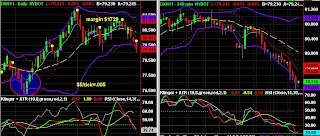

This chart shows the longer-term time frames (daily, four-hour) for the U.S. Dollar Index. It shows that the Dollar is poised to break out of the Bollinger Bands (shown in purple) on the downside if it closes the day at this level. As you may know, Bollinger Bands are designed based upon statistics.

The Bollinger Bands in these charts represent two standard deviations of statistical probability. Should break-out today occur and prices close below the lower band, the new Dollar has an 80+% statistical probability of continuing in this direction and forming a new downtrend. Thus, the likelihood of a new Dollar downtrend is relatively high. This in turn is likely to send commodity prices much higher! As you can see on this chart, the four-hour chart on the right shows that this new Dollar downtrend is already well under way. This lower Bollinger Band (on the daily chart) represents a significant support level, but a close below this level has a high statistical probability of continuation. Thus, the next few days will be critical to the emergence or repudiation of this new downtrend. Since the day hasn't closed yet, it is still conceivable that the price of the Dollar Index could rebound before the day is finished. We will know over the course of the next few hours.

Despite this, note that on the same chart, in the red-circled area, we saw a similar breakout in early November (Nov. 4th), which then reversed, with prices rebounding back within the Bollinger Bands. If prices rebound from a break-out back inside the Bollinger Bands, then there is also a strong statistical probability that prices will then have enough momentum to touch the opposite band, as they did in this case, touching the opposite band just eight (trading) days later on November 16th.

If this new Dollar destruction downtrend is confirmed, the weekly chart (not shown) shows the next area of support at around 76.100.

One more notable thought: Today is the last day of the month, quarter, and year! Window-dressing by large funds may also be at work here! Large fund managers may be seeking to lock in profits and/or wash out their losing trades so that they can start the new year fresh. It is wise to keep this fundamental dynamic in mind as well.

May 2010 be a happy and profitable new year!

skip to main |

skip to sidebar

Portfolio Manager, Head Strategist

About Me

- S Benard

- United States

- I am a student of economics, financial analyst, and futures trader, specializing in agricultural commodities, and especially grains, but I also trade gold and other metals, soft commodities, treasuries, and stock index futures. I began trading spot Forex currency crosses in May 2003, and in August 2006, I met a futures trader who has been making a living in futures for more than 20 years, and he became my futures mentor. I've never looked back, and I am now head trader for Global Capital Reserves, my own firm. I also have both Bachelors and Master of Science degrees in business. I really enjoy trading futures, and hope to share my successes, a few failures, and methodologies.

My Other Blogs:

Blog Archive

-

►

2022

(1)

- ► 08/07 - 08/14 (1)

-

►

2021

(4)

- ► 05/02 - 05/09 (2)

- ► 04/18 - 04/25 (2)

-

►

2020

(52)

- ► 09/13 - 09/20 (1)

- ► 08/30 - 09/06 (3)

- ► 08/23 - 08/30 (2)

- ► 08/16 - 08/23 (8)

- ► 08/02 - 08/09 (1)

- ► 07/26 - 08/02 (1)

- ► 07/12 - 07/19 (3)

- ► 06/28 - 07/05 (2)

- ► 06/21 - 06/28 (2)

- ► 06/14 - 06/21 (3)

- ► 06/07 - 06/14 (2)

- ► 05/31 - 06/07 (3)

- ► 05/24 - 05/31 (3)

- ► 05/17 - 05/24 (2)

- ► 05/10 - 05/17 (3)

- ► 05/03 - 05/10 (3)

- ► 04/26 - 05/03 (1)

- ► 04/19 - 04/26 (1)

- ► 04/12 - 04/19 (1)

- ► 04/05 - 04/12 (2)

- ► 03/29 - 04/05 (1)

- ► 03/15 - 03/22 (1)

- ► 01/12 - 01/19 (3)

-

►

2019

(48)

- ► 11/17 - 11/24 (1)

- ► 10/06 - 10/13 (1)

- ► 09/29 - 10/06 (1)

- ► 08/25 - 09/01 (1)

- ► 08/18 - 08/25 (1)

- ► 08/11 - 08/18 (3)

- ► 08/04 - 08/11 (2)

- ► 07/21 - 07/28 (1)

- ► 07/14 - 07/21 (1)

- ► 07/07 - 07/14 (3)

- ► 06/30 - 07/07 (3)

- ► 06/23 - 06/30 (8)

- ► 06/16 - 06/23 (5)

- ► 06/09 - 06/16 (3)

- ► 06/02 - 06/09 (4)

- ► 05/26 - 06/02 (5)

- ► 05/19 - 05/26 (3)

- ► 04/14 - 04/21 (1)

- ► 04/07 - 04/14 (1)

-

►

2018

(22)

- ► 12/16 - 12/23 (1)

- ► 10/07 - 10/14 (2)

- ► 08/19 - 08/26 (1)

- ► 07/22 - 07/29 (1)

- ► 07/08 - 07/15 (1)

- ► 07/01 - 07/08 (1)

- ► 06/24 - 07/01 (3)

- ► 06/17 - 06/24 (1)

- ► 06/03 - 06/10 (4)

- ► 05/27 - 06/03 (2)

- ► 05/06 - 05/13 (2)

- ► 04/08 - 04/15 (1)

- ► 03/25 - 04/01 (1)

- ► 01/07 - 01/14 (1)

-

►

2017

(22)

- ► 12/31 - 01/07 (1)

- ► 12/17 - 12/24 (2)

- ► 11/12 - 11/19 (1)

- ► 10/15 - 10/22 (1)

- ► 10/01 - 10/08 (2)

- ► 09/24 - 10/01 (1)

- ► 09/10 - 09/17 (1)

- ► 09/03 - 09/10 (2)

- ► 08/27 - 09/03 (2)

- ► 08/13 - 08/20 (2)

- ► 08/06 - 08/13 (1)

- ► 07/30 - 08/06 (1)

- ► 06/18 - 06/25 (1)

- ► 06/11 - 06/18 (1)

- ► 06/04 - 06/11 (2)

- ► 05/14 - 05/21 (1)

-

►

2016

(55)

- ► 10/09 - 10/16 (1)

- ► 09/04 - 09/11 (2)

- ► 08/21 - 08/28 (1)

- ► 08/14 - 08/21 (2)

- ► 07/31 - 08/07 (1)

- ► 07/24 - 07/31 (1)

- ► 07/10 - 07/17 (2)

- ► 06/12 - 06/19 (1)

- ► 06/05 - 06/12 (4)

- ► 05/29 - 06/05 (1)

- ► 05/22 - 05/29 (3)

- ► 05/15 - 05/22 (5)

- ► 05/08 - 05/15 (2)

- ► 04/24 - 05/01 (1)

- ► 04/17 - 04/24 (2)

- ► 04/03 - 04/10 (4)

- ► 03/27 - 04/03 (1)

- ► 03/20 - 03/27 (2)

- ► 03/13 - 03/20 (2)

- ► 02/28 - 03/06 (3)

- ► 02/14 - 02/21 (2)

- ► 02/07 - 02/14 (3)

- ► 01/24 - 01/31 (7)

- ► 01/10 - 01/17 (2)

-

►

2015

(94)

- ► 12/06 - 12/13 (2)

- ► 11/29 - 12/06 (4)

- ► 11/22 - 11/29 (3)

- ► 11/15 - 11/22 (4)

- ► 11/08 - 11/15 (1)

- ► 11/01 - 11/08 (5)

- ► 10/25 - 11/01 (2)

- ► 10/11 - 10/18 (1)

- ► 09/13 - 09/20 (2)

- ► 08/23 - 08/30 (4)

- ► 08/16 - 08/23 (3)

- ► 08/09 - 08/16 (1)

- ► 08/02 - 08/09 (2)

- ► 07/05 - 07/12 (1)

- ► 06/28 - 07/05 (1)

- ► 06/21 - 06/28 (1)

- ► 06/14 - 06/21 (1)

- ► 06/07 - 06/14 (1)

- ► 05/31 - 06/07 (1)

- ► 05/24 - 05/31 (3)

- ► 05/17 - 05/24 (5)

- ► 05/03 - 05/10 (2)

- ► 04/19 - 04/26 (3)

- ► 04/12 - 04/19 (5)

- ► 04/05 - 04/12 (4)

- ► 03/29 - 04/05 (10)

- ► 03/22 - 03/29 (3)

- ► 03/15 - 03/22 (3)

- ► 03/08 - 03/15 (1)

- ► 02/22 - 03/01 (2)

- ► 02/15 - 02/22 (2)

- ► 02/08 - 02/15 (2)

- ► 02/01 - 02/08 (5)

- ► 01/25 - 02/01 (1)

- ► 01/18 - 01/25 (1)

- ► 01/11 - 01/18 (1)

- ► 01/04 - 01/11 (1)

-

►

2014

(139)

- ► 12/07 - 12/14 (1)

- ► 11/30 - 12/07 (4)

- ► 11/16 - 11/23 (1)

- ► 11/09 - 11/16 (2)

- ► 10/05 - 10/12 (1)

- ► 09/28 - 10/05 (1)

- ► 09/21 - 09/28 (1)

- ► 09/14 - 09/21 (1)

- ► 09/07 - 09/14 (4)

- ► 08/31 - 09/07 (3)

- ► 08/24 - 08/31 (1)

- ► 08/10 - 08/17 (4)

- ► 08/03 - 08/10 (3)

- ► 07/27 - 08/03 (3)

- ► 07/20 - 07/27 (2)

- ► 07/13 - 07/20 (2)

- ► 07/06 - 07/13 (3)

- ► 06/22 - 06/29 (2)

- ► 06/08 - 06/15 (1)

- ► 06/01 - 06/08 (1)

- ► 04/27 - 05/04 (4)

- ► 04/20 - 04/27 (1)

- ► 04/13 - 04/20 (3)

- ► 04/06 - 04/13 (1)

- ► 03/30 - 04/06 (3)

- ► 03/23 - 03/30 (1)

- ► 03/16 - 03/23 (4)

- ► 03/09 - 03/16 (2)

- ► 03/02 - 03/09 (2)

- ► 02/23 - 03/02 (6)

- ► 02/16 - 02/23 (7)

- ► 02/09 - 02/16 (10)

- ► 02/02 - 02/09 (13)

- ► 01/26 - 02/02 (6)

- ► 01/19 - 01/26 (2)

- ► 01/12 - 01/19 (14)

- ► 01/05 - 01/12 (19)

-

►

2013

(448)

- ► 12/29 - 01/05 (15)

- ► 12/22 - 12/29 (12)

- ► 12/15 - 12/22 (12)

- ► 12/08 - 12/15 (8)

- ► 12/01 - 12/08 (16)

- ► 11/24 - 12/01 (10)

- ► 11/17 - 11/24 (14)

- ► 11/10 - 11/17 (11)

- ► 11/03 - 11/10 (13)

- ► 10/27 - 11/03 (7)

- ► 10/20 - 10/27 (3)

- ► 10/13 - 10/20 (2)

- ► 10/06 - 10/13 (14)

- ► 09/29 - 10/06 (9)

- ► 09/22 - 09/29 (4)

- ► 09/15 - 09/22 (8)

- ► 09/08 - 09/15 (2)

- ► 08/25 - 09/01 (1)

- ► 08/18 - 08/25 (7)

- ► 08/11 - 08/18 (2)

- ► 08/04 - 08/11 (1)

- ► 07/28 - 08/04 (1)

- ► 07/21 - 07/28 (3)

- ► 07/14 - 07/21 (2)

- ► 07/07 - 07/14 (5)

- ► 06/30 - 07/07 (9)

- ► 06/23 - 06/30 (11)

- ► 06/16 - 06/23 (14)

- ► 06/09 - 06/16 (6)

- ► 06/02 - 06/09 (14)

- ► 05/26 - 06/02 (4)

- ► 05/19 - 05/26 (3)

- ► 05/12 - 05/19 (14)

- ► 05/05 - 05/12 (2)

- ► 04/28 - 05/05 (5)

- ► 04/14 - 04/21 (8)

- ► 04/07 - 04/14 (1)

- ► 03/31 - 04/07 (10)

- ► 03/24 - 03/31 (9)

- ► 03/17 - 03/24 (14)

- ► 03/10 - 03/17 (4)

- ► 03/03 - 03/10 (14)

- ► 02/24 - 03/03 (16)

- ► 02/17 - 02/24 (24)

- ► 02/10 - 02/17 (16)

- ► 02/03 - 02/10 (24)

- ► 01/27 - 02/03 (11)

- ► 01/20 - 01/27 (14)

- ► 01/13 - 01/20 (10)

- ► 01/06 - 01/13 (9)

-

►

2012

(346)

- ► 12/30 - 01/06 (4)

- ► 12/23 - 12/30 (14)

- ► 12/16 - 12/23 (8)

- ► 12/09 - 12/16 (11)

- ► 12/02 - 12/09 (11)

- ► 11/25 - 12/02 (20)

- ► 11/18 - 11/25 (23)

- ► 11/11 - 11/18 (14)

- ► 11/04 - 11/11 (12)

- ► 10/28 - 11/04 (15)

- ► 10/21 - 10/28 (14)

- ► 10/14 - 10/21 (13)

- ► 10/07 - 10/14 (4)

- ► 09/30 - 10/07 (17)

- ► 09/23 - 09/30 (4)

- ► 09/16 - 09/23 (3)

- ► 09/09 - 09/16 (9)

- ► 09/02 - 09/09 (13)

- ► 08/26 - 09/02 (4)

- ► 08/19 - 08/26 (7)

- ► 08/12 - 08/19 (1)

- ► 08/05 - 08/12 (5)

- ► 07/29 - 08/05 (4)

- ► 07/22 - 07/29 (4)

- ► 07/15 - 07/22 (2)

- ► 07/08 - 07/15 (7)

- ► 07/01 - 07/08 (7)

- ► 06/24 - 07/01 (3)

- ► 06/17 - 06/24 (5)

- ► 06/10 - 06/17 (6)

- ► 06/03 - 06/10 (5)

- ► 05/27 - 06/03 (6)

- ► 05/20 - 05/27 (2)

- ► 05/06 - 05/13 (5)

- ► 04/29 - 05/06 (11)

- ► 04/22 - 04/29 (6)

- ► 04/15 - 04/22 (2)

- ► 04/08 - 04/15 (1)

- ► 04/01 - 04/08 (4)

- ► 03/25 - 04/01 (1)

- ► 03/11 - 03/18 (1)

- ► 03/04 - 03/11 (4)

- ► 01/29 - 02/05 (4)

- ► 01/22 - 01/29 (6)

- ► 01/15 - 01/22 (7)

- ► 01/08 - 01/15 (10)

- ► 01/01 - 01/08 (7)

-

►

2011

(1155)

- ► 12/25 - 01/01 (12)

- ► 12/18 - 12/25 (13)

- ► 12/11 - 12/18 (10)

- ► 12/04 - 12/11 (5)

- ► 11/27 - 12/04 (3)

- ► 11/20 - 11/27 (11)

- ► 11/13 - 11/20 (8)

- ► 11/06 - 11/13 (9)

- ► 10/30 - 11/06 (15)

- ► 10/23 - 10/30 (11)

- ► 10/16 - 10/23 (5)

- ► 10/09 - 10/16 (8)

- ► 10/02 - 10/09 (10)

- ► 09/25 - 10/02 (13)

- ► 09/18 - 09/25 (22)

- ► 09/11 - 09/18 (18)

- ► 09/04 - 09/11 (18)

- ► 08/28 - 09/04 (26)

- ► 08/21 - 08/28 (30)

- ► 08/14 - 08/21 (34)

- ► 08/07 - 08/14 (46)

- ► 07/31 - 08/07 (36)

- ► 07/24 - 07/31 (25)

- ► 07/17 - 07/24 (8)

- ► 07/10 - 07/17 (21)

- ► 07/03 - 07/10 (25)

- ► 06/26 - 07/03 (23)

- ► 06/19 - 06/26 (27)

- ► 06/12 - 06/19 (34)

- ► 06/05 - 06/12 (10)

- ► 05/29 - 06/05 (33)

- ► 05/22 - 05/29 (25)

- ► 05/15 - 05/22 (45)

- ► 05/08 - 05/15 (24)

- ► 05/01 - 05/08 (40)

- ► 04/24 - 05/01 (46)

- ► 04/17 - 04/24 (38)

- ► 04/10 - 04/17 (39)

- ► 04/03 - 04/10 (32)

- ► 03/27 - 04/03 (17)

- ► 03/20 - 03/27 (30)

- ► 03/13 - 03/20 (37)

- ► 03/06 - 03/13 (24)

- ► 02/27 - 03/06 (29)

- ► 02/20 - 02/27 (25)

- ► 02/13 - 02/20 (14)

- ► 02/06 - 02/13 (21)

- ► 01/30 - 02/06 (22)

- ► 01/23 - 01/30 (22)

- ► 01/16 - 01/23 (14)

- ► 01/09 - 01/16 (16)

- ► 01/02 - 01/09 (26)

-

▼

2010

(1302)

-

▼

12/26 - 01/02

(40)

- Tight Supplies for Soft Commodities

- It's Heeeere! Greenhouse Gas Regulation Begins!

- Socialism Sure Sucks!

- Survival of the (Least) Fittest

- It's a "Wizard of Oz" World!

- New Intraday 2010 Crude Oil High

- Dollar Bollinger Band Break-Out

- Commodities Rebound to Reach New Records

- Crude Oil Goes Parabolic

- Commodities Beat Stocks, Bonds, Dollar in 2010

- Fresh Economic Crises Dead Ahead in Europe, U.S.

- Venezuela to Devalue AGAIN!

- Worthless Pieces of Paper

- Dollar Tanks, Commodities Rebound

- We're Living a Work of Fiction

- How The Government Hides a Depression

- Reversal signs

- Signs of a Shift?

- Crude Oil Hits the Skids

- But Copper Continues to New Record High

- Sugar Collapses

- Commodities: Signs of a Top?

- Treasuries Rebound on Solid Demand

- Europe Is Going to Get Worse!

- Dollar Butchery

- Mountain West States Begin to See Higher Unemployment

- China to Set Up Trading in Rare Earths

- RE: commodities surge again!

- Poor Treasury Showing Collapses Bond Market

- Baltic Dry Index Dropping Again

- Soybeans Elevate from 1300 to 1400 in One Week!

- Gold, Copper Find Their Footing

- Commodities Surge to New Highs

- Consumer Sentiment, Shiller Home Values Drop

- Copper's Continued Climb to New Record High

- Spec Sell-Off to Come?

- The Real Global Warming Agenda: Global Redistribut...

- The Looming Bond Crisis

- There's a Run on Bond Funds

- Meredith Whitney: Massive Bond Defaults Coming

- ► 12/19 - 12/26 (10)

- ► 12/12 - 12/19 (20)

- ► 12/05 - 12/12 (31)

- ► 11/28 - 12/05 (22)

- ► 11/21 - 11/28 (27)

- ► 11/14 - 11/21 (28)

- ► 11/07 - 11/14 (36)

- ► 10/31 - 11/07 (54)

- ► 10/24 - 10/31 (24)

- ► 10/17 - 10/24 (31)

- ► 10/10 - 10/17 (48)

- ► 10/03 - 10/10 (29)

- ► 09/26 - 10/03 (35)

- ► 09/19 - 09/26 (44)

- ► 09/12 - 09/19 (37)

- ► 09/05 - 09/12 (32)

- ► 08/29 - 09/05 (52)

- ► 08/22 - 08/29 (78)

- ► 08/15 - 08/22 (34)

- ► 08/08 - 08/15 (48)

- ► 08/01 - 08/08 (43)

- ► 07/25 - 08/01 (33)

- ► 07/18 - 07/25 (19)

- ► 07/11 - 07/18 (38)

- ► 07/04 - 07/11 (27)

- ► 06/27 - 07/04 (25)

- ► 06/20 - 06/27 (8)

- ► 06/13 - 06/20 (11)

- ► 06/06 - 06/13 (16)

- ► 05/30 - 06/06 (27)

- ► 05/23 - 05/30 (28)

- ► 05/16 - 05/23 (38)

- ► 05/09 - 05/16 (22)

- ► 05/02 - 05/09 (17)

- ► 04/25 - 05/02 (12)

- ► 04/18 - 04/25 (3)

- ► 04/11 - 04/18 (4)

- ► 04/04 - 04/11 (6)

- ► 03/28 - 04/04 (9)

- ► 03/21 - 03/28 (10)

- ► 03/14 - 03/21 (7)

- ► 03/07 - 03/14 (8)

- ► 02/28 - 03/07 (10)

- ► 02/21 - 02/28 (13)

- ► 02/14 - 02/21 (17)

- ► 02/07 - 02/14 (11)

- ► 01/31 - 02/07 (27)

- ► 01/24 - 01/31 (20)

- ► 01/17 - 01/24 (7)

- ► 01/10 - 01/17 (14)

- ► 01/03 - 01/10 (12)

-

▼

12/26 - 01/02

(40)

-

►

2009

(1809)

- ► 12/27 - 01/03 (32)

- ► 12/20 - 12/27 (15)

- ► 12/13 - 12/20 (22)

- ► 12/06 - 12/13 (16)

- ► 11/29 - 12/06 (17)

- ► 11/22 - 11/29 (36)

- ► 11/15 - 11/22 (29)

- ► 11/08 - 11/15 (11)

- ► 11/01 - 11/08 (22)

- ► 10/25 - 11/01 (40)

- ► 10/18 - 10/25 (21)

- ► 10/11 - 10/18 (26)

- ► 10/04 - 10/11 (16)

- ► 09/27 - 10/04 (26)

- ► 09/20 - 09/27 (26)

- ► 09/13 - 09/20 (25)

- ► 09/06 - 09/13 (25)

- ► 08/30 - 09/06 (35)

- ► 08/23 - 08/30 (35)

- ► 08/16 - 08/23 (35)

- ► 08/09 - 08/16 (16)

- ► 08/02 - 08/09 (37)

- ► 07/26 - 08/02 (35)

- ► 07/19 - 07/26 (39)

- ► 07/12 - 07/19 (47)

- ► 07/05 - 07/12 (58)

- ► 06/28 - 07/05 (34)

- ► 06/21 - 06/28 (34)

- ► 06/14 - 06/21 (32)

- ► 06/07 - 06/14 (34)

- ► 05/31 - 06/07 (31)

- ► 05/24 - 05/31 (50)

- ► 05/17 - 05/24 (60)

- ► 05/10 - 05/17 (45)

- ► 05/03 - 05/10 (24)

- ► 04/26 - 05/03 (26)

- ► 04/19 - 04/26 (36)

- ► 04/12 - 04/19 (51)

- ► 04/05 - 04/12 (49)

- ► 03/29 - 04/05 (37)

- ► 03/22 - 03/29 (89)

- ► 03/15 - 03/22 (61)

- ► 03/08 - 03/15 (40)

- ► 03/01 - 03/08 (56)

- ► 02/22 - 03/01 (36)

- ► 02/15 - 02/22 (48)

- ► 02/08 - 02/15 (48)

- ► 02/01 - 02/08 (36)

- ► 01/25 - 02/01 (29)

- ► 01/18 - 01/25 (28)

- ► 01/11 - 01/18 (34)

- ► 01/04 - 01/11 (19)

-

►

2008

(1439)

- ► 12/28 - 01/04 (5)

- ► 12/21 - 12/28 (18)

- ► 12/14 - 12/21 (64)

- ► 12/07 - 12/14 (50)

- ► 11/30 - 12/07 (41)

- ► 11/23 - 11/30 (42)

- ► 11/16 - 11/23 (4)

- ► 09/14 - 09/21 (32)

- ► 09/07 - 09/14 (26)

- ► 08/31 - 09/07 (28)

- ► 08/24 - 08/31 (13)

- ► 08/17 - 08/24 (39)

- ► 08/10 - 08/17 (37)

- ► 08/03 - 08/10 (53)

- ► 07/27 - 08/03 (35)

- ► 07/20 - 07/27 (29)

- ► 07/13 - 07/20 (45)

- ► 07/06 - 07/13 (35)

- ► 06/29 - 07/06 (17)

- ► 06/22 - 06/29 (17)

- ► 06/15 - 06/22 (30)

- ► 06/08 - 06/15 (29)

- ► 06/01 - 06/08 (38)

- ► 05/25 - 06/01 (24)

- ► 05/18 - 05/25 (35)

- ► 05/11 - 05/18 (25)

- ► 05/04 - 05/11 (24)

- ► 04/27 - 05/04 (44)

- ► 04/20 - 04/27 (23)

- ► 04/13 - 04/20 (31)

- ► 04/06 - 04/13 (52)

- ► 03/30 - 04/06 (44)

- ► 03/23 - 03/30 (41)

- ► 03/16 - 03/23 (31)

- ► 03/09 - 03/16 (49)

- ► 03/02 - 03/09 (36)

- ► 02/24 - 03/02 (47)

- ► 02/17 - 02/24 (34)

- ► 02/10 - 02/17 (36)

- ► 02/03 - 02/10 (31)

- ► 01/27 - 02/03 (27)

- ► 01/20 - 01/27 (28)

- ► 01/13 - 01/20 (25)

- ► 01/06 - 01/13 (25)

-

►

2007

(137)

- ► 12/30 - 01/06 (27)

- ► 12/23 - 12/30 (19)

- ► 12/16 - 12/23 (23)

- ► 12/09 - 12/16 (35)

- ► 12/02 - 12/09 (24)

- ► 11/25 - 12/02 (9)

Recommended Book List

- Analyse Technique et Volatilite (english version here)- Philippe Cahen

- Analyse Technique et Volatilite - Philippe Cahen

- Bollinger on Bollinger Bands - John Bollinger

- Candlesticks Explained - Martin Pring

- Creature from Jekyll Island, The - G. Edward Griffin

- Creature from Jekyll Island, The - G. Edward Griffin

- Disciplined Trader, The: Developing Winning Attitudes - Mark Douglas

- Dynamic Technical Analysis - Philippe Cahen

- Enclyclopedia of Technical Market Indicators, The - Robert Colby

- High Probability Trading - Marcel Link

- Phantom's Gift

- Psychology of Risk, The - Ari Kiev

- The Ascent of Money - Niall Ferguson

- Trading in the Zone - Ari Kiev

- Trading in the Zone - Mark Douglas

- Trading to Win - Ari Kiev

Labels

- . (2)

- "The Buzz" (7)

- 200-day moving average (6)

- 30-year (1)

- accounting standards (3)

- Adam Smith (1)

- ADP (2)

- adults not in workforce (1)

- agriculture (41)

- agriculture ETFs (1)

- alternative exchanges (1)

- Argentina (1)

- Arlan Suderman (1)

- Art Simpson (1)

- asset overvaluation (2)

- atheism (1)

- attitude (1)

- auction rates (1)

- Aussie (10)

- Australia (1)

- Australian Dollar (10)

- Austrian School of Economics (2)

- auto sales (1)

- automated trading (1)

- B2B Index (1)

- backwardation (2)

- bad bank (3)

- bad trades (1)

- bailouts (45)

- baltic dry index (9)

- Bank of International Settlements (1)

- Bank of Japan (6)

- bank runs (1)

- bank stress test (4)

- banking crisis (20)

- banking industry (1)

- bankruptcies (2)

- Bart Chilton (1)

- bear market (4)

- Bear Stearns (2)

- bearish (2)

- behavioral finance (1)

- beige book (1)

- Bernanke (60)

- bias (1)

- bid ask spread (5)

- big business (1)

- Bill Fleckenstein (1)

- BIll Gross (2)

- Bill Hester (1)

- Bill Williams (1)

- Billion Prices Index (2)

- biofuels (5)

- black swan (4)

- blog (1)

- Bob Janjuah (1)

- BOJ (1)

- Bollinger (1)

- Bollinger Bands (28)

- Bollinger Moving Average (5)

- Bollinger Squeeze (14)

- bond bubble (5)

- bond market (14)

- bond vigilantes (22)

- bonds (44)

- bounds and conditions (1)

- Brazil (2)

- brazilian real (2)

- break-out (2)

- Brett Steenbarger (104)

- brief therapy (11)

- British Pound (10)

- brokerages (1)

- bubble (56)

- budget deficit (125)

- bull market (8)

- bullish (1)

- Bureau of Economic Analysis (1)

- Business Conditions Index (1)

- California (3)

- Canadian Dollar (10)

- candlestick pattern (4)

- Cap and Trade (26)

- capacity utilization (3)

- CAPE (1)

- capital expenditures (1)

- capital gains (1)

- capitalism (1)

- carry trade (2)

- Case Shiller (12)

- cash reserves (2)

- Caterpillar (1)

- CBO (3)

- central banking (14)

- CFTC (10)

- Chamber of Commerce (1)

- chaos theory (2)

- character (1)

- chart patterns (2)

- Chicago Mercantile Exchange (3)

- China (61)

- Chris Martenson (3)

- Christine Lagarde (1)

- civil unrest (1)

- clawback (1)

- close (1)

- closing high (1)

- Cloward -Piven (1)

- CME (10)

- coal (2)

- cocoa (15)

- coffee (7)

- coincident indicators (2)

- Colombia (1)

- commercial real estate (6)

- commodities (224)

- commodity indexes (36)

- communism (1)

- Community Reinvestment Act (1)

- competitiveness (1)

- Congress (1)

- consolidation (5)

- consumer confidence (61)

- consumer spending (2)

- contagion (2)

- contango (2)

- contract month (3)

- copper (17)

- corn (352)

- coronavirus (6)

- corporate bonds (3)

- corporate earnings (6)

- correction (2)

- correlation (1)

- COT (1)

- cotton (41)

- counter-party risk (2)

- Covid-19 (4)

- CPI (17)

- creative destruction (1)

- credit (3)

- credit crisis (42)

- credit default swaps (8)

- credit rating (10)

- crop report (5)

- crude oil (443)

- currencies (39)

- currency devaluation (1)

- currency reserves (4)

- currency war (7)

- daily charts (3)

- Dallas Fed Survey (4)

- David Rosenberg (11)

- David Stockman (4)

- David Walker (1)

- day trading (3)

- death cross (2)

- debt (125)

- debt ceiling (7)

- debt crisis (165)

- debt default (26)

- debt deflation (8)

- debt rating (10)

- debt to GDP (5)

- deficits (45)

- definition (1)

- deflation (26)

- democrat party (1)

- depression (21)

- derivatives (6)

- Deutsche Bank (2)

- Dimirtri Medvedev (2)

- discipline (6)

- distribution (2)

- divergence (6)

- dollar (60)

- Doug Kass (6)

- Dow (126)

- downtrend (4)

- drought (1)

- DTA (1)

- DTAFM (1)

- durable goods (19)

- dynamic support and resistance (3)

- dynamic technical analysis (1)

- DZZ (1)

- earnings (7)

- earnings estimates (1)

- earnings season (9)

- ECB (25)

- economic activity (1)

- economic crisis (3)

- economic indicators (4)

- economic outlook (1)

- economic stimulus (27)

- economics (84)

- economists (1)

- economy (358)

- ECRI (16)

- Ecuador (1)

- education (1)

- EIA (1)

- Elliott Wave theory (2)

- EMA (15)

- emerging markets (3)

- eminent domain (1)

- emotions and trading (27)

- Empire State Index (7)

- employment (12)

- energy (24)

- energy independence (12)

- engulfing candlestick pattern (1)

- entitlement spending (4)

- entrepreneurship (1)

- entry (1)

- EPA (2)

- EPS (1)

- equities (22)

- Eric Hovde (2)

- espionage (1)

- ETF (15)

- ethanol (4)

- Euro (79)

- Euro-Dollar Swaps (1)

- Eurobond (1)

- Eurodollar (16)

- Europe (75)

- European Central Bank (8)

- European Union (28)

- execution (1)

- exit (1)

- exiting multiple contracts (1)

- Exponential Moving Average (27)

- factory orders (4)

- fading the market (1)

- failure (1)

- fannie mae (5)

- farm dust (1)

- farm lobby (2)

- farm production (1)

- farms (1)

- FDIC (11)

- fear (2)

- Fed (267)

- Fed Funds (4)

- Fed policy (5)

- Federal Reserve Act (1)

- Federal Reserve Bank (137)

- feeder cattle (4)

- FHA (1)

- fiat money (6)

- fibonacci numbers (3)

- finance reform bill (7)

- financial crisis (9)

- financial markets (9)

- financial sector (2)

- fiscal policy (15)

- Fisherian economics (2)

- fixed income (1)

- floating rate notes (1)

- FOMC (6)

- food (27)

- food inflation (9)

- food prices (6)

- food stamps (1)

- Foreclosure-Gate (2)

- foreclosures (24)

- foreign policy (1)

- foreign stocks (3)

- Forex (7)

- formula (1)

- forward operating earnings (1)

- Founding Fathers (4)

- fracking (1)

- fractals (4)

- freddie mac (5)

- free enterprise (5)

- free markets (1)

- freedom (5)

- front-running (1)

- fuel (3)

- fundamentals (4)

- futures (24)

- futures analysis (1)

- futures and gambling (1)

- G20 (5)

- G7 (1)

- Gary Dorsch (1)

- gasoline (5)

- Gaussian (3)

- GDP (61)

- Geithner (3)

- geopolitics (5)

- George Soros (5)

- George Washington (1)

- Germany (7)

- global warming (14)

- goal-setting (11)

- gold (330)

- Goldman roll (1)

- Goldman Sachs (1)

- Gordon Long (5)

- government policies (136)

- grain in storage (8)

- grains (348)

- great depression (1)

- greed (1)

- greenhouse gases (1)

- Greenspan (4)

- gross output (1)

- GSCI (7)

- Guassian (1)

- handling losses (8)

- hard economic data (1)

- head and shoulders pattern (6)

- head fake (1)

- headlines (1)

- healthcare (1)

- healthcare reform (9)

- hedge funds (5)

- hedging (4)

- high frequency trading (3)

- Hindenburg Omen (7)

- Hoisington Management (3)

- hom (1)

- home sales (14)

- housing (122)

- Hugo Chavez (5)

- Hull (1)

- Hull moving average (3)

- humor (1)

- hunger (1)

- hurricane (5)

- Hussman Funds (1)

- hyperinflation (25)

- IMF (11)

- index funds (1)

- India (1)

- indicators (8)

- industrial equipment sales (2)

- industrial metals (4)

- industrial output (10)

- inflation (204)

- inflection points (3)

- insider trading (1)

- Institute for Supply Management (1)

- interest rates (54)

- International stocks (5)

- inventories (3)

- investing (1)

- investment banking (1)

- Iran (1)

- irrational exuberence (1)

- ISM (21)

- Israel (1)

- Jack Crooks (1)

- Japan (3)

- Jerome Powell (2)

- Jim Rogers (11)

- JK Rowling (1)

- jobless claims (26)

- jobs (154)

- John Adams (2)

- John Hussman (6)

- John Mauldin (45)

- John Maynard Keynes (3)

- John Paulson (1)

- John Taylor (1)

- Jonah Goldberg (1)

- keynesian economics (12)

- KGB King (11)

- Klinger (2)

- Klinger Volume (47)

- Klinger+ATR (14)

- Korea (1)

- Kremlin (9)

- labor force (1)

- labor market (1)

- lagging economic indicators (3)

- lake (1)

- Law (5)

- Leading Economic Indicators (12)

- lean hogs (7)

- leverage (3)

- liberty (2)

- LIBOR (11)

- limit down (1)

- liquidity (11)

- live cattle (11)

- livestock (3)

- loan modifications (1)

- lock limit (63)

- long-term trading (2)

- Loonie (1)

- LTRO (8)

- lumber (4)

- M3 money supply (2)

- MACD (9)

- macroeconomics (4)

- Main Street (1)

- manufacturing (17)

- Marc Faber (3)

- margin (10)

- margin calls (4)

- margin debt (1)

- mark to market accounting (4)

- market (1)

- market conditions (1)

- market interventions (6)

- market manipulation (6)

- market open (1)

- market psychology (1)

- market timing (1)

- market turmoil (2)

- market valuation (6)

- mean reversion (1)

- meats (3)

- media (2)

- media cheer-leading (1)

- melt up (1)

- Meredith Whitney (3)

- mergers and acquisitions (1)

- metals (2)

- methodology (2)

- Mexican Peso (2)

- Mexico (1)

- Michael Pento (3)

- midcap stocks (1)

- Middle East (1)

- milk (3)

- Minsky Melt-Up (1)

- misery index (2)

- Mish Shedlock (5)

- momentum (2)

- monetary policy (45)

- monetization of the Debt (8)

- month-end volatility (1)

- moral hazard (1)

- mortgage crisis (39)

- mortgages (1)

- moving averages (27)

- municipal bonds (4)

- NASDAQ (4)

- Nassim Taleb (2)

- national debt (8)

- natural gas (69)

- NBER (2)

- negative interest rates (2)

- net interest margin (1)

- new closing high (8)

- new home sales (9)

- new record high (106)

- new record low (20)

- New World Order (1)

- New Zealand Dollar (1)

- news (6)

- NFP (11)

- Niall Ferguson (2)

- nikkei (1)

- NIRP (2)

- Nouriel Roubini (5)

- Novak Djokovic (1)

- NYMEX (2)

- oats (3)

- Obama (61)

- Obamacare (2)

- OPEC (4)

- open (1)

- Open Interest (2)

- Open Market Operations (4)

- Operation Twist (1)

- opinion (1)

- opportunity cost (2)

- orange juice (3)

- order in charts (1)

- overbought (1)

- P/E ratios (2)

- palm oil (1)

- parallels (6)

- participation rate (2)

- Paul Krugman (2)

- pension funds (13)

- perchlorate (1)

- personal development (2)

- personal income (7)

- Peter Tchir (1)

- Phantom of the Pits (16)

- Phantom's Gift (11)

- Philippe Cahen (4)

- Philly Fed survey (4)

- platinum (3)

- Plunge Protection Team (1)

- PMI (13)

- politics (3)

- POMO (11)

- Ponzi scheme (1)

- pork bellies (1)

- poultry (1)

- power (1)

- PPI (22)

- prayer (1)

- precious metals (10)

- price controls (2)

- price-earnings ratios (4)

- prices (2)

- primary dealers (1)

- principles (1)

- productivity (3)

- profit-taking (2)

- profits (6)

- progressivism (1)

- propaganda (1)

- Proshares (1)

- QE (1)

- quant trading (2)

- quantitative easing (94)

- quotes (57)

- rally (6)

- rare earth minerals (3)

- re-hypothecation (1)

- real estate (2)

- real estate ETF (2)

- recession (27)

- record-keeping (1)

- recovery (5)

- redistribution of wealth (1)

- relief rally (1)

- renewable energy (2)

- renminbi yuan (8)

- repetition (1)

- resistance (2)

- retail (18)

- retail investors (2)

- retail sales (4)

- retirement (2)

- retracement (3)

- returns (1)

- reverse repos (1)

- rice (19)

- Richard Russell (4)

- Richmond Fed (2)

- Rick Santelli (1)

- riots (1)

- risk (13)

- riverbank (1)

- Robert Long (1)

- Robert Prector (1)

- Rogers TRAKRS (2)

- ROI (1)

- ruble (5)

- rule 48 (2)

- rule of law (1)

- Rules (2)

- Russell 2000 (1)

- Russia (33)

- S P 500 (1)

- S&P 500 (13)

- safe haven (1)

- SandP 400 Mid-Cap (2)

- Sarah Palin (1)

- saving (2)

- Schwarzenegger (1)

- SDRs (1)

- seasonal trading (19)

- SEC (4)

- self-coaching (1)

- self-talk (1)

- sell-off (3)

- sentiment (7)

- sequester (1)

- services PMI (1)

- session (1)

- shadow banking (1)

- shipping (2)

- short-selling (3)

- Silver (36)

- simple moving average (5)

- small business (6)

- small cap stocks (4)

- smart money (2)

- SNAP (1)

- social security (11)

- socialism (13)

- soft economic data (1)

- softs (8)

- solution focus (1)

- South African Rand (1)

- sovereign debt (71)

- soybean meal (4)

- soybean oil (6)

- soybeans (442)

- SP 500 (97)

- special drawing rights (1)

- speculation (40)

- SPR (2)

- spread trading (2)

- spreads (1)

- stagflation (8)

- statistics (1)

- steel (1)

- Stephen Roach (3)

- stochastic (4)

- stock futures (2)

- stock indexes (569)

- stock market (657)

- stock yields (1)

- stocks (19)

- success (19)

- sugar (30)

- support and resistance (6)

- supreme court (1)

- swine flu (5)

- swing trading (7)

- swiss franc (3)

- T1 (1)

- tail risk (1)

- TALF (1)

- TARP (13)

- taxation (21)

- technical analysis (7)

- technology (1)

- TED spread (4)

- thoughts (2)

- TIC data (2)

- tick charts (13)

- time intervals (8)

- TIPS (1)

- Todd Harrison (2)

- trade (5)

- trade deficit (4)

- trade gap (1)

- trade war (10)

- trades (11)

- Tradestation (5)

- trading (12)

- trading as a profession (51)

- trading as addiction (1)

- trading dynamically (1)

- trading hours (1)

- trading journal (2)

- trading methodology (22)

- trading performance (1)

- trading philosophy (19)

- trading profits (1)

- trading psychology (78)

- trading range (2)

- trading strategy (1)

- trading teams (1)

- trading thoughts (1)

- trading volume (11)

- training (1)

- treasuries (297)

- trend (12)

- trend analysis (1)

- Trichet (1)

- triptych (4)

- trucking (1)

- Trump (1)

- truth (1)

- tyranny (1)

- U.S. Congress (2)

- U.S. Constitution (2)

- UK (1)

- unemployment (202)

- United States (1)

- US Dollar (378)

- US Treasury Dept (2)

- USD (375)

- USDA (11)

- values (1)

- Venezuela (3)

- Visualization (2)

- VIX (5)

- Vladimir Putin (9)

- volatility (31)

- Volatiliy (1)

- Volcker (2)

- volume (21)

- Volume-weighted average price (2)

- Von Mises (1)

- VWAP (2)

- Wall Street (16)

- war (3)

- Warren Buffett (5)

- wealth (4)

- weather (1)

- Weighted Moving Average (2)

- wheat (245)

- wind energy (1)

- Working Group on the Financial Markets (1)

- World Bank (2)

- world economy (47)

- Yen (16)

- yield curve (12)

- ZEW (1)

Disclaimer:

This is a personal, not-for-profit web site, reflecting the opinions of its author. It is intended to be a personal journal of private trading and insights into the author's experience and trading methodologies. It is not a production of the author's employer or his business, nor is it affiliated with any NASD broker/dealer. Statements on this site do not represent the views or policies of anyone other than the author and/or invited guest authors. The information on this site is provided for discussion and recording purposes only, and are not investment or trading recommendations. Under no circumstances does this information represent a recommendation to buy or sell securities or any other financial instruments.

This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed as to the accuracy, and is not to be construed as representation. The risk of trading futures and options can be substantial. Each investor must consider whether this is a suitable investment. Past performance is not indicative of future results. All images on this site are presumed to be in the public domain. Please advise us if this is not the case for removal.

This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed as to the accuracy, and is not to be construed as representation. The risk of trading futures and options can be substantial. Each investor must consider whether this is a suitable investment. Past performance is not indicative of future results. All images on this site are presumed to be in the public domain. Please advise us if this is not the case for removal.