Saturday, July 9, 2011

Friday, July 8, 2011

It's a Depression! Labor Force Participation Rate Plunges to 25-Year Low!

from Zero Hedge:

This chart needs no commentary. At 64.1%, the Labor Force Paritipcation rate just dropped to a fresh 25 year low: the civilian labor force declined by 272K from 153,693 to 153,421. And tangentially, the employment to population ratio also slumped to a multi decade low of 58.2%.

Awful Jobs Report!

There is simply no way to spin this positively! Dow futures plunged from +60 to -100 in about ten seconds! Without the birth/death "adjustment", we would have lost 113,000 jobs! But Wall St will ignore this and bid up stocks quickly!

from Zero Hedge:

Absolute disaster. Total jobs per the establishment survey: +18K on expectations of 105K, Private Jobs + 57K on expectations of 132K. Last month total was revised from 54K to 25K. Combined April and May revision down 44K. The household survey was down by 445K from 139,779 to 139,334. Birth death adjustment + 131K. Complete humiliation for Wall Street's economists, the lowest prediction of whom came Bob Brusca at +60K. From the NFP: "Nonfarm payroll employment was essentially unchanged in June (+18,000), and the unemployment rate was little changed at 9.2 percent, the U.S. Bureau of Labor Statistics reported today. Employment in most major private-sector industries changed little over the month. Government employment continued to trend down." It is time for Joe LaVorgna to retire, with his 175K forecast, or off by a factor of 972%.

Birth Death:

Some key jobs categories:

Employment in government continued to trend down over the month (-39,000). Federal employment declined by 14,000 in June. Employment in both state government and local government continued to trend down over the month and has been falling since the second half of 2008.There is no sugarcoating this report. Absolutely abysmal.

Manufacturing employment changed little in June. Following gains totaling 164,000 between November 2010 and April 2011, employment in this industry has been flat for the past 2 months. In June, job gains in fabricated metal products (+8,000) were partially offset by a loss in wood products (-5,000).

Construction employment was essentially unchanged in June. After having fallen sharply during the 2007-09 period, employment in construction has shown little movement on net since early 2010.

Thursday, July 7, 2011

Market Doubles Good News, Ignores Bad News

"Who cares about headfakes: the market is back in its mania phase when good news are doubly accentuated, and bad news are immediately ignored." Tyler Durden, Zero Hedge

ADP Shows Moderate Growth, Beats Forecast; Stocks Leap

Wednesday, July 6, 2011

What SIgns to Look For Foreshadowing a U.S. Credit Event

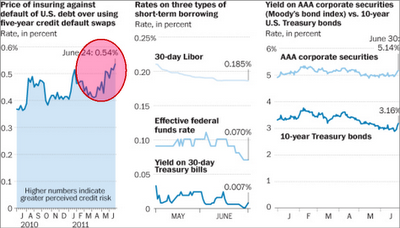

Since a U.S. dollar collapse is ranked as the greatest risk to the world, and dollar's fate is largely dependent on if the bond market has faith in Uncle Sam, it might be helpful to add five additional warning signs that the bond market is freaking out (see chart):

- Prices of bonds maturing start falling (i.e., investors start to demand higher interest rates to hold U.S. government debt).

- A narrower spread between rates on Treasury bills and other short-term credit or near substitutes, e.g. LIBOR - This would be a sign of waning faith in the U.S. government.

- A narrower spread between Treasuries and near substitutes - A sign of falling creditworthiness of Uncle Sam.

- Price spikes in U.S. CDS (credit default swaps, insuring against a U.S. debt default) - According to Markit, the most noticeable movement has occurred in 1-year spreads, which have converged closer to 5-year spreads, and is up about 430% since early April, while 5-year CDS also has risen about 46%.

- Higher volatility in the U.S. bond market - Another sign of lost confidence from bond investors.

(Click to enlarge) Chart Source: The Washington Post

So far, out of the 20 signs, there's one that's sending up a red signal flare - U.S. sovereign debt CDS, which is directly linked to the dollar (see chart above).

The U.S. does not have control over many of the indicators listed here, but at least the No. 1 risk factor -- the U.S. dollar -- is influenced by the national debt and by the monetary and fiscal policies set by the U.S. government and the Federal Reserve.

The longer the debt ceiling debate lingers, the more likely the bond market would start reacting and demanding higher interest rates. A sovereign credit downgrade as a result of missing the debt ceiling deadline would just translate into billions more in interest payments, piling on to the existing debt.

The United States is not like Iceland or Argentina, resorting to default as retorted by some could mean calamity not only to its citizens, but also to the rest of the world. Unless the government and this Congress get their act together, there will be no bailout, and instead of one lost generation to the Great Recession, there could be multi-generation missed in the next Grand Depression.

EconMatters.com

Services ISM: Not Positve!

Bad, but not dreadful! But it gets worse the deeper we look!

from Zero Hedge:

June's Services ISM just printed at 53.3, down from 54.6 in May, and missing expectations of 53.7. As a reminder for the US, which is a 70% service economy, this number is far more indicative of the true direction of the economy. Among the components, there was a decline in the New Orders, Prices, Backlogs, Imports and, huh, Inventories? Yes, the same inventories that accounted for 66% of the Manufacturing ISM surge are dropping here. Of the 17 non-manufacturing industries reporting all reported growth, except for the all too critical Financial & Insurance and the completely irrelevant Health Care & Social Assistance. Oh yes, all commodities except for diesel and gasoline were reported up in price. And now that WTI is almost back to $100, that's about to end shortly. Some deflation. And now, talk of a triple dip recession may resume.

Gold Explodes Another $18

Tuesday, July 5, 2011

Fed Keeps the Bailout Bucket Bailing

from MyBudget360:

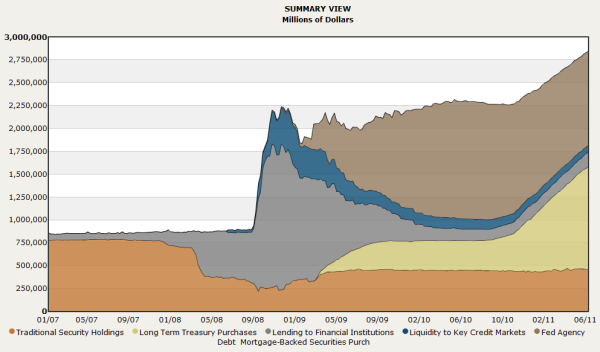

The Federal Reserve is primarily concerned with one thing and that is to protect the interests of the banking industry. The Fed has no desire or need to protect the underlying economy. If they can get away with allowing banks to jump from one bubble to another they will do so. The success of the overall economy is only consequential if it aligns with the deeper interests of the banking cabal. This weekend former Fed Chair Alan Greenspan mentioned that simply bailing out Greece was a temporary measure. When pressed he went back into “Greenspeak” and rambled on in his typical obtuse language. The reason why global banks fear Greece is not because of the country itself, but because the country has billions of dollars in debt that global banks hold. These banks do not want to pay for their bad bets and would rather shift the cost to the overall population in general. The Fed balance sheet here in the U.S. is now up to $2.84 trillion, another record that gets no airtime in the press. The Federal Reserve continues with clandestine bailouts only to protect the interests of the banking elite.

Fed balance sheet reaches $2.84 trillion

The Federal Reserve balance sheet is now up to $2.84 trillion. The Fed has become the silo for shadow bailouts including bailouts for the commercial real estate industry, toxic residential loans, mortgage backed securities, and even loans that have no business being on its books. Yet all this is seen as providing more liquidity for the banking system in the country. Since the crisis started four years ago little benefit has been seen in the underlying economy. Keep in mind the fiscal stimulus which is a fraction of what the Fed now holds on its balance sheet is what many Americans see on infrastructure projects. The total amount spent since August of 2008 approximates $550 billion (roughly 3 percent of GDP). On the other hand the Federal Reserve balance sheet specifically targeted to the banks now is up to 20 percent of GDP.

Of course little is discussed in the press about the Fed balance sheet. The Federal Reserve has specially focused on bailing out the banking sector and this has worked well. The too big to fail banks are now larger and profits are back to record levels. Their biggest success was ripping off the public and more specifically have kept most of their hidden secrets buried deep in the belly of the un-audited Federal Reserve balance sheet. We know that the Fed is holding $2.84 trillion in various “assets” but what exactly is being held? They would like the public to believe that only pristine assets are being held in exchange for U.S. Treasuries but in reality the Fed is purchasing every questionable asset under the sun. The Fed is ignoring the needs of the economy and simply focusing on protecting the interests of the banking elite.

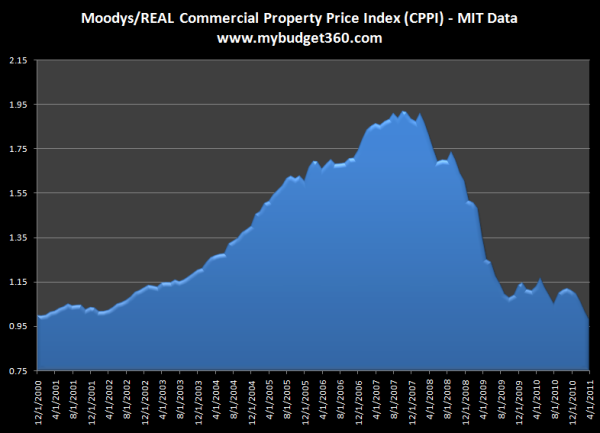

Case and point with commercial real estate

Source: MIT

Commercial real estate values have plummeted by 50 percent since their peak. The crash has been monumental and devastating for the industry. Yet banks have shifted many of these bad loans fixed to CRE and have “temporarily” placed them at the Federal Reserve. This isn’t a tiny industry. The CRE sector at its peak reached a nominal value of $6.5 trillion. Today the value has fallen closer to $3 trillion. Many of the CRE properties are solidly underwater yet the Fed has given the banks time to figure out ways to stuff their bad loans into the belly of the Fed balance sheet.

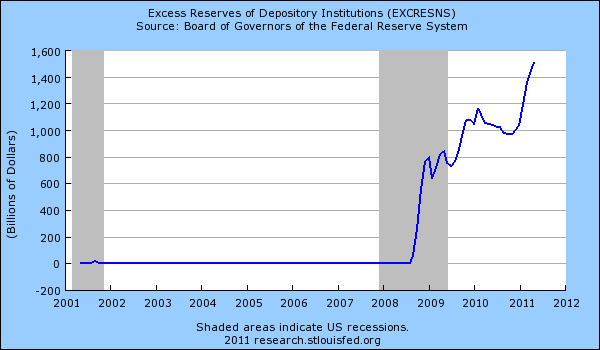

The banking system has plenty of money to lend out to the public:

The above chart shows how much money banks currently have that is readily available to lend to the public. Yet these too big to fail banks would rather keep the funds at the Fed and earn 0.25 percent on the money while they decide what other bubble they will jump into next. The too big to fail banks have nearly $1.6 trillion in excess money to lend to the American public! This is money that back in 2007 they claimed they needed to help small businesses and keep credit going. All of that was a lie and what really was the main purpose of the bailouts was to save the banking industry on the backs of taxpayers. As the chart clearly shows, the banking system is simply looking for their next big profit machine and all that excess reserves has come from the Fed being friendly with their banking cronies.

Squeezing the working and middle class

The line out of Wall Street banks has now shifted from:

-(2007) We need money from the Fed to keep money going to American families and small businesses.And the new line now follows:

-(2011) We need to cut spending and wages to keep competitive in the global marketplace.What happened to lending to American families and small businesses, the actual reason for the bailouts? These financial liars of course will say anything to steal more taxpayer money. Now it is a narrative of more stealing. These bankers of course don’t follow that line of cutting their own wages but then again, what do expect from the new oligarchy sponsored by the Fed?

The stats show something very different:

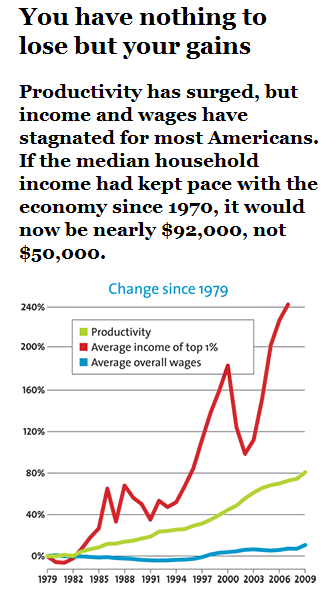

Source: Mother Jones

I’m glad the middle class battle is now being picked up by more places. If median household incomes had kept pace with the productivity of the economy the median household should now be earning $92,000 a year instead of $50,000. As the chart above clearly shows, the vast majority of productivity gains have gone to the top 1 percent who have seen average income soar by over 240% since 1979 while average overall wages for working and middle class families have gone up roughly 10 percent in real terms.

The Fed and its banking cabal would like you to believe that now, everyone needs to live on wages slightly above minimum wage while the pinstriped suit bankers continually squeeze out more and more profits through bailouts, rip offs, financial alchemy, or simply by robbing taxpayers. This is the new business model. The Federal Reserve has failed its mission in many facets because when push comes to shove it is willing to sacrifice the economy for the sake of the elite banking sector. Banks should become like a utility and strictly regulated with force. Commercial and investment banking should be completely split. Hedge funds should receive no special privileges especially when many make money by creating investments that sink the economy and also receive bailouts thanks to political connections. You wonder why unemployment is still too high and wages continue to fall? Look no further than the beast that is the Federal Reserve.

The Courtly Cost of Crude

The IEA must be fuming. While our strategic reserve is smaller by 30 million barrels, the price is $8 higher than it was when the sale was announced.

Market Turns Choppy, Indecisive

Universal Disapointment

Monday, July 4, 2011

Greece -- An Intractable Problem

Zero Hedge reported this morning that Greece is already in default on its June payment! Will these people never learn? Apparently not! The ink isn't even try on this bailout, and its already in trouble!

from FT.com:

But only one of those things is now assured: the €12bn July aid payment is expected to be finalised by the International Monetary Fund on Friday. The second Greek rescue is now being held up by what one senior European official called “an impossible knot” – getting private holders of Greek bonds to help pay for the bail-out, but without the financial markets judging the plan to be a default on Greece’s debt commitments.

When the Obama administration releases a report on the Friday before a long weekend, it’s clearly not trying to draw attention to the report’s contents. Sure enough, the “Seventh Quarterly Report” on the economic impact of the “stimulus,” released on Friday, July 1, provides further evidence that President Obama’s economic “stimulus” did very little, if anything, to stimulate the economy, and a whole lot to stimulate the debt.