Economists peddling dire warnings that the world's number one economy is on the brink of collapse, amid high rates of unemployment and a spiraling public deficit, are flourishing here. The guru of this doomsday line of thinking may be economist Nouriel Roubini, thrust into the forefront after predicting the chaos wrought by the subprime mortgage crisis and the collapse of the housing bubble.

"The US has run out of bullets," Roubini told an economic forum in Italy earlier this month. "Any shock at this point can tip you back into recession."

But other economists, who have so far stayed out of the media limelight, are also proselytizing nightmarish visions of the future.

Boston University professor Laurence Kotlikoff, who warned as far back as the 1980s of the dangers of a public deficit, lent credence to such dark predictions in an International Monetary Fund publication last week.

He unveiled a doomsday scenario -- which many dismiss as pure fantasy -- of an economic clash between superpowers the United States and China, which holds more than 843 billion dollars of US Treasury bonds.

"A minor trade dispute between the United States and China could make some people think that other people are going to sell US treasury bonds," he wrote in the IMF's Finance & Development review.

"That belief, coupled with major concern about inflation, could lead to a sell-off of government bonds that causes the public to withdraw their bank deposits and buy durable goods."

Kotlikoff warned such a move would spark a run on banks and money market funds as well as insurance companies as policy holders cash in their surrender values.

"In a short period of time, the Federal Reserve would have to print trillions of dollars to cover its explicit and implicit guarantees. All that new money could produce strong inflation, perhaps hyperinflation," he said.

"There are other less apocalyptic, perhaps more plausible, but still quite unpleasant, scenarios that could result from multiple equilibria."

According to a poll by the StrategyOne Institute published Friday, some 65 percent of Americans believe there will be a new recession.

And the view that America is on a decline seems rather well ingrained in many people's minds supported by 65 percent of people questioned in a Wall Street Journal/NBC poll published last week.

"It is true: Today's economic problems are structural, not cyclical," argued New York Times editorial writer David Brooks.

He said the United Sates is losing its world dominance much in the same way the British Empire began to crumble more than a century ago.

"We are in the middle of yet another jobless recovery. Wages have been lagging for decades. Our labor market woes are deep and intractable," Brooks said.

Nobel Economics Prize winner Paul Krugman also voiced concern about the fate of the fragile economic recovery if voters return the Republicans to political power.

"It's hard to overstate how destructive the economic ideas offered earlier this week by John Boehner, the House minority leader, would be if put into practice," he wrote in a recent editorial.

"Fewer jobs and bigger deficits -- the perfect combination."

The Wall Street Journal, usually more favorable to Boehner's call for tax cuts, ran a commentary from another Nobel Prize-winning economist -- Vernon Smith -- that failed to provide much comfort for readers.

"This fact needs to be confronted: We are almost surely in for a long slog," Smith wrote.

And it seems such pessimism has even filtered into the IMF, which warned on Friday that high levels of national debt and a still shaky financial sector threaten to derail the global economic recovery.

"The foreclosure backlog in US property markets is large and growing, in part due to the recent expiration of the home buyer's tax credit. When realized, this could further depress real estate prices."

This could lead to "disproportionate losses" for small and medium-sized banks, which could in turn "precipitate a loss of market confidence in the recovery," the IMF warned.

Sunday, September 12, 2010

Doomsday Warnings Proliferate

CBO Predicts Debt Crisis for USA

Harding and Coolidge: How to Handle a Depression

by Jim Powell from Washington Times:

Although the con- ventional wis- dom - backed by President Obama and the Democrats - is that government spending must go up in hard times, the 1920s began with a depression, and spending went down. Gross National Product (GNP) fell 23.9 percent from 1920 to 1921, compared with the 23.4 percent drop from 1931 to 1932 - the biggest annual GNP decline of the Great Depression. Unemployment doubled to 11 percent in 1921, compared with 24.9 percent in 1933, the worst unemployment level of the Great Depression.

Because pumping trillions into the economy hasn't worked this time, maybe we ought to reflect on the last time government spending was under control - back in the 1920s.

In every decade except one since then, federal spending has more than doubled. The exception (1980-1990) was a decade when spending nearly doubled. How was federal spending brought under control during the 1920s, and how does that relate to dramatically lowering unemployment?

Warren G. Harding, who won the 1920 presidential election, thought companies that prospered because of the war must find peacetime business or shut down. People had to find peacetime jobs. Harding thought that the faster adjustments were made, the better off everybody would be. He understood that the top priority was the recovery of private-sector employment because government didn't have any money other than what it extracted from taxpayers. Accordingly, Harding was determined to minimize taxpayer burdens. By the time he died in August 1923, he had cut spending almost 50 percent. He cut taxes almost 40 percent, and he began paying down the national debt. There were no big-government programs.

The result? The 1920 depression was over in just 18 months. The Roaring '20s boom began in 1922. The American middle class blossomed. Millions of people acquired their first telephone, first radio and first car. The Great Migration of blacks from the South, seeking better opportunities in Northern industrial cities, gained momentum during the 1920s. As a depression fighter, Harding was much more successful than Franklin D. Roosevelt, whose presidency during the 1930s was plagued by chronic double-digit unemployment.

Vice President Calvin Coolidge succeeded Harding and won a term of his own. He, too, was a strong believer in low spending, low taxes and minimum interference with the private sector. Coolidge further cut spending, down to $2.8 billion in 1927. Altogether, spending and taxes were cut 50 percent during the 1920s, and about 30 percent of the national debt was paid off. There were budget surpluses throughout the 1920s. Unemployment fell to 1.8 percent, the lowest U.S. peacetime level in more than 100 years.

There were three principal reasons why Harding and Coolidge were able to control spending, taxes and debt during the 1920s and achieve historically low unemployment.

First, there were no entitlements. The entitlement era in the United States began with Social Security in 1935. Today, entitlements account for more than half of federal spending, and unfunded entitlement liabilities exceed $100 trillion. Congress determines the qualifications for receiving entitlement payments, and the government is obligated to pay however many people show up with qualifications. Entitlement spending could be reduced by changing qualifications to reduce the number of people in a program, but any member of Congress who supported such changes would risk political suicide.

Second, Harding and Coolidge didn't have to deal with government employee unions. These began expanding rapidly during the 1960s. Now they're perhaps the most aggressive lobbyists for higher spending. Government employee unions have gained above-market compensation and gold-plated benefits - more than $5 trillion in federal liabilities. Unfunded state government employee liabilities are another $1 trillion.

Third, Harding and Coolidge believed the job of the military was to protect the United States. They didn't support anything like the current policy of subsidizing the defense of affluent nations in Europe and Asia that can afford to pay for their own defense, or entering other people's wars - especially civil wars - that don't involve a direct national security threat to the United States. Harding and Coolidge believed the United States could legitimately go to war after Congress debated the issues and voted for a declaration of war.

Because Harding and Coolidge were able to keep government spending low, they were able to minimize taxes, debt and government interference with the economy. The private sector flourished, productive jobs were abundant, and unemployment rates reached a historically low peacetime level that no big-government president has ever matched.

Jim Powell, a senior fellow at the Cato Institute, is author of "FDR's Folly," (Crown Forum, 2003) and "Wilson's War" (Crown Forum, 2005).

Saturday, September 11, 2010

The Death of Keynesian Economics, and US Along With It?

from Sprott Asset Management:

Despite our firm’s history of investing primarily in equities, we’ve spent much of this past year writing about the government debt market. We’ve chosen to focus on government debt because we fear its impact on the equity markets as a whole. Government debt is an intrinsically important part of the financial landscape. It is the bellwether by which we measure risk, and we believe we have entered a new era where traditional "risk-free" assets are undergoing a tremendous shift in quality.

In studying the government debt market, we have inadvertently been led to question the economic theory that most fervently justified recent government spending programs: that of Keynesian economics. The so called "beautiful theory" of Keynesian economics is arguably the most influential economic theory of the 20th Century, shaping the way Western democracies approached the balance between free market capitalism and government initiatives. Like many beautiful theories, however, Keynesianism has ultimately succumbed to the ugly facts. We firmly believe the Keynesian miracle is dead. The stimulus programs are simply not producing their desired results, and the future debt costs associated with funding these programs may cause far greater strife in the future than the problems the stimulus was originally designed to address.

Keynesian economics was born with the publishing of John Maynard Keynes’ "The General Theory of Employment, Interest and Money" in February 1936. Keynesian theory advocates a mixed economy, predominantly driven by the private sector, but with significant intervention by government and the public sector. Keynes argued that private sector decisions often lead to inefficient macroeconomic outcomes, and advocated active public sector policy responses to stabilize output according to the business cycle. Keynesian economics served as the primary economic model from its birth to 1973. Although it did lose some influence following the stagflation of the 1970s, the advent of the global financial crisis in 2007 ignited a resurgence in Keynesian thought that resulted in the American Recovery and Reinvestment Act, TARP, TALF, Cash for Clunkers, Quantitative Easing, etc., all of which have been proven ineffective, ill-advised and whose benefits were surprisingly short-lived.

The economic historian, Niall Ferguson, recently described a 1981 paper by economist Thomas Sargent as the "epitaph for the Keynesian era".1 It may have been the epitaph in academic circles, but the politicians clearly never read it. Almost thirty years later, we now get to experience the fallout from the latest Keynesian stimulus binge, and the results are looking pretty dismal to say the least.

There are a number of studies we have come across that suggest stimulus is the wrong approach. The first is a 2005 Harvard study by Andrew Mountford and Harald Uhlig that discusses the effects of fiscal policy shocks on the underlying economy. Mountford and Uhlig explain that from the mid-1950’s to year 2000, the maximum economic impact of a two percent increase in government spending was an ensuing GDP growth of approximately three percent. A two percent spending increase inevitably requires an increase in taxes. Due to the nature of interest costs, however, the government would have to raise taxes by MORE than two percent in order to pay back the initial borrowing. According to their data, this increase in taxes would generally lead to a seven percent drop in GDP. As they state in their study: "This shows that when government spending is financed contemporaneously that the contractionary effects of the tax increases outweigh the expansionary effects of the increased expenditure after a very short time."2 Stated simply, ‘borrowing to stimulate’ has never worked as planned because the cost of paying back the borrowed funds surpassed the immediate benefits of the stimulus.

In a follow-on study, Harald Uhlig estimated that an approximate $3.40 of output is lost for every dollar spent on stimulus.3 Another study on the same subject by C’ordoba and Kehoe (2009) went so far as to say that, "massive public interventions in the economy to maintain employment and investment during a financial crisis can, if they distort incentives enough, lead to a great depression."4

If the conclusions of these studies are even close to being correct, we are now in quite a predicament – not just in the US, but across the Western world. Remember that the 2007-08 meltdown was only two years ago, and as we highlighted in April 2009 in "The Elephant in the Room", the US government has spent more on stimulus and bailouts, in percentage of GDP terms, than it did in the Gulf War, Operation Iraqi Freedom, the Vietnam War, the Korean War and World War I combined.5 All that spending was justified by the understanding that it would generate sustainable underlying growth. If it turns out that that assumption was wrong, have the governments made a fatal mistake?

Another recently published Harvard study looked at stimulus at a micro-economic level and derived some surprising conclusions. Entitled "Do Powerful Politicians Cause Corporate Downsizing?", the authors compiled 232 occasions over the past 42 years when either a Senator or a Representative was voted into a controlling position over a big-budget congressional committee. Unsurprisingly, the ascendancy of the politicians resulted in extra spending in their respective districts – typically in the form of an extra US$200 million per year in federal funds. The researchers examined the economic effects of this increase in spending and found "strong and widespread evidence of corporate retrenchment in response to government spending shocks." The average firm cut back on capital investment by 15 percent and significantly reduced its R&D spending.

Companies collectively operating in the affected state reduced capital investment by $39 million a year and R&D by $34 million per year. Other consequences included increases in unemployment and declines in sales growth.6,7 Yikes!! That is not the response we’re supposed to get from government spending!

The Canadian government’s experience with Keynesian-style stimulus has been no better. The Fraser Institute reviewed the impact of the Government of Canada’s "Economic Action Plan" and found that "the contributions from government spending and government investment to the improvement in GDP growth are negligible."8 They state that, of the 1.1% increase in economic growth between the second and third quarter of 2009, government consumption and government investment contributed a mere 0.1%. Of the 1% improvement in economic growth between the third and fourth quarter of 2009, government investment and consumption contributed almost nothing. In the end, it was actually net exports that were the largest contributor to Canada’s growth. No Keynesian miracle in this country.

Our own findings compare favourably to the academic studies cited above. We looked at government spending and current dollar GDP increases in our ‘Markets at a Glance’ entitled, "A Busted Formula". Our findings, using decidedly un-econometric techniques, showed similar results, and are presented in Table A below. We looked at current dollar increases in GDP as published by the Bureau of Economic Analysis (BEA) and current dollar expenditures and receipts for the US government taken from the Treasury. One current deficit dollar resulted in an increase in current dollar GDP of a mere 10 cents. Again - no miracle Keynesian multiplier here.

A more timely epitaph for our Keynesian funeral comes from a recent op-ed piece by Jean-Claude Trichet, President of the European Central Bank, that was published in the Financial Times and entitled "Stimulate No More". In it Trichet states that, "…the standard economic models used to project the impact of fiscal restraint or fiscal stimuli may no longer be reliable."11 He explains that while debt in the euro zone has increased by more than 20 percent in only four years and by 35 to 40 percent over the same time period in the US and Japan, we have very little, if anything, to show for it. We agree. New housing sales are at all time lows, consumer intentions for auto purchases are at multi year lows, the University of Michigan consumer confidence index has turned negative, new jobless claims have started to increase, and the ECRI - a composite of leading indicators - is now forecasting a recession (see Chart C).

Since Keynesian economics is no longer relevant, some are now arguing that tax cuts will save the day. Two of the academic studies we reviewed suggest that tax relief is a much stronger stimulus to the economy than government spending, and under normal circumstances this is probably true. But we are not in a normal economic environment. Even if the tax cuts implemented by George Bush in 2006 are extended by the next Congress, the US will still face the ‘Keynesian Endpoint’. A Government Accountability Office (GAO) report published in January 2010 states the following: "In our Alternative simulation, which assumes expiring tax provisions are extended through 2020 and revenue is held constant at the 40-year historical average; roughly 93 cents of every dollar of federal revenue will be spent on the major entitlement programs and net interest costs by 2020."12 Extending tax cuts won’t solve anything.

In the end, Keynesian stimulus ultimately fooled us all. It roped in the politicians of the richest countries and set them on an unsustainable course of debt issuance. Recent Keynesian stimulus has even managed to fool the sophisticated economic models designed by central banks. The process of accounting for massive government spending ‘confuses’ the models into calculating a recovery trajectory when it doesn’t exist. The Bank of England confirmed this with its announced £3.5 million overhaul of its current model due to its inability to generate accurate inflation and recession forecasts.13

Keynesian stimulus can’t be blamed for all our problems, but it would have been nice if our politicians hadn’t relied on it so blindly. Debt is debt is debt, after all. It doesn’t matter if it’s owed by governments or individuals. It weighs on the institutions that issue too much of it, and the ensuing consequences of paying off the interest costs severely hinders governments’ ability to function properly. It suffices to say that we need a new economic plan – a plan that doesn’t invite governments to print their way out of economic turmoil. Keynesian theory enjoyed a tremendous run, but is now for all intents and purposes dead… and now it’s time to pay for it. Literally.

I Am This Blog's Sole Reader

I posted this today in comments to a news sstory about lawsuits for sharing news stories on blogs.

Friday, September 10, 2010

USDA Cuts Wheat, Corn Harvest Forecasts

* USDA cuts world wheat forecast for fourth month in a row

* U.S. corn stocks/use ratio lowest in 15 years-USDA

* Rise in corn futures buoys wheat, soy down 1.4 percent

* USDA sees record-high farm-gate corn price in 2010/11

* Higher costs likely for meatpackers and foodmakers (Rise in corn also boosts wheat futures, adds closing prices)

By Charles Abbott

WASHINGTON, Sept 10 (Reuters) - U.S. corn supply will shrink to its tightest in 15 years next year due to strong global demand and a smaller-than-expected crop hit by hot, dry weather, the Agriculture Department said on Friday in forecasts that stoked corn prices but tempered wheat.

While painting an unexpectedly tight picture for a corn market that has already surged more than 40 percent since late June, the USDA cut its wheat supply forecasts by less than expected, allaying fears that the world was headed for a repeat of the 2008 food-fear crisis.

The USDA cut its forecast for the U.S. corn stockpiles to 1.116 billion bushels (28.4 million tonnes) by the end of 2010/11, down 15 percent from its report a month ago and a nearly 20 percent decline on the year.

That put the stocks-to-use ratio at 8.3 percent, or about the equivalent of one month's consumption, the smallest since 1995/96. [ID:N07254444]

With the fall harvest under way, USDA cut its U.S. corn crop forecast by 2 percent to 13.16 billion bushels (334 million tonnes) -- a bit below forecasts for 13.2 billion bushels -- due to hot, dry late-summer weather that helped prices rise by nearly 17 percent since August.

USDA cut its forecast of the world wheat crop for the fourth month in a row, but its forecast of 643 million tonnes was not as low as expected. USDA lowered its forecasts for Russia's wheat harvest by 2.5 million tonnes from August and the European Union's by 2.4 million tonnes. [ID:N10224730]

USDA lifted its forecast for the U.S. soybean crop by 1 percent from its August estimate.

The world wheat crop would be the smallest in three years, since fears of a food shortage were rampant.

But supplies are far larger than in 2008 and USDA raised its forecast of 2010/11 wheat end stocks by nearly 2 percent, to 177.79 million tonnes, due to larger supplies in Canada.

U.S. farmers "are in an economic sweet spot" of large crops and high prices "and we think this will persist well into 2011," said analyst Mark McMinimy of Washington Research Group. "Downstream users, however, such as meat processors and baking companies and food manufacturers will likely labor under higher input costs."

CBOT December corn futures CZ0 settled up 7-1/2 cents at $4.78-1/4 on Friday, with the tighter supply forecast buffered by a lower-than-expected weekly export sales total.

December wheat WZ0 settled 1-1/4 cents at $7.36 and 3/4 a bushel. November soybeans SX0 ended lower 15 cents at $10.31 a bushel. While USDA forecast larger supplies than traders expected, export sales for wheat and soybeans were above expectations.

Global Food Supplies Tight

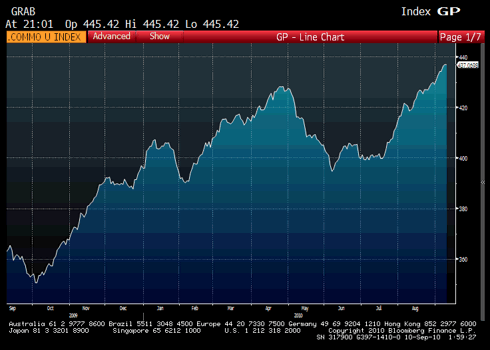

Agri-Food Price Index makes new high!

One road to wealth is to only own those assets for which the price is rising. That seems to be a rule that equity investors have forgotten. In any event, a great market technician once suggested only looking at those things with prices making new 52-week highs. His reasoning was that for the price of something to rise it must eventually make a new high. Well, based on the above chart, that technician would be all over Agri-Food commodities and associated investments. Our Agri-Food Price Index recently made a new high!

Recent embargo of grain exports by Russia due to problems with their wheat crops has served to highlight the tenuous nature of the world’s Agri-Food situation. Cessation of Russian exports did not cause prices to rise. It just helped to uncap them. The fundamental Agri-Food shortage facing the world did not suddenly arise. It has been building for years.

List of countries that cannot feed their people is not a short one. Included in it are all the nations of the Middle East, Egypt, India, China, Philippines, etc. With prosperity beginning to arise in China and on its way in India, these two nations will increasingly turn to global markets to feed their citizens. They have no choice, as they lack the land and all-important water to feed their people. In the global game of Agri-Food, those nations that bid the highest will get the food.

If one reads the commentaries or listens to traders, the discussion still drones on about absolute size of grain reserves in the world. And yes, they are sizable. That view, however, focuses on a meaningless metric. Gasoline stocks today are many times the size that existed when this author was a teenage driver. We are not, however, paying 19 cents a gallon for gasoline. For what matters is not the size of the reserves, but those reserves relative to consumption.

In our first chart this week, above, is plotted the days of consumption held in global reserves for the Big Four, corn, soybeans, wheat, and rice. They all fall into a range of 60-95 days. If no production of these grains occurred, in less than 60 days no corn would be available. In the case of rice, in less than 80 days none would be found.

Numbers in that chart do not portray a picture of overwhelming bounty. Such is the reason that global grain markets responded to the Russian announcement. At the same time, the world has really not yet come to know the impact of the floods on Pakistani rice production. That country is the number three exporter of rice.

New 90-week high about to happen?

When Agri-Food is short in supply anywhere, the world turns to North America. Per the latest USDA report, U.S. wheat export sales are running 60+% ahead of a year ago. For rice, the same number rounds to being up 30%. Those sales are tightening the prices of all grains, such as corn in the above chart.

Corn has not yet risen to a new 90-week high, but it is well on its way to doing so. China, long a net importer of soybeans, is now moving to becoming a net importer of corn. That importation takes two forms, physical corn and dry distillers grain. Latter is a byproduct of ethanol production. Essence of the problem for China is that it lacks the water to grow sufficient corn. Importing corn is the importation of “virtual water.”

When corn is $11 a bushel, who will benefit from it? Will your wealth? Two good ways exist to participate in the tightening of the global Agri-Food markets. One is through stocks of those companies that serve the global Agri-Food market. Second is through investment in Agri-Land. For those that might think in terms of the latter, our 4th Annual U.S. Agricultural Land As An Investment Portfolio Consideration - 2010 will soon be available at our web site. This report is the definitive annual study of the returns earned on U.S. agricultural land.

What On Earth Is a "Melt Up"?

What Does Melt Up Mean?

A dramatic and unexpected improvement in the investment performance of an asset class driven partly by a stampede of investors who don't want to miss out on its rise rather than by fundamental improvements in the economy. Gains created by a melt up are considered an unreliable indication of the direction the market is ultimately headed, and melt ups often precede melt downs.

Investopedia explains Melt Up

Financial analysts saw the run-up in the stock market in early 2010 as a possible melt up because unemployment rates continued to be high, both residential and commercial real estate values continued to suffer and retail investors continued to take money out of stocks.

U.S. Economic Forecast from Goldman's Ed McKelvey

This guy has a good track record. We should listen!

Despite the fact that our US outlook has been well below consensus, most indicators have surprised us to the downside over the past three months. In this comment, we summarize those results relative to our early June “road map” and extend this road map into early 2011.

The list of weaker-than-expected indicators is extensive, covering consumer spending except auto sales, confidence, housing activity, durable goods orders, payrolls, claims, and the all-items CPI. In fact, only industrial output and the Institute for Supply Management’s (ISM’s) manufacturing index surprised us significantly to the strong side, though the unemployment rate and core inflation were also firmer than expected (i.e., lower for unemployment).

Looking ahead to the fourth quarter of 2010 and the first quarter of 2011, we expect: (1) sluggish consumer spending, (2) rebounds in starts and sales from post-tax-credit paybacks (but further declines in construction outlays), (3) a stall in industrial activity, (4) renewed (but modest) labor market deterioration, and (5) a slight slowing in core inflation.

Three months ago we issued a road map for the slowdown in US growth that we anticipated for the second half of 2010. As has become our custom, we evaluate the progress to date, and are extending the road map into early 2011. With the slowdown already in place, the revised road map becomes one that we think will be consistent with a sluggish 1½% annualized growth rate.

Despite the fact that our US outlook three months ago was well below the “consensus” view, most indicators surprised us to the downside. In particular, reports on housing activity, consumer spending on items other than motor vehicles, and consumer confidence came in well below the levels we regarded as consistent with our forecast for real GDP growth to slow from a 3% annual rate in the first half of 2010 to a 1½% rate in the second half; data on initial claims, payrolls, and durable goods were also weaker than we expected. Upside surprises were confined mainly to industrial production and the Institute for Supply Management’s (ISM’s) manufacturing index; in this latter case the jury is still out, as our milepost was for the ISM index to fall below 55 in the fourth quarter. Core inflation was also firmer than we expected. On balance, these results are consistent with the fact that real GDP growth was weaker in the second quarter than we then expected and could still have downside risk in the current quarter despite this morning’s better-than-expected trade balance. Meanwhile, about a month ago we marked up our core inflation forecast modestly, reflecting the higher-than-expected results and upward revisions to data stretching back much farther.

Looking ahead, we envision a road map for the fourth quarter of 2010 and the first quarter of 2011 with the following landscape:

1. Very slow growth in consumer spending. For both quarters, we expect real consumer spending to increase only 1% at an annual rate, which implies gains of slightly less than 0.1% per month. Vehicle sales will probably rise somewhat faster, though we do not expect them to crack the 12-million annualized barrier on a sustained basis. In turn, the implication for (nominal) nonauto retail sales is for increases averaging 0.2% per month. Confidence indexes, which suffered unexpected setbacks in recent months, are apt to fluctuate around their latest readings.

2. Rebounds in housing starts and home sales from severe post-tax-credit paybacks, but to levels that remain depressed. The latest observations on home sales and, to a lesser extent, housing starts reflect an unexpectedly sharp payback following the expiration of the homebuyer tax credit. The levels to which sales have fallen are thus well below their ultimate settling points in our view. We therefore expect some improvement, albeit to sales rates that remain extremely low by longer-term historical standards – about 375,000 to 400,000 for the annual rate of new home sales and about 5 million for sales of existing units. Starts of single-family units should exhibit a similar, though less pronounced pattern. Reflecting the decline in starts and the weak fundamentals in other sectors of the construction industry, outlays for construction projects should trend lower throughout the period.

3. A stall in industrial activity. Although manufacturing output and the ISM’s index for that sector have surprised us to the upside in recent months, both our analysis of the inventory cycle (if it’s not over, then it’s moving into a phase of unintended and/or unsustainable accumulation) and key indicators (differences between indexes of new orders and inventories in various surveys, including the ISM’s) point to a significant deceleration in the near term. Specifically, we look for the ISM index to drop to 50 or below by the first quarter of 2011 and for industrial output to grind to a virtual halt on a similar timetable. As durable goods orders have already signaled in coming months, we expect little net change in such orders, with risks tilted to the downside.

4. Renewed labor market deterioration. As business firms seek to protect margins in an environment of sluggish growth, net hiring is apt to come close to stalling as well, putting the unemployment rate under renewed upward pressure. Specifically, we expect payroll gains to slow to 25,000 per month (ex Census workers) and the jobless rate to drift up to 10% over the next half year. Initial claims have never fallen to a rate that was consistent with payroll growth. That plus the presumption that control over headcount will focus on limited hiring rather than renewed firing suggests that claims will remain roughly where they have been during most of 2010.

5. A slight slowing in core inflation. As already noted, core inflation has been a bit higher than we anticipated in recent months, though the pattern is still one of gradual—if uneven--deceleration. We expect that to continue in coming months (quarters, years, and possibly decades), with monthly increases slipping once again below 0.1% on average in early 2011.

Engineering Inflation: Major Commodity Bull Market Debunks Deflationary Fears

I would add that we are in a bull market for corn, soybeans, wheat, sugar, coffee, cotton, cattle, hog, and orange juice futures.

from Seeking Alpha:

The deflationist camp continues to hog the limelight in the press of popular opinion, leading us to believe that prices of things are falling or at least will fall over the coming months. However, on the quiet the average commodity appears to be engaged in a raging bull market.

I put together an index of some 35 commodities to demonstrate just how strong the underlying commodity market is. Many of the commodities in this index are not included in the popular commodity indices such as the CRB Reuters, Goldman Sachs and UBS Bloomberg indices. Some of the commodities that make up this index are as follows:

- lumber

- coal

- polyethylene

- ethanol

- pulp

- newsprint

- handysize baltic

- bunkers

- jet fuel

- diesel

- iron ore

- uranium

Index of 35 Commodities Equally Weighted

.

.Now, since when did a bull market in commodities equate to conditions of deflation? Has the supply of virtually every commodity suddenly contracted? I think not; more likely demand has picked up. Of course, that would suggest the world economy and by default the US economy is not slowing down as your local economist would have you believe.

Do your own research don't become beholden to believing what a programming director wants you to believe just because that is what the crowd wants to hear!

Thursday, September 9, 2010

Gordon Long: America Has a Structural, Not Cyclical, Problem

1) Credit Available - Demand Flat.

2) Shifting Demographics

Doctored Unemployment Claims Data

The BLS has announced that as a result of the Labor Day weekend, 9 states (among which the biggest one California) did not report initial claims data to the bean counters, so instead the government had to "estimate" what the data would have been: yep, estimate, what the data was in these nine states. From Bloomberg: "For the latest reporting week, nine states didn’t file claims data to the Labor Department in Washington because of the Labor Day holiday earlier this week, a department official told reporters. California and Virginia estimated their figures and the U.S. government estimated the other seven." Official data is now made up on the fly. This US economic data reporting has just entered the twilight zone. Also, when the data is officially made up, it is not that difficult to get data that is "better than expected." The full list of states is: DC, Illinois, Idaho, Hawaii, Oklahoma, Michigan, and Washington. California and Virginia estimated themselves.

Can't Compete! U.S. Competitiveness Declines

from AP:

BEIJING — The U.S. has slipped down the ranks of competitive economies, falling behind Sweden and Singapore due to huge deficits and pessimism about government, a global economic group said Thursday.

Switzerland retained the top spot for the second year in the annual ranking by the Geneva-based World Economic Forum. It combines economic data and a survey of more than 13,500 business executives.

Sweden moved up to second place while Singapore stayed at No. 3. The United States was in second place last year after falling from No. 1 in 2008.

The WEF praised the United States for its innovative companies, excellent universities and flexible labor market. But it also cited huge deficits, rising government debt and declining public faith in politicians and corporate ethics.

"There has been a weakening of the United States' public and private institutions, as well as lingering concerns about the state of its financial markets," the group said.

Mapping a clear strategy for exiting the huge U.S. stimulus "will be an important step in reinforcing the country's competitiveness," it said.

The report was released in Beijing ahead of a WEF-organized gathering of global business executives next week in neighboring Tianjin. The group is best known for its annual Davos meeting of corporate leaders.

Urgent Letter to Obama

from the Daily Capitalist blog:

The President

White House

Washington, D.C. 20500

Dear President Obama:

I observed with some concern a photo of you and your glum economic team in the White House Rose Garden during your September 3 address on the jobs report.

I am aware that you are gravely concerned about the economy and the employment situation. Understandably so since your policies of fiscal and monetary stimulus have failed to create economic growth or employment. Yet despite such failures you advocate more of the same remedies in the face of their failure.

On Labor Day you announced new spending of $50 billion on infrastructure construction to create “jobs”. This is in addition to the American Recovery and Reinvestment Act commitment of $499 billion for similar projects. According to your web site, Recovery.gov, only $296 billion of that amount has been spent so why do we need more?

Yet the economy is stagnant, if not declining, unemployment is high and going higher, and credit is still largely unavailable to most American businesses even if they were willing to borrow. Home buyer credits have failed to stop the decline in home prices and Cash for Clunkers has had no lasting effect on the auto or appliance industries.

I suggest that since existing policies have failed to revive the economy, your Administration should try something different. I offer you several innovative policies that would actually speed a recovery and lead to higher employment.

The problems that we need to quickly solve are:

- High unemployment.

- Declining output.

- Credit freeze.

- Surplus of housing and commercial real estate.

- High private debt load.

- High federal debt.

Unless we understand the causes of our problems, solutions are not easy. Because you place great emphasis on “what works” rather than economic theory, I will get to the specific issues straightaway.

Here are some guiding principles for “what works”:

- Economies can repair themselves without a lot of government help. History has proven this time and again.

- Government interference in the repair process can hinder recovery or even make things worse.

- Government spending is very inefficient.

- Individuals can make better choices about what to do with their money than the government.

- Economic growth only comes from private enterprise. The corollary of this is that government can only spend money, not make money.

- Since government produces nothing, then real growth and real jobs can only come from private enterprise.

- If government spending is inefficient and if economic growth comes only from the private sector, then taking vast amounts of money out of private hands and putting it into government hands will hinder growth.

- Government spending to revive an economy has failed wherever and whenever it has been tried.

- More legislation increases uncertainty for businesses, making them reluctant to expand (called “regime uncertainty” in economic terms).

Fix the Banks

Cure the credit freeze by eliminating policies that cover up the fact that many of our banks are financially unsound. These policies generally relate to how banks value the assets that secure real estate loans, primarily commercial real estate (CRE) loans. These policies allow banks to overvalue their loan assets. These policies include “mark-to-make-believe” (rather than “mark to market”) and “extend and pretend” each of which allow banks to maintain a fiction. If the actual values of these loans were realized, banks would be required to foreclose on these bad assets. By getting these loans off their books, they would be able to recapitalize and become financial sound.

Why is this important? It is the only way to restore credit to small- and medium-sized businesses and resolve the oversupply of CRE. Big businesses have plenty of credit from the big money center banks. It’s the regional and local banks which finance the rest of us that are in trouble.

We have just gone through the world’s biggest financial bubble. During this bubble, projects that made no sense but for the cheap Fed money and the false appearance of paper prosperity, were hugely over-produced. Now that the bubble has burst, we are in the mopping up stage of recovery. Banks are reluctant to extend credit because they are unsure of their financial future. The longer banks hold on to these malinvestments, their balance sheets will remain clogged up, and credit will remain restricted. Yes, more banks will go out of business; the process is never pretty but it is necessary. It is important to keep in mind that until this done, millions of unemployed Americans will stay jobless longer.

Bring Back the RTC

If you allow banks to fail as did President Bush I (mostly S&Ls actually), then there will be many foreclosed CRE projects that will need to be liquidated by the FDIC. Alan Greenspan, then Fed chairman, for all his faults did the right thing by urging the creation of the Resolution Trust Corporation, a separate entity whose function was to liquidate S&Ls and sell off the foreclosed assets from failed institutions. It actually worked pretty well and a huge slug of bad real estate, mostly apartments, were sold off to investors. The investors got great deals, but, more importantly, the economy recovered sooner.

The RTC dealt with 747 S&Ls with total assets of $394 billion (according to the Wikipedia article). According to the latest FDIC report there are 829 “problem” banks with $403 billion in assets as of Q2 2010. It is conceivable that this idea would work again.

Stop Passing Laws

Surveys reveal that the number one problem for business is uncertainty created by the government. They have been hit with an onslaught of complex legislation the consequences of which they don’t understand. This is called “regime uncertainty” in economic terms. The truth is, according to the surveys, that even if credit was available, businesses aren’t borrowing because they don’t know what the government will do to them next. Consider that three major pieces of legislation have been passed during your administration: the American Recovery and Reinvestment Act, the health care bill, and the Dodd-Frank financial overhaul bill. Further, they are uncertain if taxes on them will be raised.

No new laws are required to allow the economy to recover. I urge you to speak to business and tell them that we Americans trust their ability to drive our economy, and that your Administration will enact no new laws that will create greater burdens on their ability to expand, borrow, hire, and reap profits.

Stop Useless Spending

While your Administration has gamely tried to convince us that you have created jobs, we know that is fiction. The CBO report and claims by prominent economists have no credible evidence that any real jobs were created. If it were the case that government could create jobs then there would be no need for the private sector. Of course you know well that history has proven that policy to be a disaster.

Only private enterprise can create a real job. Having the government pay people to work is not a “job” in the same sense as a job in the private sector. When a business hires an employee, it is because somewhere down the line consumers want the end product of his or her productivity. The job created by the business is generated by economic activity until consumers decide otherwise.

If the government pays someone to do something, it isn’t generated by economic activity. When the money stops, the job stops. That has been the case of all of fiscal stimulus spending. While someone is earning money from the government, the money to pay him or her comes from taxes, which ultimately can only be generated from private enterprise.

If the government takes money out of the economy to pay people to do things it wants done rather than let the economic forces of private enterprise work, then businesses who create real jobs will have less money with which to expand their businesses. You should consider what the person from whom the money was taxed was going to do with the money. It would aid recovery to let private enterprise keep their money.

Encourage Saving Rather Than Spending

With historically high debt loads, job uncertainty, a lack of retirement funds, and declining home values, is it not reasonable for people to increase savings? Urging people to spend at this time runs counter to people’s innate sense to take care of themselves. While people are trying to repair their financial condition after the housing and credit bubble, urging more spending is reckless advice. People are rightly using their common sense.

There are two substantial benefits to saving. It allows families to reduce their debt burdens. Once they pay down their debts, they will be more willing to spend without the fear that they will end up homeless. Saving also creates the new capital that will be required for businesses when they decide to expand. It is not as if the Fed can just print dollars to create wealth and capital; wealth can only come from savings.

Policies that encourage spending such as Cash for Clunkers or home buyer credits or various tax credits for government-favored projects only encourage spending and thus reduce savings. Furthermore, they appear to have no lasting economic impact.

Don’t Raise Taxes

In light of the detriment to the economy of giving the government more of our earnings right now, an increase in taxes would be harmful to a recovery. While we face a serious deficit in the federal budget, the only way to pay down national debt is to have a vigorous growing economy and a reduction of government spending. With the right policies put in place, lower taxes would help create economic growth.

Raise Interest Rates

Fed policies to expand the money supply to create inflation will eventually succeed. Thus they are planting the seeds for perpetual stagnation and inflation. To prevent this new disaster, the Fed should immediately raise the Fed Funds rate and stop new attempts at quantitative easing. This will have an immediate positive impact. First, it will encourage saving as people seek higher, safer returns on their capital. Second, it will unmask malinvested projects, clear away the burden of their related debt load, and allow capital to be redirected to profitable ventures. Third, it will prevent the rise of inflation which robs savers of their wealth. Fourth, it will prevent the creation of a new destructive stagflationary cycle. Fifth, as in the Volcker era, greater savings and low inflation will eventually lead to new economic growth and higher employment.

I strongly urge you to adopt these innovative solutions to solve our nation’s desperate economic problems.

Sincerely,

Dr. Jeffrey Harding