Saturday, March 12, 2011

Friday, March 11, 2011

Let's Face It! The Obama Adminstration Lies About Domestic Energy Production

The propaganda ministry is working overtime:

- Four days before the Deepwater Horizon accident there were 55 rotary rigs actually drilling offshore in the Gulf of Mexico.

- On May 28, 2010, when the administration announced the six-month moratorium on deepwater drilling, there were 46 rotary rigs operating in the Gulf.

- Last week, 25 rotary rigs were operating in the Gulf of Mexico.

We appreciate that, when it comes to selling the administration's energy policy, Secretary Salazar is in a tough position. Fortunately we are here to help, help provide the abundant and affordable energy that our economy needs, and help create the jobs our workers want. As API President Jack Gerard said recently:

"Our industry remains committed to working with government to meet our current and future challenges, but we need Congress and the administration on board. Let's stop talking and let's get back to work."

Crude Oil Reloads

Crude is back above $100, but the daily chart trend is now down!

Utah Authorizes Gold, Silver As Legal Tender

from Washington Times:

The Utah Legislature on Thursday passed a bill allowing gold and silver coins to be used as legal tender in the state — and for the value of their precious metal, not just the face value of the coins.

State backers said they hope the move will help insulate Utah from a potential monetary slide as countries question the value of the dollar. Others, casting their eye nationwide, said it could spur a broader move by Congress or states to readopt a gold standard.

"Utah, if the governor signs this particularly, they're going to change the national debate on monetary policy and get us back to basics," said Jeffrey Bell, policy director for Washington-based American Principles in Action. Mr. Bell has been in Utah to help shepherd the legislation through.

Utah's bill allows stores to accept gold and silver coins as legal tender. It also exempts gold and silver transactions from the state's capital gains tax, though that does not shield exchanges from federal taxes.

The legislation directs a state committee to look at whether Utah should recognize an official alternate form of legal tender which could become a path for creating a formal state gold standard.

A spokeswoman for Gov. Gary R. Herbert, a Republican, said he has not yet taken a public stance on the bill.

State Rep. Brad J. Galvez, the chief sponsor of the measure, said he views it as a preliminary step on the path toward securing Utah's business climate.

"If the dollar continues to fall, what this will do will help stabilize the value of the dollar in Utah, so it helps stabilize the economy," Mr. Galvez, a Republican, said.

While similar legislation has been proposed in nearly a dozen states, Mr. Galvez said that if Mr. Herbert signs his bill, Utah will be just the second state to official recognize the coins as legal tender. Colorado has recognized gold and silver for decades, he said.

Opponents questioned why a state would need to come up with an alternative money system. According to the Deseret News, one lawmaker joked that the state should establish salt as legal tender, since Utah has so much of it.

Other opponents said the state capital gains tax break could distort investing decisions and push people to choose gold and silver over other investments.

Utah's move on gold comes at a time when states across the country are seeking ways to push back against the federal government on everything from environmental regulations to health care.

But the instability of the U.S. dollar also has sent some states scrambling to try to come up with alternatives or to pass measures designed to spur federal action.

In Virginia, Delegate Robert G. Marshall, a Republican, successfully pushed through a bill — not yet signed by the governor — that authorizes the state to print gold, silver and platinum coins. He said that there is probably a good market for collectors who would prefer not to have to buy federally minted coins and said state-minted ones would create a backstop against inflation.

"I'm looking at Congress, and I'm looking at what the Chinese are doing, and I don't have a lot of confidence in what's going on there," Mr. Marshall said. "This is one way where Virginia can help our citizens as a security hedge against the inflationary action of Congress."

He also wrote a resolution authorizing a study on whether Virginia should adopt an alternate currency so it would not be dependent on Federal Reserve notes. That resolution did not pass.

The U.S. was on the gold standard and then a gold-exchange standard for much of the 20th century, but President Nixon finally decoupled the U.S. money supply from gold in 1971. Many investors, though, continue to believe it holds value better than other investments.

Thursday, March 10, 2011

Blood Flows at Wall and Broad in New York

Goldman Sachs Sees Downside Q1 GDP Risk

From Jan Hatzius:

BOTTOM LINE: Trade deficit much wider than anticipated on higher import volumes; news reinforces our sense of downside risk to Q1 growth, though it's still early in the quarter. Jobless claims higher but Labor Department cites school holidays as a potential distortion.

KEY POINTS:

1. Despite a healthy rise in exports, the US trade deficit widened substantially in January. The entire increase was due to non-petroleum imports, which rose $7bn on the quarter. The vast majority of this import increase was volume rather than price-related, pushing the real goods deficit in January at $49.5bn versus a fourth-quarter average of $45.2bn. Were this (real) deficit to be sustained through the first quarter, trade would be a substantial drag on Q1 growth - about 1 1/2 points (annualized). However, trade data can be revised and Chinese New Year-related distortions can have a significant impact on US import data in the first quarter, so for the moment we would view this simply as an additional source of downside risk to our 3 1/2% real growth estimate for the quarter.

2. The jobless claims report was a significant disappointment on first glance, with new claims back up near the 400,000 mark after a much lower print last week. However, the Labor Department cited the timing of school holidays as a possible influence on the number last week. Continuing claims--the total number of people in their first 26 weeks of jobless benefits--were essentially in line with expectations, and extended benefits fell by about 200,000 (though how much of this drop was due to people exhausting benefit eligibility is unknown).

U.S. Trade Deficit Also Disappoints

Thanks to Zero Hedge:

And another piece of bad news for both the US economy and US exporters in particular, even despite prevailing dollar weakness over the past several months: the January US trade deficit printed at $46.3 billion, on imports of $214.1 billion ($10.5 billion higher M/M) and exports of $167.7 billion ($4.4 billion higher). This was the worst number since August 2010. The December deficit was revised to $40.3 billion from $40.6 billion. The December to January increase in imports of goods reflected increases in industrial supplies and materials ($4.4 billion); automotive vehicles, parts, and engines ($2.7 billion); capital goods ($2.1 billion); consumer goods ($0.9 billion); and foods, feeds, and beverages ($0.5 billion). A decrease occurred in other goods ($0.6 billion). The December to January increase in exports of goods reflected increases in industrial supplies and materials ($3.7 billion); automotive vehicles, parts, and engines ($1.3 billion); and foods, feeds, and beverages ($0.1 billion). Decreases occurred in consumer goods ($0.6 billion); capital goods ($0.4 billion); and other goods ($0.3 billion). And unfortunately for Wall Street, few are importing US financial innovation any more: "Services exports increased $0.5 billion from December to January." So how much lower does the dollar have to plunge before someone actually starts importing US goods? And an amusing discrepancy: according to the US, the January trade deficit with China was $23.3 billion. According to China, the trade surplus with the US in January was $13.6. Just 100% off between two departments of truth. Due to notable weighting of trade data in GDP calculations, look for another round of downward GDP revisions. The Goldman spin is becoming increasingly difficult at this point. Next up: Next up: Hatzius on the Dudley hotline asking for instructions?

Stocks Seeking Support at 50-Day Moving Average

U.S. Data Disappoints Too

U.S. stocks opened sharply lower after disappointing U.S. economic news compounded the market's worries about trade in China, European sovereign debt and continued unrest in the Middle East and North Africa.

The Dow Jones Industrial Average sank 182 points, or 1.5%, to 12030, led lower by Chevron, off 3%, and Exxon Mobil, down 2.6%, which sank in response to a drop in the price of oil. The Standard & Poor's 500-stock index shed 19 points, or 1.4%, to 1301 as its energy, industrial and materials components slumped. The Nasdaq Composite fell 47 points, or 1.7%, to 2706.

Initial claims for U.S. unemployment benefits rose by 26,000 to 397,000 in the week ended March 5, the Labor Department said in a weekly report. The prior week's figures, showing claims fell to the lowest level in almost three years, were revised up slightly, to 371,000 from an original estimate of 368,000.

Economists surveyed by Dow Jones Newswires had forecast claims would rise by only 7,000 in the week ending March 5. The results pressured investor sentiment.

Investors spent much of the morning eyeing overseas developments. Besides continued unrest in Libya and the Middle East, a downgrade of Spain's credit rating and a slowdown in Chinese exports sent global markets lower.

"The market is in a tug of war right now between the recovery and evidence that the economy is slowing, and frankly, [is] dependent on quantitative easing," said Terry L. Morris, senior vice president at National Penn Investors Trust Company.

In separate U.S. data, the U.S. deficit in international trade of goods and services jumped 15.1% to $46.34 billion from a downwardly revised $40.26 billion the month before, the Commerce Department said. The December trade gap was originally reported as $40.58 billion.

The January deficit was the largest in seven months and much bigger than expected, with oil prices playing a key role. Economists surveyed by Dow Jones Newswires had estimated a $41.5 billion shortfall.

European stocks and the euro were each lower after Moody's Investor Services Inc. downgraded its rating on Spanish government debt, a move that throws the euro zone's debt issues back into the limelight. The downgrade comes on the eve of a European Union summit in Brussels scheduled for Friday.

Also helping set the bearish tone, China said that its monthly exports in February grew only 2.4% from the year-earlier period, while imports rose 19.4%. The growth represented a sharp slowdown from January, pushing China's trade balance to a deficit of $7.3 billion in February. Asian stocks finished sharply lower following the Chinese data; the Shanghai Composite index closed down 1.5%.

Global Macro Picture Weakens As China Shocks Market With Trade Deficit

from Mish Shedlock:

Equity futures are in the red across the board late Wednesday evening in light of an unexpected trade deficit in China.

Some reports suggest not reading too much into the deficit because February trade numbers are distorted following the Chinese Lunar New Year holiday. However, even the two-month total is negative, so the holiday excuse is a pretty weak one.

Please consider China Reports Unexpected Trade Deficit as Export Growth Cools

China reported an unexpected $7.3 billion trade deficit, the nation’s biggest in seven years, in February after a Lunar New Year holiday disrupted exports.Global Macro Picture Worsens

Outbound shipments rose an annual 2.4 percent, the slowest pace since November 2009, and imports climbed 19.4 percent, according to a report on the customs bureau website today.

Yuan forwards weakened after the announcement, which may deflect international pressure for China to strengthen its currency to redress global economic imbalances. Commerce Minister Chen Deming said March 7 that it’s “totally unreasonable” to say the yuan is undervalued after U.S. Treasury Secretary Timothy Geithner repeated calls for a faster pace of appreciation.

Economists combine Chinese data for the first two months of the year to eliminate distortions caused by the annual holiday. On that basis, the nation had a deficit of about $890 million, compared with a surplus of about $22 billion a year earlier.

Two months do not a trend make, but a couple more would do it.

As a side note, people frequently write wondering why China does mot buy more commodities with its US dollar reserve. There are a several reasons, one of which should be obvious from the above article.

- China's manufacturers are already squeezed, unable to pass on rising import costs.

- Accumulating commodities is pro-cyclical. China is overheating already.

- Any commodities not bought directly from US suppliers (for example copper from Australia) increases trade distortions elsewhere.

- Thanks to loose economic policy globally, commodity speculation is running rampant already. No importers want to add fuel to that fire.

China is overheating, and the global macro picture, especially from a Chinese perspective is far worse than that.

The world may not have noticed yet, but Europe is in trouble. The PIIGS are imploding under austerity measures and the most of the rest of Europe except perhaps Germany does not look very good.

Europe is China's largest trading partner.

Factor in the situation in Libya, rising oil prices, an ECB that seems hell-bent on hiking rates (I bet they back off after at most one hike), state budgets under attack in the US (thankfully), and the whole idea that Chinese growth is going to save the world is Fantasyland material.

Crude Collapses

Oil prices are finally retreating from two-and-half year highs but the market is bracing for more volatility as anti-government protests threaten to spread beyond the borders of Libya towards the world's top exporter Saudi Arabia.

U.S. crude futures [CLCV1 Loading... ()

Tuesday, March 8, 2011

1/3 of Wages Are From Government

from CNBC:

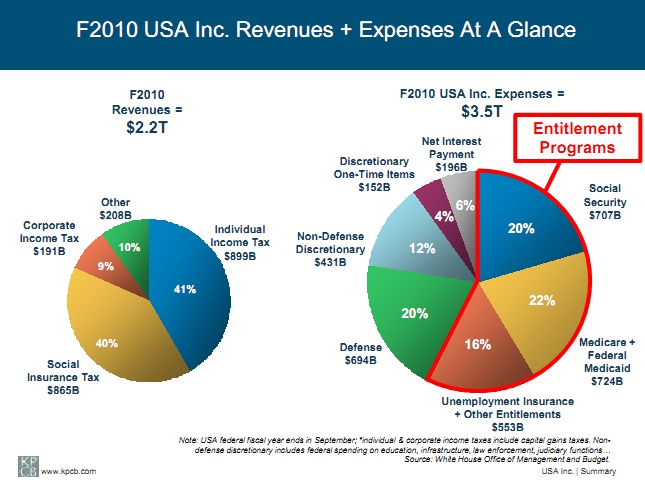

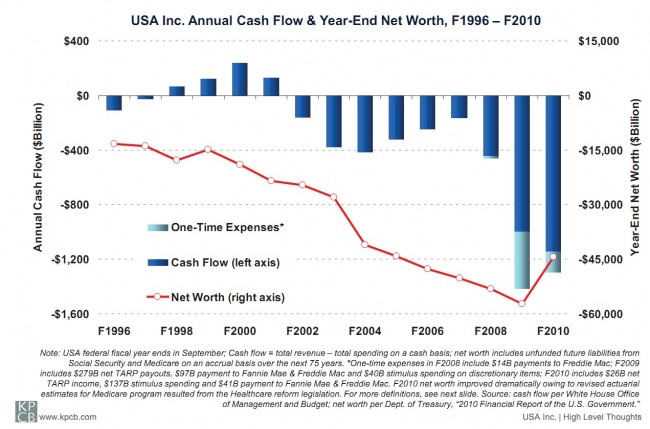

Government payouts—including Social Security, Medicare and unemployment insurance—make up more than a third of total wages and salaries of the U.S. population, a record figure that will only increase if action isn’t taken before the majority of Baby Boomers enter retirement.

|

Monday, March 7, 2011

$223 Billion -- Largest Monthly Deficit in History

from Washington Times:

The federal government posted its largest monthly deficit in history in February at $223 billion, according to preliminary numbers the Congressional Budget Office released Monday morning.

That figure tops last February’s record of $220.9 billion, and marks the 29th straight month the government has run in the red — a modern record. The last time the federal government posted even a monthly surplus was September 2008, just before the financial collapse.

Last month’s federal deficit is nearly four times as large as the spending cuts House Republicans have passed in their spending bill, and is more than 30 times the size of Senate Democrats’ opening bid of $6 billion.

Senators are slated to vote this week on those two proposals — both of which are expected to fail — and then all sides will go back to the negotiating table to try to work out a final deal.

Sunday, March 6, 2011

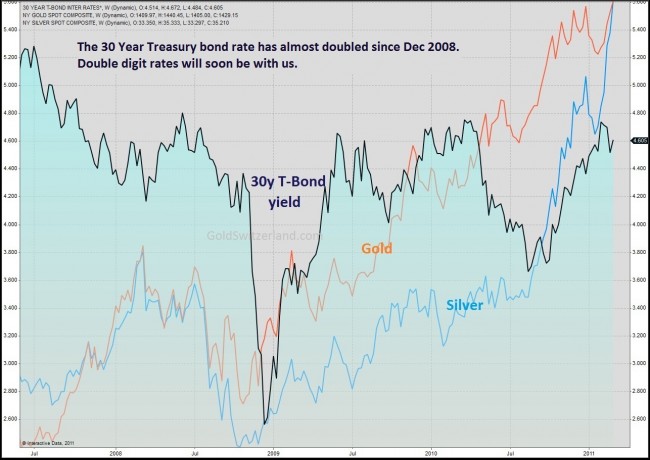

What Happens When We Revert to the Interest Rate Mean?

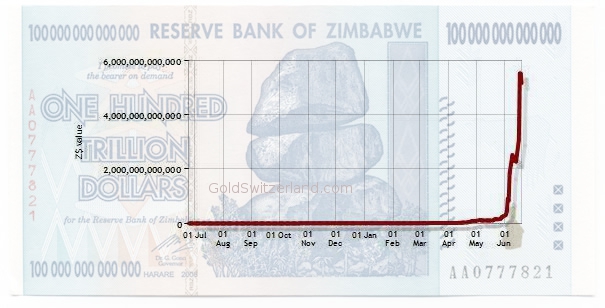

When discussing central planning, as manifested by the policies of the world's central banks, a recurring theme is the upcoming reversion to the mean: whether in economic data, in financial statistics, or, as Dylan Grice points out in his latest piece, in luck. While the mandate of every institution, whose existence depends on the perpetuation of the status quo, is to extend the amplitude of all such deviations from the trendline median, there is only so much that hope, myth and endless paper dilution can achieve. And alas for the US, whose 3.5% bond yields are, according to Grice, primarily due to "150% luck", the mean reversion is about to come crashing down with a vengeance after 30 years of rubber band stretching. The primary reason is that while the official percentage of interest expenditures as a portion of total government revenues is roughly 10% based on official propaganda data, the real number, factoring in gross interest expense, and assuming a reversion to the historic average debt yield of 5.8%, means that right now, the US government is already spending 30% of its revenues on gross interest payments! And what is worse, is that the chart has entered the parabolic phase. Once the convergence of theoretical and real rates happens, and all those who wonder who will buy US debt get their answer (which will happen once the 10 Year is trading at 6% or more), the inevitability of the US transition into the next phase of the "Weimar" experiment will become all too obvious. Because once the abovementioned percentage hits 50%, it is game over.

Below Grice lays out the framework for the disinflation delusion that has permeated the minds of all economists to the point where divergence from the mean is now taken as gospel:

What drove the disinflation of the last thirty years? Politicians would say it was because they granted their central banks independence. But the pioneering experiment here didn’t take place until ten years into the disinflation, when the Reserve Bank of New Zealand Act 1989 gave that central bank the sole mandate to pursue price stability. Macroeconomists would site breakthroughs in our understanding. Except there haven’t been any. Today’s hard money/soft money debate is identical to the Monetarist/Keynesian debate of the 1970s, the US bimetallism agitation of the late 19th century, and the Currency vs Banking School controversy in the UK during the 1840s.Ireland is probably the best example of an entity for which the cognitive dissonance between an imaginary desired universe and a violent snapback to reality has finally manifested itself after a 30 year absence:

Was it the de-unionisation of the workforce? The quiescence of oil markets since the two extreme shocks of the 70s? The dumping of cheap labour from Eastern Europe, China and India onto the global labour market? Technology enhanced productivity growth? Or maybe it was just because the CPI numbers are so heavily manipulated?

Maybe it was all of these things. Maybe it was none of these things … for the little that it’s worth, my theory is that no-one has an adequate theory, other than it being down to the usual combination of luck and judgment on the part of policymakers … or about 150% luck. The problem is luck mean-reverts. The mammoth fiscal challenges (see chart below) currently being shirked by the US political class suggest that mean-reversion is imminent.

Ireland provides a good illustration. Today it’s going through a real and wrenching depression - there is no other word for it and it is heartbreaking to watch – partly because the terms of its bailout are so onerous. And what may well be the seeds of a future popular backlash against the euro can be detected in the election of Fine Gael on a ticket of renegotiating the bailout terms, which currently require them to pay a 5.8% rate of interest.Unlike Ireland, the US still has the luxury of being able to stick its head deep in the sand of denial.

Look at the following chart showing two hundred years or so of US government borrowing costs. Two hundred years is a lengthy period of time. There have been economic booms and financial panics, localized wars and world wars, empires have risen and empires have fallen, technological change has made each successive generation’s world unrecognizable from that which preceded it. Yet government yields have remained broadly mean-reverting (and the US has been one of the best run economies over that time – other governments’ bond yields demonstrate an unpleasant historic skew towards large numbers). Coincidentally enough, the average rate of interest over that period has been around 5.8%, the rate which the new Irish government today says is ‘crippling.’And here is the math that nobody in D.C. will ever dare touch with a ten foot pole as it will confirm beyond a reasonable doubt that the US is now well on its way to monetizing its future (read: not winning)

In other words, Ireland is so indebted that it is struggling to pay a rate of interest posterity would barely yawn at. But Ireland isn’t the only one.Take the US government, for example, which currently pays around 10% of its revenues on interest payments. This doesn’t sound too bad. The problem is that those federal government interest payments are calculated net of the coupons paid into federally run programs (e.g. social security) as these are deemed ‘intragovernment transfers.’ Yet those coupons to social security are made to fund a real obligation to American citizens and as such, represent payments on a real liability. On a gross basis the US government pays out 15% of its revenues on interest payments, which makes for less comfortable reading. So the net numbers remain the most widely quoted.And where the figure gets downright ugly is if one assumes that in order to find buyers for the $4 trillion in debt over the next two years (once the Fed supposedly is out of the picture after June 30), rates revert to the mean. Which they will. What happens next is a cointoss on whether or not we enter a Weimar-style debt crunch.

Suppose the US government had to pay the 5.8% yield it has paid on average over the last two hundred years? The share of revenues spent on gross interest payments would be a staggering 30% (see chart above). If it had to pay the 6.9% it’s paid on average since WW2, those gross interest payments would account for 37% of revenues. So it’s not difficult to see the potential for a dangerously self-reinforcing spiral of higher yields straining public finances, hurting confidence in the US governments’ ability to repay without inflating, leading to higher yields, etc.Lastly, Grice makes it all too clear why we are now all screwed, and no matter how many Bernanke dog and pony shows we have, the final outcome is not a matter of if but when.

America’s political class might arrest the trend which threatens their government’s solvency (chart below). They might find a palatable solution to the healthcare system’s chronic underfunding. They might defy Churchill’s quip, and skip straight to doing the right thing. But if they don’t, such a spiral becomes a question of when and not if. And what would the Fed do then? Bernanke says the Fed “will not allow inflation to get above low and stable levels.” He says it has learned the lessons of the 1970s. He’s read the books. He can recite the theory. Yet a lifetime reading books about the Great Depression (and writing a few) didn’t help him spot the greatest credit inflation since that catastrophe any more than reading “The Ten Habits of Highly Successful People” would make him successful. It’s the doing that counts. So before lending to the US government for 3.5% over ten years, bear in mind that when it comes to a real inflation fight, not one of the Fed economists you’re betting on has ever been in one.Our advice to the good doctor and his minions (not to mention all readers), is instead of reading multitudes of history books on the depression, on Japan, or on midget tossing (for those from the SEC), is to read one book. Just one. Link here.

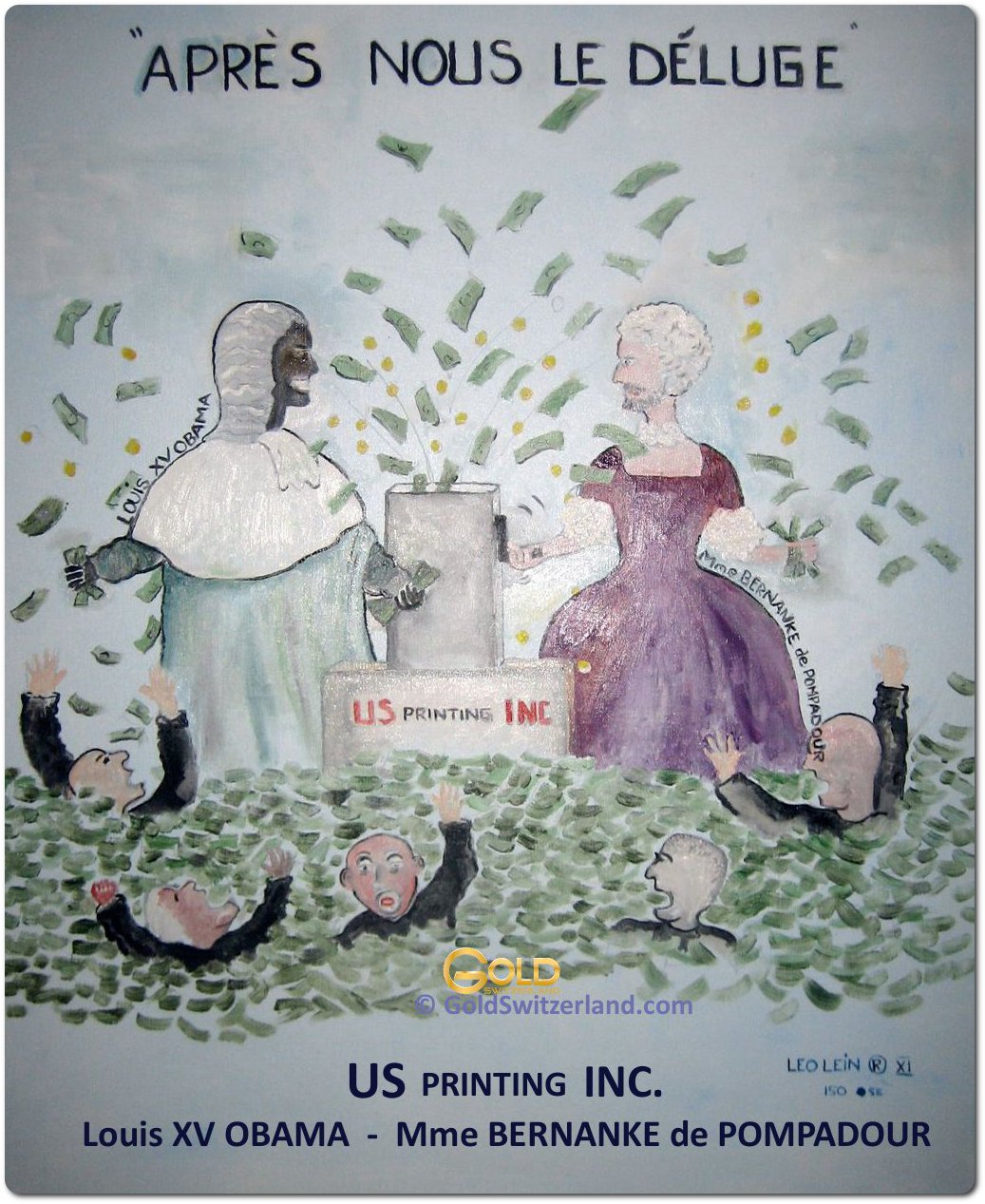

Apres Nous, Le Deluge

From Egon von Greyerz of Matterhorn Asset Management

Apres Nous, Le Deluge

Moral and financial decadence

e inequality between the rich and the poor. In the US the Gini coefficient is now at the same level as in the 1920s before the depression. In countries like the US, the rich are getting richer whilst 45 million people live below the poverty line, 43 million receive food stamps and over 700,000 are homeless. With a real unemployment rate of 22% and urban youth unemployment much higher, the US will soon experience social unrest.

e inequality between the rich and the poor. In the US the Gini coefficient is now at the same level as in the 1920s before the depression. In countries like the US, the rich are getting richer whilst 45 million people live below the poverty line, 43 million receive food stamps and over 700,000 are homeless. With a real unemployment rate of 22% and urban youth unemployment much higher, the US will soon experience social unrest.Are boom and busts inevitable?

Empty stomachs are rioting

The hyperinflationary deluge is imminent

Hyperinflation Watch

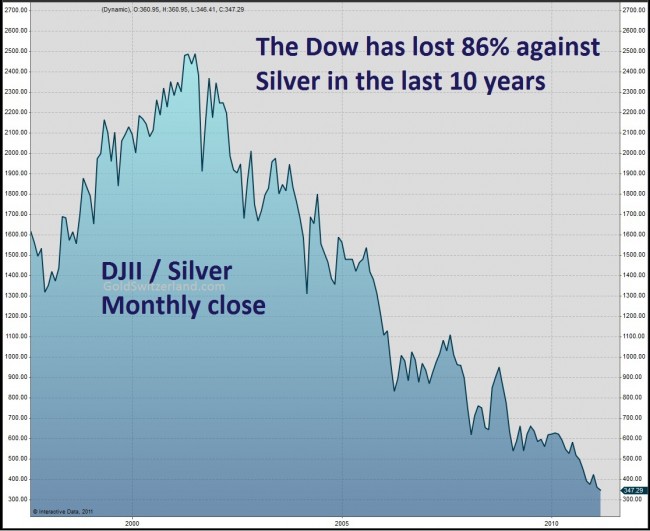

- The US dollar is down 82% against gold since 1999

- The US dollar is down 49% against the Swiss Francs since 2001

- The Dow Jones is down 81% against gold since 1999

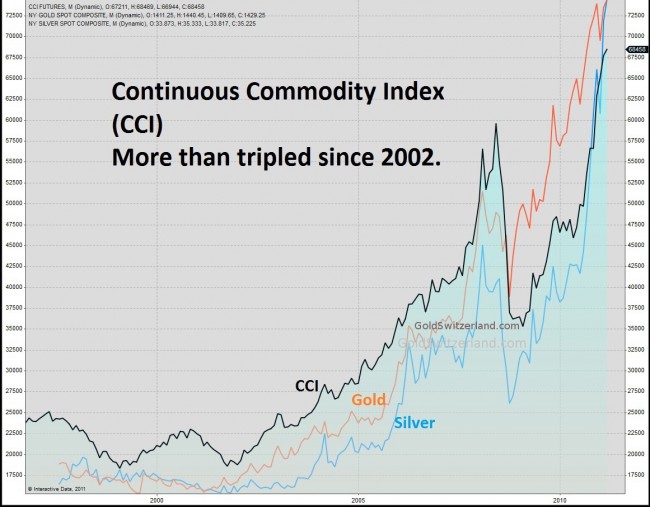

- The Continuous Commodity Index is up 100% since 2009

Stock Market

Bond market

Currency Market

As we have explained for many years, hyperinflation is created by the government destroying the currency as a result of money printing to finance deficits. This leads to the cost push inflation that we are now experiencing. Add to that, shortages in commodities worldwide, thus creating the perfect hyperinflationary scenario. The Dollar, the Pound, the Euro and many other currencies will continue to decline. They can’t all decline against each other at the same time so the market will take turns in attacking one currency at a time. But all currencies will continue to decline against gold. We believe that the dollar will soon start a very rapid fall against gold and against many currencies. Investors should exit the Dollar and also the Pound and the Euro. There is no currency better than gold or silver but for any small amounts of cash we prefer the Swiss Franc, the Norwegian Krone, the Singapore dollar and the Canadian dollar.Wealth Protection