from Big Picture blog:

Bob Bronson took a closer look at what the Unemployment data was suugesting. His view: Continuing Claims are contradicting the widely accepted view that “Less Bad Emplyment data = end of recession.”

Bronson:

“Continuing Claims reported [Friday] suggest the economically-lagging unemployment rate will increase from 8.9% to 9.6% in a few months, and, of course, that will not be the peak in the unemployment rate, since the change in Continuing Claims is nowhere near zero.”

And, according to Floyd Norris, Continuing Claims are getting worse, not better (See Unemployment Grows More Painful).

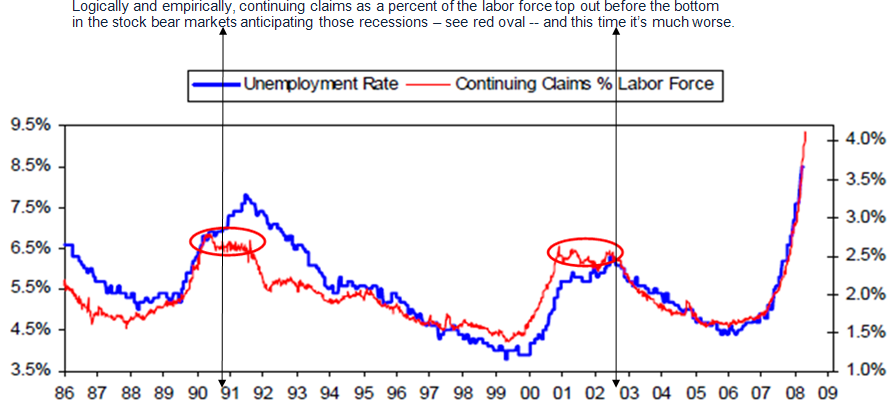

Bob’s chart (below) shows that (not surprisingly) there exists a close relationship between any changes in Continuing Claims and the Unemployment rate. What many pundits seem to be unaware of is that (at least in the past 2 recessions) continuing claims plateau before new claims peak.

>

>

Hence, why Bob does not believe unemployment is anywhere near its peak, with all that this means for mortgage defaults and foreclosures.>

How much worse? Bob suggests that you bullishly extrapolate the “less worse” downtick in the Continuing Claims just reported, assuming the trend continues in a straight line without interruption, which is extremely unlikely (see the dotted arrows in chart below). He reaches an Unemployment Rate of 13.0% before yearend: 32 weeks times an average 0.15% increase (declining from 0.30% to 0.00%) added to 8.9% = 13.3%.

Bob’s final conclusion: “Unemployment data that leads indicates the stock market will make new lows.”Bob Bronson had a few good charts looking at Unemployment/Continuing Claims versus the widely accepted view that “Less Bad = end of recession.”