With continuing weakness in the U.S. job market, Ben Bernanke confirmed last week what investors have been pricing into the markets for months - the Federal Reserve will launch a new program of "quantitative easing" (QE), probably as early as November. Analysts expect that the Fed could purchase $1 trillion or more of U.S. Treasury securities, flooding the financial system with additional bank reserves.

A second round of QE presumably has two operating targets. One is to directly lower long-term interest rates, possibly driving real interest rates to negative levels in hopes of stimulating loan demand and discouraging saving. The other is to directly increase the supply of lendable reserves in the banking system. The hope is that these changes will advance the ultimate objective of increasing U.S. output and employment.

Economics is essentially the study of how scarce resources are allocated. To that end, one of the main analytical tools used by economists is "constrained optimization" - we study how consumers maximize their welfare subject to budget constraints, how investors maximize their expected returns subject to a various levels of risk, how companies minimize their costs at various levels of output, and so forth. To assess whether QE is likely to achieve its intended objectives, it would be helpful for the Fed's governors to remember the first rule of constrained optimization - relaxing a constraint only improves an outcome if the constraint is binding. In other words, removing a barrier allows you to move forward only if that particular barrier is the one that is holding you back.

On the demand side, it is apparent that the U.S. is presently in something of a liquidity trap. Interest rates are already low enough that variations in their level are not the primary drivers of loan demand. Loans are desirable when businesses see opportunities to make profitable investments that will allow the repayment of the loan, without too much uncertainty. Similarly, loans are desirable when consumers see opportunities to shift part of their lifetime consumption stream toward the present (or to acquire durable items such as autos or homes which provide an ongoing stream of benefits), and where they also believe that their future income will be sufficient to service the debt.

Broadly speaking, neither businesses nor consumers are finding attractive borrowing opportunities, or have sufficient confidence that they will be able to repay the loans and end up better off. A few years ago, individuals did have the confidence to shift a portion of their lifetime consumption to the present because the values of their homes and other financial assets gave them the impression that their future consumption needs were well covered. Lax lending standards created a feedback loop of soaring mortgage debt, consumer debt, home values, and consumption. At the corporate level, the return on equity capital was progressively boosted by taking on increasing leverage, which eventually reached catastrophic levels in the financial sector. The subsequent collapse forced the recognition among consumers and businesses that their ability to service debt, based on expectations about the future value of their assets, was not as strong as they previously believed.

Instead, businesses and consumers now see their debt burdens as too high in relation to their prospective income. The result is a continuing effort to deleverage, in order to improve their long-term financial stability. This is rational behavior. Does the Fed actually believe that the act of reducing interest rates from already low levels, or driving real interest rates to negative levels, will provoke consumers and businesses from acting in their best interests to improve their balance sheets?

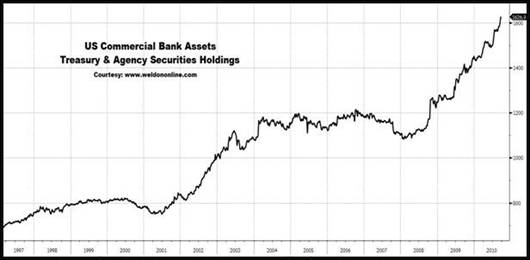

On the supply side, the objective of quantitative easing is to increase the amount of lendable reserves in the banking system. Again, however, this is not a constraint that is binding. The liquidity to make new loans is already present. U.S. commercial banks already hold $1.066 trillion of reserves with the Fed, and another $1.626 trillion in Treasury and agency securities (thanks to Greg Weldon for the graph below). Many banks may very well be insolvent in the sense that their liabilities would exceed their assets if the remaining assets were booked at levels properly reflecting their fair market value, but bank liquidity is not a binding constraint on the U.S. economy here.

Meanwhile, the corporate sector is already holding large precautionary balances in cash and marketable securities. Yet aside from predictable upgrades of information technology, the use of this liquidity has been limited to acquisitions, which simply transfer the ownership of existing assets, do nothing to increase output, and may even result in reduced employment.

In short, further attempts at QE are likely to have little effect in provoking increased economic activity or employment. This is not because QE would fail to affect interest rates and reserves. Rather, this policy will be ineffective because it will relax constraints that are not binding in the first place.

Opacity masquerading as solvency

One of the arguments for quantitative easing is the notion that the Fed's purchase of $1.5 trillion of Fannie Mae and Freddie Mac debt somehow "pulled the U.S. economy back from the abyss" of a Depression. But a closer examination of the past 19 months suggests that a much more specific mechanism - suspension of truthful disclosure - was actually the key element. Unfortunately, the benefits of this suspension are also impermanent, because the underlying solvency problems have been left unaddressed.

In early 2009, many major U.S. banks were faced with clear capital shortfalls that effectively rendered them insolvent - their liabilities exceeded their assets. Instead of restructuring this debt, or dealing with the problem in a sustainable way, the Financial Accounting Standards Board, responding to Congressional pressure, suspended "mark to market rules" and allowed major U.S. financials to use "substantial discretion" in valuing their assets. Since it was neither possible nor credible for banks to immediately write up those assets overnight, loans from the Troubled Asset Relief Program (TARP) were critical in bridging the immediate shortfall. Over the following quarters, banks substantially wrote up their assets, and they issued a large volume of additional stock. The new issuance created a moderate but legitimate improvement in the financial position of these banks, but the asset writeups appear to be inconsistent with the growing volume of delinquent and unforeclosed homes, and the deteriorating debt-service performance of commercial mortgage-backed securities. Presently, the U.S. financial sector is essentially opacity masquerading as solvency.

As Meredith Whitney has observed, the "recovery" of the U.S. financial sector has been a two stage process - massive writeups of troubled assets on balance sheets, followed by large reductions in loan loss reserves on income statements. This activity has not only driven the improvement in operating earnings reported by banks, but has been one of the primary contributors to the recovery in the aggregate earnings of the S&P 500 Index. It is not a process that should be extrapolated.

As for Fed purchases of U.S. agency securities, there is little doubt that these actions allowed the U.S. housing market to function, albeit at a weak level, over the past 18 months. But this cannot be credited to anything inherent in quantitative easing. Rather, the Fed did something that neither the American public, nor the U.S. Congress were willing to do democratically: it essentially guaranteed Fannie Mae and Freddie Mac debt by taking massive amounts onto its own balance sheet. This was later followed up by more explicit 3-year guarantee by the Treasury (through the end of 2012).

Think of it this way. If Fannie and Freddie had already been explicitly protected by the full faith and credit of the U.S. government, their securities would have been indistinguishable from U.S. Treasury securities, and housing activity through Fannie and Freddie would have proceeded without any action by the Fed. It wasn't quantitative easing that helped the housing market. It was the Fed's willingness to put the U.S. public on the line for any losses sustained by these two insolvent financial institutions.

By purchasing $1.5 trillion in Fannie Mae and Freddie Mac obligations, the Federal Reserve has placed U.S. taxpayers in the position of absorbing whatever additional losses will come on two-thirds of the nation's mortgages. Prior to the Fed's actions, the bondholders of these institutions had no right to the full faith and credit of the U.S. government, but the Fed's massive purchases of this debt are now effectively irreversible without such a guarantee. There appears to be no way for the Fed to extricate itself from this position without provoking massive economic dislocations, except through continued Treasury guarantees to make this agency debt whole so that private market participants will buy it back. By making that "monetary policy" decision, the Fed has actually forced an act of fiscal policy.

Risk without benefit

Despite the probable lack of measureable benefits, further QE poses significant risks. It has already triggered a steep decline in the exchange value of the U.S. dollar, and threatens a destabilization of international economic activity, a loss of confidence, and the creation of a "boom-bust" cycle threatening to choke off any economic recovery that does emerge.

With regard to the U.S. dollar, market expectations of QE have provoked a "jump depreciation" of the greenback in recent months, neatly following the mechanism that the late MIT economist Rudiger Dornbusch described as "exchange rate overshooting" (see the August 23 market comment Why Quantitative Easing is Likely to Trigger a Collapse of the U.S. Dollar). Specifically, the expectation of a sustained period of lower U.S. interest rates, relative to other countries, requires an abrupt depreciation of the U.S. dollar by an amount large enough to set up expectations of a future appreciation. As a crude example, if the Fed suddenly introduces a policy that is expected to depress U.S. long-term interest rates by 1% for a period of 10 years, an immediate 10% depreciation of the U.S. dollar is required in order to preserve equilibrium in the international capital markets. Following the depreciation, international investors expect a 1% annual appreciation in the dollar to compensate for the 1% loss of interest. The plunging U.S. dollar and soaring price of gold in recent weeks are reflections of this dynamic.

Unfortunately, the likely economic impact of this rapid depreciation is not benign. The Fed might like to believe that a cheaper dollar will improve trade by increasing U.S. exports and reducing imports. However, over the past two decades, and particularly in recent years, U.S. imports have been much more elastic in response to fluctuations in the U.S. dollar than exports have been. This suggests that provoking further dollar depreciation is likely to have negative effects on the global economy, owing to a shift away from imports, but with few positive effects for U.S. economic activity. Indeed, a further depreciation would unnecessarily create a negative wealth effect for U.S. consumers facing higher prices for imported goods and services. Any improvement in the trade deficit would be largely offset by downward pressure on U.S. consumption.

As a side note, some observers have suggested that QE represents nothing more than "printing money." While this might be accurate if the Fed never reverses the transactions, the most useful way to think about QE, in my view, is as an attempt to directly lower interest rates by purchasing Treasury securities. This interest rate effect - not any major inflationary outcome - is the cause of the dollar depreciation we are observing here. There is little doubt that the effect of large continuing fiscal deficits is long-run inflationary, but as I've noted repeatedly over the years, there is little correlation between inflation and temporary - even large - variations in the monetary base. Inflation is ultimately a fiscal phenomenon born of unproductive spending, regardless of how that spending is financed.

Dirty Ben

In the movie Dirty Harry, Clint Eastwood growls his famous line "I know what you're thinking. 'Did he fire six shots, or only five?' Well, to tell you the truth, in all this excitement I kind of lost track myself... You've gotta ask yourself one question. Do I feel lucky? Well, do ya punk?"

Over the past two years, the Fed has emptied what has largely turned out to be a chamber of blanks. Its remaining credibility lies in the belief by the public that Bernanke still has a live round left to fire. Once the Fed engages in QE, a failure of appreciable improvement in U.S. employment and economic activity would result in a substantial loss of public confidence. The Fed would be wise to save whatever ammunition it has left for a crisis point when the U.S. public is in dire need of confidence.

Unwinding QE

One critical question deserves far more attention. After the Fed engages in another round of QE, how will it unwind that position? The current enthusiasm about QE seems much like the enthusiasm of a ten-year-old child about to launch over a plywood ramp on a bicycle. Once the wheels are airborne, it will be a bit too late to ask "now what?"

At present, heavy purchases of Treasury debt would be easily accomplished by the Federal Reserve. But once the Fed has quadrupled or quintupled the U.S. monetary base from its level of three years ago, how will it reverse its position? Japan was able to successfully reverse its program of QE several years ago without much impact on yields, but unlike the U.S., it had the luxury of an extremely high savings rate. With nearly 95% of its debt held domestically, Japan had no need to resort to foreign capital. In contrast, over half of the U.S. national debt is held by other countries. Without a deep pool of domestic savings, and with no repurchase agreements in place, the Federal Reserve will eventually have to entice domestic and foreign investors to buy the Treasury securities back, pressuring interest rates higher, and virtually ensuring a capital loss.

It is unlikely that QE will result in a significantly greater use of existing slack capacity and labor in the U.S. economy. But several years from now, as the U.S. economy recovers (no thanks to the Fed, but simply by the emergence of new technologies and markets through innovation), the Fed will have no easy choices. Attempting to sell massive amounts of debt into an expanding economy will risk pressuring interest rates higher and choking off the recovery, while paying interest on reserves to discourage banks from lending them will ultimately require the Fed to pay banks more than the yield on comparable Treasury securities, in order to cover the opportunity cost of keeping the reserves idle.

Commodity Hoarding

An additional fruit of careless, non-economic thinking on behalf of the Fed is the idea of announcing an increase in the Fed's informal inflation target, in order to reduce expectations regarding real interest rates. The theory here - undoubtedly fished out of a Cracker Jack box - is that lower real interest rates will result in greater eagerness to spend cash balances. Unfortunately, this belief is simply not supported by historical evidence. If the Fed should know anything, it should know that reductions in nominal interest rates result in a lowering of monetary velocity, while reductions in real interest rates result in a lowering of the velocity of commodities (commonly known as "hoarding").

Look across history both in the U.S. and internationally, and what you'll find is that suppressed real interest rates are not correlated with an acceleration of real economic activity, but rather with the hoarding of commodities. Importantly, when people hoard, they generally hoard items that aren't subject to depreciation, technological improvement, or other forms of obsolescence. Look at the prices of the objects that are rising in price at present - gold, silver, oil - and you will see this dynamic in action. That said, investors should not extrapolate these advances indefinitely, because all of these commodity prices have moved up in anticipation of Fed action, and now rely on massive and sustained quantitative easing. They do not represent low risk investment opportunities at present, elevated prices.

Better policy options are available on the fiscal menu. Historically, international credit crises have invariably been followed by multi-year periods of deleveraging, but measures can be taken to smooth the adjustment. The key is to focus on the economic constraints that are binding. Presently, these relate to high private debt burdens, uncertainty about income, weak aggregate demand, and the reluctance by U.S. businesses to launch new projects. Appropriate fiscal responses include extending unemployment benefits, ensuring multi-year predictability of tax policy, expanding productive forms of spending such as public infrastructure, supporting public research activity through mechanisms such as the National Institute of Health, increasing administrative efforts to restructure debt through writedowns and debt-equity swaps, abandoning policies that protect reckless lenders from taking losses, and expanding incentives and tax credits for private capital investment, research and development.

Meanwhile, the best course for the Federal Reserve is to identify specific constraints within the U.S. banking system that create barriers to sound lending, and to formulate specific policies to relieve those constraints. Throwing a trillion U.S. dollars against the wall to see what sticks is not sound monetary policy. By pursuing a policy that relaxes constraints that are not even binding, depresses the U.S. dollar, threatens to destabilize international economic activity, encourages a "boom-bust" cycle, provokes commodity hoarding, and pops off the Fed's last round of ammunition absent an immediate crisis, the Fed threatens to damage not only the U.S. economy, but its own credibility.

Market Climate

Reduce risk.

Presently, a wide range of risky assets are priced in a way that requires perfection. Corporate bond yields are barely above 3%, while our estimates for 5-7 year total returns for the S&P 500 hover around zero. Even our precious metals models, which with few exceptions have been constructive for nearly a decade, shifted to a "high risk" condition last week.

Presently, a wide range of risky assets are priced in a way that requires perfection. Corporate bond yields are barely above 3%, while our estimates for 5-7 year total returns for the S&P 500 hover around zero. Even our precious metals models, which with few exceptions have been constructive for nearly a decade, shifted to a "high risk" condition last week.

Demand for risky assets has not been driven by the prospects for unusually high returns. Rather, investors feel "forced" to take risk despite elevated valuations, largely thanks to Federal Reserve action. The Fed has provoked risk-taking by driving down competing Treasury yields to levels that give investors no apparent option but to chase risky assets. But now that valuations are elevated and prospective long-term returns are compressed, the only way for this situation to be sustained is for investors to remain willing to accept low long-term returns indefinitely.

For example, a 10-year Treasury yield of 2.4% may seem appealing relative to near-zero money market yields, but this assumes that the yield will remain fixed over the life of the bond. Unfortunately, this is not a stable equilibrium. Even a small 30 basis point increase in the yield would result in a capital loss that wipes out that entire 2.4% yield differential. The same is true for stocks here. At a 1.97% dividend yield on the S&P 500, we estimate the probable total returns for the coming 5, 7 and 10 year periods at -3.7%, -0.3%, and 2.6% annually. Our earnings-based methods are not quite as muted, but also suggest 10-year returns of less than 5% annually. Now, a 10-year return in the range of 2.6% to 5% might seem "attractive" relative to a 2.4% yield on a similar maturity Treasury bond, but this assumes a steady state, and ignores the fact that massive price declines are required to induce fairly small increases in yield here. [A 25% price decline would be required to boost the S&P 500 yield from 1.97% to just 2.65% - the yield that prevailed at the 1929, 1972 and 1987 peaks, and was never observed on a sustained basis until the mid-1990's bubble].

As a sidenote, because of the way that S&P calculates the index divisor, both the level and growth rate of S&P 500 dividends already take account of share repurchases, as I observed in the April 30, 2007 Market Comment, Double Counting. Re-reading that comment is encouraged because the situation that investors faced then was almost identical to what we observe today.

The riskier the asset, the more yields have been compressed and valuations have been elevated, compared with historical norms. This tendency to "reach for yield" is exactly what we observed in 2007, and is essentially what produced the supply of funds that financed the housing bubble. The behavior of the Federal Reserve in creating this situation has been reckless, and will again be predictably devastating for investors. Long-term economic prosperity is created by carefully allocating savings to productive investments that increase the output of goods and services that meet the needs of consumers, and whose production generates the income required to purchase that output. Everything else is bubble chasing.

My impression is that much or all of the potential upside of quantitative easing is already fully reflected in stock, bond and commodities markets. Investors now rely not only on QE itself, but also on its success. This is a dangerous place to be. The Strategic Growth Fund is tightly hedged, with a staggered strike position that provides additional downside protection for our holdings. The Strategic International Equity Fund is largely but not completely hedged against local stock price fluctuations, owing to the fact that valuations and market conditions are not uniformly as negative abroad as domestically. We did reduce our exposure to foreign currency fluctuations last week on further dollar weakness. While the dollar may decline further, our view again is that much of the effect of quantitative easing on the financial markets is already priced in.