The Financial Times recently reported on the Fed’s latest exit strategy to eventually contain the inflation zombie:

During the crisis, the Fed created roughly $800bn of additional bank reserves to finance asset purchases and loans. This total is likely to rise in the coming months as the central bank completes its asset purchases and the Treasury unwinds financing it provided to the Fed. Fed officials think they could raise interest rates even with this excess supply of reserves by offering to pay banks to deposit their surplus funds with it rather than lend them out. However, they also want to use reverse repos in tandem to soak up some of the excess reserves. Policymakers call this a “belt and braces approach”. [The latter, clearly a nod to the great Gekko.]

Tyler Durden touched on this last Thursday, and we will expand upon it here as it is particularly relevant to our ongoing theory that it is the proceeds from permanent open market operations (POMOs) and their close cousins that are driving equities. Though this may be received wisdom to Zero Hedge readers, the Fed has done us the favor of providing additional evidence through the FT story. A bit of background, as we are new contributors to this forum:

Tyler Durden touched on this last Thursday, and we will expand upon it here as it is particularly relevant to our ongoing theory that it is the proceeds from permanent open market operations (POMOs) and their close cousins that are driving equities. Though this may be received wisdom to Zero Hedge readers, the Fed has done us the favor of providing additional evidence through the FT story. A bit of background, as we are new contributors to this forum:Money Supply: Based on our previous research on the effects of swings in M2 non-seasonally adjusted money supply (M2) on the stock market, we were a bit surprised in July 09 by the resiliency of the rally, which continued in the face of such a dramatic contraction in M2. The dismal Durable Goods report from last Friday confirms that the capital goods sector is still under significant pressure as a result of a lack of money in the general economy. With banks not lending to normal businesses and consumer credit contracting equally as violently, what is the basis for this rally and from where does the never-ending flow of equities juice flow?

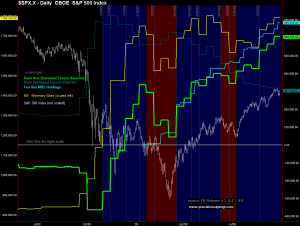

Bank Non-Borrowed Excess Reserves: The Fed statistic that most closely correlates with the 2009 equities run-up appears to be bank non-borrowed excess reserves (bank NBER), which is a component of the monetary base (M0). As explained by the Fed, bank NBER is simply total bank excess reserves minus bank borrowed excess reserves (bank BER). This resulted in bank NBER going negative throughout much of 2008 because banks acquired most of their excess reserves through participation in Fed lending programs. As the Fed has wound down these programs in 2009, bank BER has steadily declined and has been a drag on M0. Concurrently, though, bank NBER has advanced since late March 09 with only one brief material pause in June, and reflects those excess reserves that need not be repaid as part of any Fed lending program. The Fed purchases of MBS, Agency and Treasury securities netted $990 trillion since March 09. The distinction between borrowed and non-borrowed excess reserves is critical because the latter would be ideally suited for leveraging and lending out to hedge funds and the like to “invest” in the high beta stocks that have led the rally.

The primary conclusion is simple - the stock juice flows from steadily increasing Bank NBER, which is hidden to even astute observers that focus on only M0 or M2. Though we previously found no historical correlation between M0 (or its constituent components) and the stock market, we have witnessed an historically unprecedented set of circumstances. Now that the Fed has become the world’s largest hedge fund, we are prepared to accept unorthodox conclusions.

So why not inflate both equities and the general economy simultaneously? It was most likely a race against time. The administration and Fed needed to replace the incredible evaporation of wealth that occurred in late 2008/early 2009 to quell the voting and investing masses. They could not reflate the entire economy this quickly without jeopardizing their ability to borrow cheaply and restart the housing bubble. To keep long term yields low, they reflated the stock market only, with the hope that the general economy would eventually catch up in 2010 and be able to sustain the stock market gains. The problem with rising yields has not been solved, but was postponed.

As we noted in previous research, we are toward the end of a seasonal drain on M2. Once over the October hump, it should be easier for the holiday season to carry the market into March 2010, especially with the help of another $834 billion in MBS and Agency POMO into next March (not to mention the possible Treasury SFP wind-down effect to the tune of $114 to 185 billion). The Fed must be perfect, however, as any new panic will quickly feed on itself and likely lead to another mass exodus from equities. This is quite simply because currently, there is absolutely nothing else to back up this rally in the general economy if the Fed funny money cannot do its trick.

Back to Money Market Funds: If bank NBER is materially tied up in equities, then the Fed cannot drain from this source to mitigate inflation, or it risks the resulting cascade of sell orders that accompany the typical panic. According to the FT article:

The obvious counterparties for reverse repo deals are the Wall Street primary dealers. However, the Fed thinks they would only have balance sheet capacity to refinance about $100bn of assets. By contrast, the money-market funds have $2,500bn in assets, which means they could plausibly refinance as much as $500bn in Fed assets. Officials think there would be appetite on the part of the funds, which are under pressure [at gunpoint] from regulators and investors to stick to low-risk liquid investments.The Fed Helps Build Our Case: As of September 17 09, bank NBER had increased by $563 billion since the March 09 rally began. With M2 net flat during this period, the $563 billion has not made its way into the general economy by any stretch. Perhaps it is sitting idle; however, the Fed says only $100 billion would be available from primary dealers in the future? As the vast bulk of bank NBER is concentrated in primary dealers, this begs the obvious question of what will be tying up the remaining $463 billion (and we are not including the expected increases in bank NBER into next March, which could double this amount)? Given a conservative lending leverage ratio of 10 to 1, there is potentially $4.63 trillion already sloshing around. Even if we are much more conservative, given the roughly $2 trillion increase in the US stock market since Mar 09, it is not only easily conceivable, but probable, that a substantial portion was courtesy of the Fed ATM machine.

As Gekko closed his famous speech in Wall Street, “Greed – you mark my words – will save Teldar, and that other malfunctioning corporation, the U.S.A.” While we have focused here only on coercive greed, it will be interesting nonetheless to see how this works out.