By Walter Kurtz, Sober Look

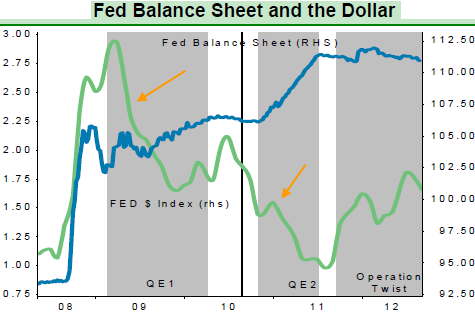

Economists continue to insist that there is no connection between

Fed’s monetary expansion and increases in commodity prices, particularly

agricultural products globally (discussed here). Here is a typical comment:

If it is commonly believed that the FOMC can cause a worldwide food shortage then we are truly in a dark age of macro. The FOMC has no ability to raise the price of commodities relative to national income, and I can’t even imagine the rationale that monetary expansion could somehow increased prices internationally (that is, denominated in foreign currencies). The only way they could raise food prices in real terms is if they could spur increased food consumption domestically, which would be much more likely if they strengthened the dollar than if they weakened it. The FOMC can cause a lot of trouble, but this is just not on the list of problems they can cause, and certainly not via monetary expansion.Unfortunately macroeconomic theory here diverges from market experience. Monetary expansion in the recent past corresponded with significant dollar weakness. The chart below shows the dollar weakening during both QE1 and QE2. “Twist” on the other hand did not involve monetary expansion and only focused on reducing the average duration of treasuries.

Dollar weakness to any commodity trader is a

signal to buy – which is not necessarily linked to demand fundamentals.

Those who don’t believe this should only take a look at the following

chart comparing the dollar (DXY) with the CRB commodity index.

Source: Bloomberg

What’s important to point out here is that

the commodity price movements have been much larger than the dollar

movements. In fact on a percentage basis the CRB range in the graph

above is almost double the dollar range. That means even for currencies

that are not in any way tied to the dollar (although a number of

emerging market currencies are), when the dollar weakens, commodity

prices move higher even if denominated in these other currencies.

Commodity price increases due to dollar weakness therefore propagate

globally even in nations whose currencies are not linked to the dollar.

This empirical relationship drives global commodity markets even if

supply/demand fundamentals don’t warrant such adjustments. But when one

faces tight and uncertain supply conditions to begin with (as we have

now for agricultural commodities), dollar weakness will force an even

larger commodities swings to the upside.

In 2011 the CIA was chastised for not being able to see the Arab

Spring coming. Where did all that pro-democracy fervor come from all of a

sudden? Why wasn’t the CIA able to see key signs of the movement

earlier? The answer has less to do with zeal for democracy and more to

do with not being able to buy food. As food prices spiked across the

Arab world, so did the protests.

Source: Bloomberg

Certainly in the long run macroeconomic

fundamentals should play out. But we don’t live in “the long run”.

Global markets take seconds to reprice, usually far

overshooting/distorting the “fundamentals”. And, as the Arab Spring

showed, people don’t wait for these fundamentals to settle to their

expected levels.