Investing for the Fall of the American Empire. Adrian Day of Adrian Day Asset Management says that you should be restructuring your portfolio to reflect the ongoing economic decline of the West and the rise of the East. The US is now in a period that historically parallels Great Britain at the end of WWII, when a pound cost $5, on its way to $1, some 37 years later.

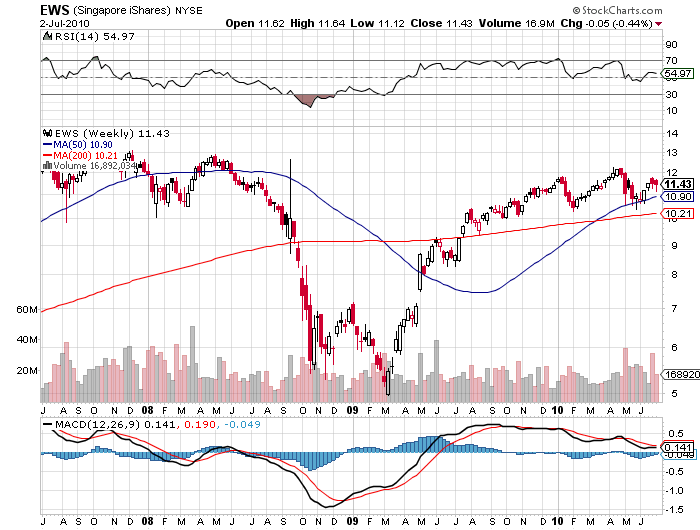

While we are seeing some dollar strength now, this is only a fleeting move in a secular bear market (UDN). Central banks have cut their holdings of the greenback from 70% to 65%, and we could be on our way to 50% or lower. They no longer wish to hold such a heavy weighting of the currency of a country with such a large and worsening structural deficit. This will not be achieved through some great cataclysmic sell off, but a slow and steady diversion of new money into other assets. Adrian especially likes the Singaporean and Hong Kong dollars and the Chinese Yuan (CYB). Ownership of Canadian and Australian dollars, and gold, is rising. He is not a fan of the yen or the euro.

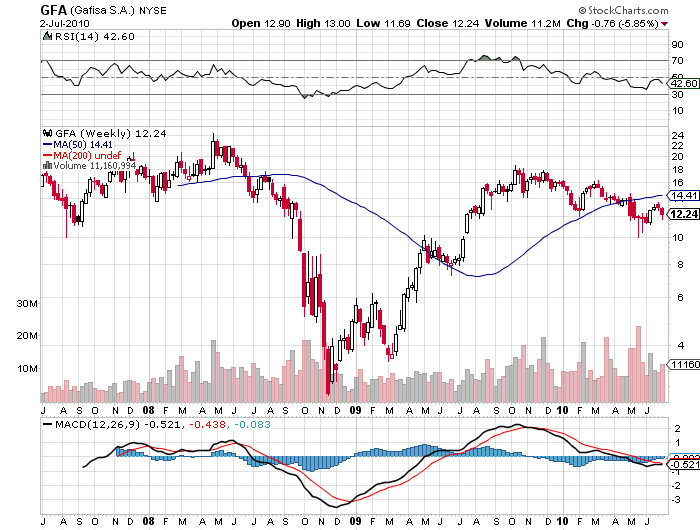

Day is extremely cautious about global stock markets for the time being, but likes emerging markets long term, which will be driven by a rising middle class in the decades to come. Brazil (EWZ) is a top choice, with vast improvements in governance since the bad old days of the eighties, and one of the world’s strongest currencies. He’s out now, awaiting an election that could bring a leftist tilt. He likes real estate mortgage lender Gafisa (GFE), in which Chicago mogul San Zell is the largest investor (click here for more depth ). Adrian clearly adores Singapore (EWS), where companies have believable accounting and super strong balance sheets. Day has nothing in Africa or Eastern Europe.

Adrian is also a big gold bull (GLD), as it now is a defensive holding that does well in every economic scenario. He doesn’t see the retail rush to buy the barbaric relic as a fiat currency replacement any time soon. And then there’s the central bank bidding war. Ben Bernanke and Alan Greenspan are in denial, still don’t understand the Fed’s role in creating the credit bubble, and until they do, investors have no reason to trust in paper currencies.

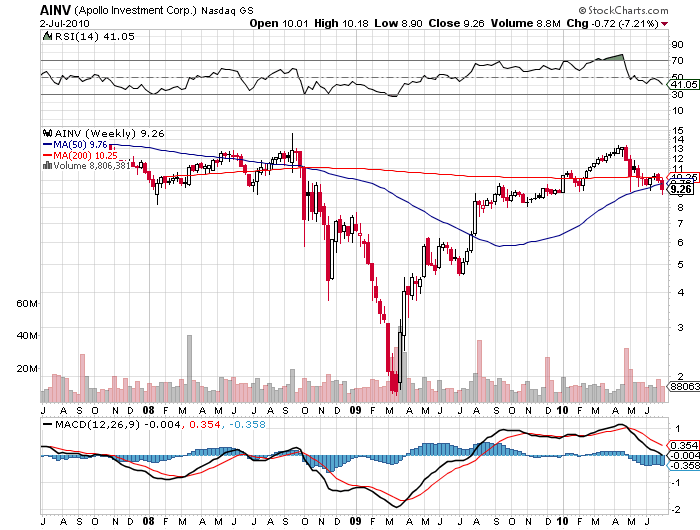

The cerebral Englishman wants to buy oil and gas during the traditional summer weakness, as well as commodity producers. He worships Freeport McMoRan (FCX), the top copper miner, as one of the best managed companies in the world. He is bullish on food (CORN), ags like Potash (POT), and water (PHO) (click here for my piece on H2O). He also likes business development companies such as Apollo Investments (AINV) and Ares Capital (ARCC).

After getting a degree from the prestigious London School of Economics, Adrian devoted a lifetime to uncovering undervalued investment opportunities around the world. Today Adrian runs his own money management firm which focuses on global diversification for institutional clients. He is about to release a book entitled Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks. You can learn more about Adrian’s firm by visiting his site at http://www.adriandayassetmanagement.com/ .

To listen to my interview with Adrian on Hedge Fund Radio in full, please click on the “PLAY” arrow above.