle East, the Barents Sea shelf and other Arctic regions, the Caspian and Central Asia," said the strategy paper that was posted on the presidential Security Council's Web site.

"Amid competitive struggle for resources, attempts to use military force to solve emerging problems can't be excluded," it added. "The existing balance of forces near the borders of the Russian Federation and its allies can be violated."

Wednesday, May 13, 2009

Grains, Commodities Hit By Stronger Dollar, Weak Broader Markets

Despite stronger fundamentals following yesterday's USDA report, grains are struggling to remain in positive territory. All commodities are broadly lower today. This chart for soybeans is typical.

Despite stronger fundamentals following yesterday's USDA report, grains are struggling to remain in positive territory. All commodities are broadly lower today. This chart for soybeans is typical.

Stock Market Tipping Point?

Chrysler and the Rule of Law

from WSJ:

By TODD J. ZYWICKI

The rule of law, not of men -- an ideal tracing back to the ancient Greeks and well-known to our Founding Fathers -- is the animating principle of the American experiment. While the rest of the world in 1787 was governed by the whims of kings and dukes, the U.S. Constitution was established to circumscribe arbitrary government power. It would do so by establishing clear rules, equally applied to the powerful and the weak.

Fleecing lenders to pay off politically powerful interests, or governmental threats to reputation and business from a failure to toe a political line? We might expect this behavior from a Hugo Chávez. But it would never happen here, right?

Until Chrysler.

The close relationship between the rule of law and the enforceability of contracts, especially credit contracts, was well understood by the Framers of the U.S. Constitution. A primary reason they wanted it was the desire to escape the economic chaos spawned by debtor-friendly state laws during the period of the Articles of Confederation. Hence the Contracts Clause of Article V of the Constitution, which prohibited states from interfering with the obligation to pay debts. Hence also the Bankruptcy Clause of Article I, Section 8, which delegated to the federal government the sole authority to enact "uniform laws on the subject of bankruptcies."

The Obama administration's behavior in the Chrysler bankruptcy is a profound challenge to the rule of law. Secured creditors -- entitled to first priority payment under the "absolute priority rule" -- have been browbeaten by an American president into accepting only 30 cents on the dollar of their claims. Meanwhile, the United Auto Workers union, holding junior creditor claims, will get about 50 cents on the dollar.

The absolute priority rule is a linchpin of bankruptcy law. By preserving the substantive property and contract rights of creditors, it ensures that bankruptcy is used primarily as a procedural mechanism for the efficient resolution of financial distress. Chapter 11 promotes economic efficiency by reorganizing viable but financially distressed firms, i.e., firms that are worth more alive than dead.

Violating absolute priority undermines this commitment by introducing questions of redistribution into the process. It enables the rights of senior creditors to be plundered in order to benefit the rights of junior creditors.

The U.S. government also wants to rush through what amounts to a sham sale of all of Chrysler's assets to Fiat. While speedy bankruptcy sales are not unheard of, they are usually reserved for situations involving a wasting or perishable asset (think of a truck of oranges) where delay might be fatal to the asset's, or in this case the company's, value. That's hardly the case with Chrysler. But in a Chapter 11 reorganization, creditors have the right to vote to approve or reject the plan. The Obama administration's asset-sale plan implements a de facto reorganization but denies to creditors the opportunity to vote on it.

By stepping over the bright line between the rule of law and the arbitrary behavior of men, President Obama may have created a thousand new failing businesses. That is, businesses that might have received financing before but that now will not, since lenders face the potential of future government confiscation. In other words, Mr. Obama may have helped save the jobs of thousands of union workers whose dues, in part, engineered his election. But what about the untold number of job losses in the future caused by trampling the sanctity of contracts today?

The value of the rule of law is not merely a matter of economic efficiency. It also provides a bulwark against arbitrary governmental action taken at the behest of politically influential interests at the expense of the politically unpopular. The government's threats and bare-knuckle tactics set an ominous precedent for the treatment of those considered insufficiently responsive to its desires. Certainly, holdout Chrysler creditors report that they felt little confidence that the White House would stop at informal strong-arming.

Chrysler -- or more accurately, its unionized workers -- may be helped in the short run. But we need to ask how eager lenders will be to offer new credit to General Motors knowing that the value of their investment could be diminished or destroyed by government to enrich a politically favored union. We also need to ask how eager hedge funds will be to participate in the government's Public-Private Investment Program to purchase banks' troubled assets.

And what if the next time it is a politically unpopular business -- such as a pharmaceutical company -- that's on the brink? Might the government force it to surrender a patent to get the White House's agreement to get financing for the bankruptcy plan?

Mr. Zywicki is a professor of law at George Mason University and the author of a book on consumer bankruptcy and consumer lending, forthcoming from Yale University Press.

CNBC Complicity in Brainwashing America

P.S. the phrase "rock-bottom housing prices" was uttered 5 times on CNBC in the past 3 hours. Curious what the hourly quota is.

Interest Rates Rising Despite Central Bank Interventions

from Bloomberg:

Like clockwork, the alarm bells are going off as long-term Treasury yields start their inevitable climb.

“Rising Government Bond Yields Frustrate Central Banks,” trumpets yesterday’s Wall Street Journal.

“Rising bond yields present fresh Fed challenge,” according to the April 29 edition of the Financial Times.

It’s a funny thing about long-term interest rates. They’re pro-cyclical. They tend to rise when the economy is doing well, when demand for credit is strong. They fall when the economy is in the tank, and the private sector isn’t much interested in investing and spending.

If there’s a way to accommodate the increased demand for credit that goes hand in hand with recovery without pushing up the price, no one has figured it out just yet.

Moody's Says Fed's "Worst Case" Assumptions Bogus

In this particular case, Moody's focuses on credit-card charge offs; however the same principle can easily be applied to any other axis in the Supervisory Capital Assessment Program. As Moody's says:

SCAP loss rates for credit card assets range from 12%-17% in the Baseline scenario, and 18%-20% in the More Adverse one. We currently expect industry charge-offs to peak at 12% in the second quarter of 2010, which translates, roughly, to 22% on a two-year cumulative basis [TD: their base case]As for specific differences which can account for the rose-colored tint on Bernanke's contact lenses, the rating agency provides the following color:

Therefore, the Fed’s More Adverse charge-off rate assumptions for issuers’ managed credit card portfolios are consistent with our expected range of charge-off rates for related credit card trusts. Our current assumptions are predicated on the observance of surging delinquency trends and also the expectation that the unemployment rate will peak at about 10% in early 2010. Changes in the trajectory of unemployment will have the greatest influence on the actual magnitude and timing of peak charge-off rates.

Differences exist between trust data and managed portfolios, making a direct comparison of Fed’s and our estimates difficult. For example, Chase’s credit card trust (“CHAIT”) does not include receivables from the recently acquired Washington Mutual credit card portfolio, which has comparatively much higher charge-offs.Of course, it is not possible to engineer a short squeeze if retail investors are fully aware of just how bad things are going to get, and the last thing one needs is for Capital One and other credit card companies to be unable to raise equity at this critical market inflection point, so everything ends up in proper perspective. For a good observation of how one man's Adverse Case is another man's Base Case, see the table below.

Although the Fed’s More Adverse charge-off rate assumption is much higher than our base case expectation, some of that disparity is explained by the absence of the high-loss Washington Mutual portfolio in CHAIT. Other disconnects between managed and trust data may be explained by differences in accounting for recoveries (i.e., the reporting of net or gross charge-offs) and assumptions regarding balance growth/attrition rates.

Missing: $9 Trillion of Your Money Via the Fed

As for the pittance of $9 trillion in Fed off-balance sheet transactions over the past 8 months, well, yeah, that's also somewhere out there... Just don't ask the Federal Reserve where.

Rep. Alan Grayson summarizes it best "I am shocked to find out that nobody at the Federal Reserve is keeping track of anything."

(P.S. Zero Hedge uses the term "anyone" generically, with the presumption that the Fed's Inspector General should traditionally receive most memos on memorandum items that deal with a dollar sign and +/- 12 zeros after it).

Foreclosures Hit All-Time High

from Reuters:

from Reuters:

U.S. foreclosure activity in April jumped 32 percent from a year ago to a record high, and should mount because temporary freezes on foreclosures ended in March, RealtyTrac said on Wednesday.

One in every 374 households with mortgages got a foreclosure filing in April, the highest monthly rate since RealtyTrac began tracking it in January 2005. Filings were reported on 342,038 properties last month.

The abundance of distressed properties keeps pressuring home prices, thwarting a housing recovery that is critical to rejuvenating the recessionary U.S. economy.

Most of April's filings, which included notices of default and auctions, were in early stages. Bank repossessions, known as real-estate owned or REOs, fell on a monthly and annual basis to the lowest level since March 2008.

"This suggests that many lenders and servicers are beginning foreclosure proceedings on delinquent loans that had been delayed by legislative and industry moratoria," RealtyTrac chief executive James J. Saccacio said in a statement.

A temporary foreclosure freeze by major banks and government-controlled home funding companies Fannie Mae and Freddie Mac ended before President Barack Obama's massive housing stimulus, unveiled on March 6, could take root.

Retail Sales Worsen

from Reuters:

Sales at U.S. retailers fell for a second straight month in April, pulled down by sluggish gasoline and electronic goods purchases, government data showed on Wednesday.

The Commerce Department said total retail sales slipped 0.4 percent after falling by a revised 1.3 percent in March, previously reported as a 1.2 percent drop.

Chrysler Bankruptcy to Take Two Years, Not One Month!

Reuters:

Chrysler's bankruptcy may take as long as two years, instead of the two months that President Barack Obama suggested as a target, Bloomberg said, citing an administration official.

The 60 days projected by Obama at an April 30 press conference announcing Chrysler's bankruptcy only applies to a sale of the automaker's best assets to a new entity, the official told the news agency.

Chrysler Bankruptcy to Take Two Years, Not One Month!

Reuters:

Chrysler's bankruptcy may take as long as two years, instead of the two months that President Barack Obama suggested as a target, Bloomberg said, citing an administration official.

The 60 days projected by Obama at an April 30 press conference announcing Chrysler's bankruptcy only applies to a sale of the automaker's best assets to a new entity, the official told the news agency.

Tuesday, May 12, 2009

Major Lender Halts Operations On Rising Default Rates for Small Businesses

from Bloomberg:

Advanta Corp., the issuer of credit cards for small businesses, will shut down accounts for its 1 million customers next month and seek to pay off securitized debtholders early as the recession pushes defaults higher. Lending will cease June 10 as part of a plan to preserve capital after uncollectible debt reached 20 percent on some cards as of March 31, the Spring House, Pennsylvania-based firm said yesterday in a statement.

Economist Survey Downgrades Economic Recovery, Raises Unemployment Forecast

from Bloomberg:

Economists downgraded their projections for a recovery from the deepest U.S. recession in half a century, now seeing the jobless rate exceeding 8 percent through 2011, a Bloomberg News survey showed.

Unemployment will average 8.5 percent in 2011 after a 9.6 percent rate next year, higher than previously expected, according to the median forecast in the survey taken from May 4 to May 11. The economy may expand 2.8 percent in 2011, less than estimated last month, after a 1.9 percent rise in 2010.

“The worse the labor market is and the longer that lasts, the more difficult it’ll be for consumers to recover,” said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez Inc., a New York forecasting firm. “The economy isn’t going to come roaring out of the box here.”

$60 Crude Oil Is Back!

After bottoming at around $34/barrel, crude oil has reached $60 again, the highest price since November '08!

After bottoming at around $34/barrel, crude oil has reached $60 again, the highest price since November '08!

Grain Stocks In Short Supply

from Arlan Suderman's Twitter posts analyzing this morning's USDA grain report:

USDA's May new-crop US soybean stocks estimate has been too high in 12 of the past 14 years by an average of 141 million bushels.

Argentina produces 34 mmt beans this year; Resurges to 51 mmt next year to provide global stocks a 9mmt increase in 2009-10.

Global corn stocks will tie for 2nd tightest of the past 35 years at just a 58.7-day supply and continuing to drop. in 2009-10.

USDA World wheat prod. @ high 657.6 mmt.; Stocks increase to 181.9 mmt or 103-day supply.

USDA - Old-crop bean stocks squeaky tight at 130 mln bu.; New-crop stocks snug at 230 mln bu. or a 27-day supply; price supportive.

USDA - Old-crop corn stocks DN 100 mln to 1.6 bln bu; New-crop stocks at just 33-day supply at 1.145 bln bu.; price supportive.

$$ breaks to new 4-mo. lows this AM; Set to test lows for 2009; bullish for commodities if USDA data proves supportive.

Social Security -- Almost Broke NOW!

The Congressional Budget Office this morning released a report that the Social Security surplus has dropped 95% within the past year. This suggests that very soon, we have to either raise taxes to fund Social Security or borrow even more money to pay for current benefits. This train wreck is closer than anyone could have ever imagined just 12 months ago!

Monday, May 11, 2009

The $33 Trillion Question

from Absolute Return Partners (quoted in John Mauldin's newsletter):

"Never in the history of the world has there been a situation so bad that the government can't make it worse."

-Unknown

Is the crisis really over?

Commercial paper spreads have come down dramatically. Libor rates are (hmm - almost) back to normal. Even high yield spreads are narrowing. It certainly appears as if the credit crisis is well and truly over or, at the very least, the light which most of us think we can see at the end of the tunnel is no longer that of an oncoming freight train.

No wonder equities are currently enjoying one of their best spells ever. And while equities continue to go up and up, most of us are left scratching our heads. Is this the real thing or will it go down in history as 'just' another bear market rally? Not so long ago, the entire financial system stared Armageddon in the face. Now, only a few months later, equity markets behave as if all the worries of yesterday have been washed away. How is that possible?

The great bank illusion

The current bull market began in earnest in the second week of March, but what really got everyone going were the surprisingly good Q1 US bank earnings which were reported during the first half of April. Most commentators interpreted the numbers as the clearest piece of evidence yet that we are now firmly on the road to recovery.

Of course US banks made good money in Q1. The environment created for them is the equivalent of the US government reducing the cost of goods to zero for its embattled car manufacturers and then going on to buy - courtesy of the US tax payer - a couple of million cars that nobody really needs. Even Detroit would make money given those conditions!

Liquidity is trapped

The problem for the rest of us is that the banks are not sharing the candy they have been handed. Much of the liquidity created by the central banks remains trapped in the financial sector (see chart 1). Quite simply, the multiplier is not doing its job, as many banks prefer to hoard cash rather than increase lending at this juncture.

This is both good and bad news at the same time. Good because it implies that we probably do not have to worry too much about the inflationary effect of the aggressive monetary easing currently taking place; bad because it means that the economy is not going to kick back to life as quickly as everyone would like – and expect.

Meanwhile investors are growing cautiously optimistic about the GDP outlook for the second half of the year with many now forecasting modest growth – at least in the United States. Only a fool would suggest that GDP would shrink by 5-10% per quarter in perpetuity, as has been the case over the past two quarters. The economic slowdown is now decelerating and, as I pointed out last month, there are good reasons why we may see a temporary lift in economic activity later this year, but it will almost certainly prove transitory.

We are still in a bear market

The dangerous conclusion to draw from the experience of the past few weeks is that all is now well and dandy and it is time to load up on stocks again. I cannot emphasize it strongly enough: The bull market of March-April 2009 is almost certainly a bear market rally but, as one of my partners pointed out the other day, NYSE saw four 20%+ rallies between 1929 and 1932 (see chart 2). Bear market rallies can be extremely powerful and hence deceiving.

The problems are not over yet. Not by a long stretch. It will take longer than 18 months to unwind the excesses of the past 25 years. Analysts at Morgan Stanley reckon that the 15 largest banks which between them have shrunk their balance sheets by about $3,600 billion so far in this crisis, will shed another $2,000 billion in 20091. If you do not share my pessimism, please take a quick look at chart 3 below. The US financial sector debt load (as a % of GDP) is now 117%. In the early days of the great bull market in 1982, the same number was 22%. Households are not much better off with total household debt now at 96% of GDP vs. 47% in 1982.

Further write-offs to come

The IMF reckons that both European and US banks - but in particular the European ones - are well behind the curve in terms of recognizing their credit crunch related losses. According to the IMF, there is at least another $1,500 billion to come. So when the US banks reported surprisingly good numbers for Q1 it was certainly not because the economy had suddenly and miraculously revived itself, but because some of the oldest tricks in the book were used to gloss over much bigger problems2.

As the recession bites into the lives of ordinary people, banks will face losses not only on sub-prime mortgages but on all loan products. As you can see from chart 4, sub-prime is indeed a small fraction of the total loan book for the US banking sector.

Delinquencies are on the rise

And that is precisely what is beginning to happen as illustrated in chart 5. Delinquencies are now on the rise on all mortgage products; however, whereas sub-prime started to deteriorate as early as 2007, it is only recently that delinquencies related to Alt-A and adjustable rate mortgages have taken off, and prime and jumbo loans are only now starting to suffer.

These are all temporary problems, though, however bad they may appear. By far my biggest concern at the moment is the enormity of the debt problem facing most OECD countries. In the March issue of the Absolute Return Letter I referred to an important study conducted by Carmen Reinhart and Kenneth Rogoff back in December of last year3 which I would like to re-visit (see chart 6).

Banking crises run and run

Reinhart and Rogoff studied every banking crisis of the past generation and made some startling observations. One in particular caught my attention. It has to do with the subsequent rise in government debt which, according to Reinhart and Rogoff, has been "... a defining characteristic of the aftermath of banking crises for over a century". According to the authors, governments inevitably underestimate the ultimate cost of a banking crisis, because the indirect costs (such as falling tax revenue in subsequent years) end up much higher than predicted.

The IMF estimates that the cost of the current crisis to the United States will eventually reach 34% of GDP or close to $5 trillion. However, the Obama administration, through its various implicit and explicit guarantees, is already using a number close to $9 trillion4. And Reinhart and Rogoff's historical average of 86% of GDP implies an ultimate cost of over $12 trillion!

The IMF is too optimistic

I have a lot of respect for all the good work being produced by the people at the IMF; however, they are sometimes too politically correct for my taste; maybe too afraid of stepping on someone's toes. So when they go public, as they did recently, with an estimate of how much the current crisis would ultimately cost, their projection will more than likely prove hopelessly inadequate.

The true cost is important, because it has to be financed through new bond issuance, and it is my thesis that the sheer size of this tsunami will eventually overwhelm the world's bond markets. As you can see from chart 7, using the official IMF estimates, the twelve most industrialised of the world's G20 countries (in my book known as the Dirty Dozen) will have to issue about $10 trillion worth of new bonds to cover the cost of the current crisis.

The final cost will be enormous

However, if you (like me) believe that IMF underestimates the true cost of this crisis, Reinhart and Rogoff offer a more realistic approach (see chart 8). Using their least costly case study (Malaysia 1997) as our best case scenario, the true cost comes to $15 trillion. If one uses the average of 86% instead, the cost jumps to a whopping $33 trillion. I didn't even bother to produce a worst case scenario - it all got too depressing!

I need to put the $33 trillion into perspective, because it is so big that it is almost incomprehensible. According to Wikipedia (see chart 9), total private wealth across the world today is about $37 trillion less the losses incurred in 2007-09, so the real number is probably closer to $30 trillion now. Total global savings (loosely adjusted for the big losses in 2008) are probably somewhere in the region of $100 trillion. In other words, financing this crisis could absorb one-third of total global savings. No wonder Gordon Brown looks tired!

Where do we find the money?

Obviously, governments may buy a portion of these bonds themselves, but they cannot afford more than a fraction of the total unless they want to challenge Mugabe as the ultimate master of illusion. Neither should investors hold out for sovereign wealth funds to do the dirty work. As is clear from chart 9, the total amount of wealth accumulated in these funds is pocket money when compared to the projected bond issuance over the next few years.

Hence it comes down to the price at which governments can attract sufficient demand from people like you and me. One of two things may happen. Either this crisis will ignite such a bout of deflation that investors will happily own government bonds yielding 2-3% or the deflation scare goes away ultimately, the global economy recovers and bond investors demand much higher yields for taking sovereign risk. I am not yet sure which scenario will prevail, but I do know that both are quite bad for equities longer term. Take your profits!

Niels C. Jensen

1 "Doomsday is on hold but banks will still feel further pain", The Financial Times, 30th April, 2009.

2 In particular one US accounting rule change (FASB rule 160) explains a large part of Q1 profits.

3 "The Aftermath of Financial Crisis", Carmen Reinhart & Kenneth Rogoff, December 2009.

4 http://zerohedge.blogspot.com/2009/04/bail-out-for-dummies-part-1.html

S&P Futures Show Bearish Divergence

The Klinger Volume indicator is showing a bearish divergence on the daily chart. It is still not a certainty, since the indicator must turn down for a few more days to cross its moving average (shown in yellow). I also require the divergence to be confirmed by other indicators. However, this indicator appears to be demonstrating higher prices but with a lower high on the volume indicator. If the S&P futures close below the EMA and then continue lower the following day, the bearish trend will be confirmed.

The Klinger Volume indicator is showing a bearish divergence on the daily chart. It is still not a certainty, since the indicator must turn down for a few more days to cross its moving average (shown in yellow). I also require the divergence to be confirmed by other indicators. However, this indicator appears to be demonstrating higher prices but with a lower high on the volume indicator. If the S&P futures close below the EMA and then continue lower the following day, the bearish trend will be confirmed.

CBO: Deficit Mushrooming Even Faster Than Thought

The Congressional Budget Office this morning revealed that the deficit has mushroomed even faster than previously thought, with the U.S. government now spending more than $2 for every $1 of revenue it takes in. This quadruples the single-year deficit from last year's record.

Here's the math:

2009 budget: $3.59 trillion

2009 deficit: $1.84 trillion

deficit % of total: 51.25%

Unbelievable! Meanwhile, Nobel Laureate Paul Krugman today says the government isn't spending aggressively enough! The guy must be a lunatic!

Sunday, May 10, 2009

Another View on Unemployment Results

from Big Picture blog:

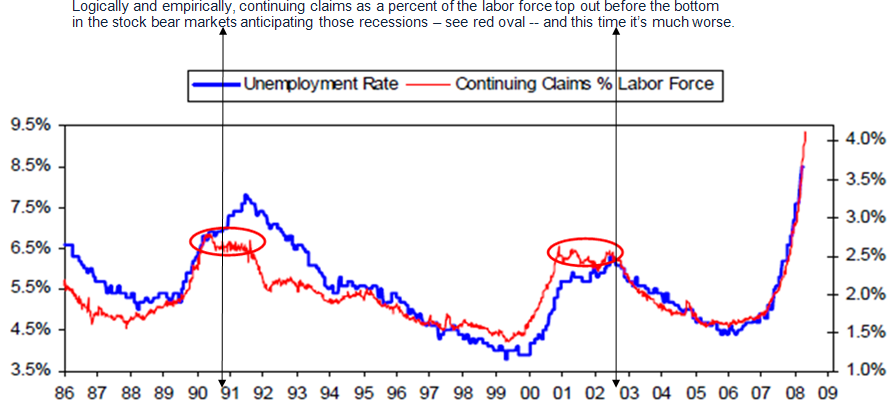

Bob Bronson took a closer look at what the Unemployment data was suugesting. His view: Continuing Claims are contradicting the widely accepted view that “Less Bad Emplyment data = end of recession.”

Bronson:

“Continuing Claims reported [Friday] suggest the economically-lagging unemployment rate will increase from 8.9% to 9.6% in a few months, and, of course, that will not be the peak in the unemployment rate, since the change in Continuing Claims is nowhere near zero.”

And, according to Floyd Norris, Continuing Claims are getting worse, not better (See Unemployment Grows More Painful).

Bob’s chart (below) shows that (not surprisingly) there exists a close relationship between any changes in Continuing Claims and the Unemployment rate. What many pundits seem to be unaware of is that (at least in the past 2 recessions) continuing claims plateau before new claims peak.

>

>

Hence, why Bob does not believe unemployment is anywhere near its peak, with all that this means for mortgage defaults and foreclosures.>

How much worse? Bob suggests that you bullishly extrapolate the “less worse” downtick in the Continuing Claims just reported, assuming the trend continues in a straight line without interruption, which is extremely unlikely (see the dotted arrows in chart below). He reaches an Unemployment Rate of 13.0% before yearend: 32 weeks times an average 0.15% increase (declining from 0.30% to 0.00%) added to 8.9% = 13.3%.

Bob’s final conclusion: “Unemployment data that leads indicates the stock market will make new lows.”Bob Bronson had a few good charts looking at Unemployment/Continuing Claims versus the widely accepted view that “Less Bad = end of recession.”

It's a Bank Balance Sheet Race

from Calculated Risk blog:

Imagine a bank holds a RMBS (Residential Mortgage Back Security). Forget about tranches - just imagine the security is based on 100 mortgage loans. All of the loans are current, but the security is actively traded, and the price falls to 50 cents on the dollar because investors believe that there are many default (and losses) coming. The bank has lost 50% immediately. The bank holds the security, not the loans - so it is the change in the value of the security that hits their income statement.

Perhaps the bank believes the most profitable thing to do is just keep the loans in its own portfolio (fair value accounting principle called "highest and best use"). Now the bank also has a portfolio of 100 loans with exactly the same characteristics as the RMBS. The Fair Value estimate for income producing loans for which there is no available market or counterparty will be based on the Income approach (discounted future cash flows). As before all of the loans are current, so the bank takes writedowns based on estimates of discounted future cash flows (they are being held to maturity). As the losses, both current and future, become estimable, the bank takes the writedown.

The Fed estimated both future losses and future earnings. As Dr. Roubini noted, there will be a race between losses and earnings - and if the Fed overestimated earnings or underestimated losses, the banks will need additional capital.

Strange thing to bet our future on!

Stress Test Results Were "Negotiated"

from Reuters:

The Federal Reserve reduced the size of capital deficits facing several banks before releasing the results of "stress tests" on the financial institutions, according to a story in the Wall Street Journal on Saturday.

The changes came after days of negotiations with the banks, the story said. The Federal Reserve used a different method than analysts and investors had expected to calculate the required capital levels.

and the Wall Street Journal:The Federal Reserve significantly scaled back the size of the capital hole facing some of the nation's biggest banks shortly before concluding its stress tests, following two weeks of intense bargaining.

In addition, according to bank and government officials, the Fed used a different measurement of bank-capital levels than analysts and investors had been expecting, resulting in much smaller capital deficits.

The overall reaction to the stress tests, announced Thursday, has been generally positive. But the haggling between the government and the banks shows the sometimes-tense nature of the negotiations that occurred before the final results were made public.