I would add that we are in a bull market for corn, soybeans, wheat, sugar, coffee, cotton, cattle, hog, and orange juice futures.

from Seeking Alpha:

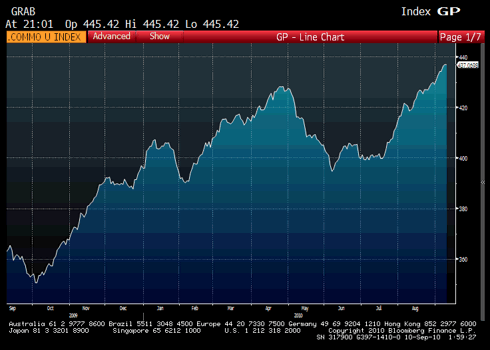

The deflationist camp continues to hog the limelight in the press of popular opinion, leading us to believe that prices of things are falling or at least will fall over the coming months. However, on the quiet the average commodity appears to be engaged in a raging bull market.

I put together an index of some 35 commodities to demonstrate just how strong the underlying commodity market is. Many of the commodities in this index are not included in the popular commodity indices such as the CRB Reuters, Goldman Sachs and UBS Bloomberg indices. Some of the commodities that make up this index are as follows:

- lumber

- coal

- polyethylene

- ethanol

- pulp

- newsprint

- handysize baltic

- bunkers

- jet fuel

- diesel

- iron ore

- uranium

Index of 35 Commodities Equally Weighted

.

.Now, since when did a bull market in commodities equate to conditions of deflation? Has the supply of virtually every commodity suddenly contracted? I think not; more likely demand has picked up. Of course, that would suggest the world economy and by default the US economy is not slowing down as your local economist would have you believe.

Do your own research don't become beholden to believing what a programming director wants you to believe just because that is what the crowd wants to hear!