from WSJ:

NEW YORK—A scarcity of commodities such as cotton, sugar and coffee that propelled prices to historic highs late in 2010 is expected to continue into 2011, and it could mean more prices increases for consumers.

Cotton, sugar and coffee are seen remaining in recent high price ranges as supplies remain low.

Cotton broke a post-Civil War record in December, as supplies from top producers failed to keep up with demand, particularly China's voracious appetite for the fiber. Cotton futures gained 91.5% for the year; the March contract closed 2010 on the InterContinental Exchange at $1.4481 a pound on Friday.

Saturday, January 1, 2011

Tight Supplies for Soft Commodities

It's Heeeere! Greenhouse Gas Regulation Begins!

As of Sunday, Jan. 2, 2011, the Obama administration is officially regulating greenhouse gas emissions under the Clean Air Act. The White House is under pressure to fulfill its pledge to tackle climate change while avoiding the appearance that it's hindering job growth. What that means immediately is that new and upgraded industrial facilities like power plants and refineries will be forced to install technologies to curb their greenhouse gas emissions.

At first, the greenhouse gas rules will only apply to new and modified plants that would already trigger control requirements based on their emissions of other pollutants regulated by EPA, like soot or smog. Starting in July, large plants will fall under EPA's rules based only on their greenhouse gas output. EPA says phasing in those rules will allow states and other permitting authorities to get used to the process.

The agency is also planning to take over greenhouse gas permitting indefinitely in Texas, where state officials have staunchly refused to get in line with the Obama administration's climate policy. While some states say they are expecting no trouble, industry officials have warned that long delays could occur as authorities work to issue greenhouse gas permits for the first time and as opponents of new projects challenge the emission control requirements in court.

Socialism Sure Sucks!

One of the devastating impacts of socialism that progressives and their collectivist cousins always ignore is high inflation. Socialism promises much and then create staggering amounts of debt that are monetized, resulting in high inflation.

from Reuters:

CARACAS, Dec 31 (Reuters) - Venezuelans worried on Friday that a second devaluation of their currency in 12 months would make life even harder as the socialist government of President Hugo Chavez struggled to turn the economy around.

Already suffering one of the world's highest inflation rates and the only major Latin American economy still in recession after the global financial crisis, they fear the New Year devaluation could hit their livelihoods more.

"It is a blow against the pockets of the workers, against the poorest people," said Robinson Calua, a 50-year-old security guard in downtown Caracas.

Officials say the devaluation announced on Thursday will increase spending and boost growth in South America's biggest oil producer, while easing the pressure on foreign reserves and freeing up dollars for imports.

Survival of the (Least) Fittest

from Reuters:

LONDON (Reuters) - The euro currency area has only a one-in-five chance of surviving in its current form over the next 10 years because of competitive imbalances between its members, a leading British think tank said on Friday.

The Center for Economics and Business Research said Spain and Italy would have to refinance over 400 billion euros ($530 billion) of bonds in the spring, potentially sparking a fresh crisis within the 16-nation euro area.

"The euro might break up at this point, though European politicians are normally able to respond to a crisis," said CEBR Chief Executive Douglas McWilliams in a list of 10 forecasts for 2011.

Sovereign debt crises in Greece and Ireland have rocked euro nations this year, leading some commentators to speculate that Germany could eventually lose patience with bailing out its more profligate neighbors, triggering a split in the currency bloc.

Chancellor Angela Merkel has repeatedly stressed Berlin's commitment to the euro and she said so again in her New Year message to the country on Friday.

"The euro is the foundation of our prosperity," she said. "Germany needs Europe and our common currency. For our own well-being and in order to overcome great worldwide challenges. We Germans assume our responsibility, even when it is sometimes very hard."

McWilliams argued that the deeper imbalances between the euro zone's stronger and weaker economies, which have become increasingly apparent since the 2008 financial crisis, would undermine the project in the long term.

"I suspect that what will break up the euro will be the failure of most of the countries to take the tough medicine necessary to make their economies competitive over the longer term," McWilliams said:

"We give it only a one in five chance of surviving in its present form for 10 years. If the euro doesn't break up, this could be the year when it weakens substantially toward parity with the dollar," he added.

Friday, December 31, 2010

It's a "Wizard of Oz" World!

But the government says there's NO inflation!

So get ready now! Tap your heels together three times and repeat:

"There IS no inflation! There IS no inflation! There IS no inflation!"

You'll be transported quickly to a make-believe world where there's no inflation!

Or you can live in REALITY and look at the prices of commodities! There IS inflation, and its still heating up!

Steve

New Intraday 2010 Crude Oil High

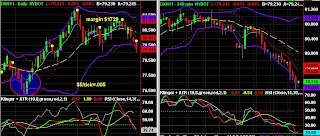

Dollar Bollinger Band Break-Out

The Bollinger Bands in these charts represent two standard deviations of statistical probability. Should break-out today occur and prices close below the lower band, the new Dollar has an 80+% statistical probability of continuing in this direction and forming a new downtrend. Thus, the likelihood of a new Dollar downtrend is relatively high. This in turn is likely to send commodity prices much higher! As you can see on this chart, the four-hour chart on the right shows that this new Dollar downtrend is already well under way. This lower Bollinger Band (on the daily chart) represents a significant support level, but a close below this level has a high statistical probability of continuation. Thus, the next few days will be critical to the emergence or repudiation of this new downtrend. Since the day hasn't closed yet, it is still conceivable that the price of the Dollar Index could rebound before the day is finished. We will know over the course of the next few hours.

Despite this, note that on the same chart, in the red-circled area, we saw a similar breakout in early November (Nov. 4th), which then reversed, with prices rebounding back within the Bollinger Bands. If prices rebound from a break-out back inside the Bollinger Bands, then there is also a strong statistical probability that prices will then have enough momentum to touch the opposite band, as they did in this case, touching the opposite band just eight (trading) days later on November 16th.

If this new Dollar destruction downtrend is confirmed, the weekly chart (not shown) shows the next area of support at around 76.100.

One more notable thought: Today is the last day of the month, quarter, and year! Window-dressing by large funds may also be at work here! Large fund managers may be seeking to lock in profits and/or wash out their losing trades so that they can start the new year fresh. It is wise to keep this fundamental dynamic in mind as well.

May 2010 be a happy and profitable new year!

Commodities Beat Stocks, Bonds, Dollar in 2010

from Bloomberg:

Commodity prices beat gains in stocks, bonds and the dollar this year as China, the biggest user of everything from cotton to copper to soybeans, led the recovery from the first global recession since World War II.

The Thomson Reuters/Jefferies CRB index of 19 raw materials gained 15 percent through yesterday. The MSCI All Country World Index of stocks rose 13 percent with dividends reinvested. Global bonds returned 4.7 percent, based on Bank of America Merrill Lynch’s Global Broad Market Index, and the U.S. Dollar Index, a gauge against six counterparts, added 2.1 percent. The CRB outpaced the other measures for the first time since 2007.

Investors snapped up raw materials this year as China’s growth, the fastest of any major economy, spurred record demand for sugar and soybeans and rising imports of copper. At the same time, crops were ruined by Russia’s worst drought in at least a half century, flooding in Canada and parched fields in Kazakhstan, Europe and South America.

“This year has been incredibly strong,” said Nic Johnson, who helps manage about $24 billion in commodities at Pacific Investment Management Co. in Newport Beach, California. “You’ve had strong growth from China that put a bid into copper, and global crop problems cause huge rallies.”

This was the first year since 2005 that commodities, stocks, bonds and the dollar all rose as the global economic recovery proved resilient.

Cotton, Silver

Gains in the CRB were led by cotton, which surged 89 percent this year, reaching a record Dec. 21, on speculation that supply would fail to keep pace with rising demand in China. Silver, the precious metal most used in industry, jumped 81 percent as it attracted investors betting on both faster and slower economic growth. Corn jumped 49 percent and coffee climbed to a 13-year high as inventories shrunk and bad weather threatened crops in South America.

China’s economy expanded more than 10 percent this year, according the median of 18 economists’ estimates compiled by Bloomberg. While growth will slow to 9 percent next year, that will still be three times the rate of the U.S. and six the times the speed of the euro region, based on Bloomberg surveys of as many as 69 economists.

“There is no doubt that demand is coming from China, and there are other emerging markets where demand grew,” said James Paulsen, who oversees $350 billion as the chief investment strategist at Minneapolis-based Wells Capital Management. “Commodities have gone up because the economy was gearing up. It became a sustainable global economic recovery.”

Materials Rebounded

Raw materials rebounded in the last two quarters, with the CRB surging 27 percent since June 30. That’s the best second- half performance since the index debuted in late 1956. In the first six months, the gauge lost 8.8 percent.

Seventeen of 19 commodities tracked by the CRB rose this year. Natural gas lost 22 percent and cocoa fell 8.8 percent.

In December, the commodity gauge jumped 8.5 percent. That compares with a 7 percent advance for the MSCI All Country World Index and a 0.7 percent drop for bonds. The U.S. Dollar Index lost 2.1 percent. The Standard & Poor’s 500 Index added 6.7 percent with dividends reinvested, and returned 15 percent in 2010.

Returns for commodity investors may be lower than the spot CRB index suggests. The S&P GSCI Total Return Index, tracking the net amount received, rose 7.3 percent this year. When longer-dated contracts cost more than those for immediate delivery, a market structure known as contango, investors pay a premium to maintain their holdings as positions expire.

Financial Crisis

Stocks overcame the worst financial crisis since the 1930s as corporate profits exceeded estimates and central banks kept interest rates near record lows. Boeing Co., Home Depot Inc. and General Electric Co. beat earnings estimates for at least the past four quarters.

Governments have taken unprecedented measures to spur growth and boost confidence, as concerns the debt crisis in Europe would derail the global recovery pushed the MSCI All World Index to a low of 262.64 on May 25. The index posted back- to-back monthly gains in September and October and is headed for the biggest December rally since 1999.

The MSCI All World Index of developed and emerging stocks reached 330.9 on Dec. 29, the highest since Sept. 2, 2008, before the collapse of Lehman Brothers Holdings Inc.

‘Honorable Returns’

“It’s good to be crossing the finish line with honorable returns,” said Lawrence Creatura, a Rochester, New York-based fund manager at Federated Investors Inc., which oversees about $340 billion. “The double dip did not occur. The unemployment situation in the U.S., while not improving, did not deteriorate further. Globally, Europe was able to prevent a worst-case scenario.”

U.S. Treasuries, benchmarks for borrowing costs around the world, returned 5.5 percent this year, rebounding from a 3.7 percent loss in 2009, Bank of America figures show.

Bonds rallied from January through August as the U.S. economy threatened to slide back into a recession. They trimmed gains in the last four months of the year, sliding as Federal Reserve Chairman Ben S. Bernanke implemented a plan in November to pump $600 billion into the market.

Japanese bonds, the biggest debt market, returned 2.4 percent in 2010 as the central bank cut its benchmark interest rate to “virtually zero.” The rally was more than double the 0.9 percent gain in 2009, based on the Bank of America data.

Financial Bailouts

Greece and Ireland, which sought financial bailouts this year, had the worst-performing bonds among the 26 sovereign markets compiled by the European Federation of Financial Analysts Societies and Bloomberg.

Corporate bonds worldwide returned 7.12 percent this year, compared with 16.3 percent in 2009, according to Bank of America Merrill Lynch’s Global Broad Market Corporate Index. The debt has lost 0.82 percent in December, following a 1 percent drop in November. The securities are poised for the biggest quarterly decline since the three months ended September 2008.

The extra yield investors demand to own corporate bonds instead of government debt has declined to 169 basis points, or 1.69 percentage points, from 176 basis points on Dec. 31, 2009, the index data show. Spreads narrowed this month from 177 basis points on Nov. 30.

“Economies are up and some of the darkest fears of the pessimists did not come to fruition,” Creatura said. “The U.S. and global economies, while they’re not firing on all cylinders, are moving forward.”

To contact the reporter on this story: Debarati Roy in New York at droy5@bloomberg.net

Fresh Economic Crises Dead Ahead in Europe, U.S.

by Simon Johnson at NYT:

Most experienced watchers of the euro zone are expecting another serious crisis in early 2011, tied to the rollover funding needs of its weaker governments. With debts coming due from March through May, the crisis seems much more predictable than what happened to Greece or Ireland in 2010.

And the investment bankers who fell over themselves to lend to these countries on the way up now lead the way in talking up the prospects for a serious crisis.

This situation is not more preventable for being predictable, because its resolution will involve politically costly steps – which, given how Europe works, can be taken only under duress. Don’t smile at the thought and think, “It can’t happen here,” because this same logic points directly to a deep and morally disturbing crisis in the United States.

The euro zone needs to, and eventually will, take three steps:

Step 1: Agree on greater fiscal integration for a core set of countries. This will not be full fiscal union but some greater sharing of responsibilities for each other’s debts. There is much room for ambiguity in government accounting and great guile at the top of the European political elite, so do not expect something completely clear to emerge.

But Germany will end up underwriting more liabilities for the European core; its opposition Social Democratic Party and the Greens are pushing Chancellor Angela Merkel in this direction, calling her “un-European.”

Step 2: For the core countries, the European Central Bank will receive greater authority to buy up government bonds as needed. Speculators in these securities will be badly burned as necessary. The wild card is whether the Bundesbank president, Axel Weber, will get to take over the central bank in fall 2011 – as expected and as apparently required by Ms. Merkel.

Mr. Weber has been vociferously opposed to exactly this bond-buying course of action. So the immovable Mr. Weber will meet the unstoppable logic of economic events. Good luck, Mr. Weber.

Step 3: One or more weaker countries will drop out of the euro zone, probably becoming rather like Montenegro, which uses the euro as its currency but does not have access to the European Central Bank-run credit system. Greece is probably the flashpoint; when it misses a payment on government debt, why should the central bank continue to accept Greek banks’ bonds, backed at that point by a sovereign entity in default?

The maelstrom will probably sweep aside Portugal and perhaps even Ireland; Spain and Italy will be threatened.

It would be easy to set up pre-emptive programs for Portugal and Spain with the International Monetary Fund, but this will not happen. The political stigma attached to borrowing from the I.M.F. is just too great.

The unfortunate truth is that despite its supposed return to pre-eminence and the renewed swagger of its senior officials, the I.M.F. remains weak and of limited value. It is an effective lender to small European countries under intense pressure — Latvia, Iceland, Greece and so on. But the I.M.F. does not have the resources or the legitimacy to save the bigger countries.

At the end of the day, the Europeans will save themselves, with the measures outlined above, only because there will be no other way to avoid wasting 60 years of political unification. But one or more countries will be forced out of full euro-zone membership (although they are likely to keep the euro as the means of exchange). The costs to everyone involved will be large – and largely unnecessary.

And when the financial markets are done with Europe, they will come to test the fiscal resolve of the United States. All the indications so far are that our politicians will struggle to get ahead of financial market pressure.

There are plenty of places in Europe where you can find an easy political consensus to cut taxes and increase budget deficits. Sadly, this no longer pacifies markets. The American political elite – right and left – believes that we are different from the Europeans because we issue the dollar and therefore have some special privileges forever.

But this is not the 1950s. Asia has risen. Europe will sort itself out and become more fiscally Germanic. The Age of American Predominance is over.

Our leading bankers looted the state, plunged the world into deep recession and cost the United States eight million jobs. Now many of them stand by with sharpened knives and enhanced bonuses – willing to suggest how the salaries and jobs of others can be further cut. Consider the morality of that.

Will no one think hard about what this means for our budget and our political system until it is too late?

Venezuela to Devalue AGAIN!

from WSJ:

CARACAS—Venezuela will devalue its "strong bolívar" currency on New Year's Day, the government said Thursday, the second such devaluation within a year and at least the fifth major devaluation during the decade-long populist government of President Hugo Chávez.

News of the devaluation came just after the central bank said the Venezuelan economy contracted 1.9% in 2010, the second consecutive year of declining output in the oil-rich nation after a 3.3% decline in 2009.

Both pieces of news suggest Mr. Chávez is having an increasingly difficult time balancing his populist policies with economic reality, according to economists.

Worthless Pieces of Paper

We now live in a world where governments print worthless pieces of paper to buy other worthless pieces of paper that combined with worthless derivatives, finance assets whose values are totally dependent on all these worthless debt instruments. Thus most of these assets are also worth-less. -- Egon von Greyerz, Matterhorn Asset Management

Thursday, December 30, 2010

We're Living a Work of Fiction

I love this at Zero Hedge:

Today's must see TV comes from the following interview of Pimm Fox on the consumer and the economy with retail expert Howard Davidowitz, who in 10 minutes provides more quality content and logical thought than we have seen from CNBC guests in probably all of 2010 (except of course for that one time when Erin Burnett kicked out Mike Pento, but that's a different story). Where does one start? Probably at the end: "I am not surprised by the strength of retail sales, because i knew that 30% of consumers are responsible for retail sales, and these 30% did much better because of the performance of capital markets. I don't think it is indicative of anything going forward. I don't think the economy is going to get any better. If you look at our fiscal and monetary policy, we went two trillion in the hole last year. Two trillion... to produce this... and unemployment went up to 9.8%! We've spent two trillion we're printing money we're going bananas. Our balance sheet, we've got $2.6 trillion on there, and what;s on there government securities, and MBS." And here is the kicker for the world's biggest hedge fund, which at least one person besides Zero Hedge appears to get: "If interest rates go up a point Bernanke's bankrupt. Everything he's bought is underwater. All the MBS are underwater, the whole country is underwater." Does anyone see the issue now with why rising interest rates, aside from predicting a "recovery", may also, courtesy of its now $2 billion DV01, "predict" the insolvency of the Federal Reserve?

Some other observations on the retail "renaissance":

- Walmart is 10% of US retail sales, has 150 million customers, and its stock it is down 6 consecutive quarters;

- Sears is the largest department store in America: "their stock is terrible"

- Best Buy had a huge earnings miss

- Toys'R'Us loss increased last quarter

- A&P filed bankruptcy

- Loehmann's filed bankruptcy

- Charming Shoppes is going to close 100 stores

- TJMaxx just liquidated AJ Right

Online sales have to lead you to question the whole retail selling strategy. We have 21 square feet of selling space for every man woman and child in this country. We already have double of what we need. With the explosion of online sales, what happens to all these retail malls and shopping centers which are marginals? Huge changes are going to be taking place as people continue shopping online.... In the end what do you do with the retail space...This is going to be a huge question for retail in the next ten years, that's why Walmart is starting to build smaller stores, that's why Walmart is building more overseas than they are building here. It's going to be the biggest retail change that we've ever seen."The biggest losers: commercial real estate landlords. Read REITs:

Landlords better start figuring it out pretty quick because they already have occupancy problems, rent problems and everything else right now. I don't think the CRE problems are fixed by any means. That's why we are going to close hundreds of community banks going forward, we are going to close hundreds more. Those CRE debts are coming due and they will not be able to be rolled over. We've got lots of problems still coming up in the banking system, and the problems in the real estate issue is here for a long time.In other news, Kool Aid to be served in aisle 5 of the next door Sears box from now until permanent closing time.

Full must watch video after the jump (we are looking for an embeddable version).

h/t etrader

How The Government Hides a Depression

from Financial Sense.com

Overview

The real US unemployment rate is not 9.8% but between 25% and 30%. That is a depression level of job losses - so why doesn't it look like a depression for many people? How can so large of a statistical discrepancy exist, and how is it that holiday shopping malls are so crowded in a depression?The true devastation is hidden by essentially placing the job losses inside three different "boxes": the official unemployment box, the true full unemployment box, and most importantly, the staggering and persistent private sector job loss box that has been temporarily covered over by a fantastic level of governmental deficit spending. The "recovering and out of the recession" cover story is only plausible when nobody connects the dots and adds all the boxes together.

We will add together the three boxes herein - using US government statistics for all three - and convincingly show that the US economy is in far worse condition than what is presented by the government or by the mainstream media. No, we have not emerged from "recession" and there will be no "double dip" - because the first "dip" was straight down to a depression-level economy in 2008/2009, and we haven't come back up.

Creating artificial "free money" on a massive scale that artificially boosts short-term employment is how you segment depression level unemployment into the separate boxes and hide what is really happening. It is this radical strategy that most distinguishes the current downturn from the 1970s and 1930s. The ultimate source of most of the current "free money" that hides the depression is the government risking the impoverishment of US savers and investors for potentially decades to come, with the worst of the damage concentrated on retirees and Boomers.

To have a chance of defending your hoped-for future lifestyle, there is simply no substitute for seeing the truth clearly. For it is only when we see through the lies with clarity that we can distinguish the false opportunity of manipulated markets from the real opportunities that can be found in unexpected places.

Headline Unemployment (Box 1)

The graph above is our starting point and first "box". It is the "headline" rate of unemployment in the US that is featured in newspaper articles and discussed on the cable business news. As of November 2010 the official US unemployment rate was 9.8%. While that's deeply painful, and unemployment rates since 2008 have been the highest seen since the end of the Great Depression (with the exception of the 10.8% peak in 1982), 9.8% is not a depression level unemployment rate.Real Unemployment (Box 2)

As economists and political decision makers know quite well, the "official" unemployment rate is not the full rate of US unemployment. The "official" rate is technically known as the U3 rate of unemployment, and it is a politically advantageous partial accounting for the unemployed. The U.S. Bureau of Labor Statistics calculates unemployment 6 different ways, U1-U6, and it is only in the U6 statistic that all the categories of unemployment are added together.The two biggest differences between the U3 official rate of unemployment and the U6 full rate of unemployment are in the treatment of the long-term unemployed and involuntary part-time workers. If you've been out of work for a long time, you badly want a job, but you know from your long search that nobody in your area is hiring; you already have applications on file at every reasonable prospect, and you haven't filled out a new application recently - then from an official perspective (U3), you are not only no longer unemployed, you just became a non-person altogether. Alternatively, if you have a master's degree in engineering, lost your job, and are working 15 hours a week (the most you can get) in a convenience store at minimum wage to keep a little money coming in, then from an official (U3) perspective you would be fully employed. In contrast, U6 is the most inclusive measure of unemployment, as it includes both the long-term unemployed and the involuntary part-time categories. Thus, individuals in each of the situations described above would be included in the U6 measure.

The green bar segment in the graph above illustrates what happens when we look at the full, U6 measure of unemployment as reported by the U.S. Bureau of Labor Statistics for November of 2010. Our unemployment rate almost doubles, as we go from 9.8% to 17% of the civilian work force being unemployed. The real unemployed go from one in ten workers, to one in six workers. The difference between a just-under-10% unemployment rate and a close to 20% rate of unemployment is the difference between recession and depression.

Unfortunately, there is more in the mix than simple unemployment statistics, and when we look inside the "third box" in the next section, we will see that the economic situation is not a mild depression, but rather a full blown major depression.

(To try to prevent a flood of corrective e-mails from readers, let me state that the challenge I set for myself in writing this article was to illustrate what was happening using only official US government numbers. Meaning, in my opinion, using unreliable and deliberately misleading numbers that have been subjected to increasing degrees of political manipulation over the decades. I have been writing articles for years that have discussed increasing government manipulation of inflation statistics, and am well aware of the work of John Williams and others in trying to independently determine genuine inflation and unemployment rates. I personally believe that the real inflation and unemployment rates are substantively higher that what is being reported to us, and that the real U6 measure is likely 20% or above.

That said, I wanted to separate the concept of the three boxes from the concepts of statistical manipulation, so there were no distractions for a reader who was skeptical about manipulations, i.e. whether the US government would abuse the fine print of economic statistics to mislead its citizens for political purposes. If you have no trouble accepting that the government manipulates statistics for political advantage, then understand that the situation is significantly worse than what is illustrated herein.)

The Gaping Hole In The Economy

To see what a real depression looks like, take a long look at the graph below, which shows what happened to the US economy between 2007 and 2009. As shown with the blue bars and the chart below the graph, the size of the US private sector economy plunged by $1.3 trillion - and it hasn't come back.Yet, we don't see the full extent of this plunge around us on the streets or in the headlines. Indeed, despite this ongoing, gaping hole in the US economy, the official story is that the US isn't even in a recession. What happened to all of the job losses from this rapid and persistent collapse of a large section of the US private economy?

The answers can be found in the red and yellow bars above, representing Federal government spending and state and local government spending. Federal spending rose by $700 billion, and state and local government spending rose by $300 billion. (With the state and local spending being funded by Federal government transfers that have been netted out, so it is really almost all growth in Federal spending.) The private economy plummeted by $1.3 trillion while the government economy soared by $1 trillion, and we were left with what looks like a much more manageable $300 billion shrinkage, the kind of economic change that might be associated with a 9.8% official unemployment rate. In other words, a little over 75% of the collapse in the private economy was (and is) being covered by increased government spending.

As shown in the graph above, there has been a radical shift in the composition of the US economy with the government share of the economy leaping from 35% to 43%. This is perhaps the most rapid and greatest change in the fundamental nature of the US economy since World War II - yet there has been remarkably little discussion of the full consequences.

The US government has fantastically increased its spending relative to the overall economy, but the government's sources of revenues haven't increased. The target of this spending has been the "Third Box" - the covering over of real, persistent and massive private sector job losses through creating what are effectively artificial short-term jobs, originally paid for by ramping up the deficit at a fantastic rate, with the covering over now being funded by the creation of new money from thin air.

The Third Box: Artificial Employment

What happens if we add the real, full U6 unemployment rate of 17% to the hole in the private economy that is currently being covered by the government's spending money it doesn't have? The simplest approach is to say that 9% of the US economy is manufactured money that's funding government deficits, and if we didn't create artificial money to fund artificial jobs, then that 9% of the economy implodes. If 9% of the economy abruptly disappears, there goes 9% of the jobs as well, so the unemployment rate would immediately jump by another 9%. There are a staggering number of simplifications involved in this approach, but it's not a bad approximation for illustration and discussion purposes within a short article.Add 17% and 9%, from two different US government sources, and we have 26% real unemployment right there. That is, if the Federal Reserve were not manufacturing money out of the nothingness to fund government spending without limits – at grave peril to all savers and investors – then it would be fair to say that the US would be at a 26% unemployment rate. This is slightly higher than the peak 25% unemployment rate in 1933, during the worst part of the US Great Depression.

Unfortunately, it is likely worse than even that. There is a multiplier effect when it comes to employment, and if we drop 9% of the economy, the support jobs that are created to serve the people who make up that 9% go away as well. We also need to allow for more government manipulation of inflation statistics, which creates a little greater economic loss picture, and in total, arguably, if we look at the real private sector right now, and we set aside jobs funded by monetization, we're at a real unemployment rate of over 30%. And if we were to end the deficits and the assault on the value of the US dollar, and the US government only spends what it could take in – we would be at that 30%+ level almost instantaneously.

Hiding The Depression Through Impoverishing Boomers, Retirees & Other Savers

Many people, looking at what has just been presented, would see this as being a major reason to keep that deficit spending right up there and maybe even get more aggressive about it. This is indeed the position of many politicians and pundits, as well as a number of mainstream economists. Unfortunately, there is a double problem with this approach: there's no indication that it's working other than as a short term band-aid, and the cost of the "band-aid" risks wiping out the value of money, savings and investment on a nationwide basis.Fundamentally, we haven't seen the benefits to the private sector of the economy that pays for everything else, including the real US standard of living. Oh, there are a lot of claims floating around that the private economy is rebounding fast, and in some individual sectors, that is true. But there is an elementary reasonableness check that we can use to see if this is true for the nation as a whole.

The total economy is the sum of the private and public sectors. If the private sector were indeed recovering rapidly, and recapturing much of the lost "real" private jobs (not dependent on government spending), while government spending didn't change, then the overall size of the economy should be soaring when we add private and public sectors together. That isn't happening, however. Now, if government stimulus efforts were truly working and this was leading to snowballing growth in the private economy, which then allowed the government "Keynesian" stimulus to be gradually withdrawn, then the size of the economy would remain roughly the same, while government deficits and the government share of the economy would be falling rapidly, dollar for dollar with the rise of the private economy. But that isn't happening either. The deficits are larger than ever, and the government share of the economy isn't shrinking.

If we pull away all of the massive government spending that has funded the "Third Box" of containing unemployment, then as the walls fall down and the Third Box collapses, all the newly unemployed flow over to the 1st and 2nd boxes, true comparability with the 1970s and 1930s is restored, and we have an obvious depression-era level of unemployment all around us. So with two years of extraordinary government deficits representing almost 10% of the US economy per year - we still haven't solved the problem, and we get the same dismal outcome if the emergency measures were to be withdrawn.

The problem with this seemingly endless supply of "free money" is that there truly is no such thing as free money, as responsible economists have understood for many centuries. If you could just create trillions out thin air and pass it around to politically favored special interests like it was candy – common sense would indicate that every government in the world would be doing it as a matter of official policy. If governments could skip the unpleasantness of having to pay for spending through taxation, and instead just spend free money at will with no devastating side effects - then every government on the planet would have been doing this exact program for centuries. The fact that responsible governments don't do this is a very simple reality check on the irresponsibility of the Federal Reserve and the US government's attempts to hide the true state of the economy through deficit spending that is funded by the reckless creation of vast amounts of new money.

In pursuing this process however, we have passed the point where it is reasonable for the free market to support the US government's endless spending - at least, at current interest rate levels. So the federal government, in a move that has the convenient side effect of dropping the value of the US dollar and making the US economy more competitive (at great cost for older Americans), is currently manufacturing about thousand dollars per month, per American household, directly out of the nothingness and injecting it into the US economy to try to cover this gap. As I cover in detail in my article "Bullets In The Back: How Boomers & Retirees Will Become Bailout, Stimulus & Currency War Casualties", the direct cost of this strategy of masking the hole in the real economy for a few years is the annihilation of the value of decades of earnings for tens of millions of good hard-working Americans, who have done nothing wrong.

http://danielamerman.com/articles/Bullets.htm

Cover-Ups & The Perils Of Artificial Employment

The current economic situation in the United States is a fantastic one. The "respectable" mainstream economists, politicians and journalists not only failed to see this coming - but would have ridiculed the very idea that something like this could happen. Yet, here we are. The US government is covering up a gaping hole in the private economy by having the Federal Reserve manufacture money out of thin air at a rate of over $100 billion a month, so that Congress can pass that money out to favored political interests on a congressional district basis. Thirteen percent of the US private sector economy collapsed in a matter of months - and it hasn't come back. This is covered over by the Federal Reserve creating about as much new money every six months, as total US physical dollars in circulation after 230 years (roughly $700 billion). The possibility is raised by rating agencies and the International Monetary Fund of the US government defaulting on its soaring debts. (Though payment by inflation is far more likely than actual default.)Yet, these same mainstream economists, politicians and journalists insist there is nothing extraordinary going on, that this is just another economic rebound from yet another recession. There is support for this viewpoint, not just in carefully selected official economic statistics, but in the real world bottom line of holiday shopping and sales. Depressions evoke images of bread lines, not circling the mall and following other shoppers out to their cars, hoping to snag a parking spot. So, from the perspective of the average American (at least the purported five of six who are still employed) this doesn't look like a depression at all.

Creating a plausible surface that is different from the fundamental underlying reality requires splitting this extraordinary state of affairs into separate boxes, and stating that by definition the boxes are independent of one another. There are "lies, damn lies & statistics", and statistical manipulation allows the widespread reporting to the minority of the population who reads the paper and watches the news, that unemployment is still just under 10%. Sure, the well informed know better - but what percentage of the general population understands the difference between the U3 and U6 measures of unemployment, and why the true rate is closer to 20%?

However, the very heart of the intellectual deception is to take the fantastic and unprecedented, government actions we have never seen before in our lives, and use these actions on a massive scale to create a third box: the artificially employed. By definition, any reasonable person knows that an employed person is not an unemployed person, so this split into the third box, would seem eminently rational and even a very good idea, almost unassailable from a conventional perspective.

Until we remove the fantastic and unprecedented. Without the step of using the massive and direct creation of money to support government deficits to artificially create jobs - the third box of artificial employment collapses. We go from 1 in 10 workers unemployed (1st box), to 1 in 6 (2nd box) to 1 in 4 (3rd box), and it is straight-up depression level unemployment in a matter of weeks or months.

The current government approach is a lose-lose proposition that temporarily covers up failure at the cost of impoverishing tens of millions of Americans over the long term, particularly retirees and Boomers. The danger is that the value of the dollar plummets, wiping out the value of a lifetime of savings and investment for most of the nation, but the hole in the economy will still be there, the "third box" will still collapse, and unemployment will still surge.

We go from having jobs and savings, to temporarily covering up job losses by setting in motion a process that destroys the value of savings, and then we end with having neither jobs nor savings.

It is only real fundamental growth and real fundamental change that will bring the US private economy out of that hole. The worst of the current policy is that it provides political cover for extending failed policies, which gives little incentive for finding the desperately needed alternative policies that might actually work. It has been more than two years - and the hole in the economy is still there. The distribution of borrowed and/or manufactured money by the leaderships of both major US parties to politically favored special interest groups on a congressional district basis - is demonstrably not growing the real economy.

The Personal Challenge

The first step to finding personal solutions is acceptance. Do you accept that there has been a $1.3 trillion collapse of the US private economy?Do you accept that this hole is being covered through the creation of money on a massive basis by the US government?

Do you believe that funding an economy through the government manufacturing money without end is unsustainable?

Do you see the very real consequences for the value of your savings and investments?

It is essential for investors to not only see the truth of what is happening, but to see the implications. Unfortunately it appears quite likely that there will be a crash in the value of money itself. This is likely to be accompanied by a crash in the purchasing power of financial assets. The stock market may collapse in a way we haven't seen since the last time we saw this level of depression, that being the 1930s. We are likely to see a tremendous bond market crash as US government monetary creation and manipulation is eventually overwhelmed by reality.

So the lynch pins of investments for US retirees, US boomers – and virtually all US pension funds – are likely to be collapsing in real terms. However, something really interesting (and terrifying) happens when you combine monetary inflation with asset deflation in real terms (meaning the purchasing power of assets is plummeting). As the dollar price of the assets in ever-more-worthless dollars climbs higher and higher, the purchasing power of those assets drops lower and lower. This generates very high taxable profits that are then taken by an increasingly desperate federal government. A very simple two-minute illustration of this can be found in the video linked below, "Deadly Dow 50,000".

http://danielamerman.com/articles/DeadlyDow.htm

Gold would seem to be the answer, but the world is more complex in its unfairness than the average gold investor is aware. The good news for gold investors is that they are likely to do much better in a monetary meltdown than a stock investor or a bond investor. But nonetheless, as illustrated in the article "Hidden Gold Taxes, The Secret Weapon Of Bankrupt Governments" linked below, a simple approach of buy-and-hold gold is also likely to lead to a devastating reduction in the purchasing power of your savings due to the one-two combination of inflation and inflation taxes.

http://danielamerman.com/articles/GoldTaxes1.htm

Let me suggest an alternative approach, which is to study, learn and reposition. To have a chance, you must learn not just how inflation will redistribute wealth, but also how unfair government tax policies (that can be relied upon to increase in unfairness) will cripple most simple methods of attempting to survive inflation.

Then, yes – buying gold (and perhaps a lot of it) can be one key component of a portfolio approach, as discussed in my Gold Out-Of-The-Box DVD set. Use multiple components, each doing what they do best, shift the components in a dynamic strategy over time, and position yourself so that wealth will be redistributed to you in a manner that reverses the effects of government tax policy. So that instead of paying real taxes on illusionary income, you're paying illusory taxes on real income. And the higher the rate of inflation and the more outrageous the government actions – the more your after-inflation and after-tax net worth grows.

Do you know how to Turn Inflation Into Wealth? To position yourself so that inflation will redistribute real wealth to you, and the higher the rate of inflation – the more your after-inflation net worth grows? Do you know how to achieve these gains on a long-term and tax-advantaged basis? Do you know how to potentially triple your after-tax and after-inflation returns through Reversing The Inflation Tax? So that instead of paying real taxes on illusionary income, you are paying illusionary taxes on real increases in net worth? These are among the many topics covered in the free “Turning Inflation Into Wealth” Mini-Course. Starting simple, this course delivers a series of 10-15 minute readings, with each reading building on the knowledge and information contained in previous readings. More information on the course is available at DanielAmerman.com or InflationIntoWealth.com .

Contact Information:

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Reversal signs

For a true reversal, I require 4 things in order to short the market. To liquidate, I only require 2 of four:

1) Close below the Exponential Moving Average. DONE!

2) Reversal of volume (ie., volume-based selling) DONE, but somewhat weak.

3) Two consecutive days of lower closes (not yet)

4) Prices must confirm the previous days' price collapse by breaking through the low of the prior day. (ie., price dip must continue over a period of days rather than be a one-day event). Will wait for confirmation tomorrow. Some commodities met this criteria today. Others haven't yet. The Index hasn't.

The New Year may be a factor here. It is the last day of the month, quarter, and year! Funds may be taking profits, only to reestablish positions again once the New Year starts. Should be exciting!

I noticed that Doug Kass shorted stocks today. Stocks have been weak for a week (no pun intended). We need a correction!

Ciao! Prospero Ano Neuvo!!

Steve

Signs of a Shift?

I'm short on time, so this is brief. This may be a top, or just another consolidation on the way to another high. But grains sold off moderately today also. Even livestock saw some selling. Only 1 new high -- copper.

Crude collapsed $2 today.

Sugar hits stops all the way down.

The NYBOT CCI showed a reversal IF prices continue to drop tomorrow. Sometimes, traders will use a pull-back as a buying opportunity rather than a shorting opp.

Steve

Sugar Collapses

This was a pretty hard fall!

Sugar intraday

Sugar daily

from Bloomberg:

Sugar futures plunged 10 percent as computerized trading triggered sales following an early slide spurred by bets that demand may ease on the heels of the rally in the second half of 2010.

“You had an initial movement that triggered a lot of stop losses,” or orders to sell when the price drops to a specified level, said Ricardo Scaff, a trader at Rabobank International in New York. “Some trading systems are automatic, and once they see the movement, they add to it.”

Raw-sugar futures for March delivery slumped 3.45 cents to settle at 30.38 cents a pound at 2 p.m. on ICE Futures U.S. in New York. The percentage drop was the biggest since Nov. 12. On that date, the commodity plunged 12 percent, the most since July 1988, as speculation that China would increase borrowing costs roiled commodity markets.

“A sell-off was expected at the end of the year,” said Mario Silveira, an analyst at FCStone Group Inc. in Campinas, Brazil. “No one thought it would be of this magnitude.”

Companies are switching to substitute sweeteners because of high sugar prices, Michael McDougall, a senior vice president at Newedge USA, said this week in a report. Yesterday, futures dropped 1.6 percent.

Yesterday, the price reached 34.77 cents, the highest since November 1980, as floods damaged crops in Australia, the world’s third-biggest exporter.

Brazil, Thailand

Anna Bligh, the premier of Australia’s Queensland state, said today that floods resulted in “a disaster that is going to run into the billions of dollars.” Adverse weather also has hurt crops in Brazil, the top exporter, and Thailand, the second-biggest.

In the second half of this year, sugar has jumped 89 percent, the biggest gain among 19 raw materials in the Thomson Reuters/Jefferies CRB Index. In 2010, the sweetener is up 13 percent. The price plunged 40 percent in the first half.

Refined-sugar futures for March delivery fell $65.10, or 7.9 percent, to $761.30 a metric ton on NYSE Liffe in London, the biggest drop since Nov. 12. The price jumped 62 percent in the second half of the year.

“There is a pullback in the market,” said Tom Mikulski, a senior strategist at Lind-Waldock, a broker in Chicago. “Also, there is bound be some profit-taking at this time of the year.”

Wednesday, December 29, 2010

Europe Is Going to Get Worse!

from UK Independent:

Dollar Butchery

The dollar fell against most of its major counterparts as signs of global economic recovery spurred demand for higher-yielding assets including stocks.

The greenback weakened versus the New Zealand and Australian dollars on reduced demand for safety before a U.S. report tomorrow forecast to show initial jobless claims fell. Sweden’s krona appreciated versus as the nation’s trade surplus widened in November. Taiwan’s dollar rose to a 13-year high on the prospect of an increase in borrowing costs.

“January tends to be risk-on, and if you’re expecting risk assets to do well, now’s a good time to get in,” said Geoffrey Yu, a London-based currency strategist at UBS AG. “There’s some seasonality in terms of flow patterns, and if funds have fresh liquidity there’s more money to invest.”

The dollar dropped against the yen for an eighth day, decreasing 0.3 percent to 82.12 at 7:42 a.m. in New York, from 82.38 yesterday. The U.S. currency was little changed at $1.3130 versus the euro, compared with $1.3115. The euro fell 0.1 percent to 107.92 yen, from 108.06.

Mountain West States Begin to See Higher Unemployment

from HuffPo:

WASHINGTON — A delayed decline in home prices and drops in manufacturing and tourism have caused unemployment in western mountain states to rise faster in the past year than in any other region.

The jobless rate in the eight-state Mountain West region has jumped to 9.3 percent from 8.7 percent a year ago. That's still lower than the 9.6 percent national average. But the gap is narrowing with the rest of the nation. The jobs crisis in regions with higher unemployment has mainly stabilized.

The lagging pace represents a sharp turnaround for a region that had been growing at a healthy pace before the recession. And it illustrates how broadly the Great Recession and its aftershocks are affecting the country.

A rush of young people and California transplants helped make the region – covering ground from New Mexico to Montana – one of the fastest-growing parts of the country in the past decade. Housing boomed in Boise, Salt Lake City and in Denver.

Thriving cattle farms, wheat crops and copper mines insulated much of the region from the level of layoffs the rest of the country experienced in 2008. And while Nevada and Arizona were among those hit hardest when the housing bubble burst, the six other states in the region had milder housing booms and fewer subprime borrowers.

Still, as the economy and home prices soured elsewhere, fewer people were willing or able to move for work. Home sales slumped. Prices fell. Idaho, Colorado and Montana lost thousands of construction jobs. Timber companies lost business.

The states' snow-capped mountains and prized national forests received fewer visitors. And the ones who did arrive after the recession traveled on tighter budgets.

A big blow to Idaho came in early 2009, when technology companies such as chipmaker Micron Technology and Hewlett-Packard Co. laid off thousands of workers. The industry has rebounded, but the jobs haven't come back.

In Idaho, the number of people receiving food stamps has surged.

"We got pulled in a little bit later than the rest of the country," said Larry Swanson, an economist at the University of Montana and director of the Center for the Rocky Mountain West. Now "we are catching up," he said.

After previous recessions, the region has usually benefited from rebounds in homebuilding, tourism, and other service industries, said Addison Franz, an assistant economist at Moody's Analytics. But those trends haven't helped this time. Consumers around the country are still cautious and housing is still weak.

"You would expect (the region) to catch the wave of recovery, but they haven't been able to this time," she said.

Montana, for example, has seen its unemployment rate rise by the most in the country since September 2009, to 7.4 percent from 6.5 percent. The state has lost jobs in its timber and tourism industries. People aren't spending as much even when they do visit popular sites like Glacier National Park or Yellowstone, according to Patrick Barkey, an economics professor at the University of Montana.

Montana's Flathead Valley, which includes Glacier National Park, a popular ski resort and blue-ribbon fly fishing, has one of the highest unemployment rates in the state. It reached nearly 14 percent at its peak in March.

After visitor numbers flagged last year, many seasonal employees weren't hired back this summer. The timber industry's continued slide also added to job losses in the region.

The situation appears to be turning around, in part spurred by Glacier National Park's centennial celebration this summer. That's caused the number of visitors to rebound. But employment and hiring hasn't followed.

Darwon Stoneman, a co-owner of Glacier Raft Co., which guides tourists on rafting and fishing trips, said business was better this year and he expects it to be good next year, too. But while he is building new guest cabins, he is still being cautious about hiring.

He doesn't expect to add back the guide jobs that he didn't fill last year or this year.

Idaho has seen the second-steepest rise in unemployment in the nation since the recession began, to 9 percent from 3.5 percent in December 2007.

In Boise, home prices are still falling faster than the national average, Franz said. The housing slump has cost the state 4,000 construction jobs in the past year.

A 75-unit condominium high-rise downtown offers a stark symbol of the downturn.

Scott Kimball, a Boise developer, built it in 2008, just as the state's unemployment rate was starting to bulge and housing values started to slump.

Two years later, sales have been slow and only half the building is occupied. Last month, he held an auction to generate sales and interest, setting a minimum bid for studio and 1-bedroom units of $99,000 – half the previous asking price.

"My plan was to build through the recession and come out on the other side when people were looking to buy and move in," Kimball said. "I thought this would be a typical recession .... But this one has been different."

Only Nevada – an epicenter of the foreclosure crisis – has seen its unemployment rate rise faster than Idaho. Other states with high rates, such as Michigan and California, were struggling before the recession began.

One painful impact of that change is that Idaho's food stamp rolls have jumped by 40 percent in the past year, the largest increase of any state. Nevada has seen the second-largest and Utah the fifth-largest.

"Idaho actually has had one of the worst times during this recession of any state," Franz said. It's gone from "a relatively fast-growing, vibrant state to a state experiencing job losses and home prices declining. It's a pretty stark change."

China to Set Up Trading in Rare Earths

Brilliant move!

from People's Daily:

China is considering establishing an industry association and a government unit for the rare earths industry to gain more control over the precious metals, senior officials said Tuesday.

The rare earths industry association is likely to be launched in May and will assist companies in exports and international cooperation, Wang Caifeng, a former official of the Ministry of Industry and Information Technology (MIIT), who is setting up the group, said at a forum.

"We will be on the frontlines leading price talks with foreign buyers. Our role will be similar to that of the China Iron and Steel Association (CISA)," she said.

Chinese industry associations have served as agents through which companies negotiate with foreign suppliers and buyers, such as CISA representing Chinese steelmakers in talks with global miners on iron ore prices.

China also plans to establish a government unit in 2011 to specifically manage the rare earth sector, said an industry insider who requested anonymity. There are six ministry-level bodies overseeing the sector, including MIIT, the National Development and Reform Commission, and the Ministry of Commerce.

"The MIIT is leading the work of setting up the new unit, but it hasn't been decided whether it will be vice-ministerial or bureau level," he said. "The new unit will formulate the industry plan and guide the industry."

China has released guidelines to reform the industry by cracking down on illegal mining practices, encouraging more consolidation and reducing exports as oversupplies have depleted its own resources and seriously damaged the environment.

Rare earths, composed of 17 elements, are used in a number of high-tech processes ranging from wind turbines and hybrid cars to missiles. China has about 30 percent of global rare earths reserves, but produces 97 percent of the world's total.

China on Tuesday issued the first round of 2011 export quotas for rare earths, 14,446 tons, 11 percent less than the first round last year, according to a statement on the Ministry of Commerce website.

On claims made by United States on China's alleged restrictions on exports of rare earths, experts said China's policy has never violated the rules and regulations under the framework of the World Trade Organization.

On Tuesday, in the annual report on China's compliance with WTO rules, the Office of the US Trade Representative filed complaints to the WTO against China's trade policy for the alleged "excessive government intervention". The rare earths export policy was highlighted in the report.

"China's moves are based on market demand and economic development. Based on this, no one should blame China," Wang said.

Zhang Anwen, deputy secretary-general of the Chinese Society of Rare Earths, said: "China's measures are for the sake of protecting the environment for the sustainable development for the industry."

Since 2006, the country has imposed temporary taxes on rare earths exports and set limits on quotas. In 2010, China reduced export quotas to 60 percent, causing alarm among importing countries such as Japan.

The Ministry of Finance said on its website last week that China will raise the export taxes for some rare earth minerals to 25 percent in 2011.

The country is speeding up the pace of mergers and acquisitions in the rare earths sector and is encouraging consolidation among State-owned enterprises. China plans to cut the number of rare earths companies from the current 90 to 20 by 2015.

Tuesday, December 28, 2010

RE: commodities surge again!

In reply to an email question:

You may not like my answer to this, but I feel an obligation to my integrity to be truthful. I hope this isn't too professorial to be useful.

I don't predict the future, despite that I trade it! That probably sounds contradictory, but its not really. I keep telling myself that predicting the future is for prophets, not profits! That may sound simplistic, but its also true.

Here's why:

I have found that when I form an opinion -- a market bias, if you will -- in my mind, I then become vested in that opinion or forecast. I then tend to see only the data points that support that bias. It thereby blinds me somewhat to evolving market developments. I then make capital investments that are based upon my OPINION, rather than my ANALYSIS. Because I trade solely on technical analysis, I must always try to separate my OPINION or bias from my ANALYSIS. They are often in conflict with each other. My analysis is almost always more accurate than my opinions, biases, and "forecasts". I am therefore constantly striving to act on my analysis rather than my opinion.

Making predictions and acting on those predictions often gets in the way of my best trading. It is very difficult for me to brush aside my biases and opinions, but it is necessary for me to be an effective trader because the best trades usually come at an inflection point where my opinion/bias hasn't caught up with the shift in market sentiment yet. It takes a lot of GUTS to act against my bias in favor of my analysis!

That said, IF you were to ask me if I have any reason, based upon my ANALYSIS, to believe that the current trend higher in commodities is coming to an end, my technical analysis suggests that the answer is NO! But that could all change tomorrow. Here are what I watch as potential risks to that current trend:

1) biggest risk -- a collapse in the stock market related to an economic collapse. Bad economic news can always send commodities tumbling if the perception of a change/drop in demand alters the economic climate. Tyler Durden is right -- correlation is very high, and the more liquid commodities tend to move harmoniously with stocks

2) change in supply/demand for individual commodities -- dry weather in Argentina is buoying grains, but some rain might change this. But that wouldn't affect commodities as a class now, would it?

3) change in Fed monetary policy -- not much chance of that, is there? But if inflation started to show signs of getting out of control (as my BIAS says it likely will by summer), the Fed might be FORCED to raise interest rates. I can't see Bernanke EVER pulling his head out and awakening to this reality, can you? But eventually, he will be FORCED to by the data!

4) commodity prices push us back into the double dip scenario -- this is a very LIKELY scenario, in my opinion. Crude oil reached another 2010 high today, and the high cost of crude is one of the greatest threats to continued improvement because it is a burdensome cost on just about everything! Remember that $147 crude was one of the variables that threw us into recession back in 2008. Ultimately, higher cost weighs down any recovery and increases the risk of another economic collapse. Higher price eventually crushes demand. That's classic demand/supply economics. But it also kills the economy, too!

Bottom line: the charts tell me the trend will continue until it kills the economy and with it, demand. Sorry if that's convoluted, but this is my thought process.

What makes me sick about all of this is how manipulated our markets have become. Bernanke denies the impact his policies have on the downside unintended consequences until its too late. He and his fellow "educated imbeciles" and "arrogant academics" ignore the risks and treat our economic future like a bunch teenagers with a chemistry set that won't stop until they blow up the neighborhood.

One of my best friends and most intelligent people I know told me months ago something that I keep thinking about almost daily. He has a photographic memory and spends all his time reading and studying, even to a fault. He said:

"Steve, we can not defy the laws of sound economics forever!"

Eventually, the consequences are going to catch up to us! I dread that day, but continue as best I can to prepare for it.

I hope that helps and isn't too arcane to be insightful for you, Gonzalo.

Ask God for insight in your writing, and He WILL help you and inspire you. Expect it and you'll receive it! Your warning voice can help many people to prepare and avoid risk. You have a MISSION to help people! I ask for help and inspiration every day in my trading. His guiding hand is critical!

Many regards and God bless!

Steve

Baltic Dry Index Dropping Again

from Zero Hedge:

Last week, we pointed out when the BDIY dipped below 2000 for the first time since August. In the next three days, the index slide has accelerated and after dropping 3% just overnight, is back to 1830, just 130 points away from the 2010 lows printed in July. And while the index topped in early September following a brief and uninspired climb, it has since been a one way downward pointing slope. Whether the BDIY is a leading indicator to anything is debatable: some believe it is a completely irrelevant indicator. Others disagree. A very strong case for the former camp was made last week by Nordea which demonstrated, in its chart of the week, the average speed of its vessel fleet. One thing is certain: for whatever reason, demand for trans-Pacific cargo shipments is once again plunging.